Volume Analysis | Flash Market Update – 2.20.24

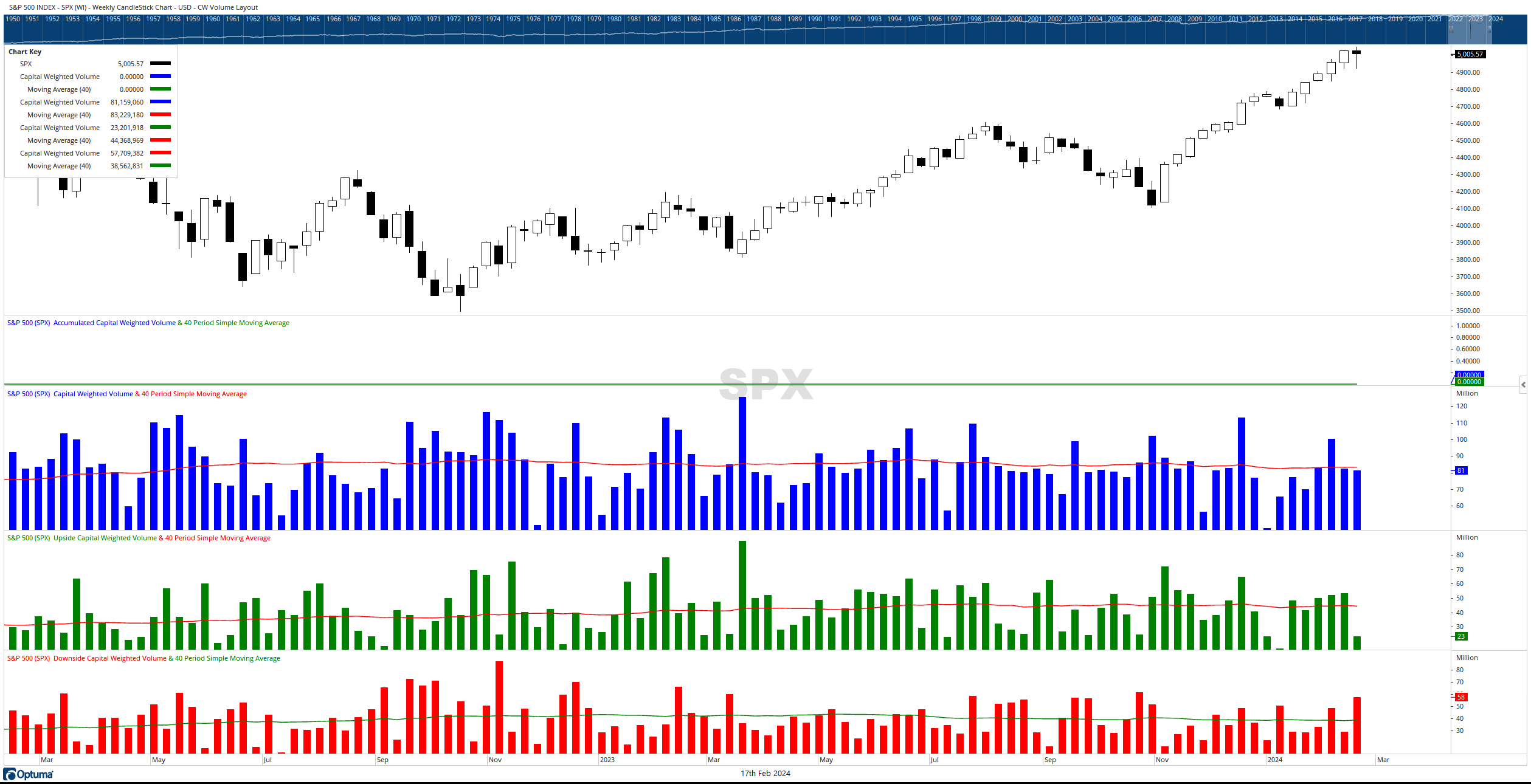

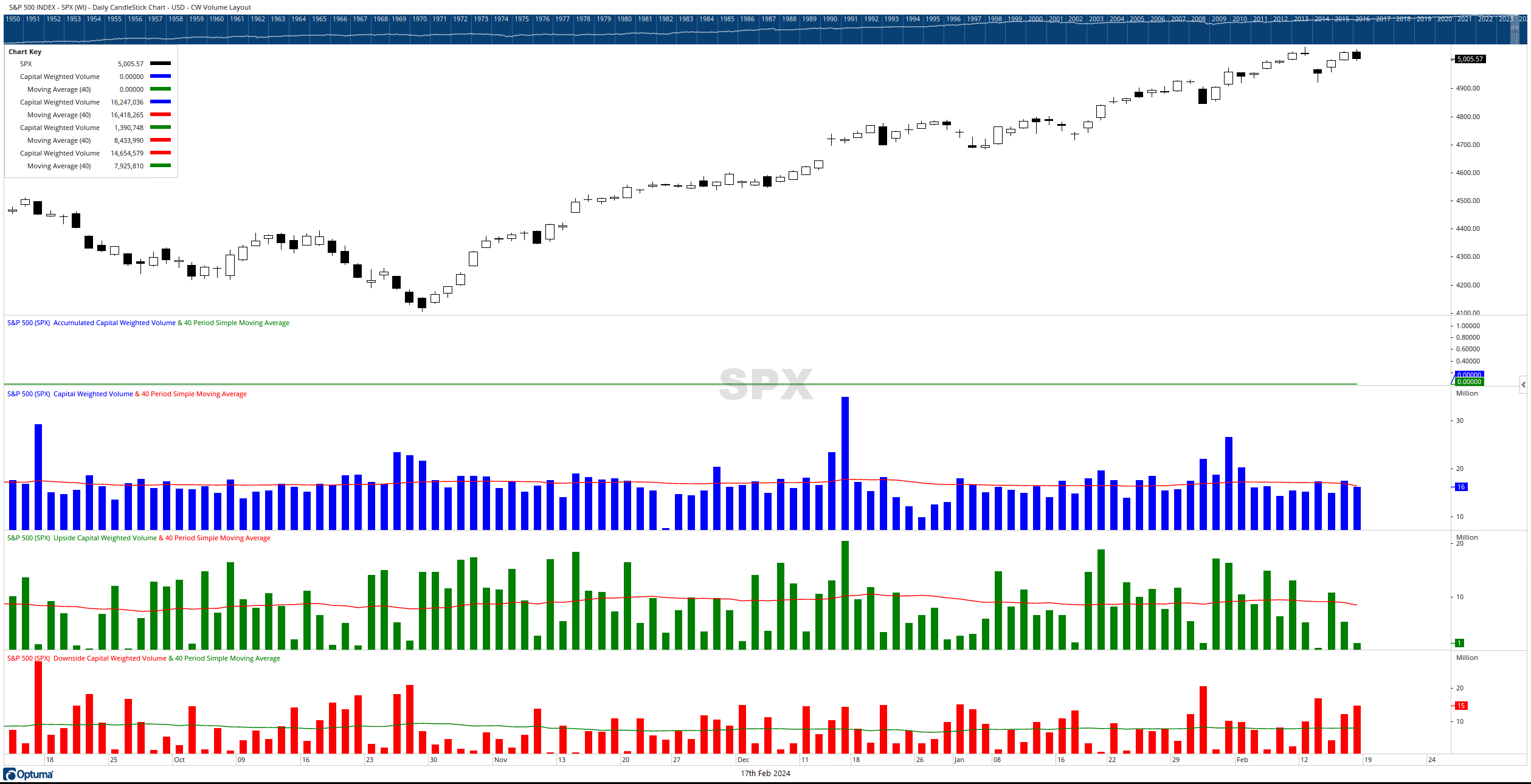

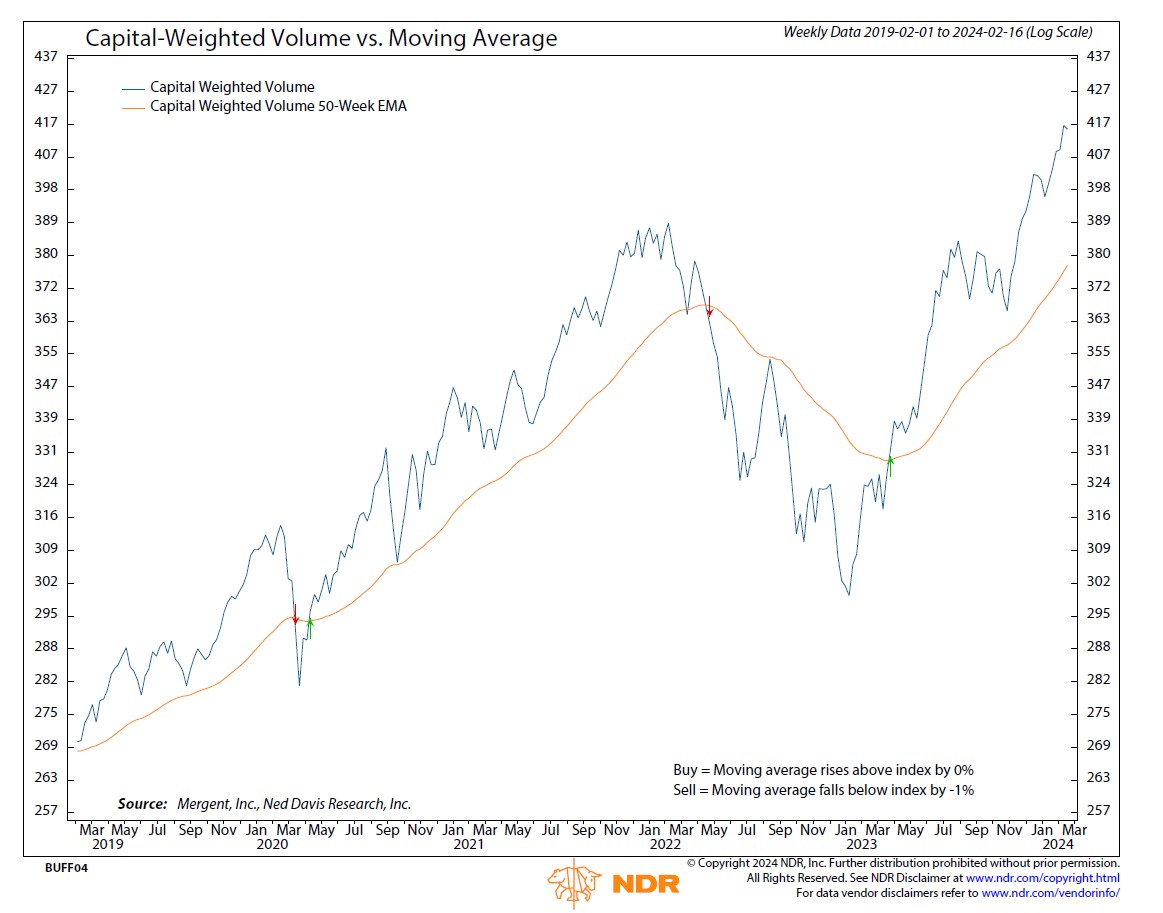

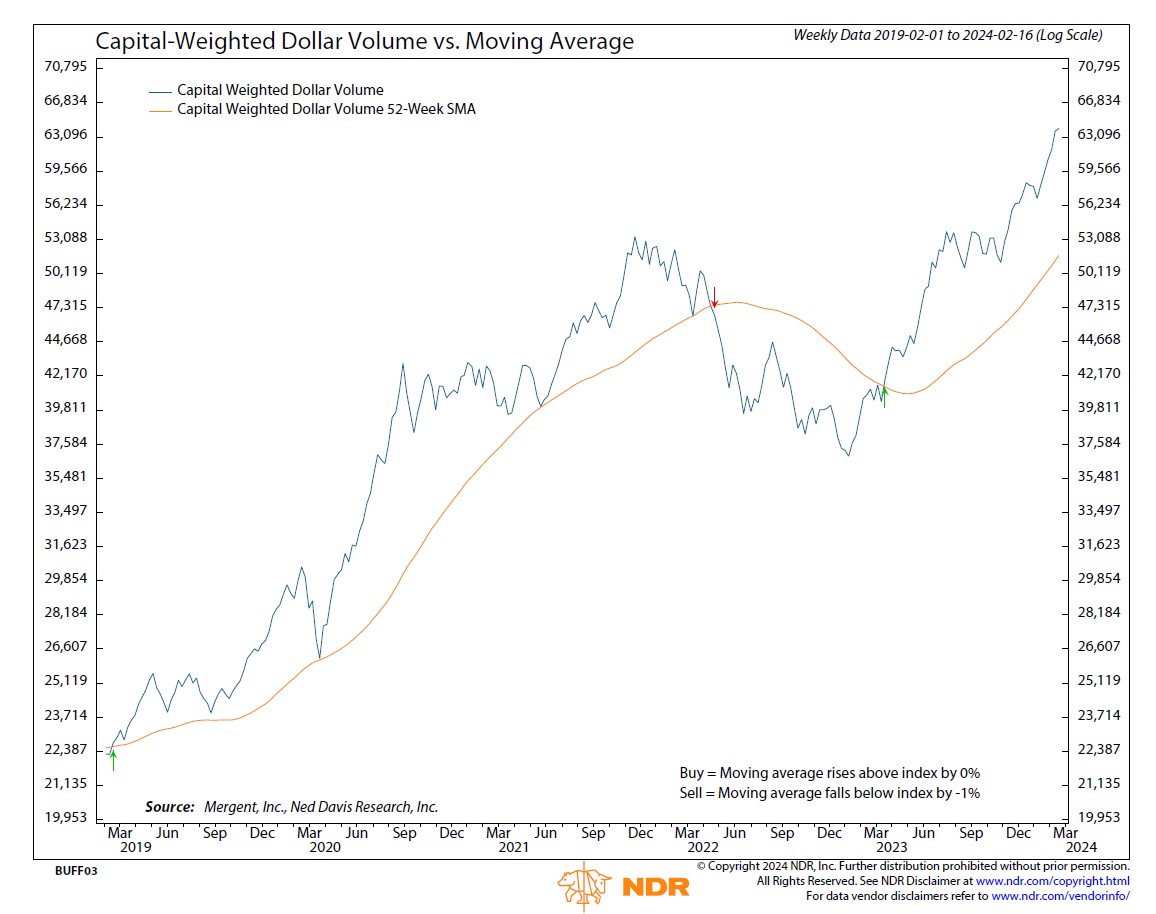

Last week witnessed a stark departure from recent market trends. Since November, the market has been on an upward trajectory fueled by above-average inflows and increasing capital volume. However, the S&P 500 closed the past week down -0.41%, accompanied by significant net capital outflows. Despite the downturn, the net S&P 500 Capital Weighted Volume remained flat for the week, which is a positive indicator amidst market declines. Nonetheless, capital outflows from the S&P 500 index were substantial, amounting to $57.7 billion, while capital inflows were notably low at $23.2 billion. Consequently, outflows more than doubled inflows, despite the S&P 500 experiencing less than a half-percent decrease.

