Volume Analysis | Flash Update – 7.7.25

The Advance Broadens

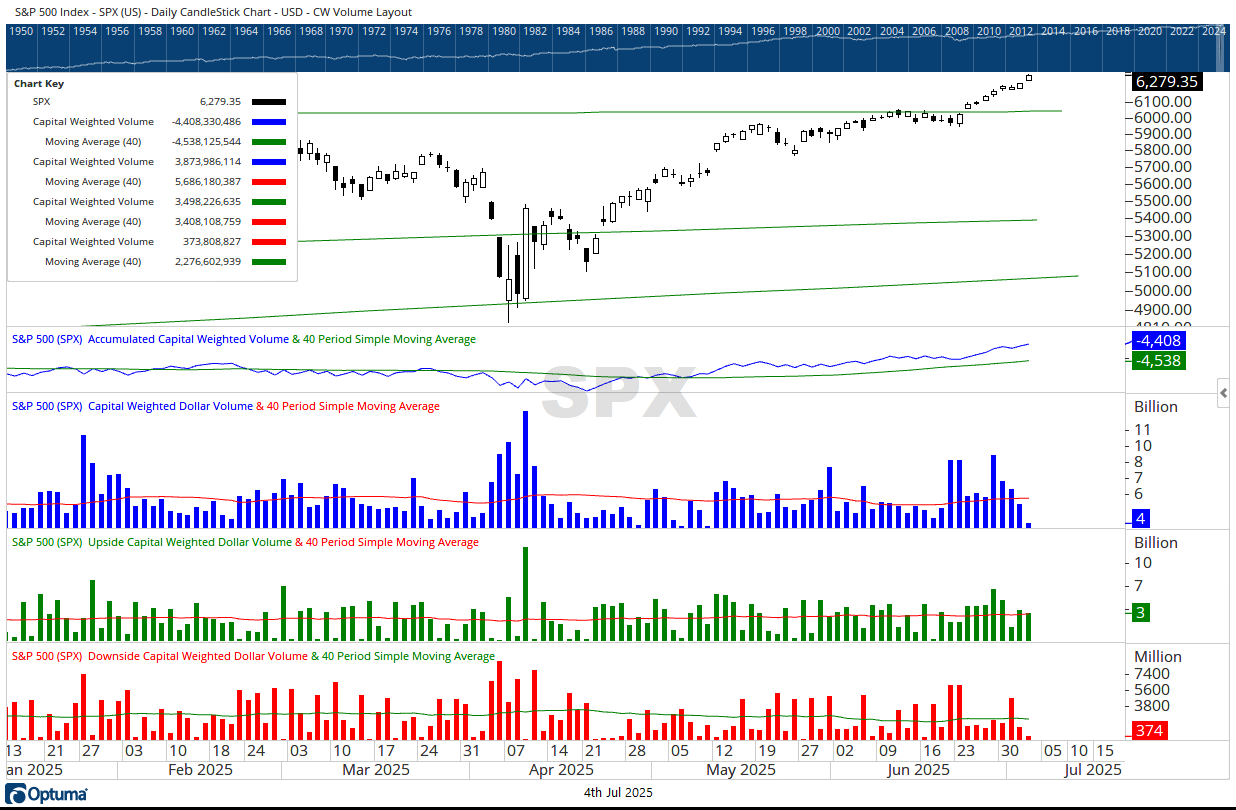

In a shortened holiday week, the S&P 500 once again closed at all-time weekly highs, continuing its campaign with minimal resistance. Volume remained in command, with 67 percent of activity advancing and capital flows confirming the push as five out of every eight dollars moved into equities. Reinforcements arrived from the broader front as the NYSE Advance–Decline Line broke out joining volume and price composites in the all-time new high rally in a display of strengthening breadth.

