Volume Analysis | Flash Market Update – 5.6.24

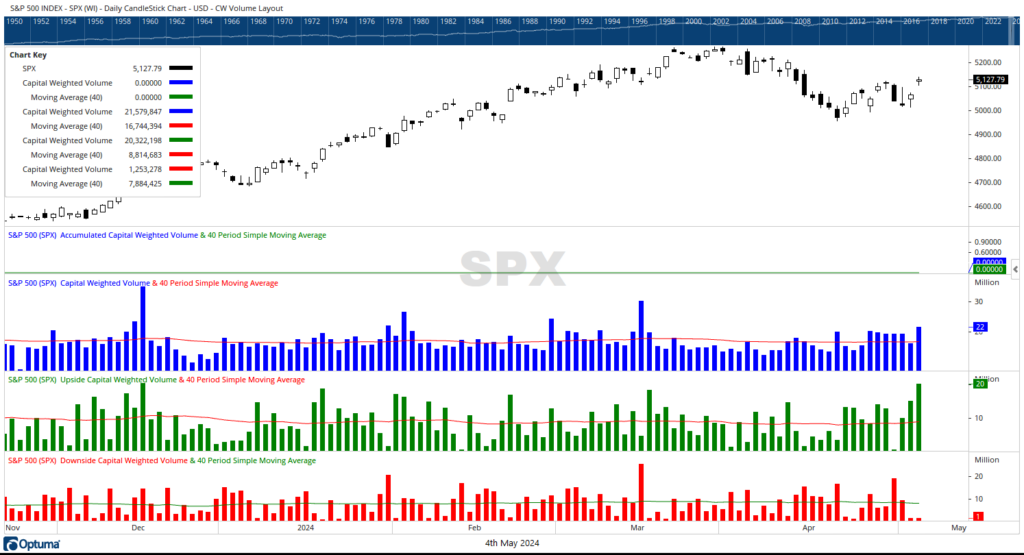

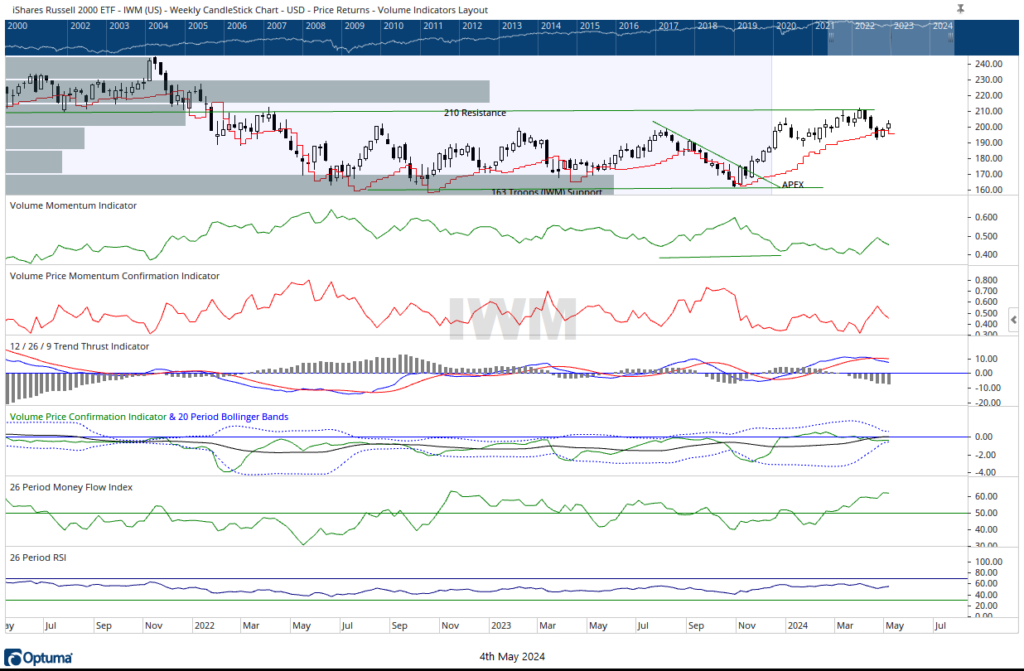

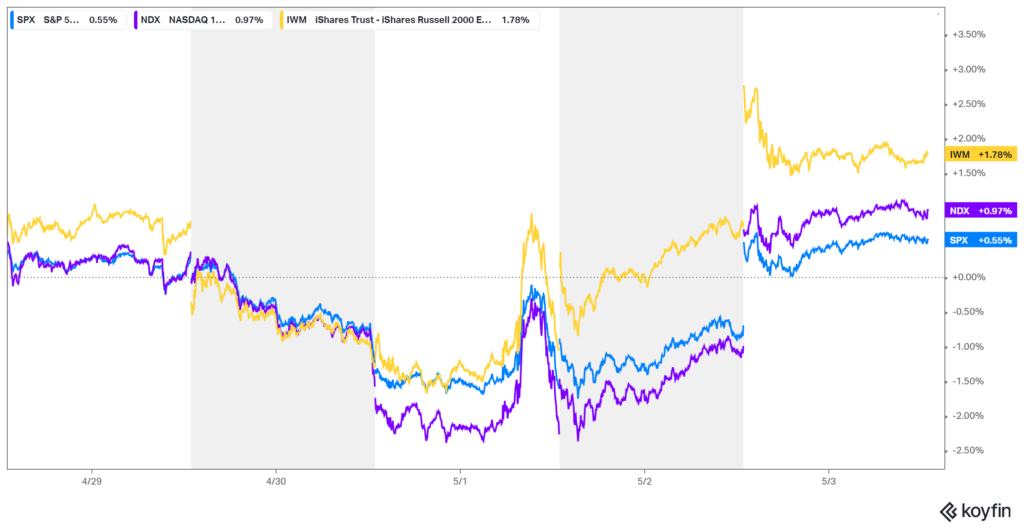

In last week’s Volume Analysis Flash Update, I highlighted the previous week’s market dynamics, noting a strong start with an 86% Capital Weighted Volume day on Monday, followed by an even more impressive 93% upside day on Tuesday. Such concentrations of capital inflows may indicate a bullish trend within the market. However, this past Tuesday saw a notable shift as the S&P 500 closed April with a 97% downside day, witnessing $19 billion flowing out compared to just $500 million in inflows. Nevertheless, Thursday saw a swift reversal, with a 92% Upside day ($15 billion in vs. $1.26 billion out), followed by an even stronger performance on Friday (05/03) with a 94% Upside Day ($20.3 billion in vs. $1.25 billion out), marking the second bullish cluster in two weeks. For the week, the lagging troops (iShares Russell 2000 ETF, IWM) led the broad markets higher, appreciating 1.78%, followed by the generals (NDX 100) up 0.97%, with the S&P 500 rising 0.55%.

