Volume Analysis | Flash Market Update – 3.18.24

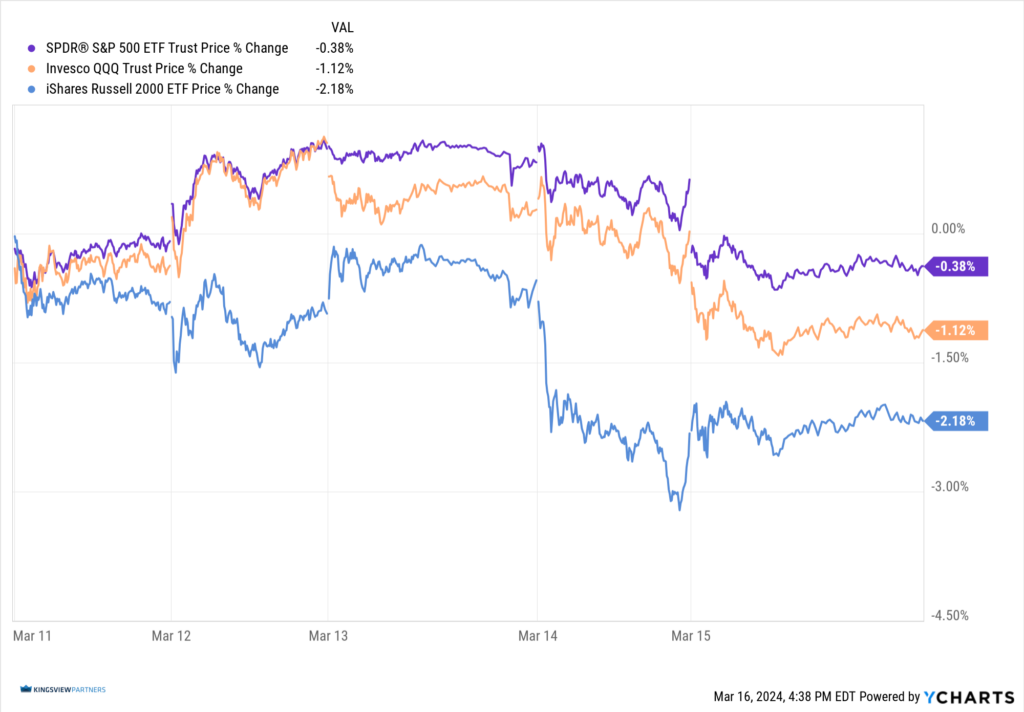

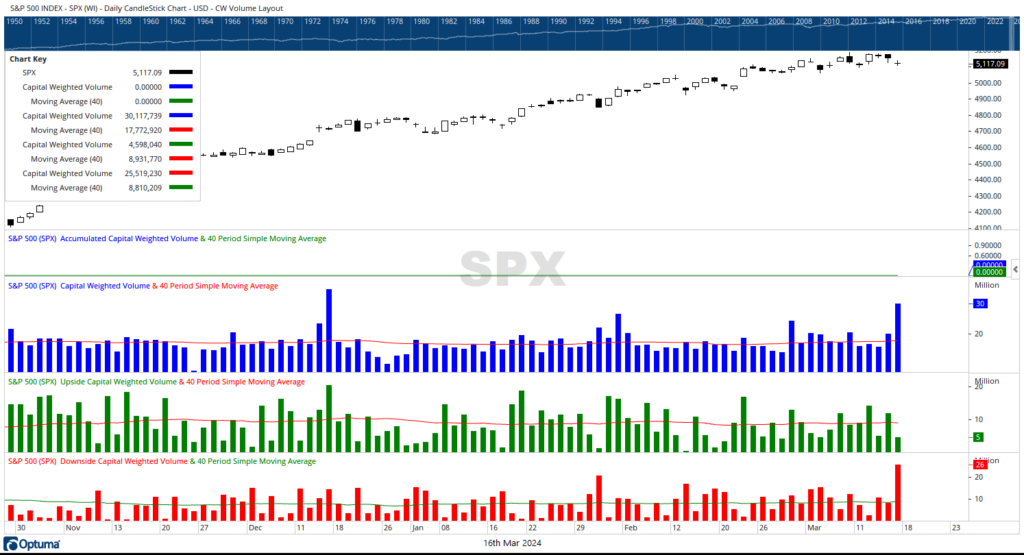

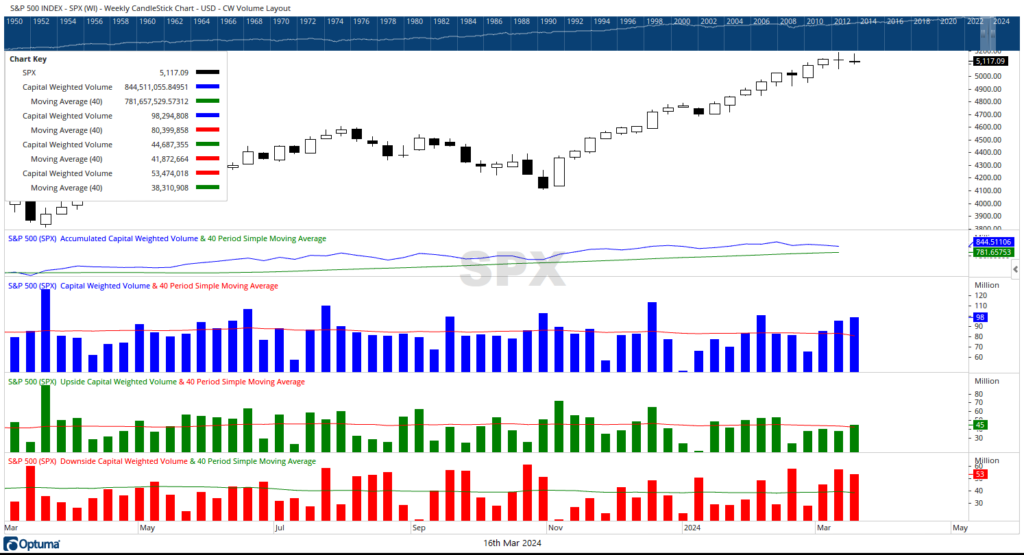

Downside S&P 500 Capital Weighted outflows led inflows $53.5 to $44.7 billion on above-average volume. Both the generals (QQQ- Nasdaq 100 ETF), the troops (IWM Russell 2000 ETF) were down -1.12% and -2.18% on the week. Meanwhile, the Spyder (SPY S&P 500 ETF) closed down just -0.38% to remain completely inside last week’s “Doji Star” range. However, IWM broke and closed beneath its prior week’s “Doji Star” low.

