Volume Analysis | Flash Update: Bond Focus –12.30.24

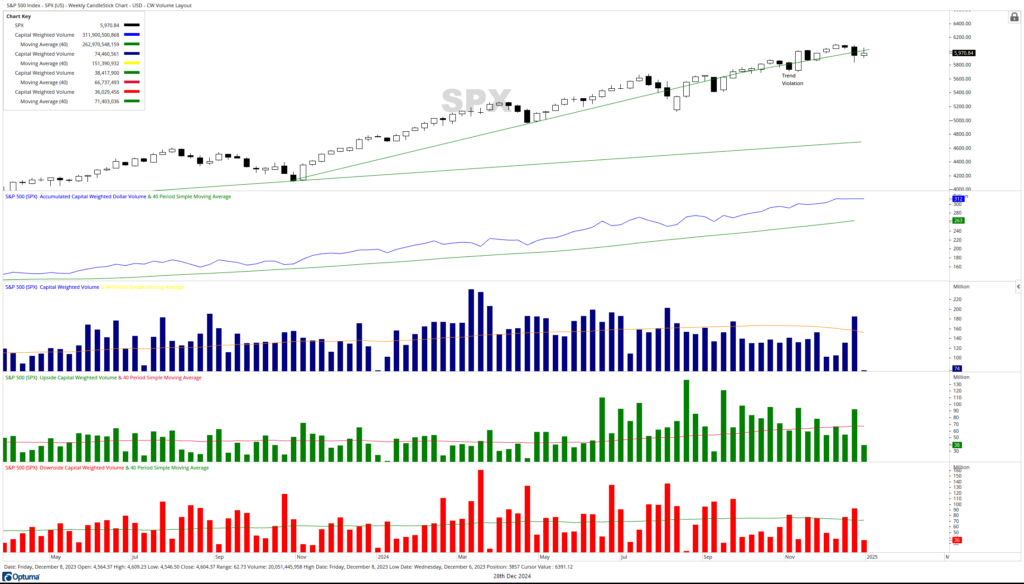

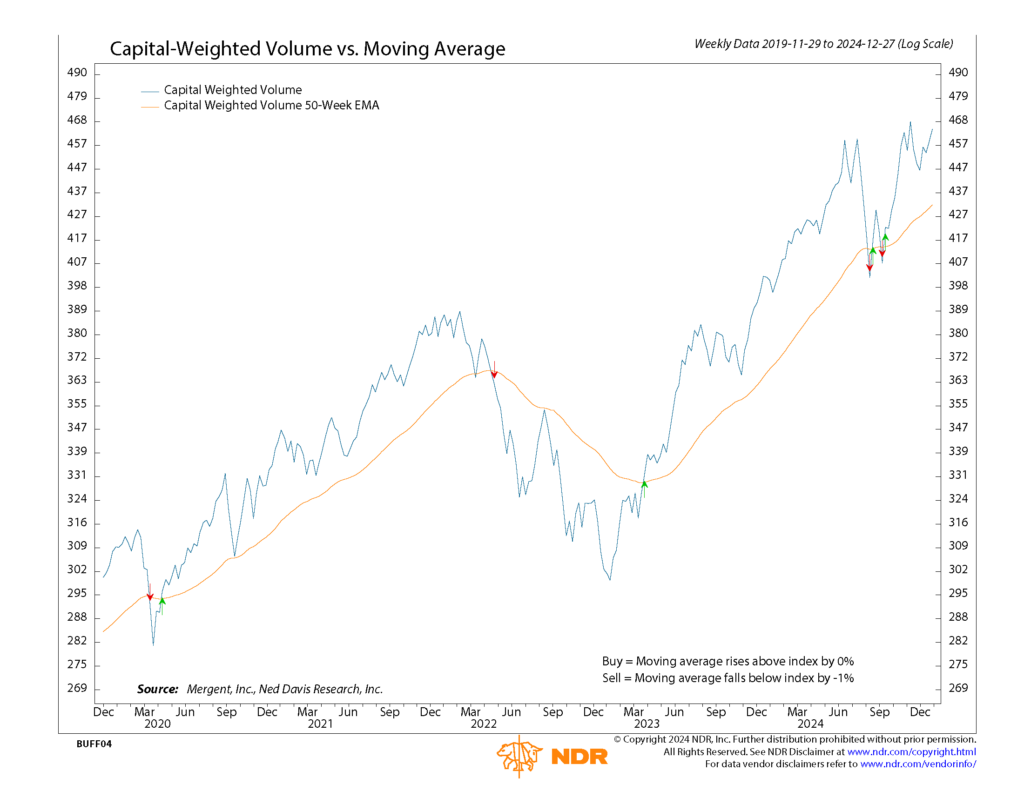

In the Christmas-shortened week on Wall Street, the market’s volume was exceptionally light, reflecting the holiday lull. The SPY (SPDR S&P 500 ETF Trust), our primary battlefield indicator, demonstrated resilience by advancing 0.07% over the 3 ½ trading days. Despite the thin trading conditions, both S&P 500 Capital Weighted Volume and Dollar Volume exhibited bullish behavior, with upside volume outpacing downside volume, suggesting underlying strength in the market’s foundation.

The generals, represented by the Invesco QQQ ETF Trust, retreated slightly, losing 0.03%. However, the troops, embodied by the iShares Russell 2000 ETF, rallied to lead the charge with a 0.42% gain, showcasing the small-cap sector’s ability to find support and advance. Our brass commanders, the Invesco S&P 500 Equal Weight ETF (RSP) and the Schwab US Dividend ETF (SCHD), also marched forward, posting gains of 0.24% and 0.31% respectively. These movements indicate a broader market participation beyond the large-cap tech stocks that have often dominated headlines.

Adding to the positive sentiment, the NYSE Advance-Decline Line, a crucial measure of market breadth, found support and rallied slightly higher during the abbreviated week. This tactical advance suggests that a larger contingent of stocks is participating in the market’s upward movement, potentially strengthening the overall market position. As we transition from this light-volume period, the stage is set for a potentially more active engagement in the markets, with investors poised to reassess their strategies in light of the evolving economic landscape and central bank policies.

