Portfolio Manager Insights | Why Cash Is Not a Long-Term Investment – 5.8.24

In times of market uncertainty, investors often seek the safety of cash. This has been true over the past several years as markets have swung due to the pandemic, geopolitical events, Fed rate hikes, inflation, gridlock in Washington, technology trends, and more. More recently, the possibility of worse-than-expected inflation and a delay 0f the first Fed rate cut have led to renewed investor concerns. At the same time, interest rates on cash are at their highest levels in decades, making it appear that there are attractive “risk-free” returns. What role should cash play in investor portfolios today?

After over a decade of historically low interest rates, higher cash yields are a welcome development for many investors. Interest rates are higher across all cash instruments including many savings accounts, certificates of deposit, and money market funds, just to name a few. This is because the Fed raised rates rapidly from early 2022 to mid-2023 and has kept the federal funds rate in a range of 5.25% to 5.50% since last July. After the recent Fed meeting, Fed Chair Jerome Powell noted that it “will take longer than previously expected” to gain greater confidence that inflation is on the right path, implying that policy rates could stay higher for longer.

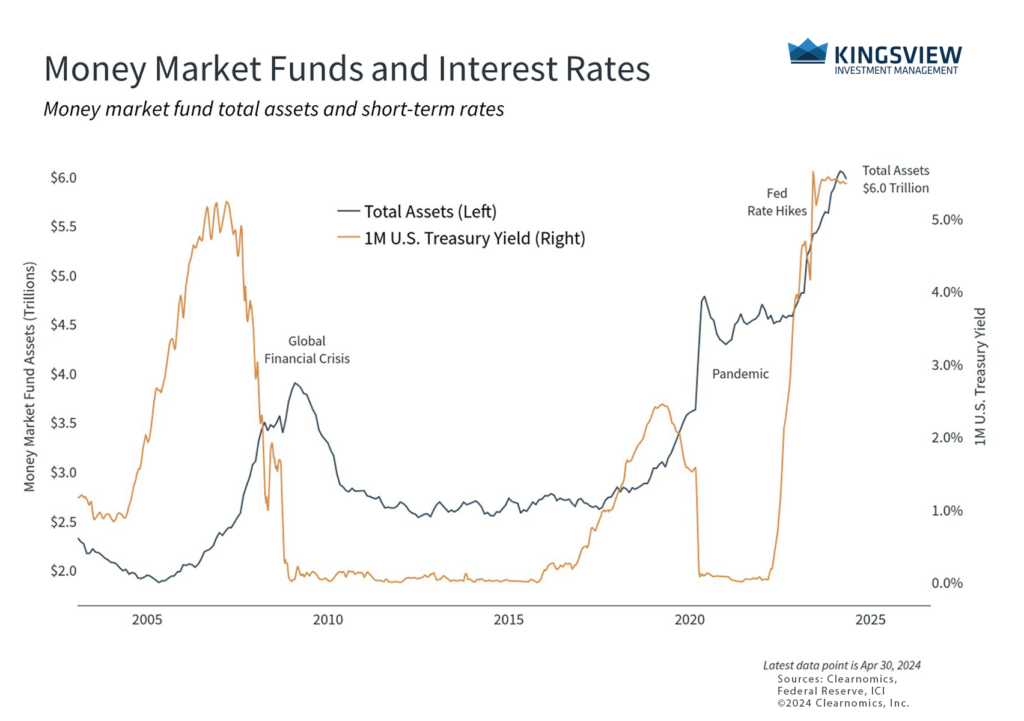

Money market funds have experienced significant inflows

These dynamics have led many investors to hold more cash than in the past. Money market funds, for instance, have attracted inflows with total assets reaching new all-time highs of $6 trillion. This is more than double the assets held in money market funds prior to the pandemic when interest rates were near zero for the better part of a decade. As the accompanying chart shows, money market fund assets have typically grown in times of economic distress or when interest rates have been high.

Cash is an essential part of any financial and investment plan. From a financial planning perspective, cash provides the liquidity needed to cover expenses and important life events. The down payment on an upcoming home purchase, for instance, should primarily be held in cash-like instruments. Similarly, it’s important to have enough cash to serve as an emergency fund in case of unexpected personal events such as injury or illness or broader events such as an economic downturn. From an investment standpoint, cash can also serve important roles including reducing overall portfolio risk and by allowing investors to take advantage of attractive market prices.

