Volume Analysis | Flash Market Update – 4.8.24

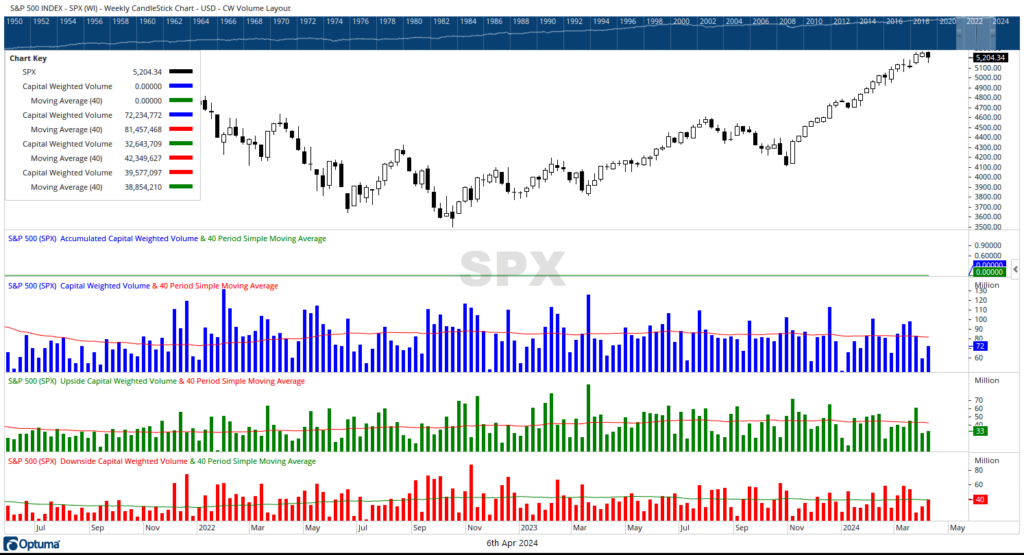

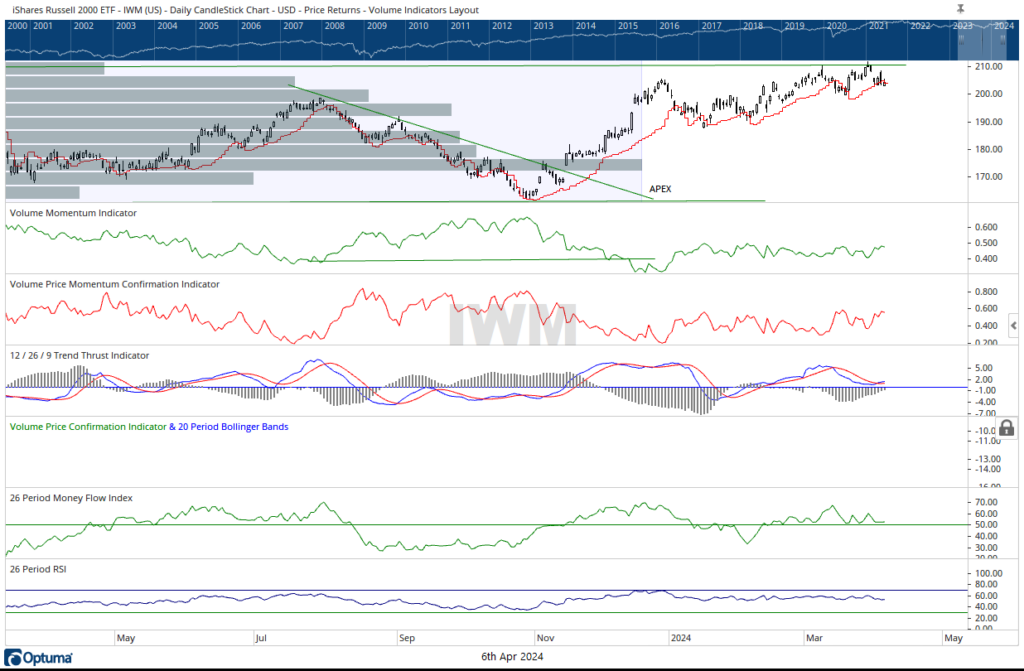

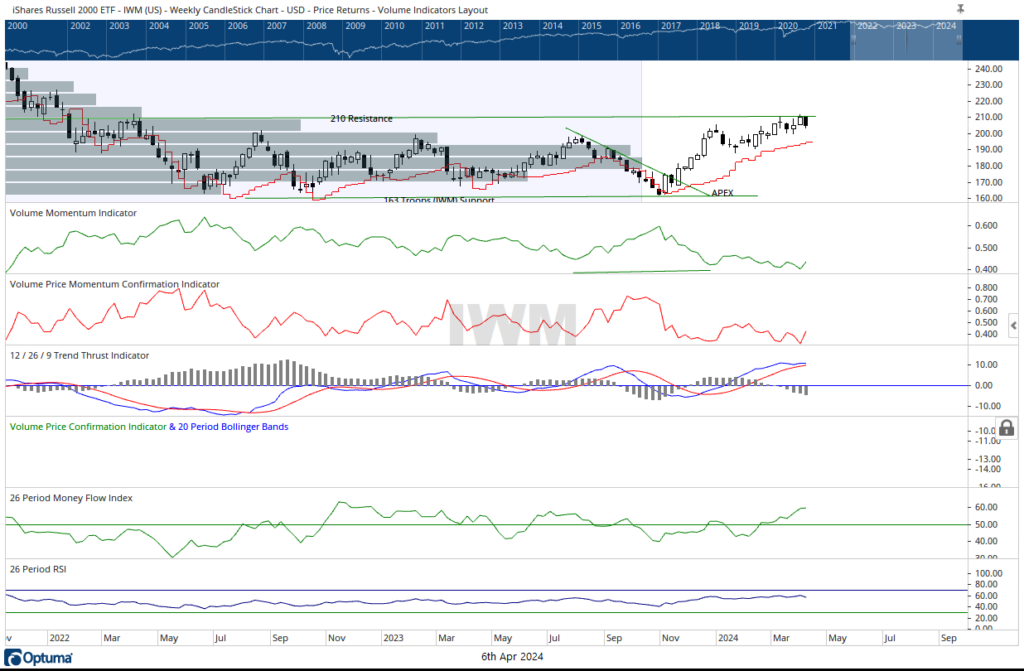

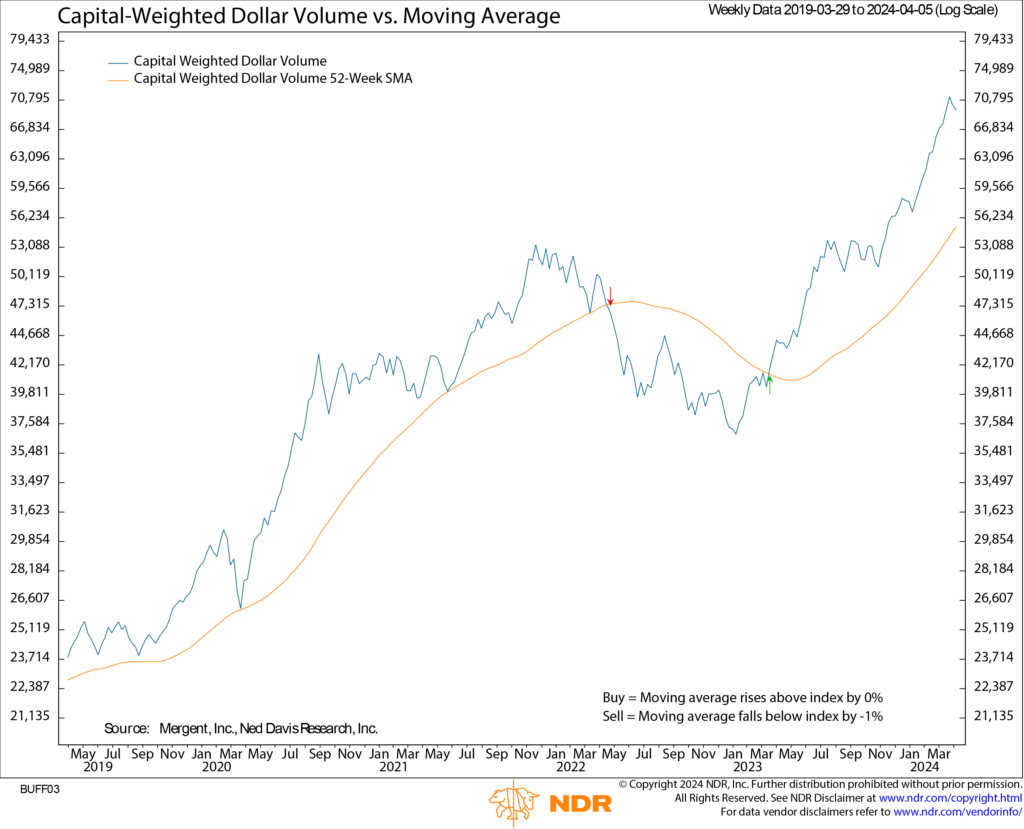

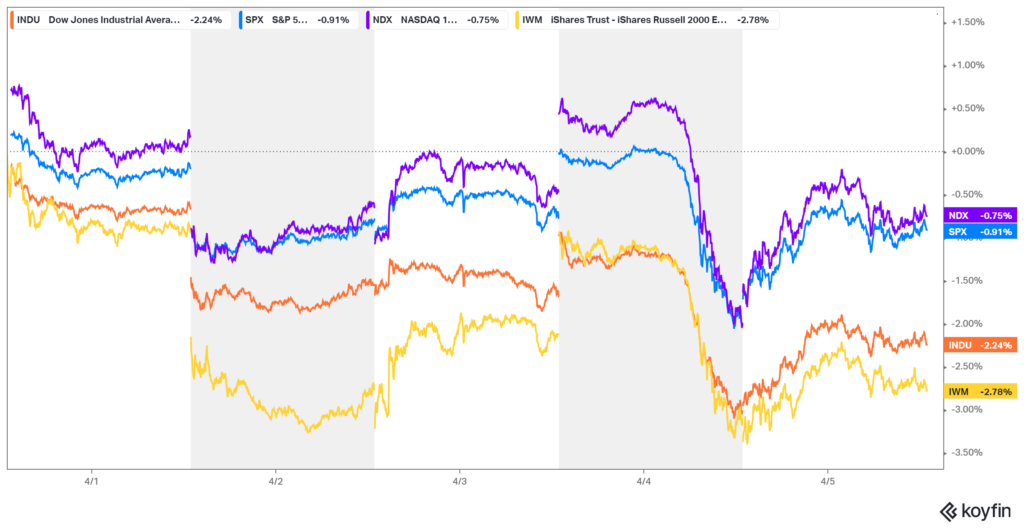

This past week witnessed a pullback occurring on light volume. The S&P 500 experienced outflows of $39.5 billion, notably low for a downturn week. Meanwhile, inflows amounted to $32.6 billion, falling below the average for a typical week. Among our tracked indexes, the Nasdaq 100, serving as the generals, demonstrated the most resilience, with