Portfolio Manager Insights | What This Earnings Season Reveals About the Economy and the Banking Crisis — 4.26.23

The corporate earnings season for the first quarter is underway and about one-fifth of S&P 500 companies have reported results. Investors are focused on these earnings announcements even more than usual due to ongoing economic uncertainty amid high inflation, slower growth, and the banking crisis. In this context, corporate profitability can shed light on how companies, sectors, and the broader economy are truly faring in this environment. For long-term investors, focusing on earnings trends is a way to cut through the day-to-day noise of the stock market and news headlines.

It’s important to remember that coming into 2023, some investors and economists expected a recession within six to twelve months. Instead, the broad economic trends have remained positive with unemployment still near historic lows and inflation improving, propelling the S&P 500 to a year-to-date total return of 8.2%. With international developed market equities and fixed income also having a better year, a hypothetical 60/40 stock/bond portfolio has gained 5.5%. These are sharp reversals from last year’s trends and, while much can happen between now and year end, serve as a reminder that markets can turn around when it’s least expected.

In the long run, markets tend to follow earnings

One reason for long-term investors to focus on corporate profitability is that earnings growth is a fundamental component of stock returns. By buying a company’s stock, investors have the right to share in the company’s profits. The value of this right to shareholders depends on the growth in the company’s earnings along with the change in its valuation. In other words, stock prices go up if corporations are more profitable, if investors are willing to pay more for that profitability, or both. So, the fact that the economy expands and companies earn more is a key reason that stock prices rise over the long run.

While a recession may not be imminent, the economy is still expected to remain flat throughout 2023 before rebounding in 2024. Not surprisingly, the same is true for earnings expectations. Current consensus estimates suggest that S&P 500 earnings will be flat this year at around $215 per share before rebounding by 12% next year. While these figures should be taken with a grain of salt, both the economic and earnings projections suggest that 2023 will be a reset year before a “v-shaped” recovery occurs. This will depend on factors such as inflation and Fed rate hikes.

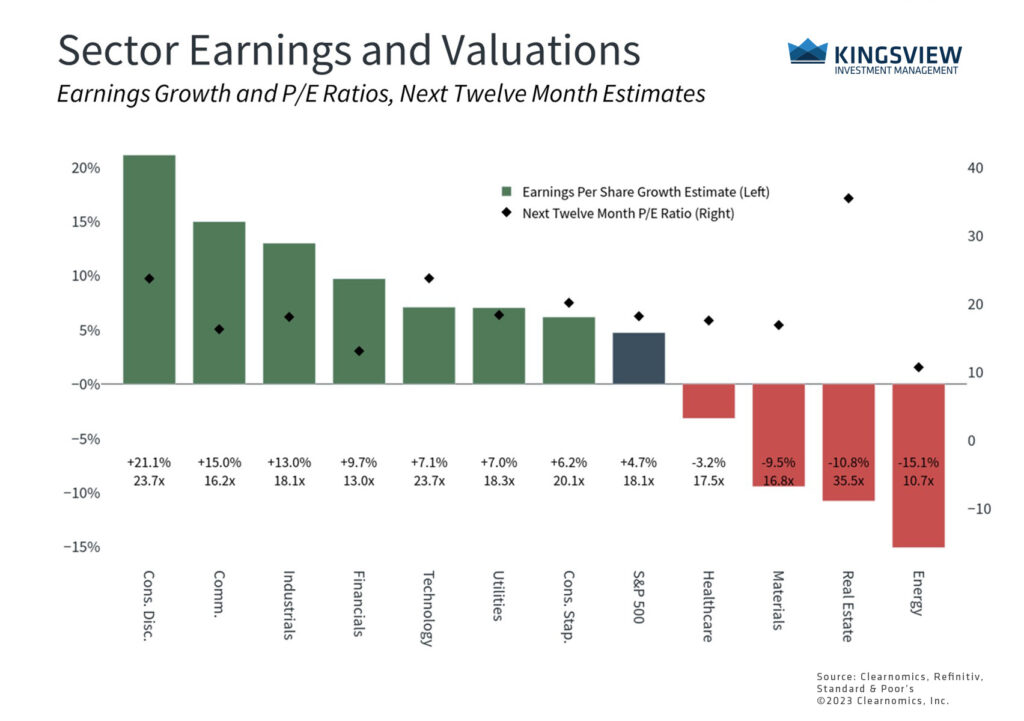

Most sectors are expected to experience positive earnings growth

The specific circumstances also differ greatly across individual companies and industries. At the moment, it’s positive that seven of the eleven S&P 500 sectors are expected to experience earnings growth over the next 12 months. This includes sectors such as Information Technology, Communication Services, and Consumer Discretionary, which are facing near-term struggles with the tightening rate environment. Information Technology experienced a 15% decline in earnings last quarter, concentrated in Semiconductors, but these figures suggest that this could turn around later this year. In contrast, Consumer Discretionary experienced the largest year-over-year earnings growth this quarter (36% according to FactSet), and some of the largest positive surprises as well. However, keep in mind that this sector is largely dominated by Amazon, a reflection of the retail sector more broadly.