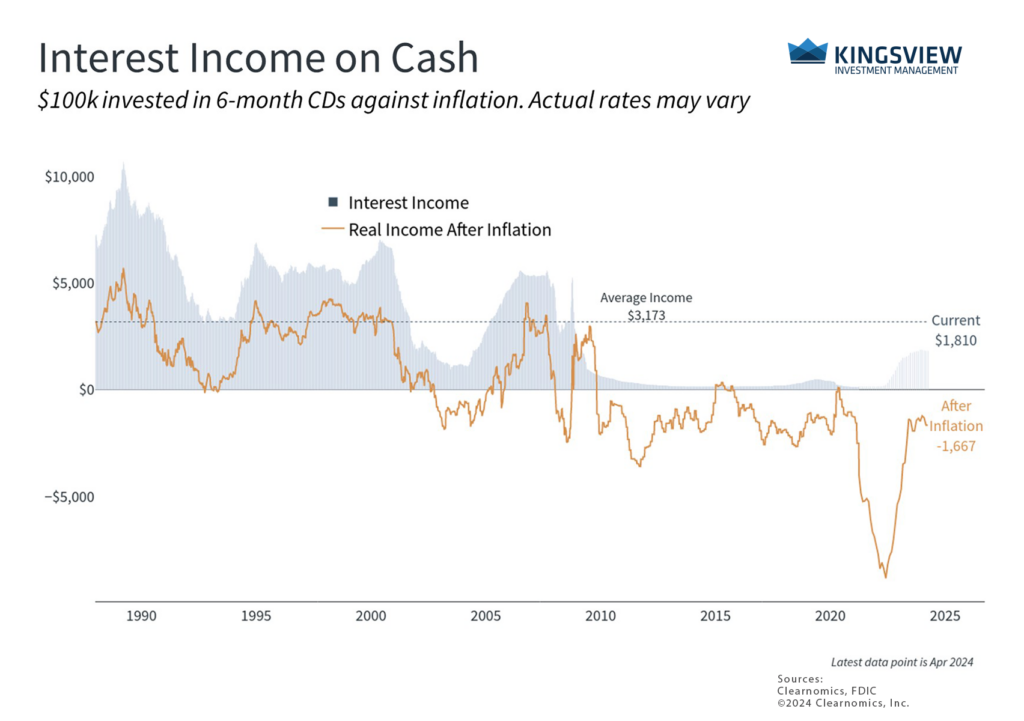

Inflation erodes the value of cash

While cash is important, it can become problematic when investors hold too much cash. This is because cash is not truly risk-free for two important reasons. First, inflation quietly erodes the purchasing power of cash over time. So even if yields appear to be high, the real value of your money could decline. As the accompanying chart shows, the inflation-adjusted income on cash has consistently been negative when considering average certificate of deposit rates.

While there are many cash instruments that could generate more yield than these averages, the problem is that these rates are not “locked in.” By definition, short-term rates need to be rolled over often as instruments mature and expire, introducing what is known as “reinvestment risk,” or the idea that future rates may not be as attractive. Even in the best case scenario, investors need to actively manage these instruments to ensure that they are still receiving the level of rates they expect.

The second challenge with holding excess cash is the opportunity cost of not investing in stocks or bonds. Just as interest rates have risen for cash, yields have also jumped across many types of bonds. The average yield on U.S. investment grade corporate bonds, for instance, is now 5.5% – far more attractive than the average of 3.7% since 2009. Unlike cash, these yields are longer-term in nature and these bonds could experience price appreciation if rates do decline.

Similarly, the stock market has performed extremely well despite many investor concerns over the past few years. The S&P 500 is still up 8% with dividends and has gained about 47% since the market bottom in 2022. While the past is no guarantee of the future, these returns have far outpaced inflation and would have helped to offset the erosion of purchasing power across a portfolio.

Stocks and bonds have outpaced inflation over history

The prospects for cash will only worsen if the Fed does begin to cut rates later this year. Investors would be forced to reinvest their cash either at lower interest rates or in stocks and bonds whose prices would most likely have already risen. The possibility of falling rates has been an important driver of the overall stock market that will likely continue.

The accompanying chart makes this opportunity cost clear. Due to inflation, what cost one dollar in 1926 now costs $17. However, the stock market has significantly outpaced inflation over long periods of time. A hypothetical one dollar investment in the stock market in 1926 would be worth over $13,000 today. A similar investment in long-term bonds would be worth $106, also outpacing inflation.

Thus, while short-term investments can play important roles in financial plans and portfolios, it’s critical in today’s market environment to avoid holding cash for the wrong reasons. Market fear and high short-term rates have driven significant flows into cash and cash-like instruments. While these may make sense for short periods, history shows that they are not the foundation of long-term financial success.

The bottom line? Investors should review their cash holdings as the stock market continues to rally and the Fed prepares to cut rates. In the long run, holding a proper allocation of stocks and bonds is still the best way to achieve financial goals.