a decline of -0.75%. Conversely, the troops, represented by the iShares Russell 2000 ETF, experienced the most significant retreat with a decline of -2.78%. The S&P 500 closed the week down -0.91%, returning within its former doji range.

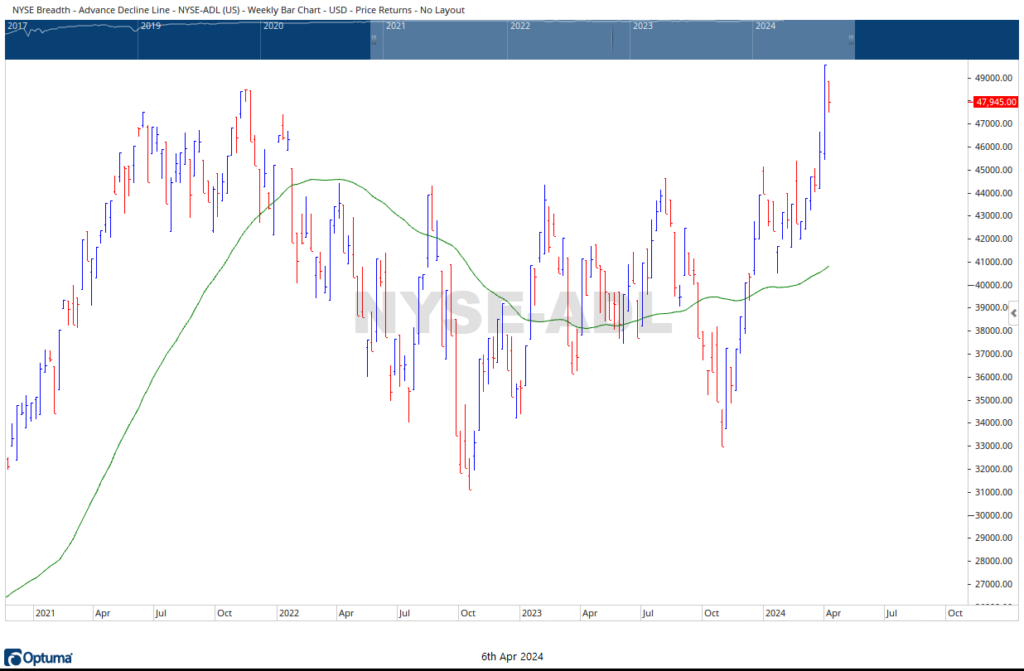

Following last week’s movements, both the iShares Russell 2000 ETF and the S&P 500 find themselves once again within the ranges of their respective doji’s formed a month ago on March 8th. IWM faces resistance around 211 and approaches potential support near 199. Similarly, the S&P 500 encounters doji support at 5130, with resistance extending beyond 5200. Despite the breadth thrust last week that resulted in new highs, the NYSE Advance-Decline closed within the wide range observed the previous week.

Overall, the week appeared bearish in terms of price action, particularly for small caps. However, it’s worth noting that the pullback in large caps didn’t coincide with significant volume or substantial capital outflows, which may provide a somewhat encouraging sign amidst the market turbulence.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 4/8/2024. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.