Coming off a light week now is a good time to revisit the bond themes touched on in last week’s commentary. Although many investors seem to be watching the pretty magician’s assistant (the Federal Funds Rate), I believe the real magic in both bonds and stocks is being dictated by the action of longer-term rates such as the 10-year treasury bond.

As we survey the economic battlefield, the Federal Reserve’s current stance presents a strategic conundrum not seen since the early 1980s. For the first time in over four decades, the Fed has effectively called a ceasefire on rate hikes while inflation remains above its 2% target. This tactical shift, signaled by Chair Powell’s indication that rate hikes are no longer under active consideration, marks a significant departure from historical norms and suggests a strong bias towards easing despite core PCE inflation standing at 3.1%.

This unconventional approach by the Fed’s high command could potentially fuel continued market bullishness, reminiscent of the 1982 scenario when easing inflation and rate cuts ushered in a major secular bull market for both stocks and bonds. However, if the Fed’s intelligence on inflation proves faulty once again, it could reignite inflationary concerns, potentially ambushing both equity and fixed income positions.

The current economic intelligence remains mixed, with strong corporate earnings and decelerating inflation counterbalanced by a softening labor market. This creates a strategic dilemma for the Fed in balancing the risks of premature easing against potential economic slowdown. Three potential battle plans emerge: the Fed could align with market expectations, risking an inflation resurgence; the market could adjust to the Fed’s more conservative outlook, potentially leading to asset repricing; or economic data could evolve to bridge the gap between market and Fed views, creating a more stable front.

