Portfolio Manager Insight | 7 Market and Economic Insights for the Second Half of 2023 — 7.5.23

Major stock market indices made significant gains in the first half of the year due to improving inflation, slowing Fed rate hikes, the absence of a recession, a more stable banking sector, and a strong rally in tech stocks. The S&P 500 has climbed 16.9% with reinvested dividends this year, while the Nasdaq and Dow have returned 32.3% and 4.9%, respectively. Markets have recovered much of their losses from last year with the S&P 500 now 7% from its all-time high. Interest rates have also been steady after their sharp jump last year with the 10-year Treasury yield hovering around 3.8%, helping bond prices to recover as well. How can investors keep this recent market performance in perspective as we enter the second half of the year?

Given this strong year-to-date performance, many investors may be wondering whether this is truly the beginning of a new bull market or is instead a “bear market rally.” This is a shift from the concerns investors and economists faced at the start of the year when bear markets and recessions were top-of-mind. There are a few reasons why the past six months only further underscore the investment principles that long-term investors should follow in order to achieve their financial goals.

First, this year’s market performance is more evidence that investor sentiment can turn on a dime. The history of bear markets and short-term corrections shows that markets can turn around when it’s least expected, especially when investors are most pessimistic. This was true at the start of the year when few believed markets would ever recover, just as it was in April 2020, mid-2011, March 2009, October 1987, and so on. Each market downturn was driven by a real event such as a surge in inflation, the pandemic, the U.S. debt downgrade, the global financial crisis, or even Black Monday. However, in every case, investors expected these events to continue to worsen, even as fundamentals and valuations quietly improved.

This is why it is often better for everyday investors to simply stick to their well-crafted financial plans. By the time investors agree that a recovery has begun, significant gains have often been missed. This is not to say that downturns aren’t painful or that markets only go up. Rather, history shows that it’s often better to simply stay invested in an appropriately-constructed portfolio. In the worst case, investors who try to time the market and focus too much on short-term events completely miss the subsequent market recoveries.

Second, just as it’s difficult to predict the direction of the market, it’s difficult to know whether a particular rally is sustainable as it is occurring. This is why it’s often better for long-term investors to focus on the underlying fundamentals driving the rally. Even though markets can swing in either direction over the course of days, weeks, and months, steady economic growth and improving corporate profitability tend to drive markets higher over the course of quarters, years, and decades.

Thus, the importance of the economy remaining strong cannot be overstated. Only a year ago, the prospect of the Fed achieving a “soft landing,” i.e. that inflation would improve without a recession, seemed far-fetched to many. While core inflation remains a problem, the fact that overall consumer prices have shown improvement at a time when unemployment remains at historic lows is positive for markets. If and when corporate earnings begin to pick up, market valuations could become more attractive over time.

Finally, there are always reasons to see the glass as half empty, especially with many uncertainties still looming. Today, despite more stability in the financial system, there continue to be challenges in the wake of the bank failures earlier this year, most notably in commercial real estate. Upcoming refinancing activity could test the stability of the system as rates remain high and lending activity tightens. Additionally, while a debt ceiling crisis was averted, the can has only been kicked down the road to the beginning of 2025. In the meantime, geopolitics continue to be problematic as U.S. relations with China and Russia remain strained. Next year’s presidential election will also soon be at the forefront as markets assess all of these risks.

However, experienced investors with a broad perspective on markets know that there are always risks that must be balanced against long-term returns. These risks often feel insurmountable as they are occurring. Once they are in the rear-view mirror, investor concerns often shift to whether the recoveries are sustainable. These back-and-forth swings in investor sentiment are a normal and natural part of markets, and are why long-term investors can increase their odds of success by focusing instead on underlying trends. To that end, below are seven important insights from the first half of the year that will likely be just as relevant in the second half.