It’s also notable that the Financials sector is still expected to grow earnings as well. The recent banking turmoil has been primarily concentrated in regional and mid-sized banks. While larger banks have generally faced deposit outflows as customers seek higher yields, they have benefited more recently from a flight-to-safety as smaller banks have struggled. The exceptions to the earnings picture are still the commodity-sensitive materials and energy sectors which benefited from rising prices last year, and the real estate sector which has been directly hit by rising rates.

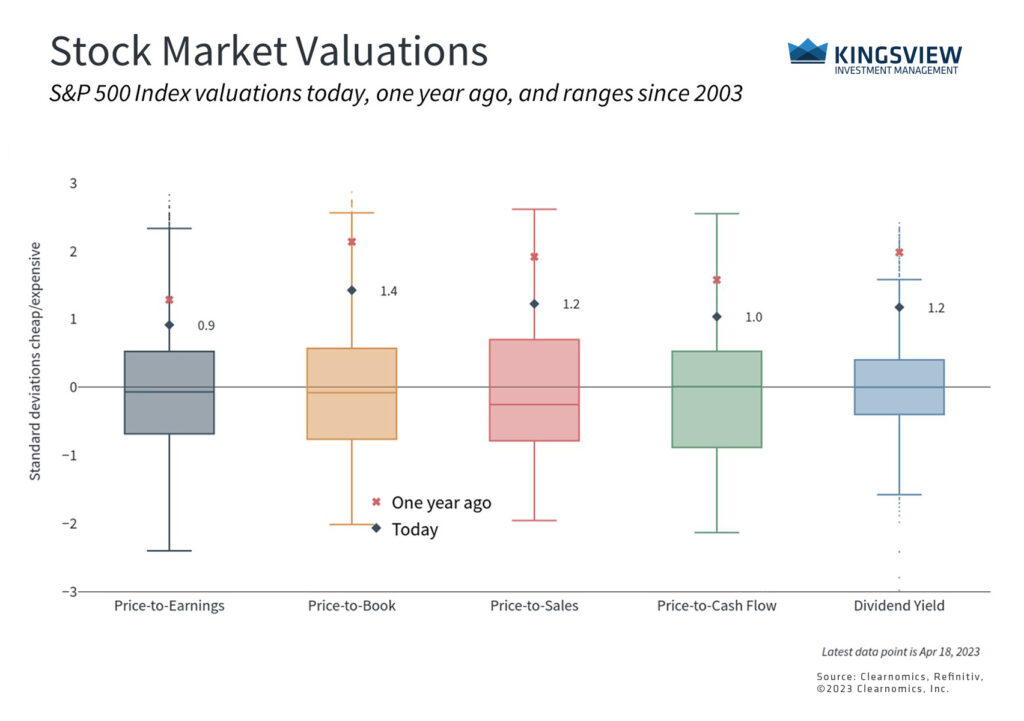

Valuation metrics have risen due to slowing earnings growth

What does this mean for the overall market? Flat growth this year makes valuing the stock market tricky. For valuation metrics with earnings, sales or cash flow in the denominator, slower earnings growth makes the market appear more expensive, especially when stock prices have recovered as they have. However, if the economy and earnings rebound next year as the market expects, valuation levels will slowly normalize. For the time being, many valuation metrics are well below historic peaks, but still higher than average.

Thus, it’s more important than usual for investors to maintain a longer-term perspective on valuations and their portfolios. Earnings can be volatile from quarter-to-quarter, especially in difficult economic environments. And while investors tend to focus on individual company results, the aggregate figures are much more important to the vast majority of long-term investors. Following these trends can help investors to properly assess longer-term trends and avoid overreacting to short-term news.

The bottom line? Earnings growth is expected to be flat this year but there have been positive surprises among certain sectors. The broad earnings picture is important to investors since, in the long run, the stock market follows the trajectory of earnings.

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser. (2023)