Portfolio Manager Insights | What Is the Value of Gold Amid Fed and Washington Uncertainty? — 5.31.23

As the debt ceiling drama in Washington unfolds, uncertainty around the Fed grows, and inflation remains stubbornly high, the price of gold has experienced a surge over the past six months. Gold prices climbed above $2,000 per ounce in early May, reaching just around its peak levels during the pandemic in 2020 and prior to the Fed raising rates in 2022, before pulling back over the past few weeks. While gold can serve many purposes, some investors focus on it at the expense of other, often more appropriate investments. How is gold affected by recent events and what role can it play in a well-diversified portfolio?

There are many reasons that everyday investors are drawn to gold. Many look to it as a timeless store of value, especially in inflationary periods or when the value of the dollar is in question. Others flock to gold in periods of political and economic uncertainty, particularly as a hedge against lax fiscal and monetary policies. Still others buy and hold physical gold in order to have a tangible asset rather than more abstract holdings such as shares of stock.

Gold prices have risen over the past two decades

While all of these uses are valid, the problem occurs when investments in gold are made on a standalone basis, or when gold is the only asset with which investors feel comfortable. History shows that while gold can play a part in a carefully constructed portfolio, investors should not do so to the exclusion of other asset classes, starting with a foundation of stocks and bonds. In the worst case, a focus on gold can result in missed opportunities for investors in more appropriate asset classes selected as part of a tailored financial plan.

From a broader investment perspective, gold can serve at least two important but distinct purposes. First, as a precious metal with consumer and industrial uses, the value of gold has risen over time due to its limited supply but steadily increasing demand. Not only is gold seen to have “intrinsic value” by many individuals and cultures, but commercial uses of gold have increased due to the growth of the high-tech sector. As a result, gold can serve as a store of value when the world is uncertain, as inflation rises, or as central banks increase stimulus.

Indeed, much of the rise in gold prices over the past two decades occurred during the global financial crisis as the Fed grew its balance sheet and amid the significant fiscal and monetary stimulus during the pandemic. These periods of loose policy are often seen as the textbook environments for holding gold. More recently, gold prices have risen due to the combination of the debt ceiling debate in Washington, the possibility of a Fed pause then cut later this year, and as core inflation remains sticky.

Second, investors often flock to gold for safety when markets get choppy. In many ways, this is no different from how some investors view cash or safe bonds to protect them from short-term stock market pullbacks. Thus, the potentially more attractive purpose of gold is to help diversify portfolios, especially in times of financial distress.

The stock market has outperformed gold over the long run

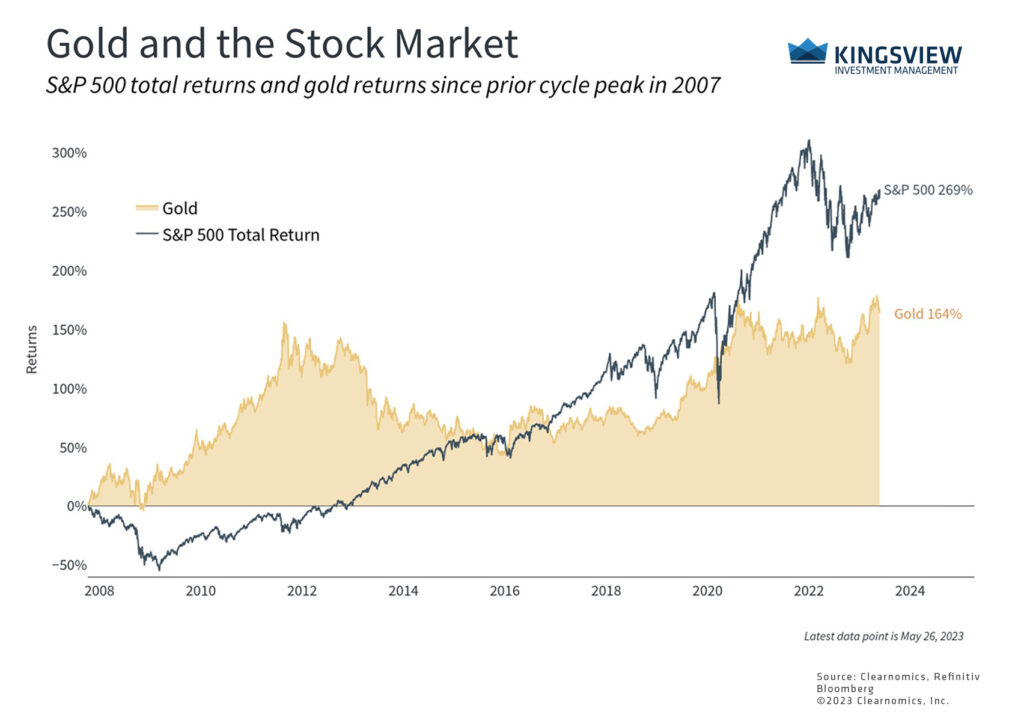

However, while these two uses often work in specific periods, the patterns can also reverse without notice. For example, the period from 2011 to 2015 was one in which the Fed kept policy rates at the zero lower bound, continued to grow its balance sheet by $2 trillion dollars, and events such as the downgrade of the U.S. debt by Standard and Poor’s occurred – yet gold prices plummeted during those years. In contrast, the stock market grew rapidly, kicking off what would be the longest bull market in history.