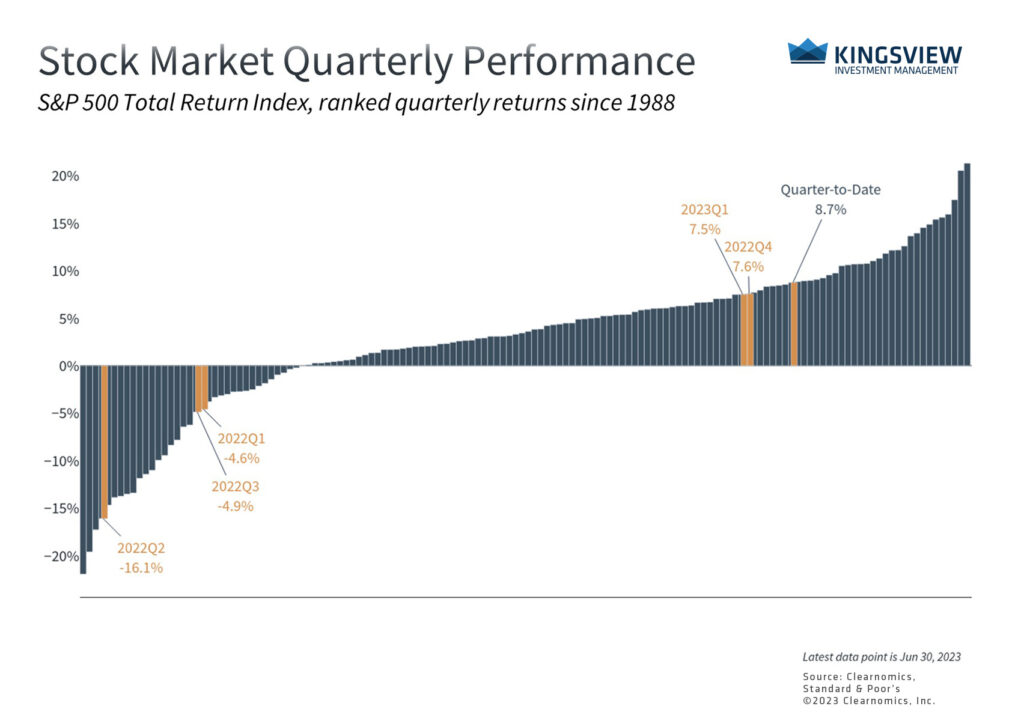

Strong returns over the past three quarters have surprised many investors

The S&P 500 has now notched three consecutive quarters of strong returns, beginning with the fourth quarter of 2022. This is a 180-degree shift from the bear market returns experienced during the first three quarters of last year, and is happening at a time when sentiment is still negative. While there is no guarantee that markets will continue on this strong trajectory, it underscores the idea that markets can change direction without notice.

Market breadth has been low as mega-caps have led the rally

While the market rally has benefited most investors, not all stocks have participated equally. Under the surface, mega-cap stocks have led the way. The accompanying chart shows that the largest stocks in the S&P 500 have outpaced the broader index this year. What’s more, an equal-weighted index (i.e., an index that gives more weight to smaller stocks than the market-weighted index), has lagged even more.