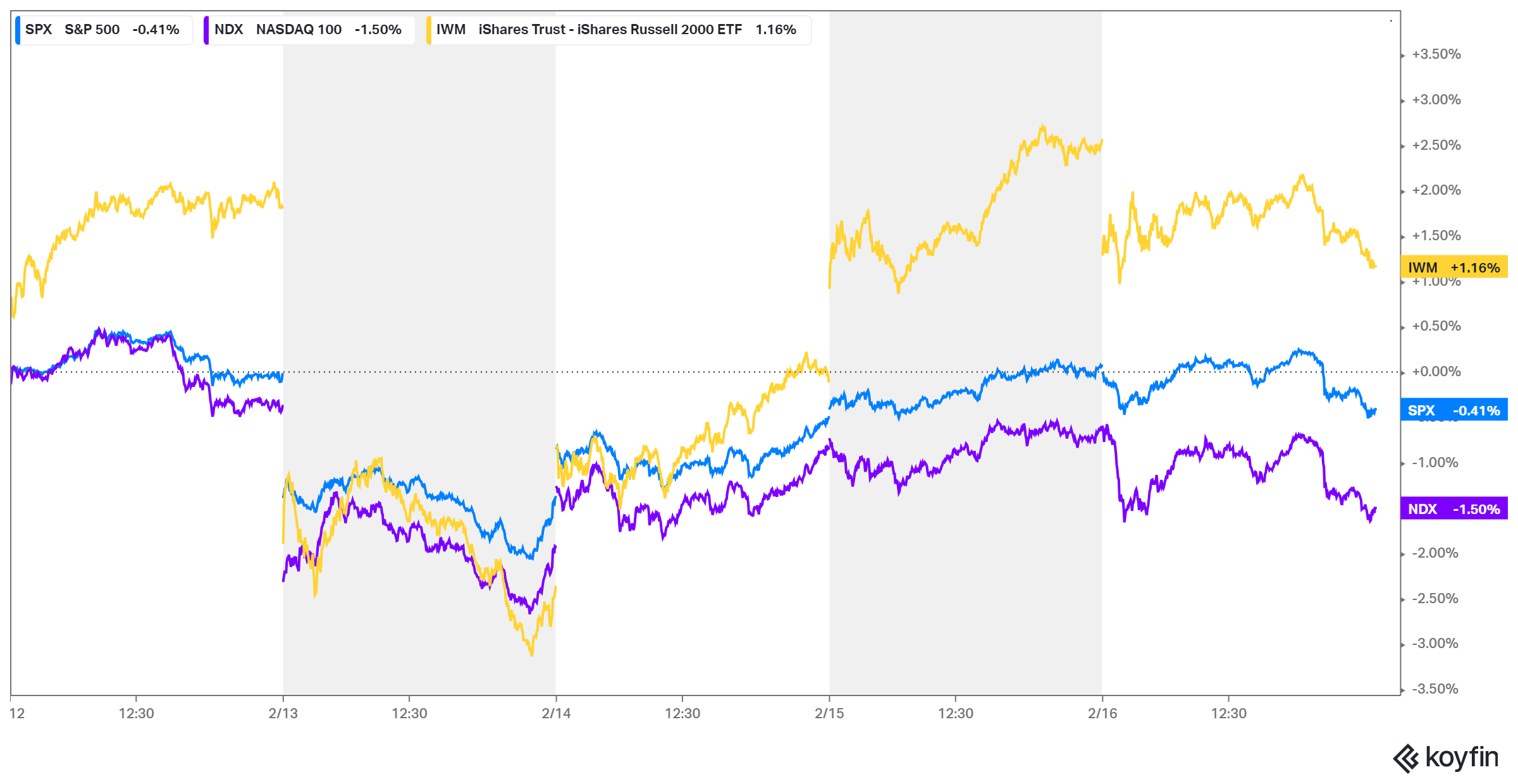

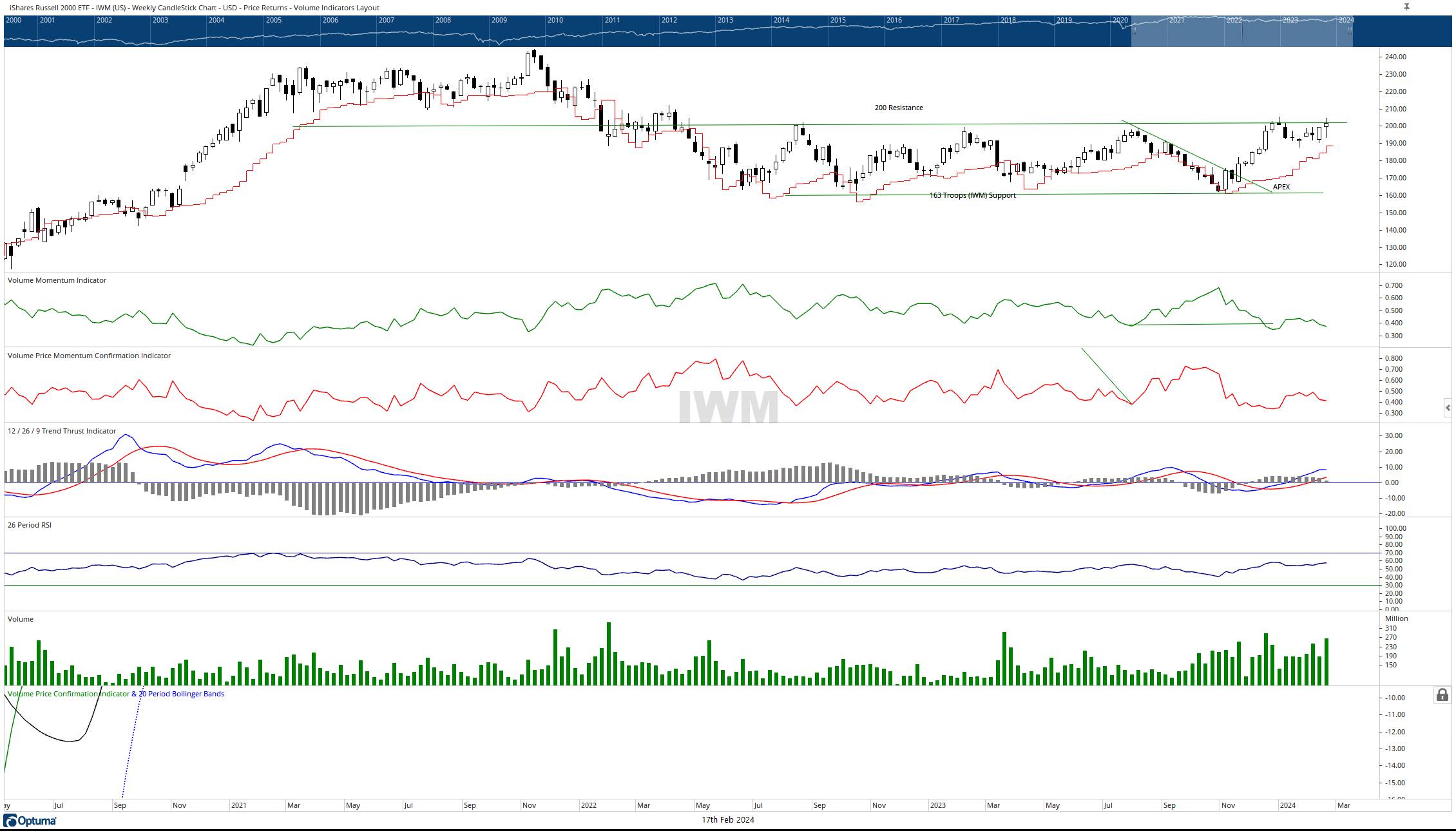

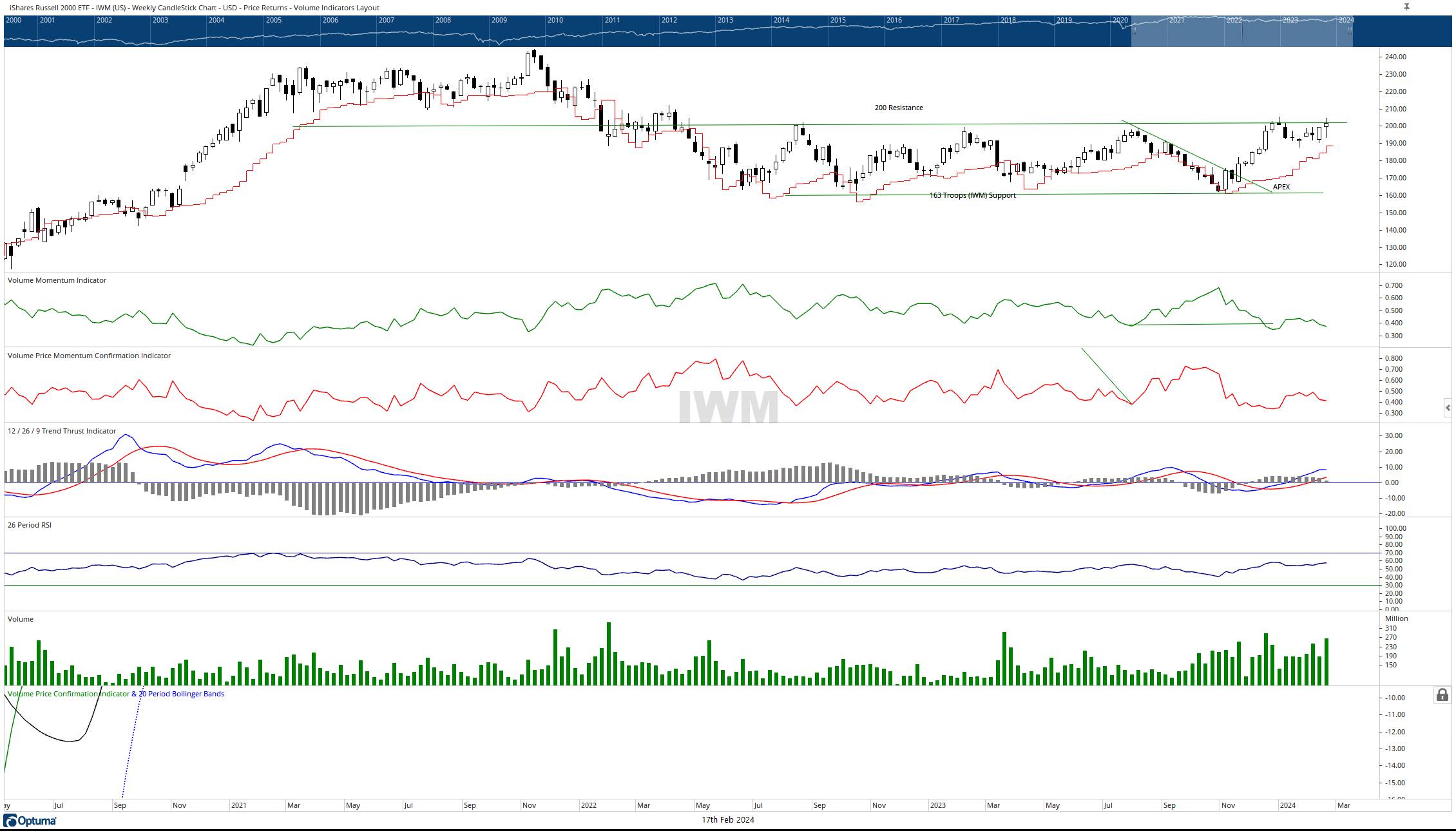

Among market indices, the generals (NDX 100) experienced the largest retreat last week, down -1.50%. Conversely, the troops, represented by the iShares Russell 2000 ETF (IWM), rallied to close the week with a 1.16% increase.