The disconnect between market expectations and Fed projections has set the stage for a potential conflict. While the market rally has been driven by expectations of multiple Fed rate cuts in 2024 – with some anticipating as many as six 25 basis point reductions – the Fed’s more cautious approach suggests only two or three potential rate cuts. This misalignment in battle plans could lead to significant market volatility as investors recalibrate their strategies to the evolving economic landscape. As we navigate this uncharted territory, investors must remain vigilant, ready to adapt their tactics to the shifting dynamics between Fed policy, interest rates, and equity markets.

The bond market has recently become a theater of intense action, with long-term Treasury yields staging a significant advance. The 30-year Treasury yield is now approaching its 2023 high of 4.81%, a level that could prove to be a critical battleground for market sentiment. This surge in yields has been marked by extraordinary volatility, including a 10 basis point jump in a single day and a recent 40 basis point surge in just two weeks. Such rapid movements reflect growing uncertainty about the Federal Reserve’s inflation-fighting credibility and could potentially trigger a mass exodus from bond positions, pushing yields even higher.

On the front lines of this conflict, we’re closely monitoring the 10-year US Treasury Bond yield, where resistance stands firm at 4.7%. This level represents a key strategic position; a breach could signal a new offensive in the bear market for bonds. Simultaneously, we’re watching the iShares 20+ Treasury Bond ETF (TLT) for signs of weakness. A strong breach below the 87 level in TLT could confirm a new bearish trend in bonds, potentially unleashing a wave of selling pressure across fixed-income assets.