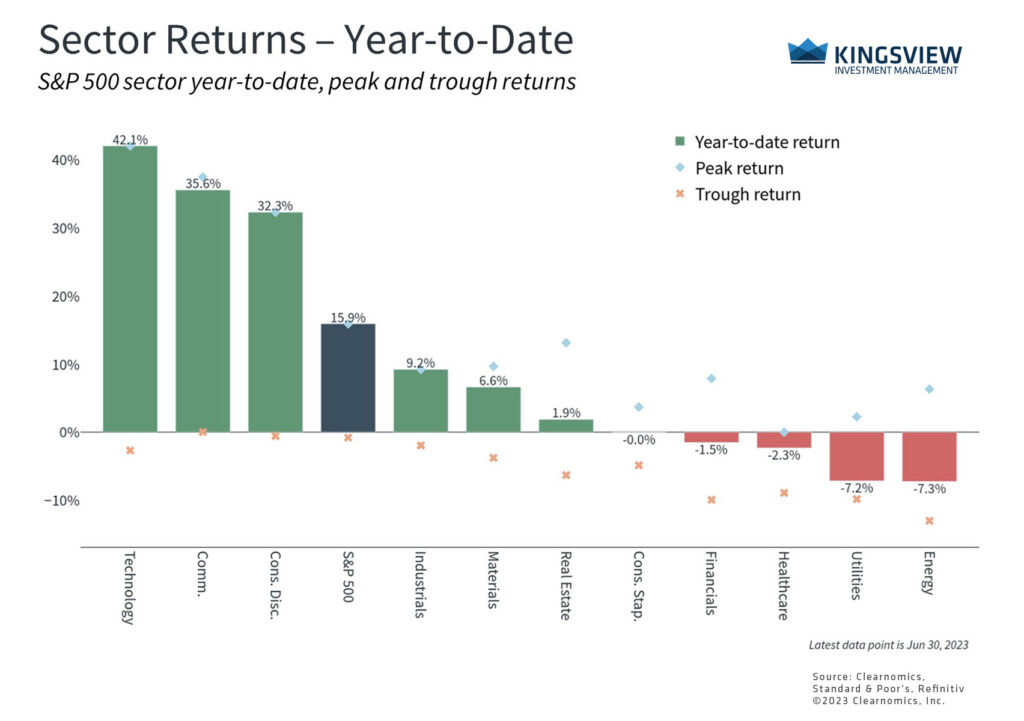

Sector returns have differed across the market and compared to last year

Thus, one investor concern is whether this year’s returns have been “distorted” by tech returns. Unfortunately, it is a fact that the largest stocks have only grown in importance over the past decade. This is due to the increasing economies of scale due to technology across the economy. More recently, enthusiasm for artificial intelligence has driven greater gains in these sectors.

However, this year’s gains in these areas are not only due to these trends. The returns among these companies also represent a rebound from last year when these were the hardest-hit stocks as rates were rising and the future looked increasingly bleak. Taking the last two years together, returns are still outsized but look much more reasonable.

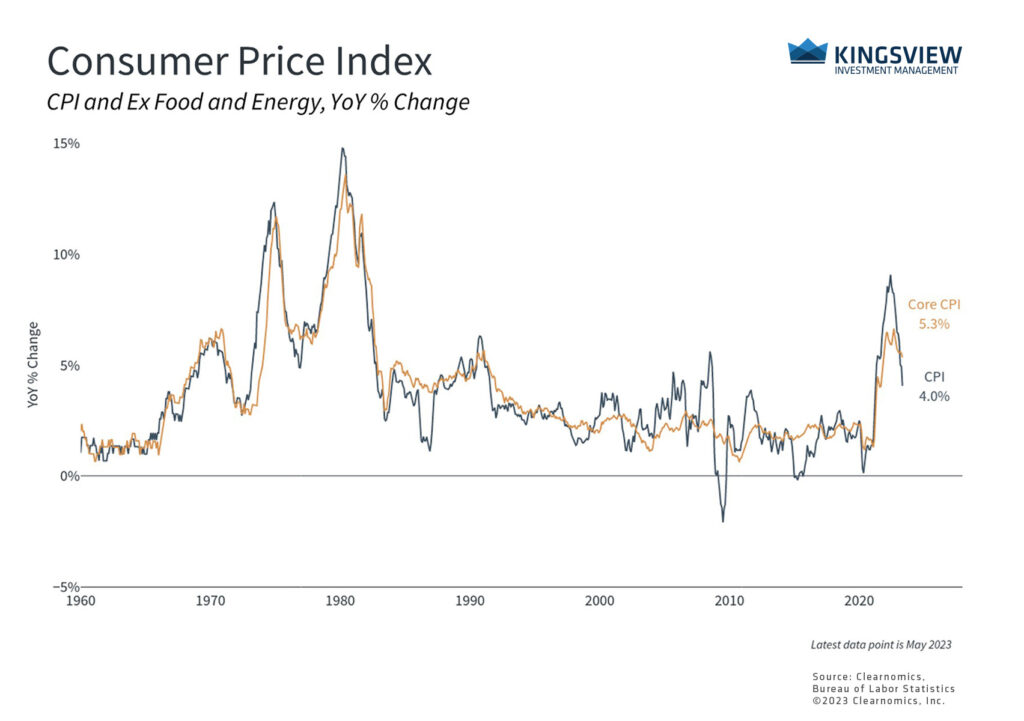

Inflation is improving even as core measures remain sticky

One reason for the reversal from last year is that inflation has shown signs of improvement. The headline Consumer Price Index has decelerated from a peak of 9.1% a year ago to 4% today. This is primarily due to deflation in energy prices and other categories such as used cars. However, core inflation remains sticky due to shelter prices.

The Fed and other economists believe that these prices will improve as rent prices stabilize and new leases are signed. Investors should also maintain perspective on further inflation improvements. At best, both headline and core inflation will likely remain high through much of 2024. In the meantime, it’s possible that year-over-year inflation figures will worsen due to comparisons to last year’s levels.

