Volume Analysis | Flash Market Update — 5.1.23

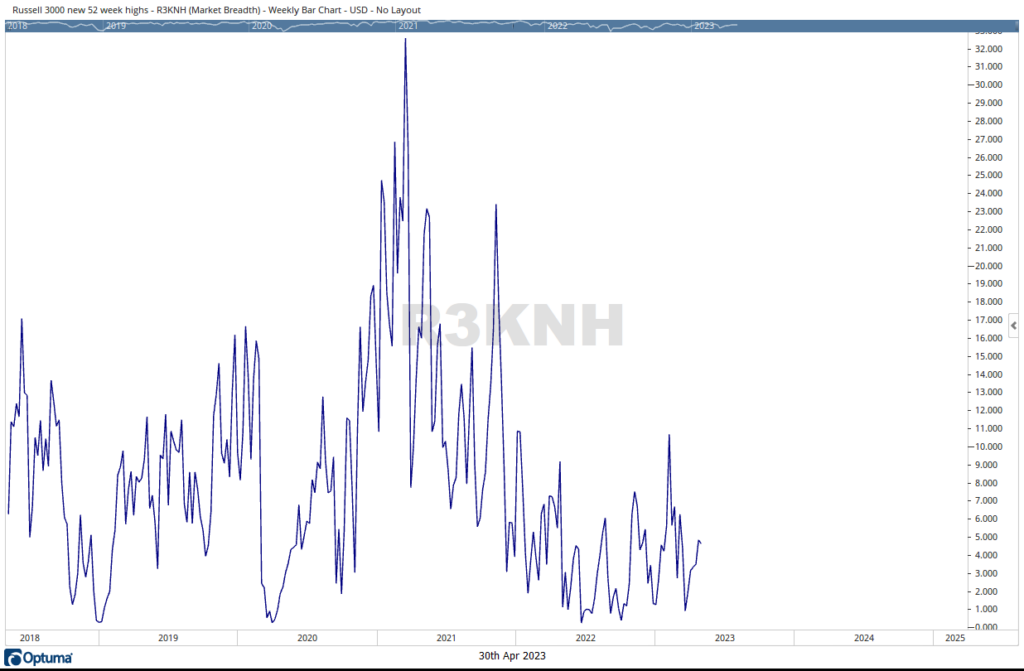

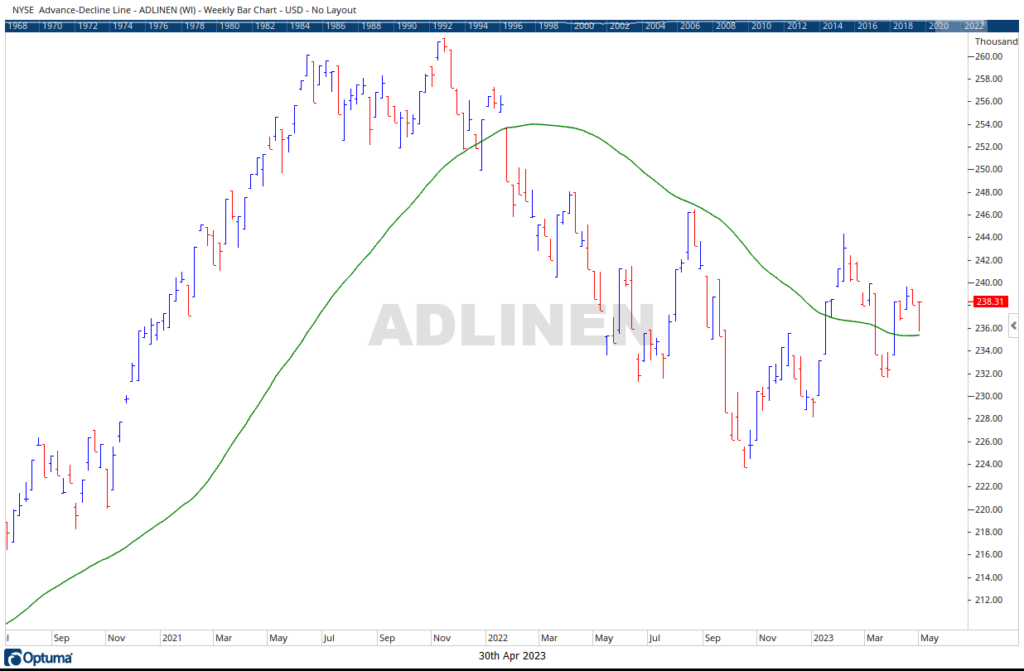

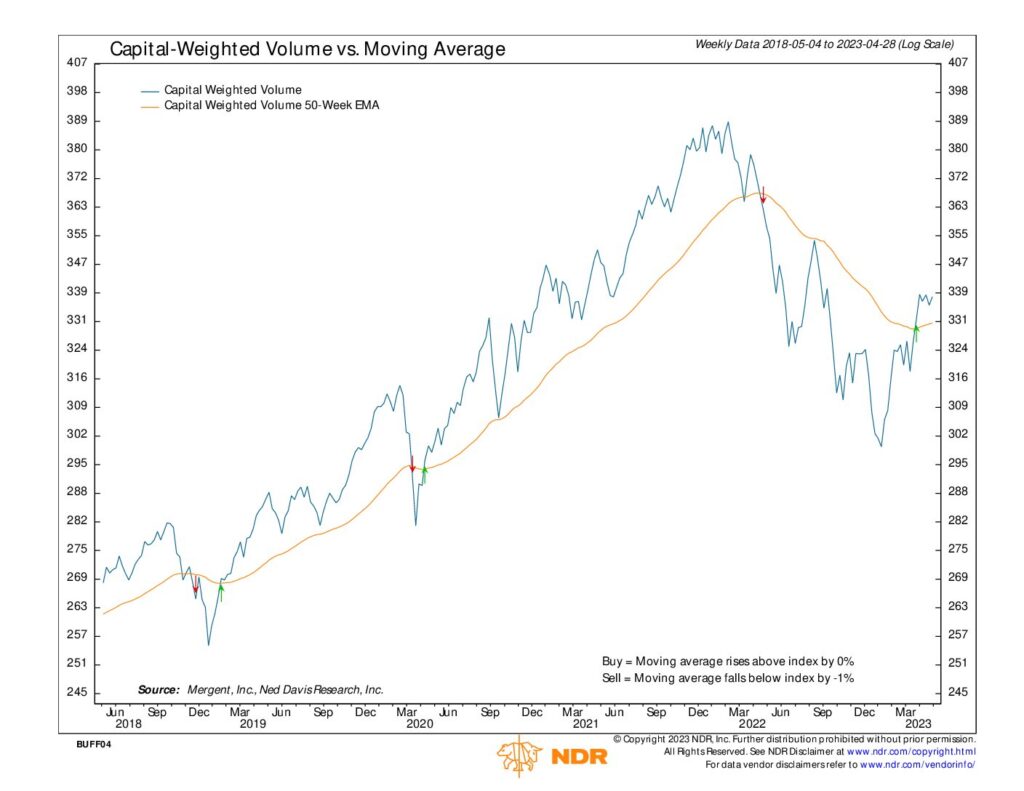

Closing just below high point of the week at 4169, the S&P 500 closed at the same level as last week’s high. Capital Weighted Dollar weekly volume was slightly above average, as were capital inflows of $49 billion versus outflows of $43 billion. After testing support earlier in the week, the Advance-Decline Line also ended up slightly positive for the week. New highs continue to expand, albeit off of low levels.

Evaluating trends, Capital Weighted Dollar Volume is closing in on the August highs, which is now once again bullishly leading price. However, price (S&P 500), the Advance-Decline Line and Capital Weighted Volume have a way to go before meeting their August high-water marks. This is yet more evidence supporting our theme that the generals (the mega caps) are leading but the troops (small and mid-caps) are struggling to keep pace. This certainly bore through this past week, with the Nasdaq 100 (Nasdaq Mega caps) up 1.89%, S&P up 0.87%, while the Russell 2000 (small and mid-caps) closed down -1.26%. The S&P 500 is closing in on yearly highs. Conversely, the Russell 2000 is nearing the lows of the past 12 months. Often the generals are able to whip the troops into shape but first they must prove themselves by breaking 4200 resistance. To confirm the bullish trend, look for Capital Weighted Dollar Volume to break through September highs. However, capital flows faltering suggests broader weakness may follow.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 5/1/2023

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.