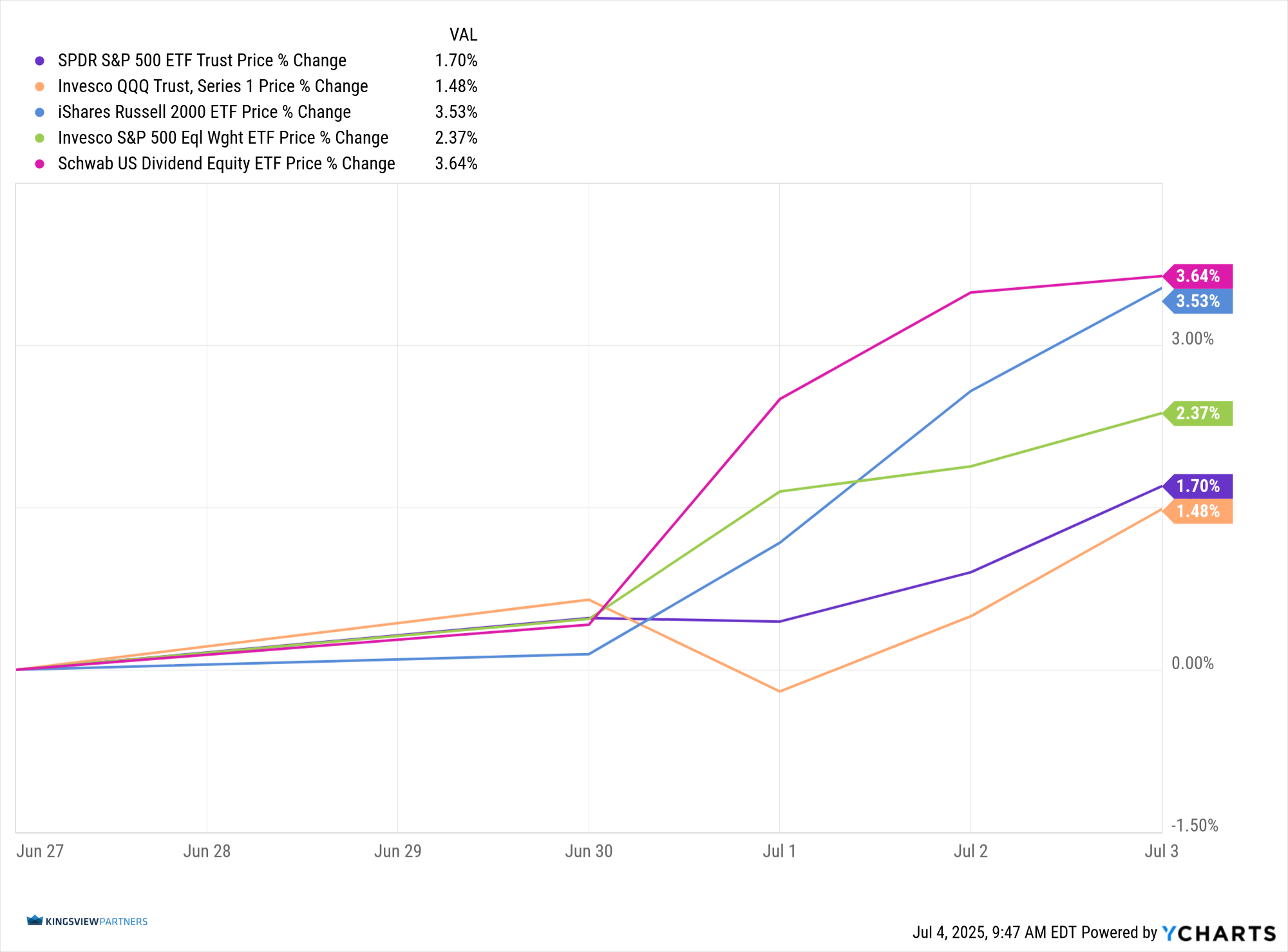

This week, it was the brass commanders, represented by SCHD (Schwab US Dividend Equity ETF) leading the charge. After sitting out much of the rally since the April 9th reversal, these income-focused forces advanced decisively, with SCHD up 3.64% for the week. Their resurgence added depth to the advance, signaling broader participation among these previously sidelined units.