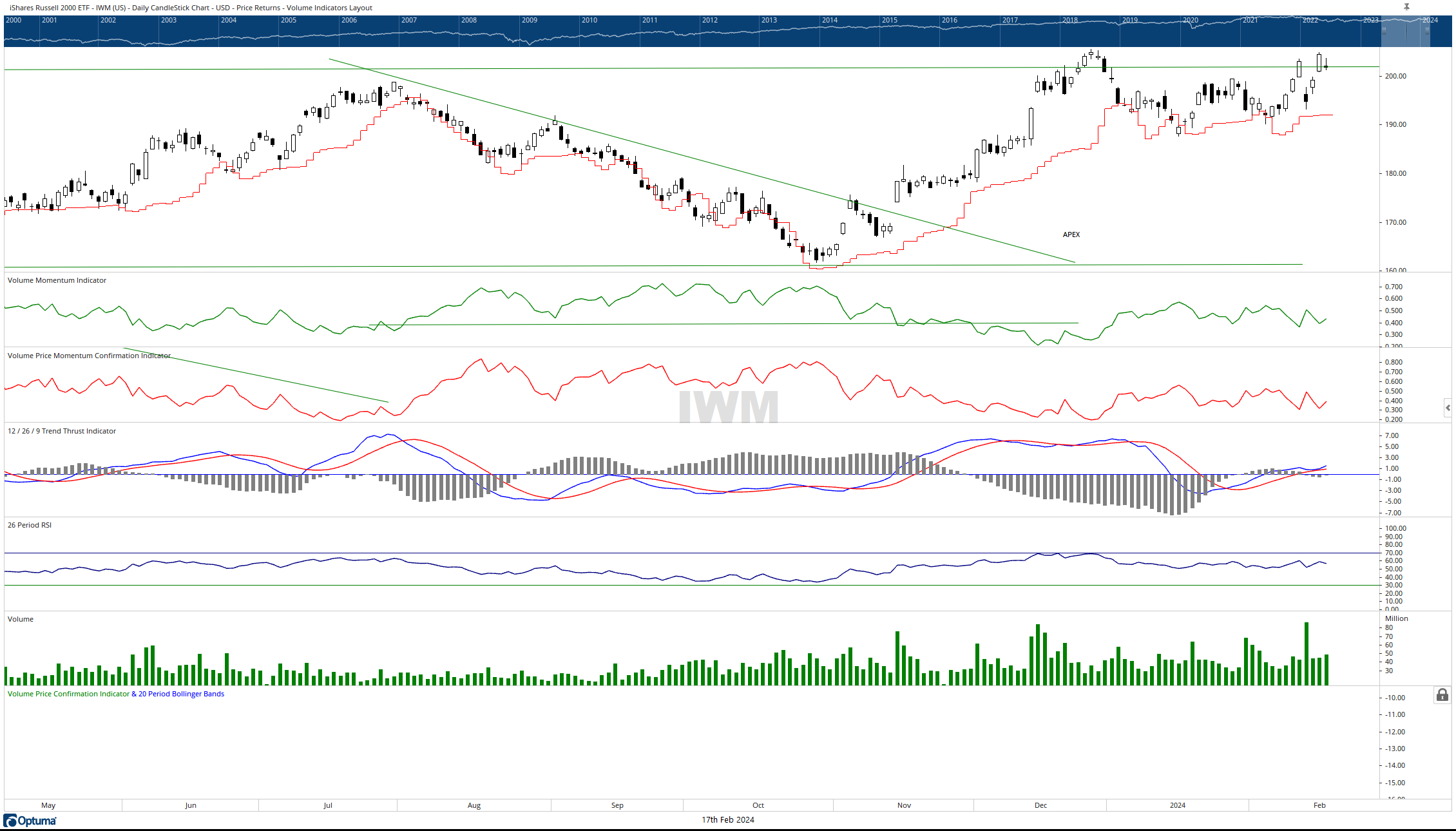

Following a notable downturn on Tuesday, the troops attempted to surpass their 2023 yearly highs on Thursday but fell slightly short of achieving that milestone. Presently, the approximate range of Thursday’s IWM levels constitutes short-term support (200) and resistance (205). Although the S&P 500 experienced a decline for the week, the NYSE’s Advance-Decline data posted a bullish showing, surpassing December’s highs. This is another positive indicator for the troops. As alluded to in last week’s report, the movements of the troops could serve as a bellwether for assessing the overall health of the broad markets.

Reviewing the S&P 500 daily capital-weighted flows, despite Tuesday’s significant drop, capital outflows were just slightly above average. Overall, unlike the recent market behavior characterized by the general’s upward advancement fueled by high volume and capital inflows, this past week the generals posted a modest decline amidst low demand while the troops pressed forward.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 2/20/2024.Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.

Updated: 2/20/2024.Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.