The choppiness of gold prices over the past few years also shows that while it can act as a hedge during periods of uncertainty, this can reverse quickly as conditions change. For instance, while gold has gained over 6% this year, the Nasdaq has recovered 24%. In other words, relying on gold as a hedge, rather than a portfolio diversifier is similar to trying to time the market which history shows is difficult if not impossible to do.

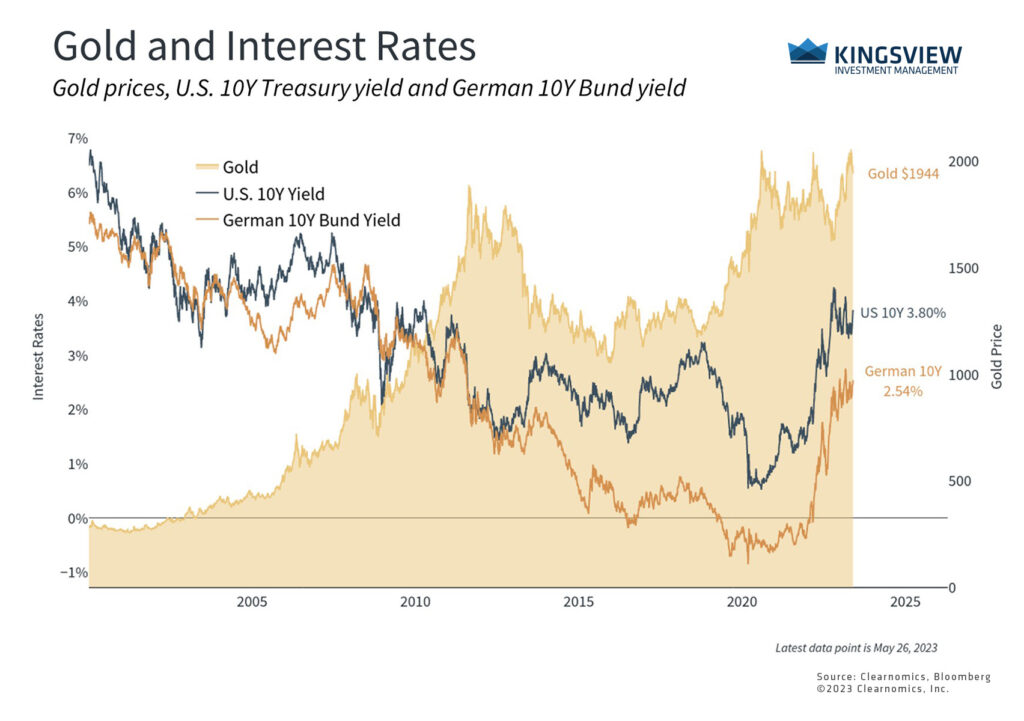

The accompanying chart shows this relationship between gold and the stock market over the past fifteen years. While stocks are well ahead of gold when tracing their performance back to their 2007 peaks, they have taken very different routes. To experienced investors, this is a tell-tale sign that holding these assets in the right proportions can create diversification benefits. The relationship between interest rates and gold shows a familiar pattern as well: gold prices tend to rise as interest rates fall. Thus, gold prices have behaved similarly to bond prices – yet more reason to believe that gold is better suited as a portfolio diversifier than as a standalone investment.

Another common issue is that, for those investors who need portfolio income, especially in or near retirement, gold does not generate yield or pay interest. So, while it can protect investors from short-term uncertainty, especially when the Fed or Washington are involved, it may not help with other financial needs. For those investors with longer time horizons who need growth, the stock market simply has a much longer track record of creating long-term wealth.

Federal debt levels remain near historic peaks

One final important note is that gold itself can be extremely volatile. For those investors worried about stock market volatility, short-term movements in gold can be as bad or worse. In just the few weeks since its peak in May, gold prices have fallen over 5%. This can happen even when the textbook reasons to hold gold are present, such as the elevated level of the U.S. debt. Just as with the stock market, movements in gold may run counter to expectations.

The bottom line? The choice to invest in gold, or any other asset, should be viewed in the context of a diversified portfolio rather than as a standalone investment. When appropriate, doing so can help to balance other asset classes, creating a smoother ride toward long-term financial goals.

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser. (2023)