The Fed has slowed its pace of rate hikes

Improving inflation alongside a strong economy allows the Fed to slow its pace of rate hikes. The Fed has raised rates 10 consecutive times from zero to 5%. The size of each increase has decelerated over the past year from a peak of 75 basis points (0.75%) every meeting to perhaps 25 basis points every other meeting.

The Fed has made it clear that they are committed to returning inflation to their 2% target by keeping rates higher for longer. Market-based expectations have shifted this year from believing the Fed will cut rates later this year to agreeing that rates could rise further.

Rate-sensitive areas such as commercial real estate face challenges

Of all of the areas impacted by rising rates and financial instability, commercial real estate is seen as the biggest source of risk among investors. This is not only because CRE has struggled with post-pandemic shifts in office usage and occupancy, but because trillions of dollars in loans will need to be refinanced in the coming years. Higher interest rates and tighter lending standards may make this more difficult, creating both liquidity and solvency issues among CRE companies.

So far, greater stability in the banking system over the past few months, along with Fed and government support have helped to reduce some of these risks. Market participants will continue to watch this sector closely in the months to come.

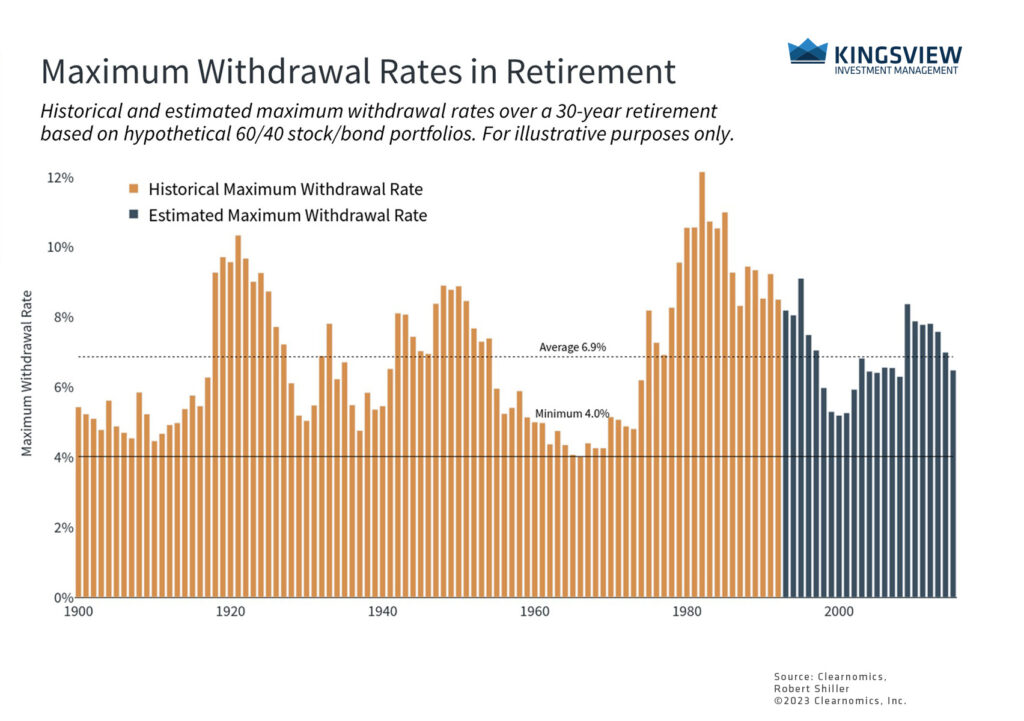

Financial planning is especially important in times of uncertainty

Many investors may wonder what market uncertainty means for their portfolios, especially for those approaching retirement. The classic 4% rule specifies a “safe” withdrawal rate in retirement based on the historical performance of a hypothetical 60/40 stock/bond portfolio, as shown in the accompanying chart. This includes both good and bad market periods since 1900.

However, this chart also shows that safe withdrawal rates can fluctuate significantly, with the average being closer to 7%. So, while investors need to minimize the risk of running out of funds, they also need to make the most of their retirements, especially as life expectancies increase. Rather than just following a rule of thumb, it’s important for investors to understand their unique circumstances to better project their safe withdrawal rates. Doing so can help long-term investors to better achieve their financial goals, especially during uncertain market periods like the present.

The bottom line? Markets rebounded in the first half of the year, catching many investors off guard. While markets never move up in a straight line, investors who focus on long run fundamentals and avoid trying to time the markets will likely be in a better position to take advantage of market opportunities in the second half of the year.

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser. (2023)