Volume Analysis | Flash Market Update 12.27.22

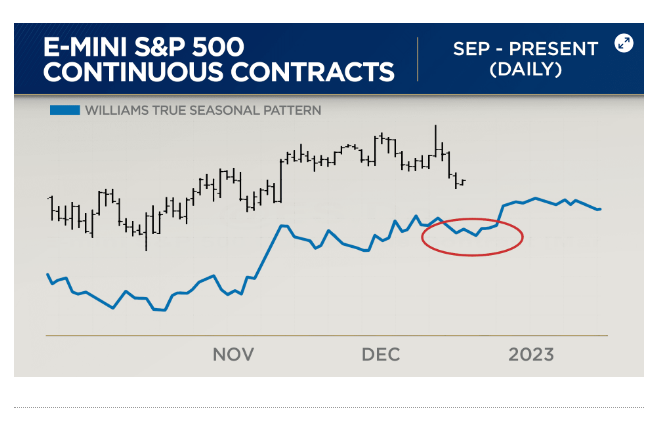

After stumbling out of the gate Monday, the bulls dashed through the bears Wednesday on an exuberant Santa Clause sleigh ride rally. The Santa Clause Rally is a short seasonal cycle that typically begins the week before Christmas and can last into early January, sometimes peaking between Christmas and New Year’s (see attached: Williams True Seasonal Pattern Source, CNBC).