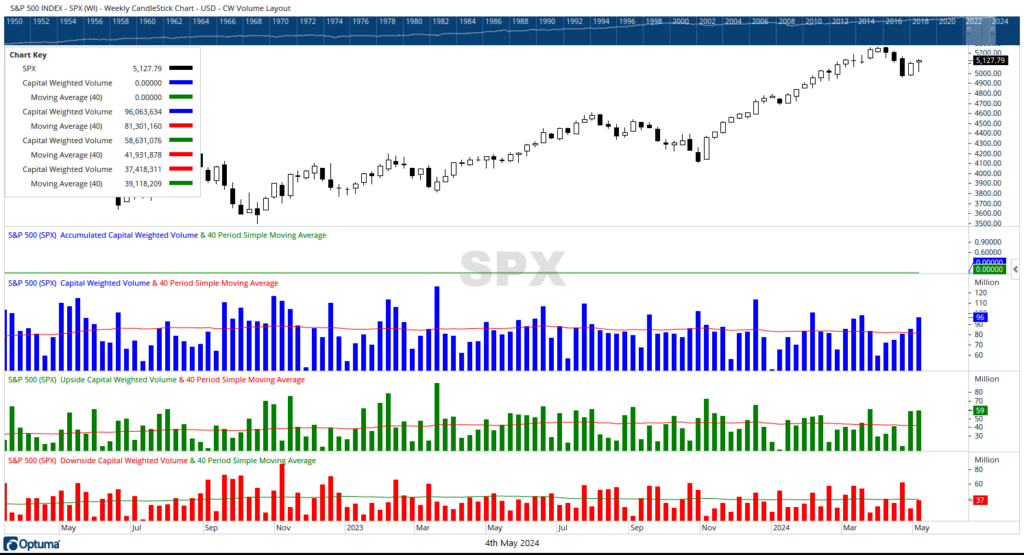

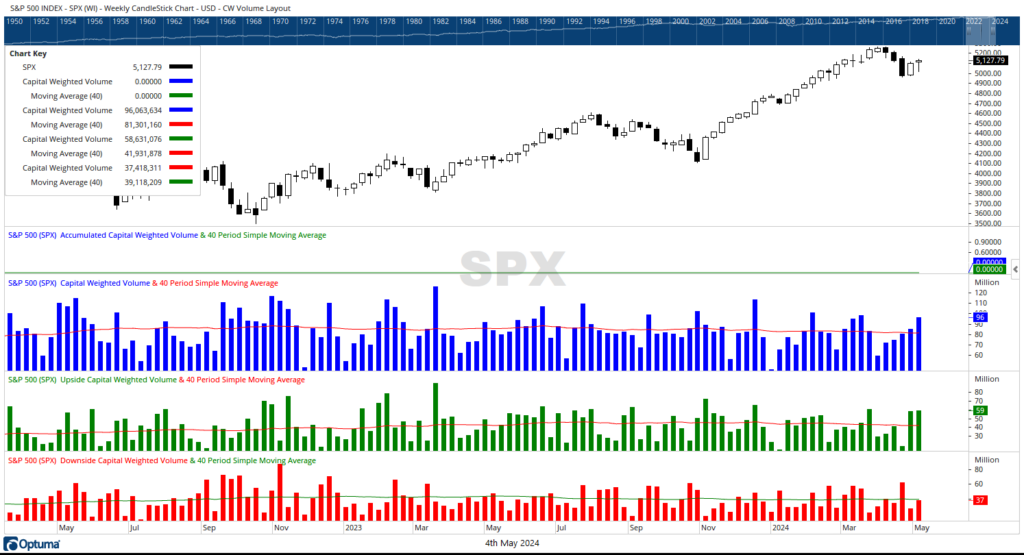

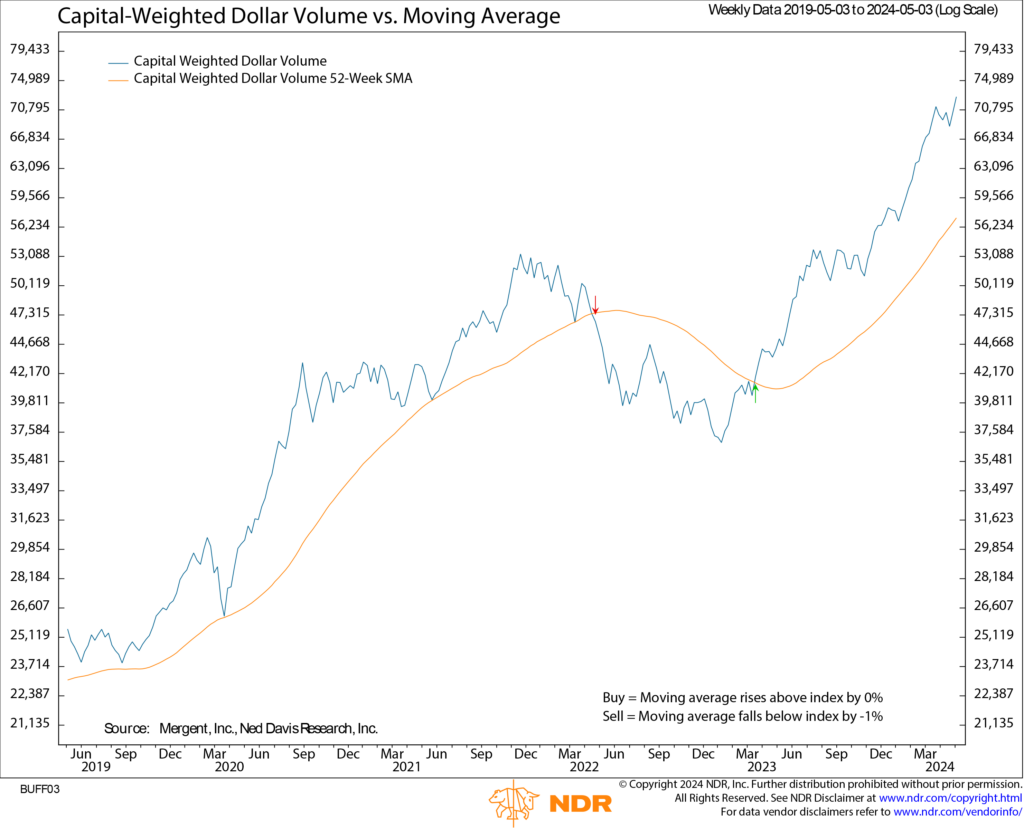

S&P 500 Capital inflows surpassed outflows at $58.5 billion to $37.5 billion, with $96 billion changing hands in above-average market action. Last week, capital-weighted volume rose to grapple with all-time high resistance, but this week it surged, soaring to new highs. Meanwhile, accumulated Capital Weighted Dollar Volume also reached new highs. Hence, both our S&P 500 Capital Weighted Volume Indexes are still widely leading the S&P 500 price index, which remains below its former doji top and even further away from its March all-time highs. Volume leading price signals a potentially healthy market state. Additionally, the NYSE Advance-Decline Line enjoyed a bullish week and now sits near the midpoint of its significant bullish breakout that concluded March. On Friday, the troops (IWM) briefly breached 203 resistance but only to close the day below, further substantiating the resistance level. Overall, market conditions appear to remain robust, fueled by asset inflows.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 5/6/2024. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.