Volume Analysis | Flash Update – 9.8.25

A New Hope or a Gathering Storm?

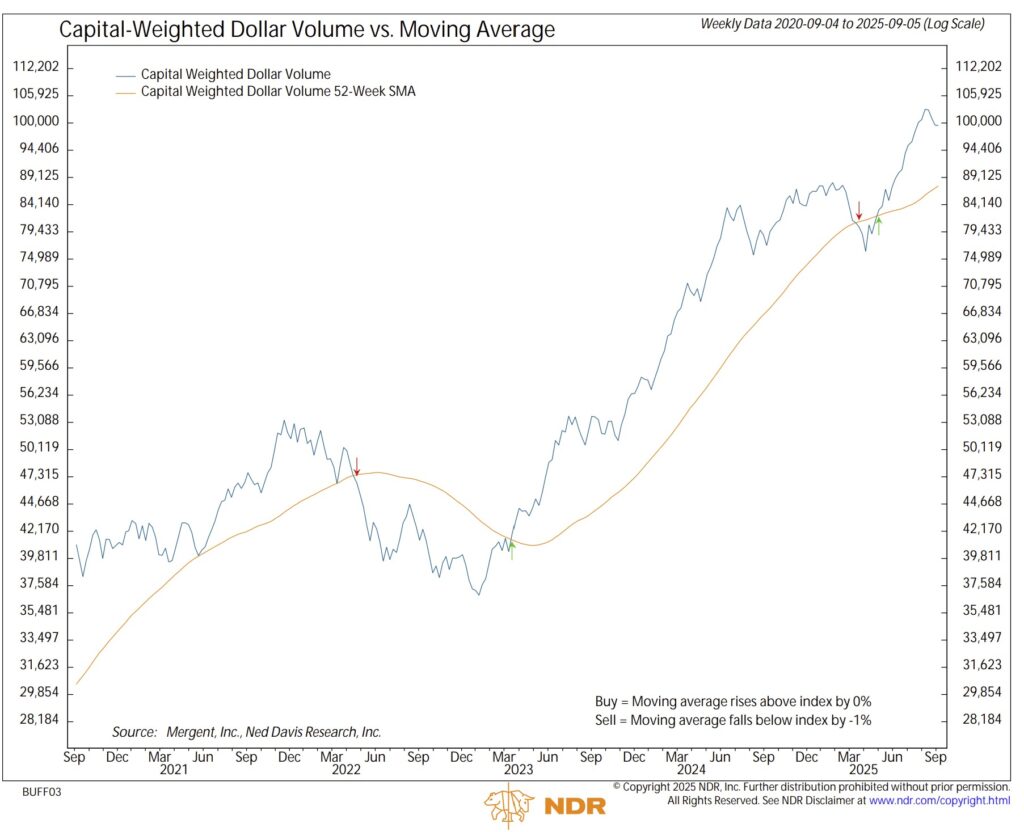

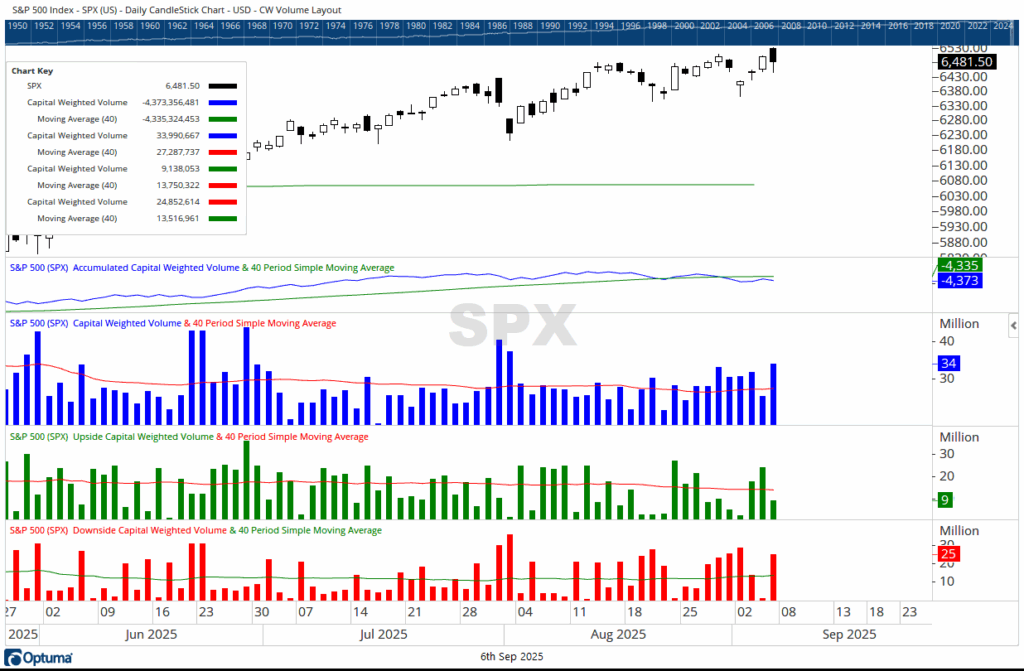

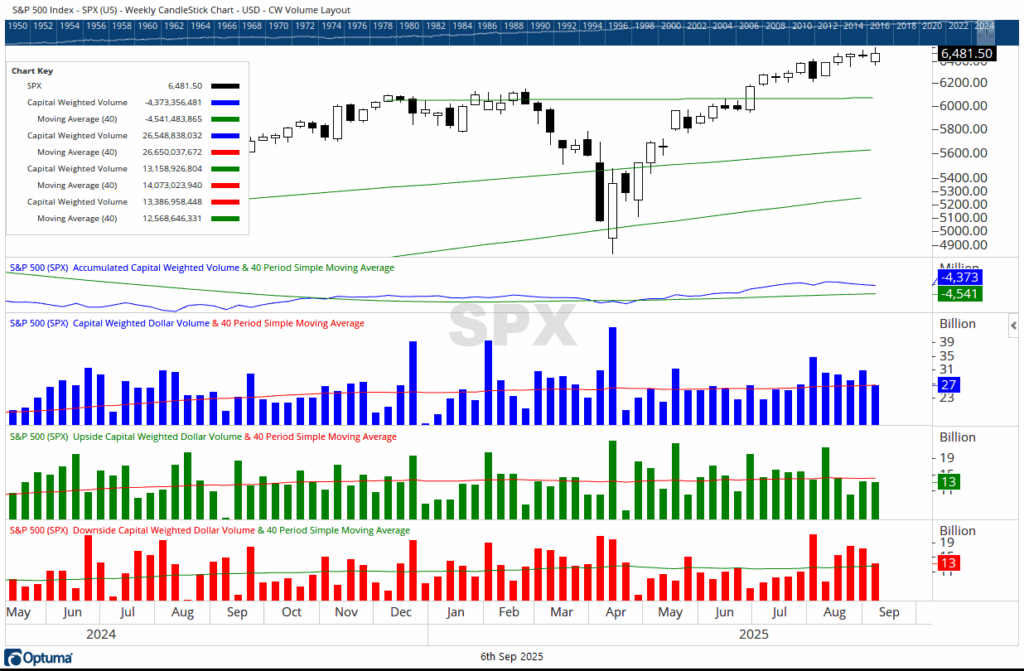

The shortened Labor Day week still produced outsized signals in the supply lines. Despite losing a trading day, downside volume averaged 121.5 million shares, nearly double the 65.5 million in upside. Across the week, 43% of trading was to the upside while 57% flowed to the downside—an imbalance worth noting.

- Tuesday, Sept 2 90% Downside Day: 93% of Capital-Weighted Volume (CWV) pushed to the downside on above-average volume.

- Thursday, Sept 4 90% Upside Day: 95% of CWV reversed to the upside, though notably on below-average volume.

This pattern echoes the theme of a battlefield clouded by smoke: strong signals on both sides, but neither sustained with full force.

