Volume Analysis | Flash Market Update – 4.22.24

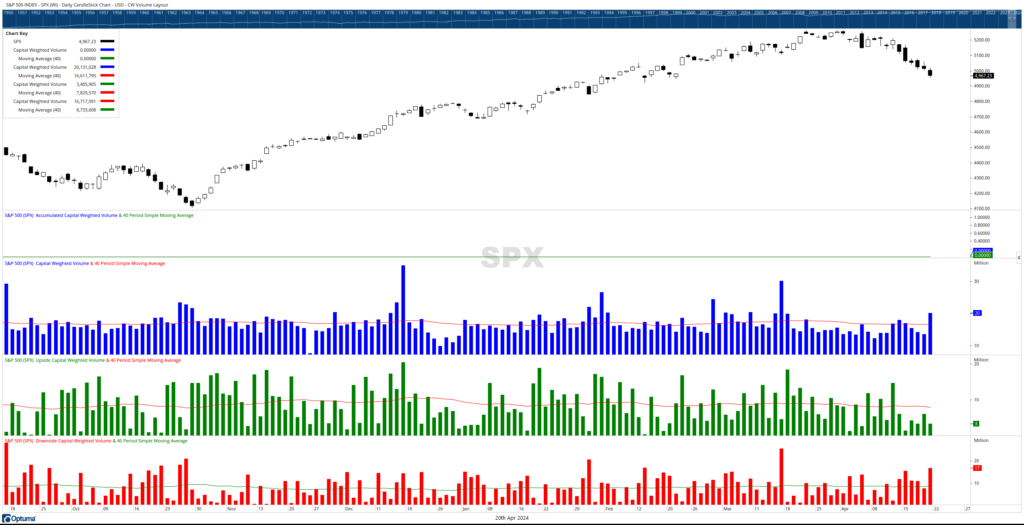

The generals (NDX) continued to spearhead the market, albeit in a downward direction this past week. The NDX 100 saw a decline of -5.36%, overshadowing the more modest decreases of the lagging troops (iShares Russell 2000 ETF – IWM) which fell -2.79%. That was less of a decrease than the S&P 500, down -3.05%. Outflows from the S&P 500 surpassed inflows by $61.5 billion to $18.7 billion, marking the most substantial capital outflows since the week ending October 20th, 2023, around the third quarter’s nadir. Despite the accumulation trends of Capital Weighted Dollar Volume and Volume moderately dipping on modest volume, they remain notably above trend.

In terms of support levels, the S&P 500 breached its doji support at 5050, and is now eyeing support at 4840 with minor backing around 4890. Conversely, the troops find some support around the 190 mark, with a supportive range extending to 180. Market breadth painted a discouraging picture for the bulls as the NYSE Advance – Decline Line not only gapped down but also closed beneath its March 29th weekly breadth thrust signal, essentially nullifying the gains from the signal while still holding above trend.

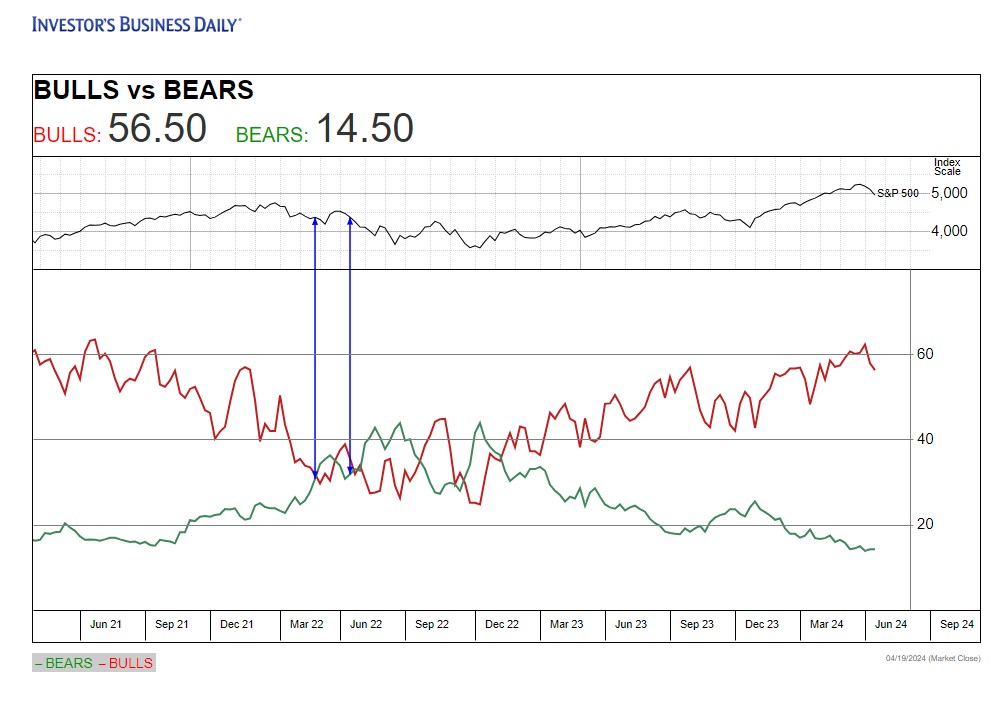

My perspective remains that the market may have moved too far too fast. Extreme sentiment readings underscore this view. While exuberant sentiment isn’t necessarily a sell signal, it might not be the opportune moment to increase equity exposure. Despite retail investors’ sentiment, as measured by Investor Intelligence, remaining high, asset managers’ sentiment (NAAIM Exposure Index) has tapered off from its exuberant peaks. This current state in Q2 2024 is reminiscent of Q3 2023 in several aspects. Overall, the market environment appears to remain robust and healthy, yet a bit of breather may be needed considering the progress made.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 4/22/2024. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.