Volume Analysis | Flash Market Update — 1.2.24

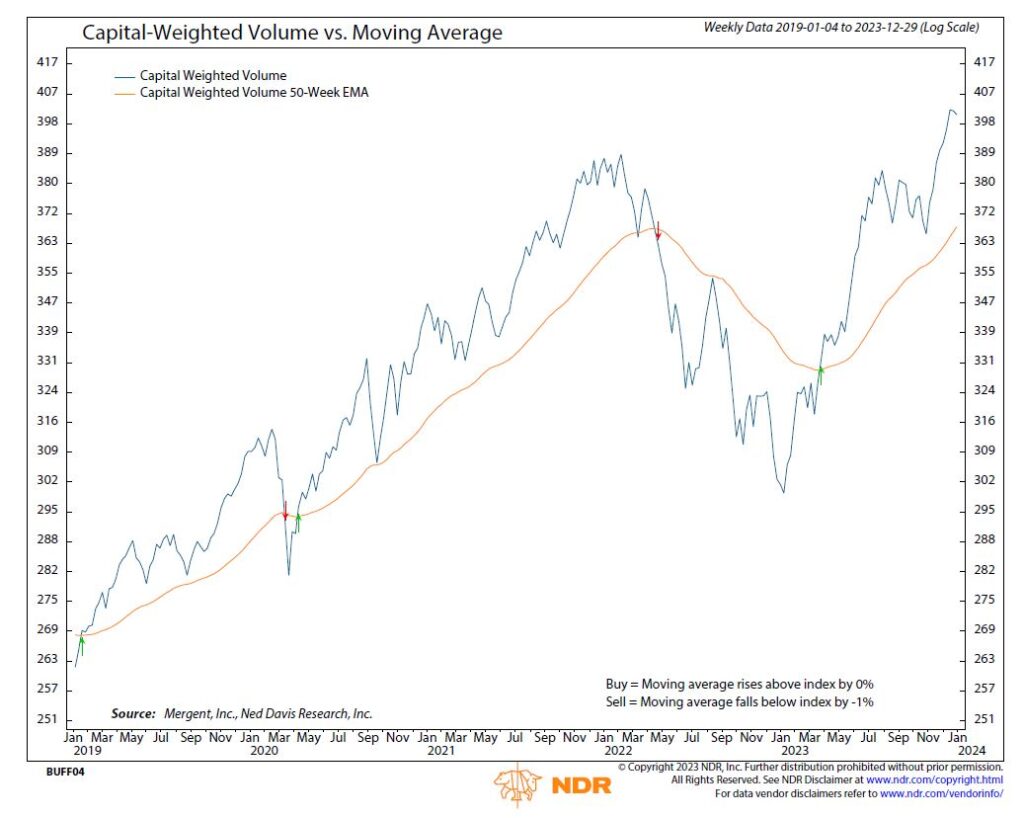

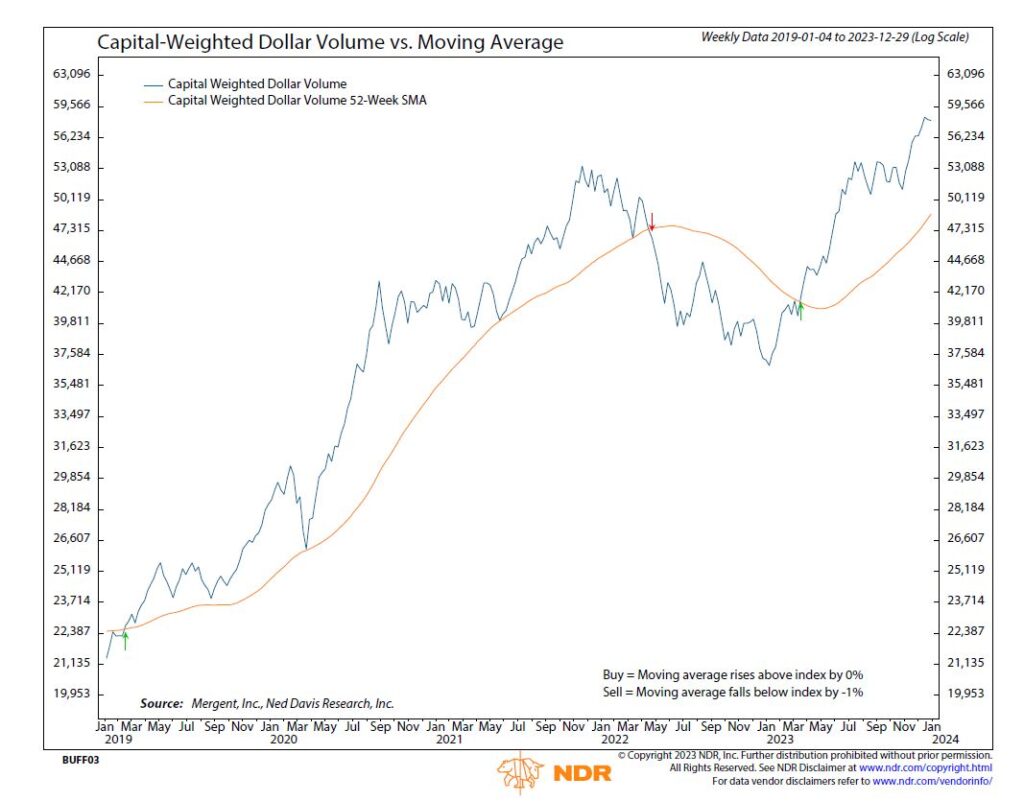

Capital Weighted Volume and Dollar Volume were light on the shortened week. Despite a slight upward movement in the broader markets, both Capital Weighted Volume and Dollar Volume showed declines. The Volume Momentum Indicator (VMI), currently at 29, is approaching levels indicative of a potential washout, suggesting that the market may be overbought. While a robust bull market can push through overbought conditions, a moderate bull market often takes a pause, and a weak bull market typically undergoes a correction. The last instance of VMI reaching this level was on July 29th (VMI 28), highlighting that phase of the bull market as weak.

Wishing you a fantastic 24!

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 1/2/2024

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.