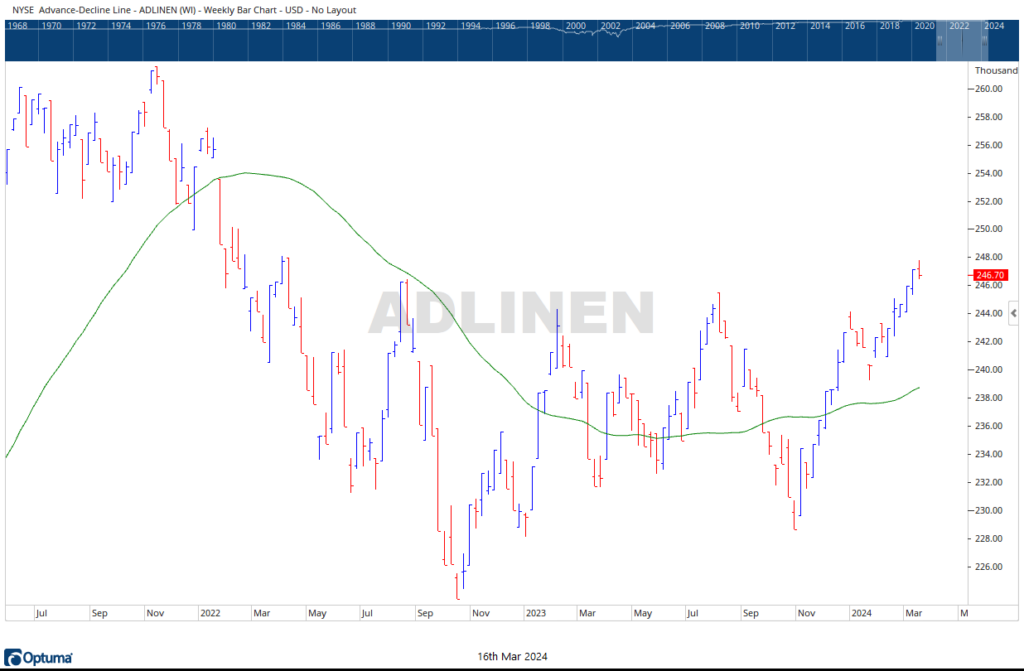

Despite the price drop, both Capital Weighted Volume and Dollar Volume reached all-time highs intra-week. However, Friday’s downside capital flows represented approximately 85% of flows on very high volume. Meanwhile, advancing market breadth also took a bit of a breather, finishing lower after making a new yearly high earlier in the week. Overall, last week theme of a pause seems to being playing out to script.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 3/18/2024. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.