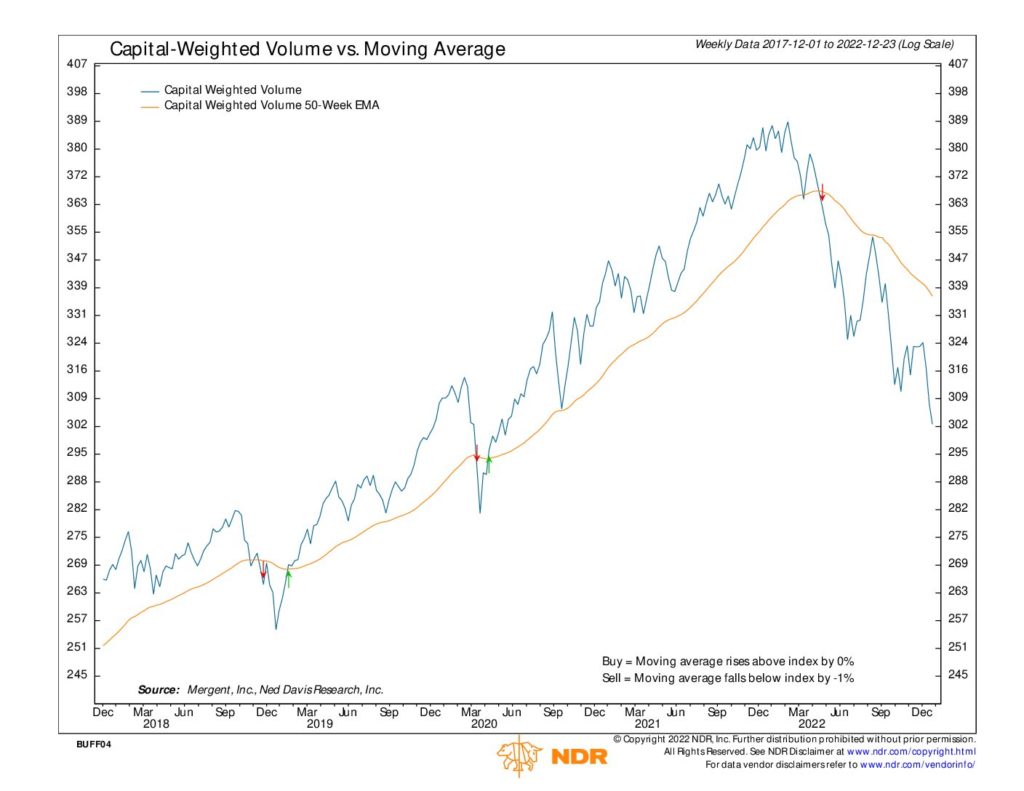

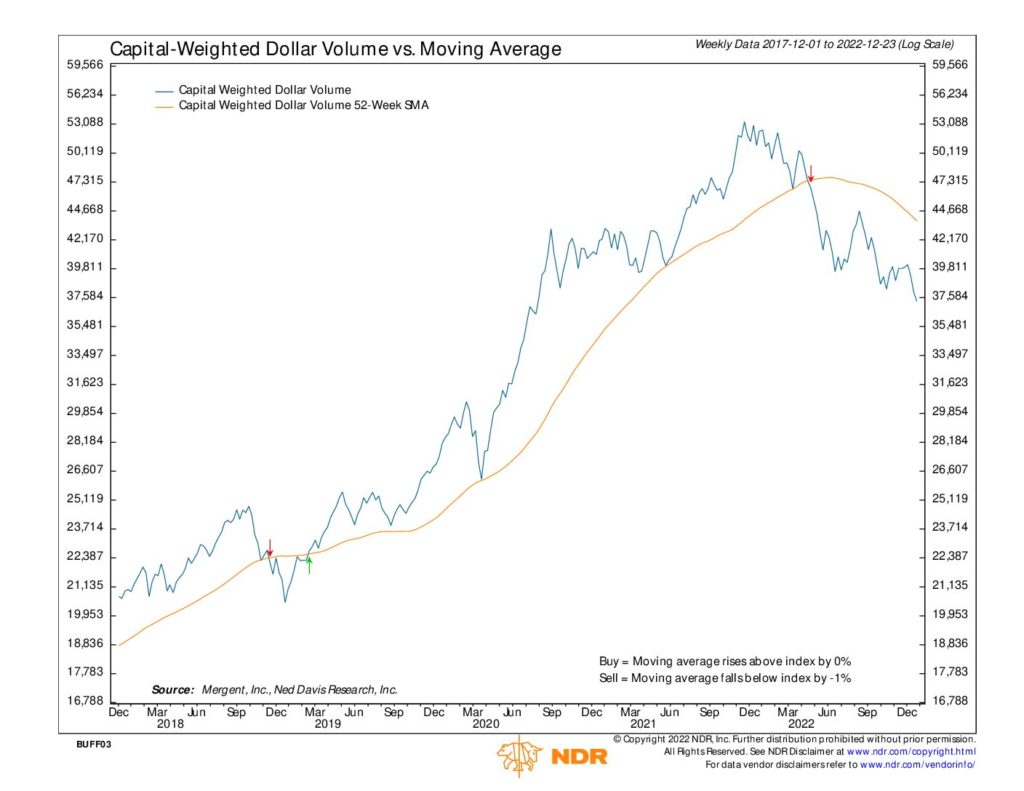

But Wednesday’s Santa Clause Rally came without ribbons, it came without tags. Rather, it came on empty packages, boxes and bags.. Although big and green, the heart of Wednesday’s rally was two sizes too small, as capital weighted volume was nearly nowhere to be found. Wednesday’s small hearted rally, set up an easy steal for the smiling Grinch riding in on Thursday. Thursday losses piled up a heaping load of downside capital weighted volume ushering in new lows not seen since November 9th. However, despite not receiving any presents at all, the Grinch hadn’t stopped the Santa Clause Rally for all. Thursday’s markets rallied back towards the close, trimming the heavy losses of capital out flows.

In candlestick analysis, this action forms a short-term bullish pattern called a Hammer. The Hammer sign is a deep drop that fails to close near the low. Friday, wisemen from the East came bearing gifts of Bullish tidings saying, “We saw the Hammer sign when it rose and have come to purchase them”. Despite Wednesday and Friday’s gains, the S&P 500 closed down on the week.

As we Hammer out 2022 next week, seasonality remains bullish, both short-term, with the Santa Claus Rally, as well as intermediate term, via the Presidential Cycle. That stated, as we gaze into 2023, the broken bearish wedge pattern, strong capital weighted outflows, and weak internals remain the primary drivers of our analysis.

Wishing you a very Merry Christmas and a 2023 full of glee.

— Buff Dormeier