Volume Analysis | Flash Market Update – 4.15.24

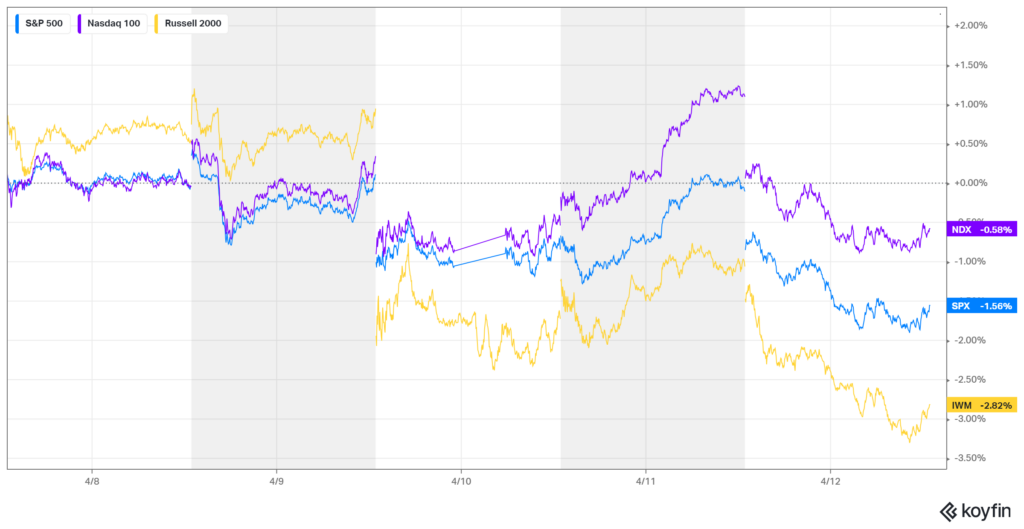

From a volume analysis perspective, the week may have felt more dire than it truly was. The iShares Russell 2000 ETF (IWM, the troops) experienced the most significant decline, down by -2.82%, while the Nasdaq 100, representing the generals, saw a more modest loss of -0.58%.

