Volume Analysis | Flash Market Update – 4.29.24

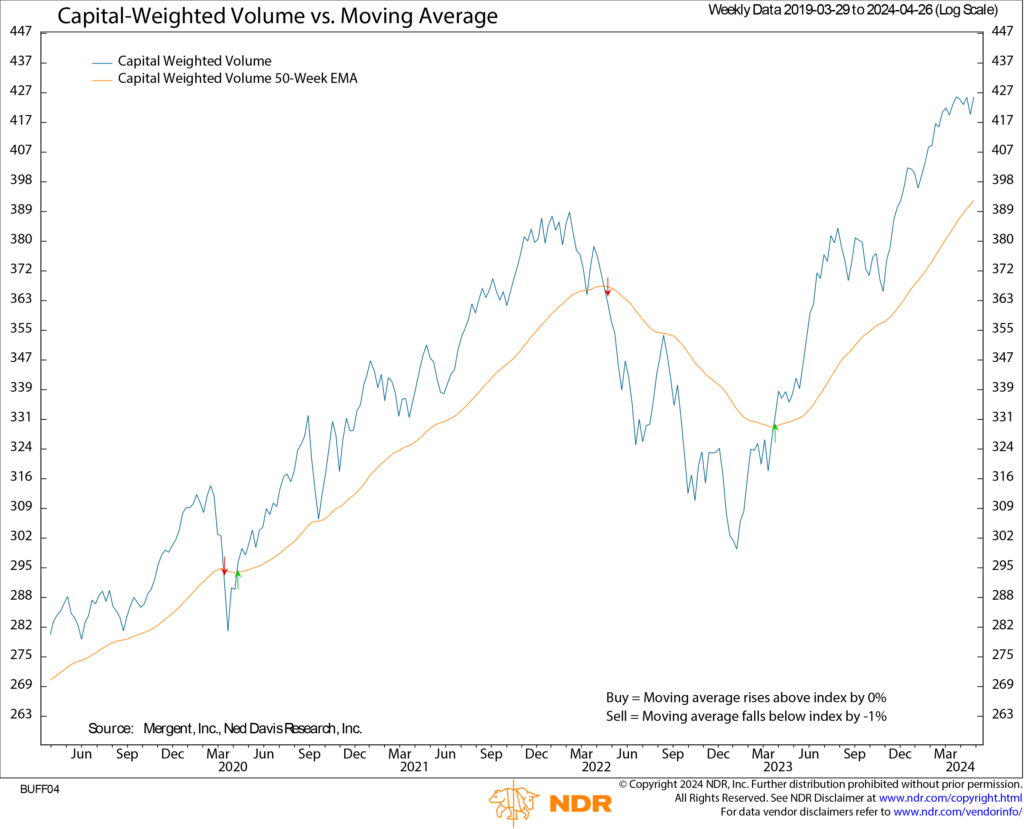

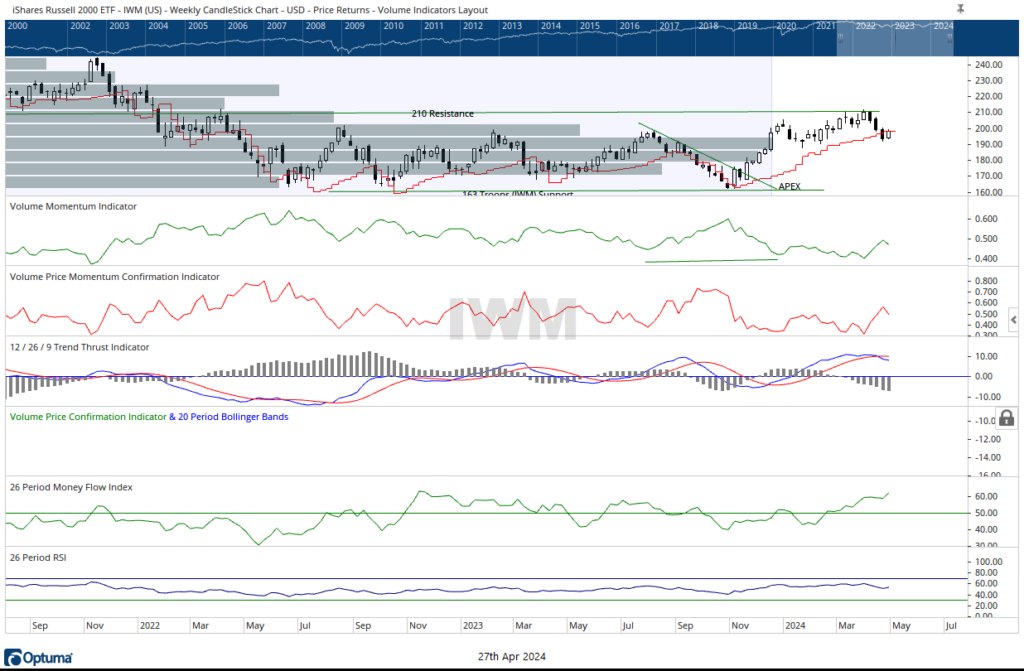

This past week saw a bullish resurgence in the market, with the generals again leading the charge upwards (+3.99% for the NDX 100) and the troops dutifully following suit (+2.70% for the iShares Russell 2000 ETF, IWM). Notably, S&P 500 Capital Weighted Volume Flows showcased an impressive performance, witnessing capital inflows more than double outflows, with $58 billion pouring in compared to $27 billion flowing out. The week kicked off with a robust 86% Capital Weighted Volume day on Monday, followed by an even more impressive 93% upside day on Tuesday. Such clusters of capital inflows may signal a bullish foundation within the market. Overall, S&P 500 Capital Weighted Dollar Volume continues to outpace price, indicating a potentially healthy market condition, while its sibling Capital Weighted Volume gains momentum. Despite the S&P still being over a hundred points shy of its all-time highs, Capital Weighted Volume has surged to all-time highs, another possible indication of a bullish market condition.

After finding support the previous Friday, the troops maintained their momentum throughout the week. In IWM, resistance lies ahead at the former doji bottom of 203, with support resting at 193. The NYSE Advance-Decline opened the week with a gap higher and sustained momentum as the week closed. Looking at the S&P 500, the next resistance levels are at 5150, followed by the top of the old doji at 5190.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 4/29/2024. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.