Volume Analysis | Flash Update – 9.29.25

A New Hope or a Gathering Storm?

This week’s battlefield was quiet on the surface but filled with subtle signals beneath the smoke. The S&P 500 carved out a higher high and a lower low, yet closed almost exactly where it began leaving behind a doji candle on the weekly bar. At first glance, this may appear inconsequential, but in candlestick analysis, the doji represents a moment of indecision. The forces of buyers and sellers locked horns, neither side able to claim decisive ground.

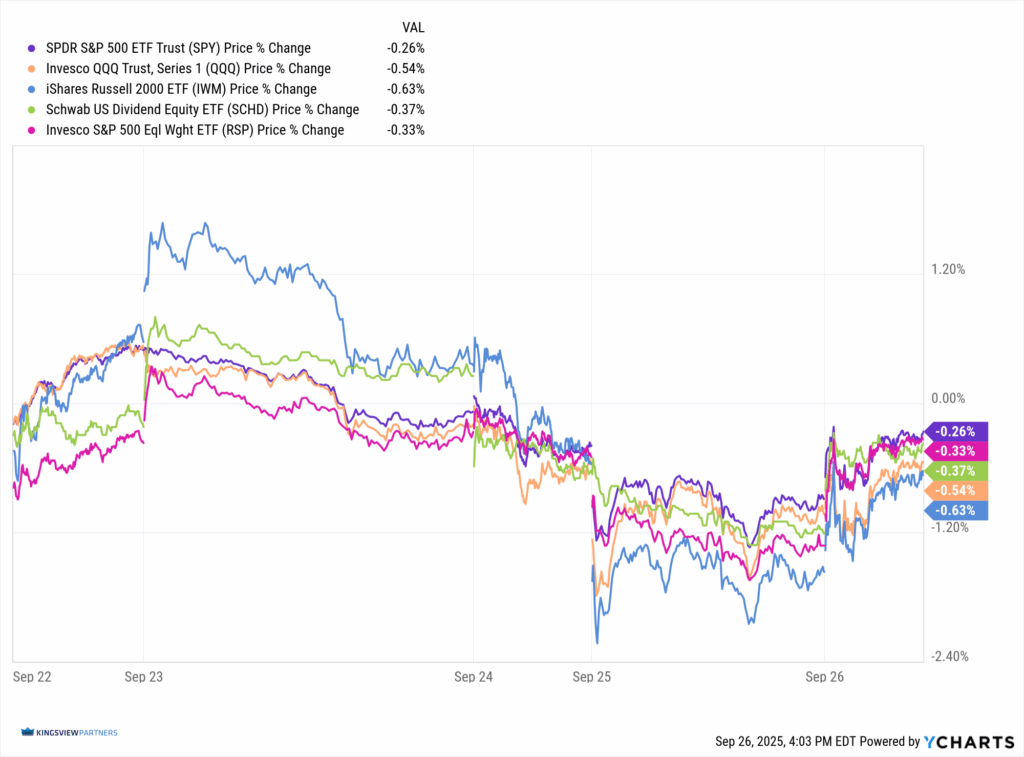

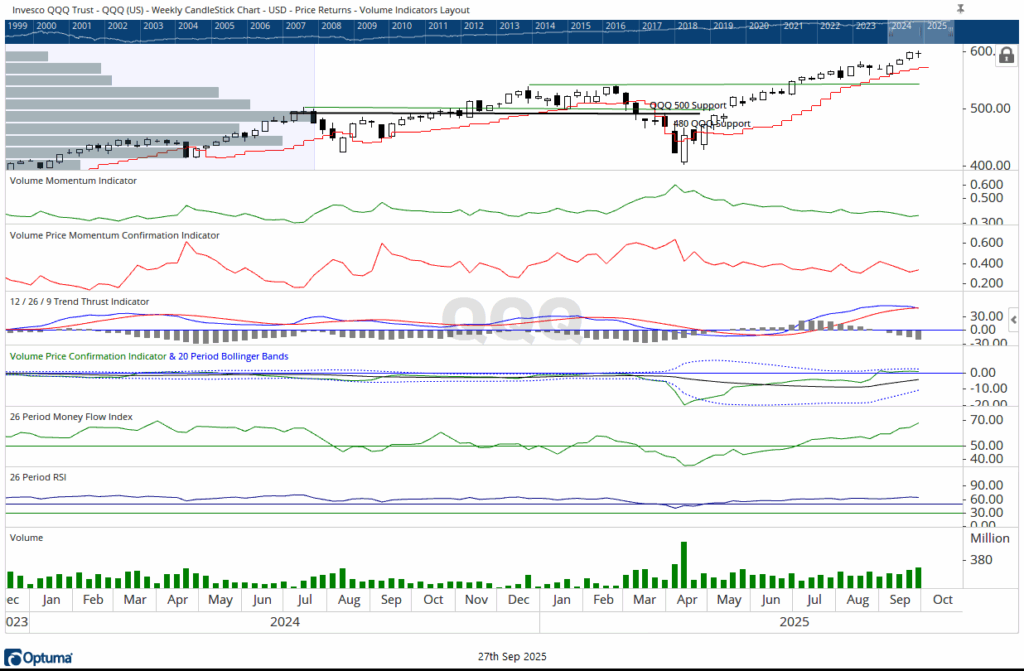

The generals, Invesco QQQ Trust (QQQ), closed the week down -0.54%, leaving behind their own doji, a sign of hesitation after recent strength. The troops, iShares Russell 2000 ETF (IWM), suffered a slightly larger retreat, down -0.63%, and marked the field with a long-legged doji. This formation suggests a market pushed violently in both directions intraweek, only to settle back near its opening levels. Such candles reflect exhaustion and uncertainty: a selloff reversed by late buying and then quickly met by strong resistance. In such cases, volatility without direction may foreshadow an imminent turning point.

Meanwhile, the lieutenants, Invesco S&P 500 Equal Weight ETF (RSP), fell -0.33%, and the brass commanders, Schwab U.S. Dividend Equity ETF (SCHD), slipped -0.37%. The capital-weighted S&P 500 ETF (SPY) held the line best, down just -0.26%. In other words, all units retreated slightly, but none were routed.

