Volume Analysis | Flash Market Update – 3.4.24

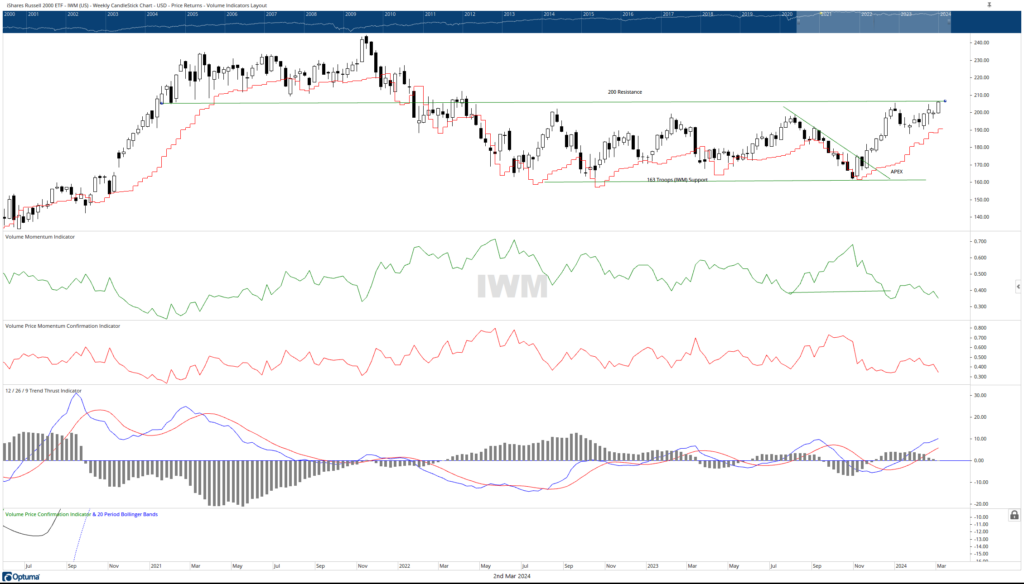

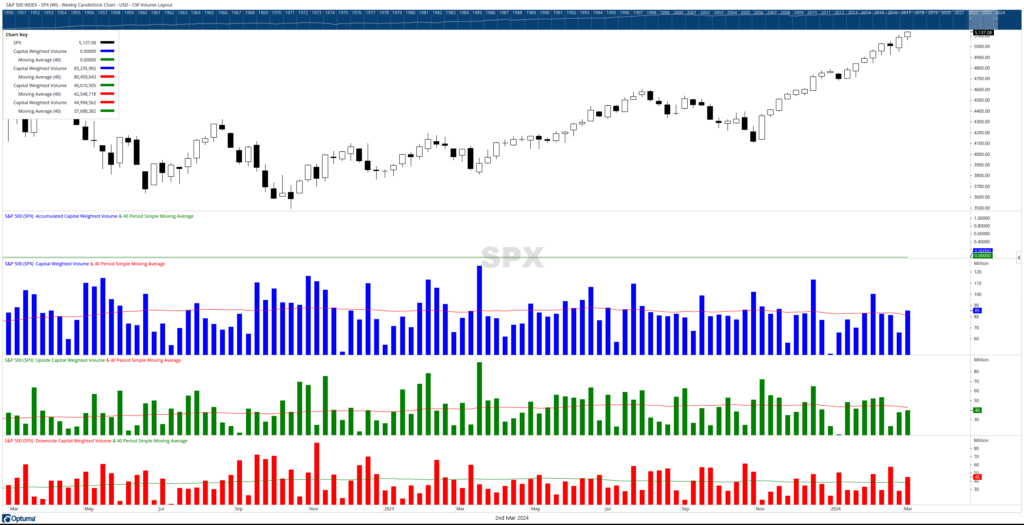

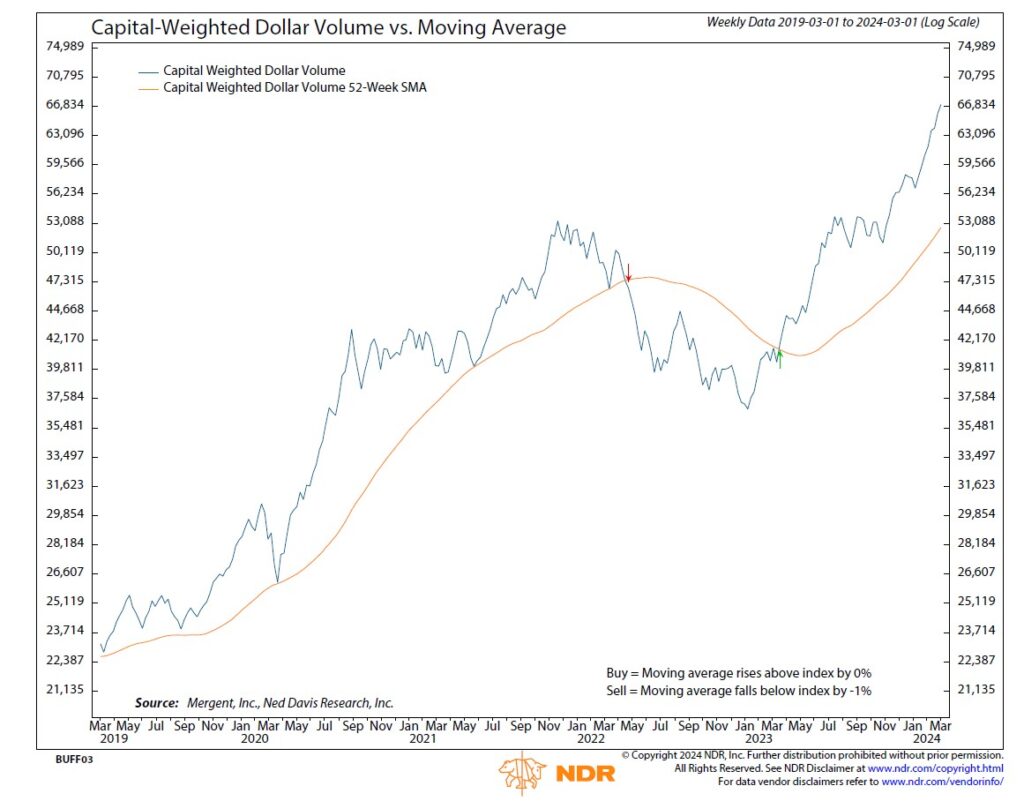

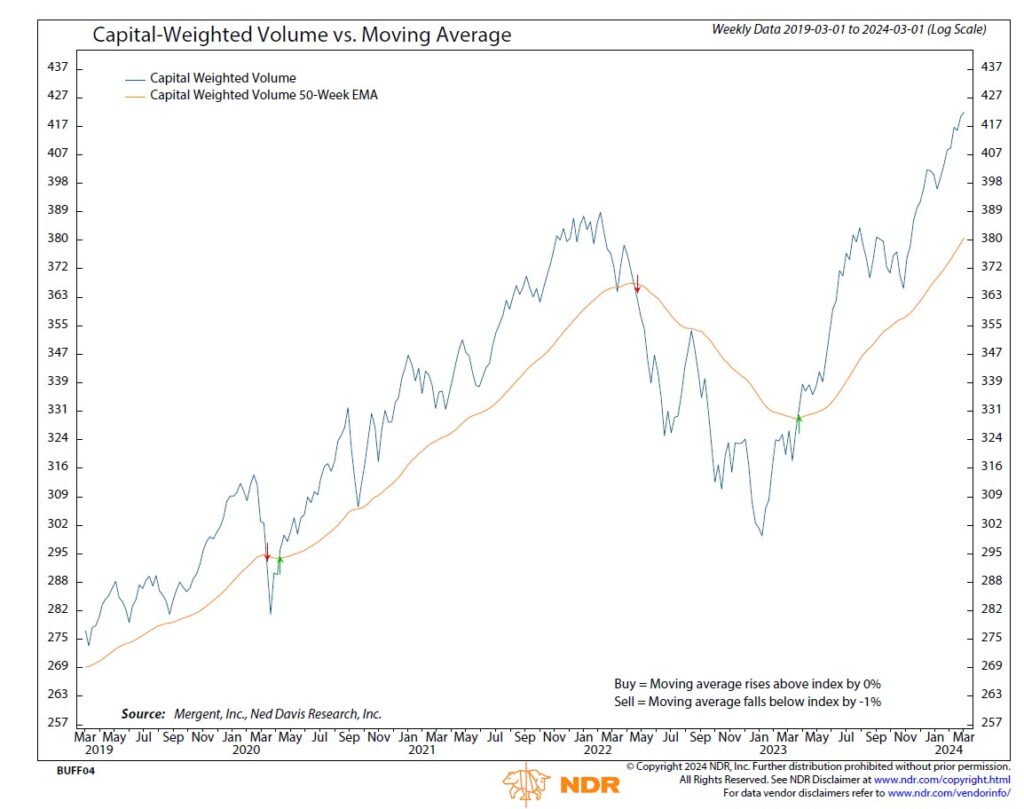

Despite the S&P 500 reaching an all-time high, capital outflows surpassed inflows with $45 billion exiting compared to $40 billion entering the capital weighted index. While this capital flow data may disappoint bullish investors, analyzing other datasets suggests a potentially healthy market broadening. Throughout the week, smaller-cap stocks, the troops, represented by the iShares Russell 2000 ETF (IWM) surged by 2.83%, while our leading generals represented by the Invesco QQQ ETF (QQQ) also saw a strong advance of 1.91%. The SPDR S&P 500 ETF Trust (SPY) followed with a comparatively modest gain of 0.82%. Notably, S&P 500 Capital Weighted Volume reached another record high and continues to lead the price index.

The performance of IWM remains a key focal point, closing the week just above a critical resistance level of 205. Despite numerous attempts to break out, the index has struggled around this level for the past couple of years. A decisive breakout above 205 may carry significance not only for smaller-cap stocks but also for the broader market as a whole. Concurrently, market breadth, as indicated by the NYSE Advance-Decline Line, achieved a new yearly high and is now approaching levels not seen since July of 2023.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 3/4/2024.Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.