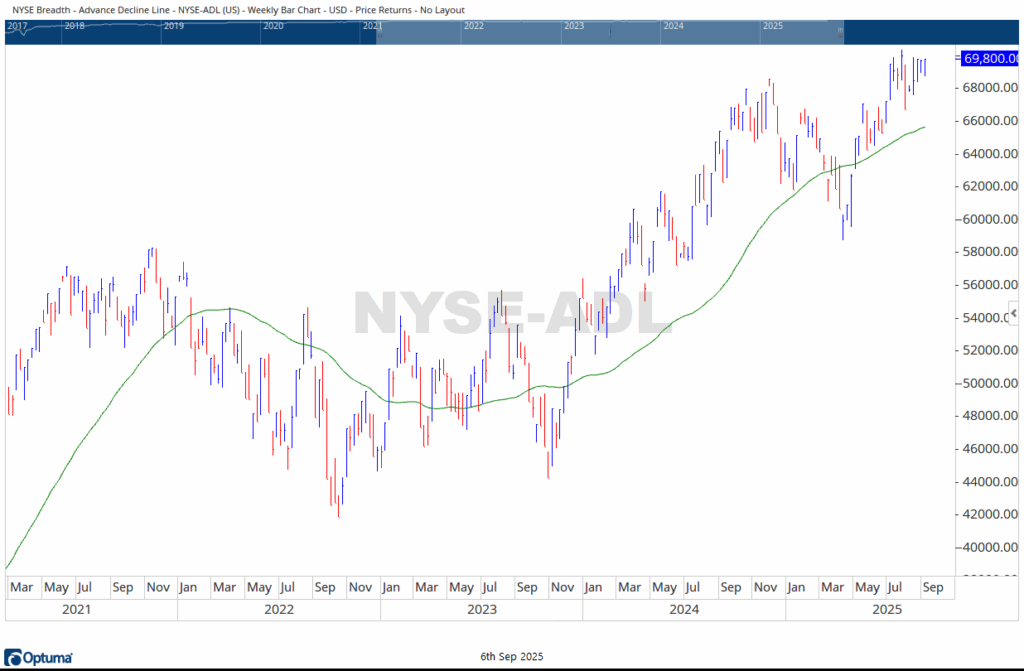

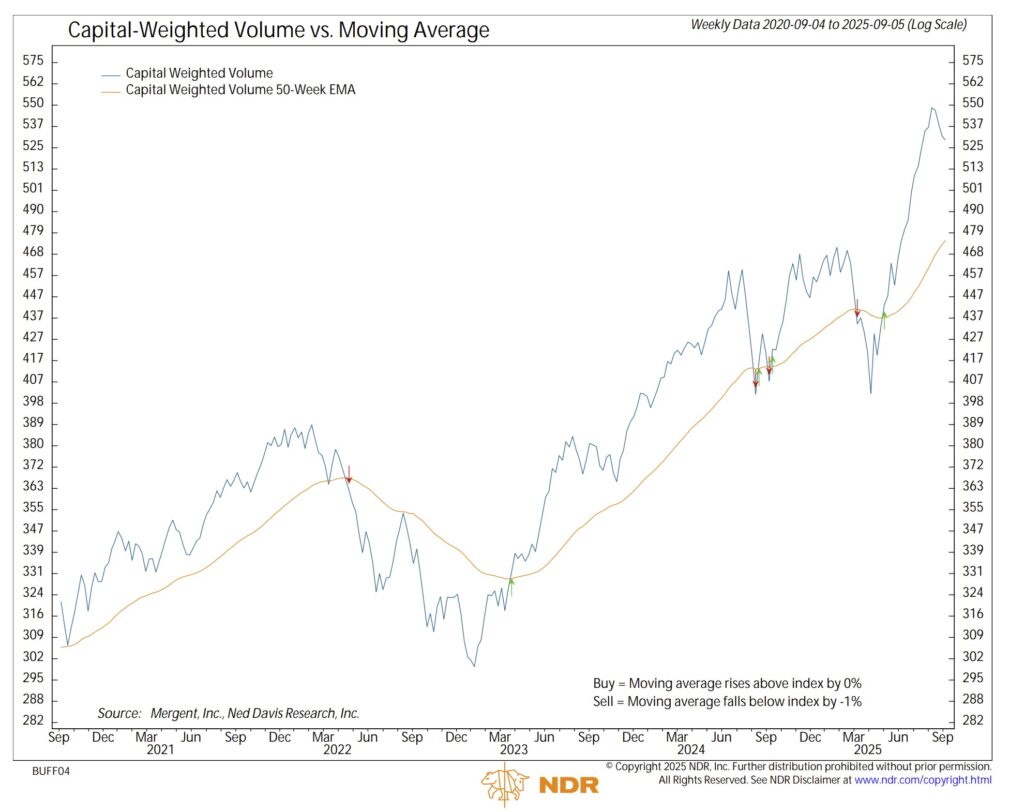

The NYSE Advance–Decline Line closed higher for a third consecutive week yet still has not broken through resistance. Capital flows also leaned negative, averaging 52% outflows to 48% inflows. The soldiers are stirring, but the supply lines remain strained.