Volume and Flows

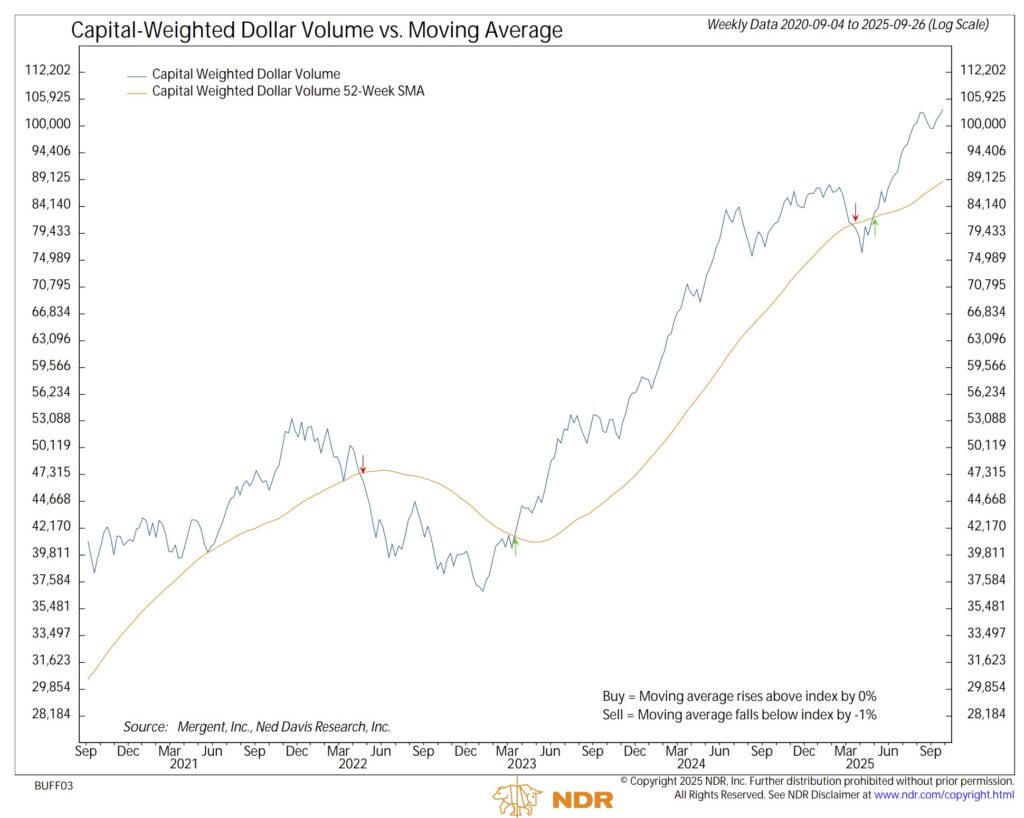

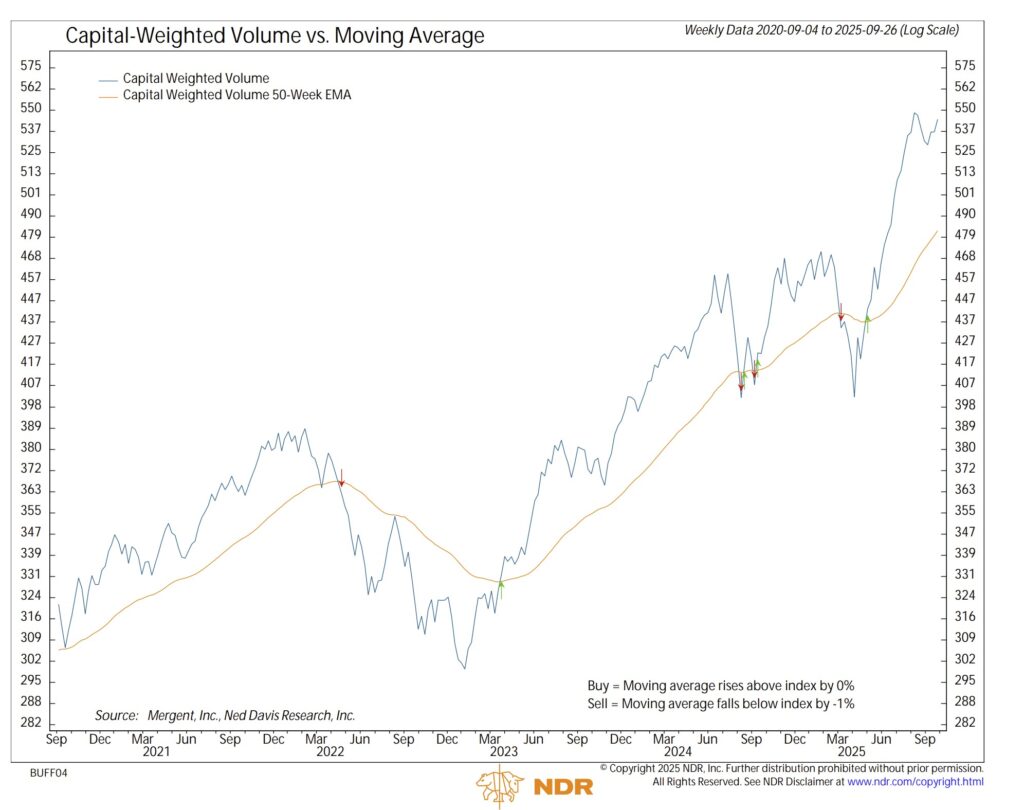

Capital flows were above average, with outflows slightly edging inflows. Capital-weighted volume registered at average levels, with upside volume narrowly outpacing downside volume. This creates a picture of stalled conviction, liquidity present, but not decisive in either direction.