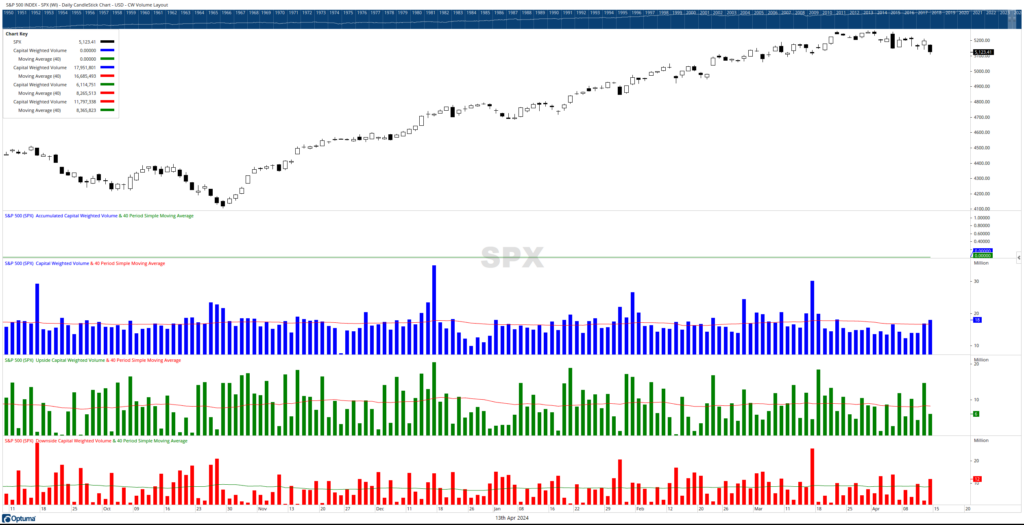

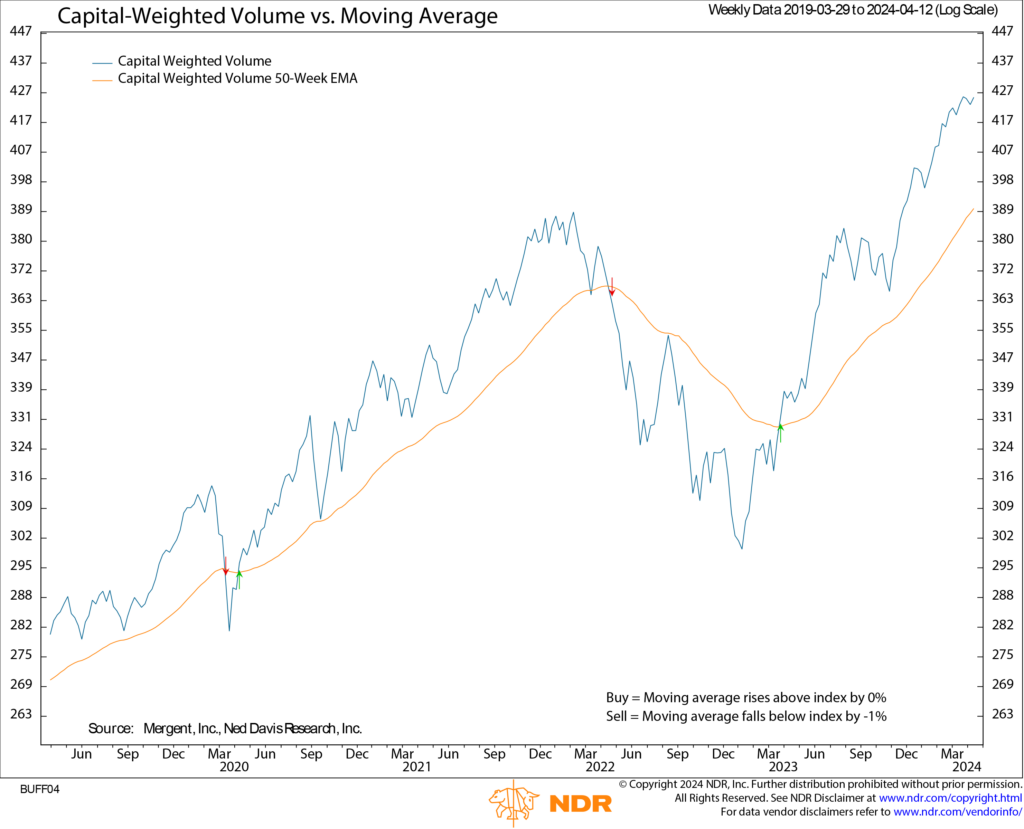

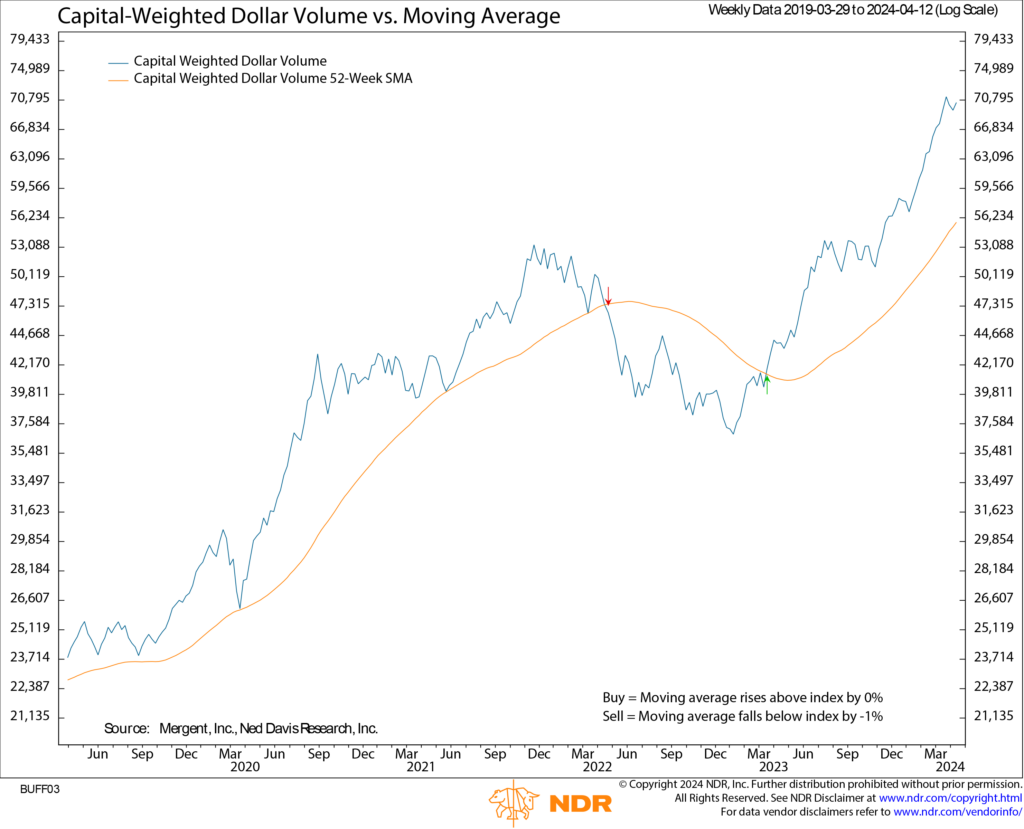

Despite the S&P 500 finishing the week down by -1.56%, both S&P 500 Capital Weighted Volume and Dollar Volume saw increases for the week. This uptick was largely driven by Thursday’s strong bullish performance, where approximately 88% of the capital flows favored the upside. For the week, capital inflows surpassed outflows, totaling $41 billion to $39 billion. Both of these readings slightly lagged behind their weekly averages, contributing to a week characterized by light volume.

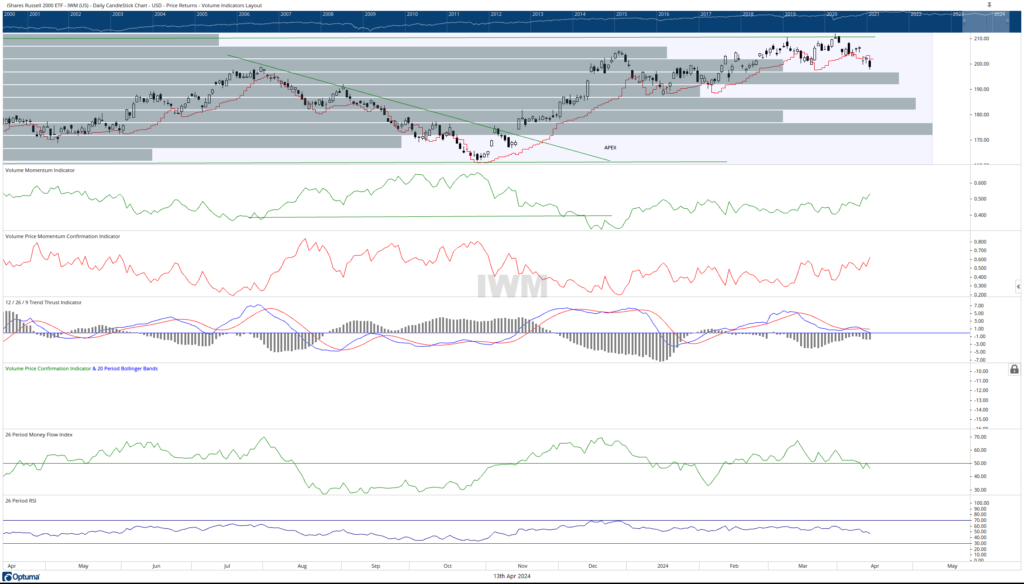

Notwithstanding poor market breadth, with decliners notably outpacing advancers, the Advance-Decline line remains above its blastoff lows set March 29th. IWM’s next minor support level is at 193, with more significant support expected below 190. The S&P 500 still maintains its doji support at 5055, while the Invesco QQQ Trust (QQQ) has corresponding support around 432.

Overall, the price indexes stumbled during the past week, primarily led by the retreat of the troops. However, the sell-off occurred amidst low volume and positive cash flows, suggesting that volume did not strongly support the price decline, particularly within the large-cap space.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 4/15/2024. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.