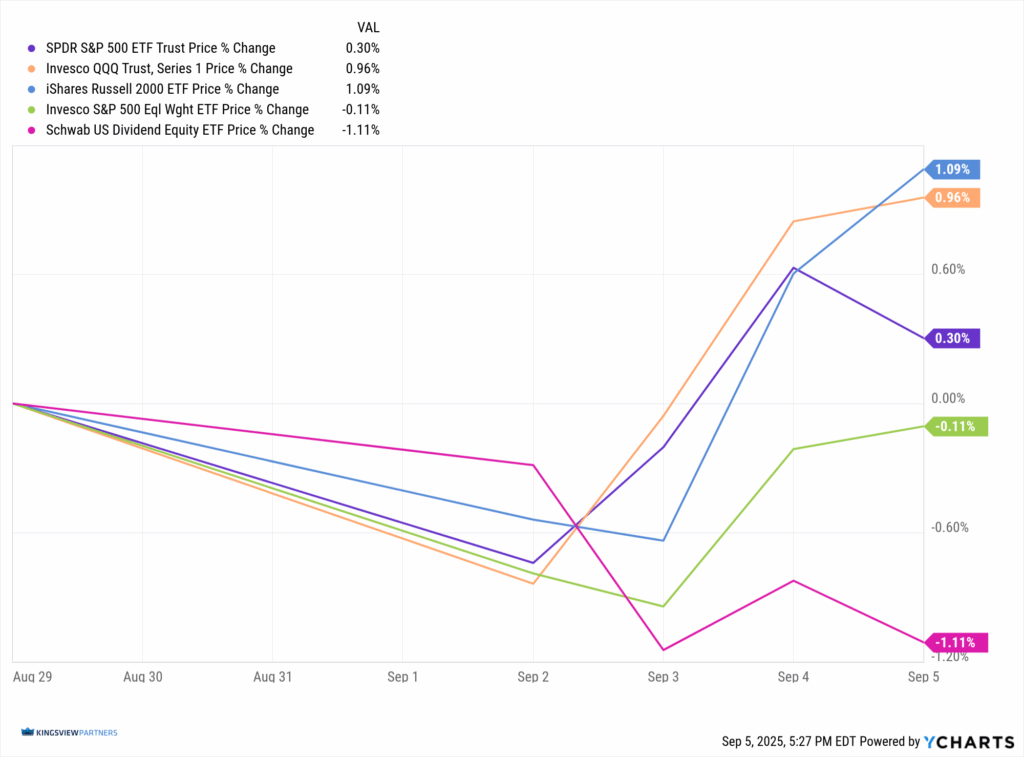

On the field, the troops—iShares Russell 2000 ETF (IWM)—notched their fourth straight weekly high, rising +1.09%. They now face resistance at 241 with their all-time high still looming at 245. The generals—Invesco QQQ Trust (QQQ)—closed up +0.96%, after breaking below the prior week’s low midweek but recovering into the close. The brass commanders faltered: Invesco S&P 500 Equal Weight ETF (RSP) slipped -0.11%, while Schwab U.S. Dividend Equity ETF (SCHD) fell -1.11%.

This creates a battlefield split. The troops continue their advance, building what appears to be a new line of hope. The generals, though shaken, remain on their feet, closing higher after a midweek scare. The commanders and lieutenants, however, faltered, hinting at disarray within the leadership ranks.

In allegorical terms, this is the tension between new hope and a gathering storm. The troops show resilience, pressing against resistance as if testing the gates. The generals, though bloodied, survive to fight another day. Yet the capital flows—the lifeblood of any campaign—remain strained, suggesting the supply lines may not support a prolonged march without reinforcement.

Conclusion:

The market remains caught between dawn and darkness. Hope stirs among the ranks, but storm clouds hover above the generals and supply lines. In times where both hope and warning coexist, investors must be tacticians—prepared to advance with discipline yet shielded should the storm break. Risk management is not simply a defensive posture—it is the strategy that keeps portfolios standing, ready for whichever outcome history writes next.

Grace and peace my friends,

BUFF DORMEIER, CMT

Updated: 9/8/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.