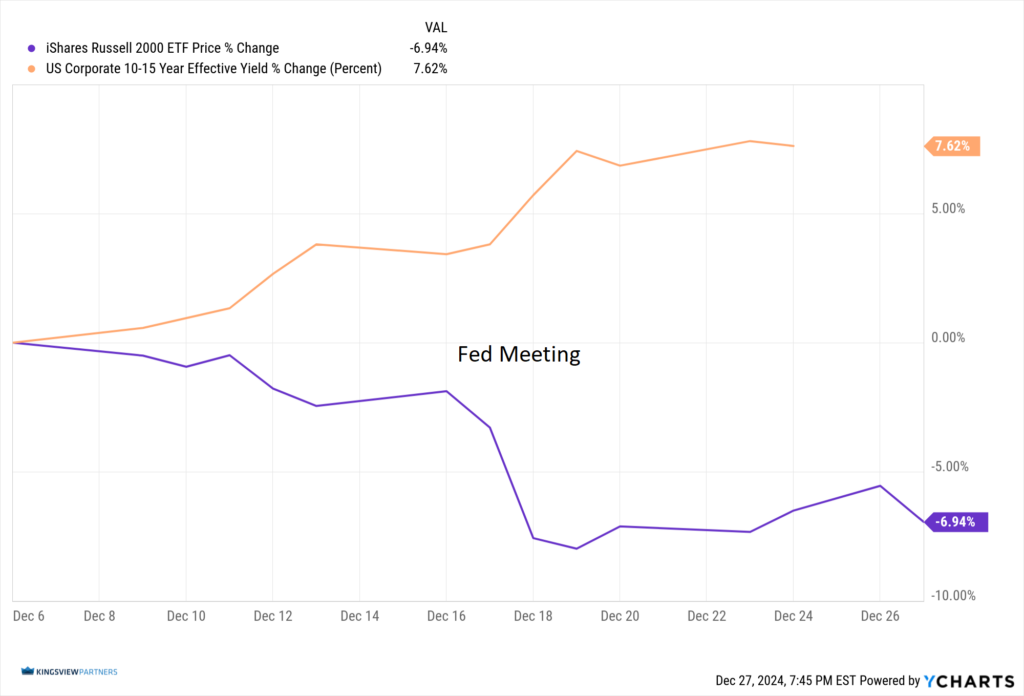

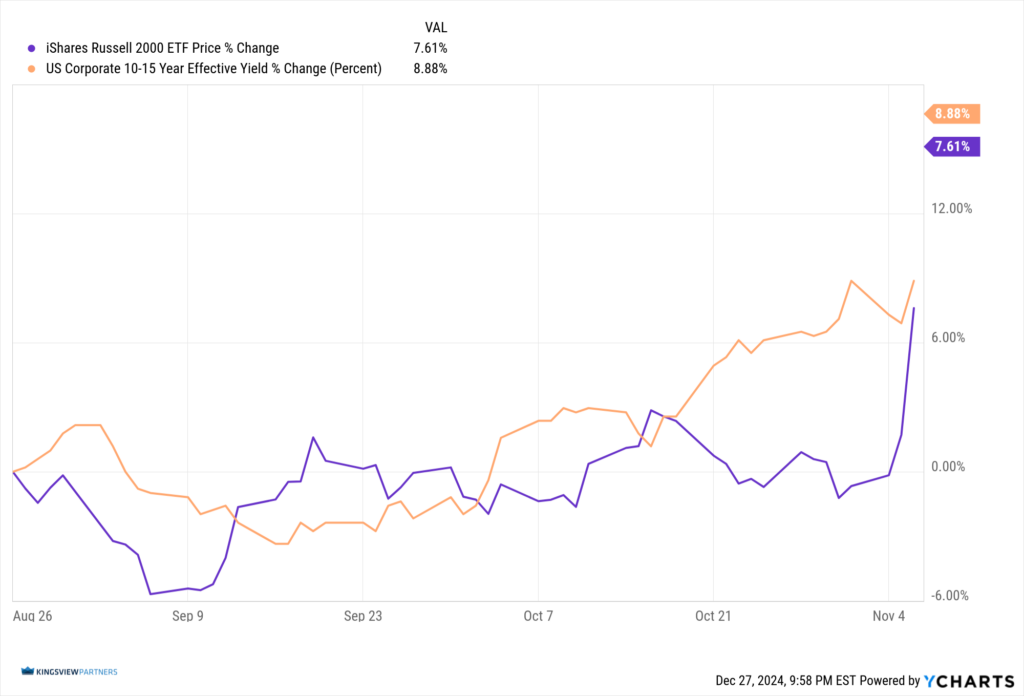

The impact of these bond market maneuvers on equities cannot be overstated. While the troops (small-cap stocks represented by the Russell 2000) initially showed resilience in the face of rising yields following the August lows, the correlation has now completely reversed. Since December, the troops have been moving in inverse relation to effective long-term yields, demonstrating their vulnerability to interest rate fluctuations. This shift in market dynamics suggests that further increases in bond yields could pose a significant threat to the broader equity markets, particularly impacting the small-cap sector that has recently shown signs of strength.

The hierarchical nature of financial markets means that disruptions in the bond market can have far-reaching consequences, potentially causing substantial losses across multiple fronts. As we navigate this complex battlefield, investors must remain alert to the evolving interplay between bond yields and equity performance, recognizing that the current environment may require swift tactical adjustments to protect and advance their positions.

As we navigate this complex economic battlefield of widening interest rate spreads, investors must be prepared for a period of heightened volatility. The significant disconnect between market expectations and Federal Reserve projections creates a potential powder keg that could ignite at any moment. To weather this storm, investors should consider adopting adaptable investment strategies that can quickly respond to changing market conditions.

Currently, the S&P 500 is engaged in a skirmish with intermediate trend line support, a critical position that could determine short-term market direction. Meanwhile, the troops (IWM) are holding the line at the 212 support level. These key positions warrant close monitoring, as breaches could signal a shift in market sentiment and trigger broader selloffs. Investors should be prepared to adjust their defensive positions accordingly, potentially increasing allocation to more defensive sectors or cash if these support levels fail to hold.

As we advance into this uncertain terrain, vigilance is paramount. Regularly reassessing risk tolerance, maintaining disciplined position sizing, and having clear exit and entry strategies for each investment are essential tactics for navigating potential market turbulence. By staying alert to evolving market dynamics and being prepared to execute swift, tactical adjustments, investors may position themselves to not only defend against potential downturns but also capitalize on opportunities that may arise in this volatile environment.

Grace and peace my friends,

BUFF DORMEIER, CMT

Updated: 12/30/2024. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.