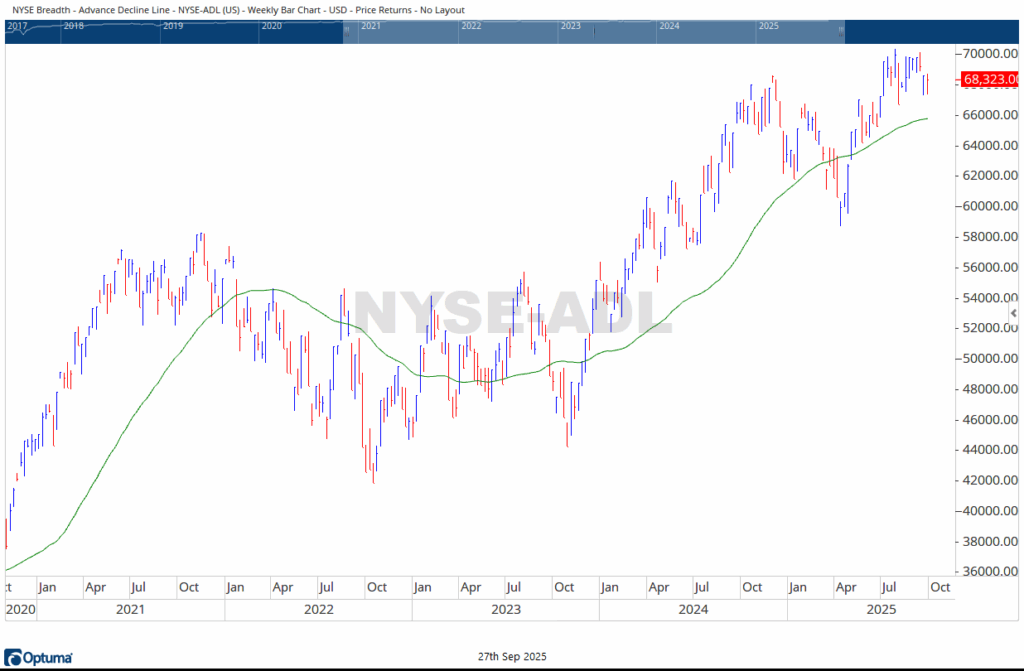

The Advance–Decline Line was engulfed within last week’s range. However, unlike the prior week’s weak close near the bottom of the bar, this week finished near the top. Together, this formation forms a spinning top, yet another sign of market indecision. Breadth has not yet broken out, but it no longer sits in retreat, a tentative sign of resilience.

The Battlefield Theme

Taken together, the picture is one of stalemate. The generals and troops, who led last week’s advance, were this week’s laggards. Their doji footprints suggest hesitation, their advance slowed as if the armies paused at the edge of contested ground. The lieutenants and commanders, though steadier, also failed to mount an advance.

Conclusion: A Pause in the Campaign

The emergence of doji and spinning candles across the major forces carries important implications. These type of candles often precede turning points, either a reversal or a fresh surge once indecision resolves. The generals’ doji signals their leadership is now in question, while the troops’ long-legged doji reveals volatility without commitment. With breadth still contained and flows now slightly lagging, the rally’s foundation appears less stable than its headlines suggest. These signs are akin to flags planted on contested ground, the armies advance no further, awaiting fresh orders. The generals hesitate, the troops test the flanks, but the battlefield lies in suspense. History shows that such stalemates rarely last; soon, either a victorious charge or a sudden retreat breaks the standstill.

The market once again balances between new hope, troops gaining ground, breadth closing near its highs, upside volume still marginally ahead and the gathering storm, indecision among leaders and the strain of new outflows.

For investors, this is a reminder: risk management must remain at the forefront. Doji candles are crossroads. They do not determine direction, but they warn of imminent decision. Portfolios should be positioned with discipline, ready to withstand either a broadening advance or a storm should selling pressure reassert itself.

Grace and peace my friends,

BUFF DORMEIER, CMT

Updated: 9/29/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.