Volume Analysis | Flash Update 1.3.23

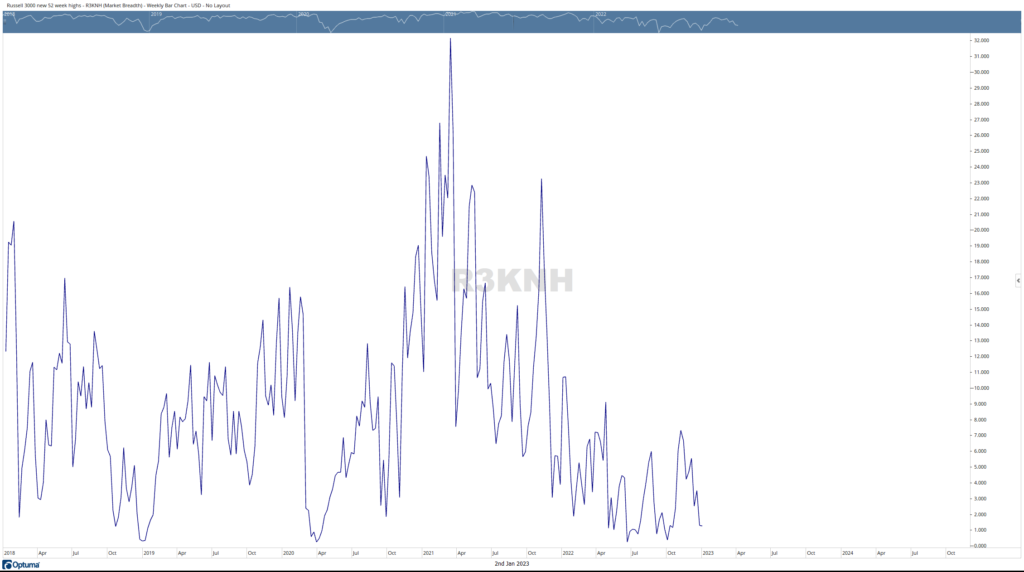

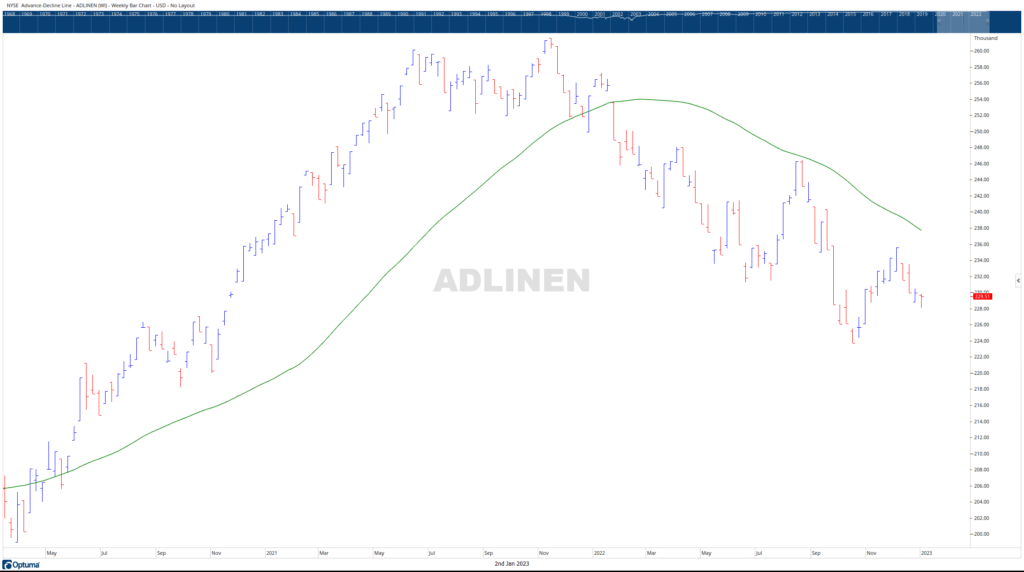

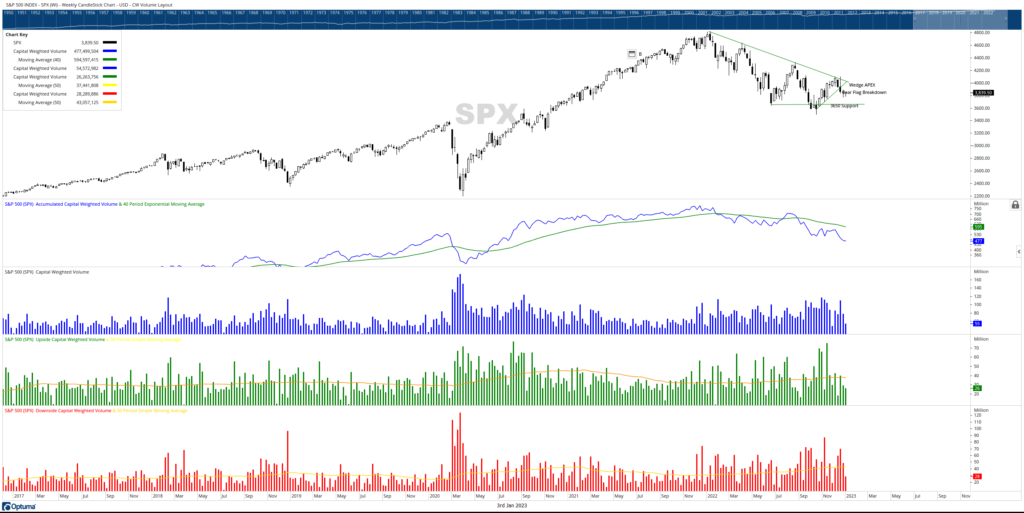

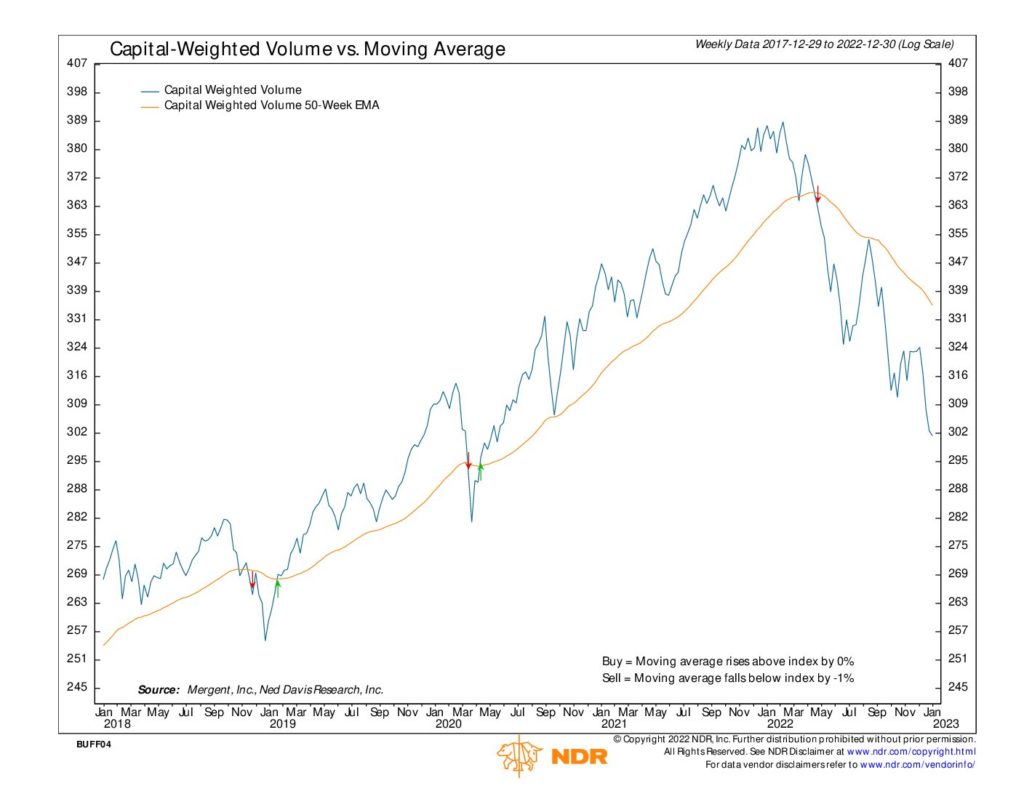

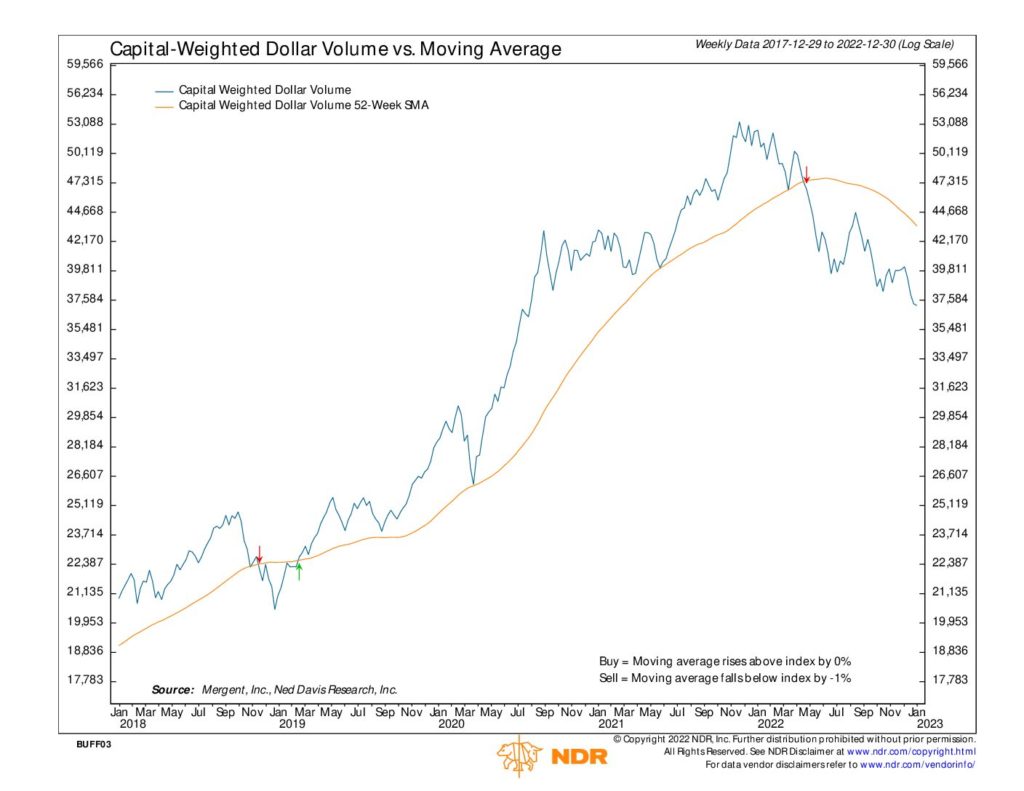

This past week was short and light. The S&P 500 brought in $26.25 billion in inflows versus $28.25 billion in capital outflows. We begin the new year with very poor market internals. Breadth is week with the Advance-Decline Line falling and the % of stocks obtaining New Highs falling rapidly, nearing July / October lows. Meanwhile both Capital Weighted Volume and Capital Weighted Dollar Volume closed the year at 52-week plus lows.

Recently, the S&P 500 broke a bearish Wedge pattern and now is forming a smaller wedge / ascending triangle inside the former Bear Flag. The triangles resistance point is 3850. Seasonality is still positively influenced by the Christmas Rally and the Presidential cycle. Should SPX 3850 resistance be taken out by a daily close, look for further resistance at the SPX 3950 region. Conversely, short term support resides at 3700.

Grace and peace to you my friends.

Buff Dormeier

CHIEF TECHNICAL ANALYST