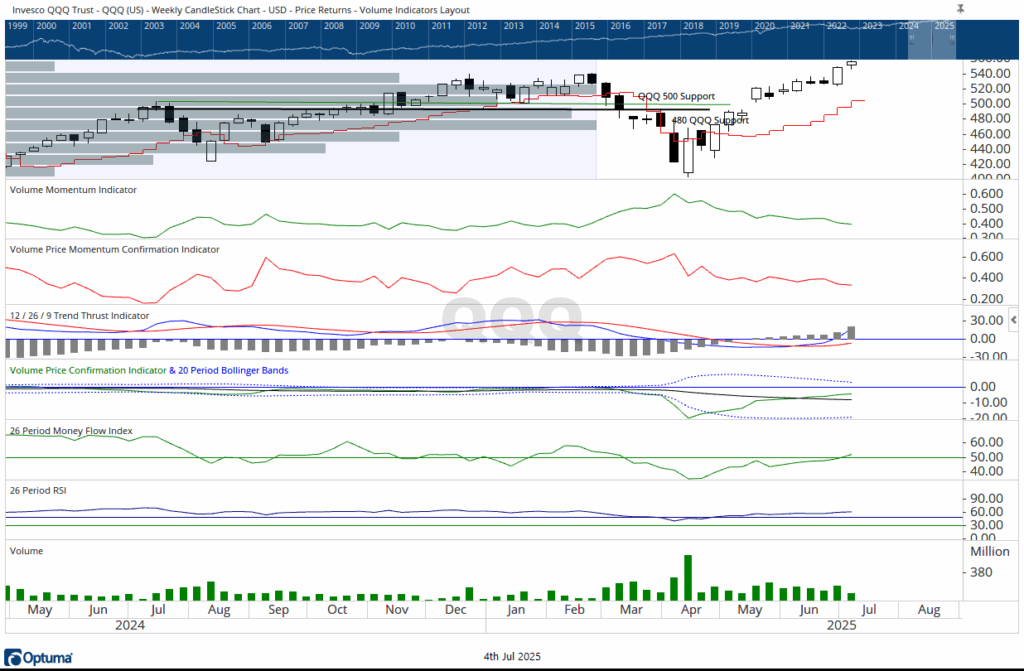

The troops (IWM – iShares Russell 2000 ETF) continued their forward movement up 3.53%. The generals (QQQ – Invesco QQQ Trust), while still in command, lagged this week with a 1.48% gain. This temporary shift in leadership allowed the broader formation to regain alignment, offering tactical balance to the advance.

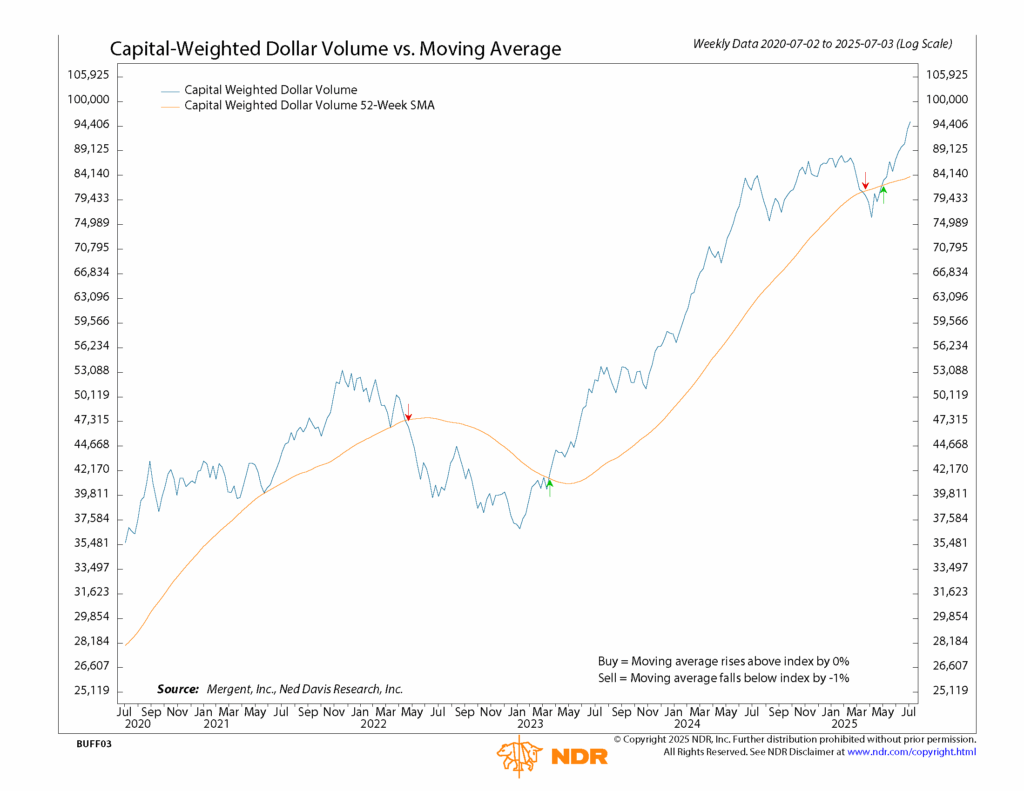

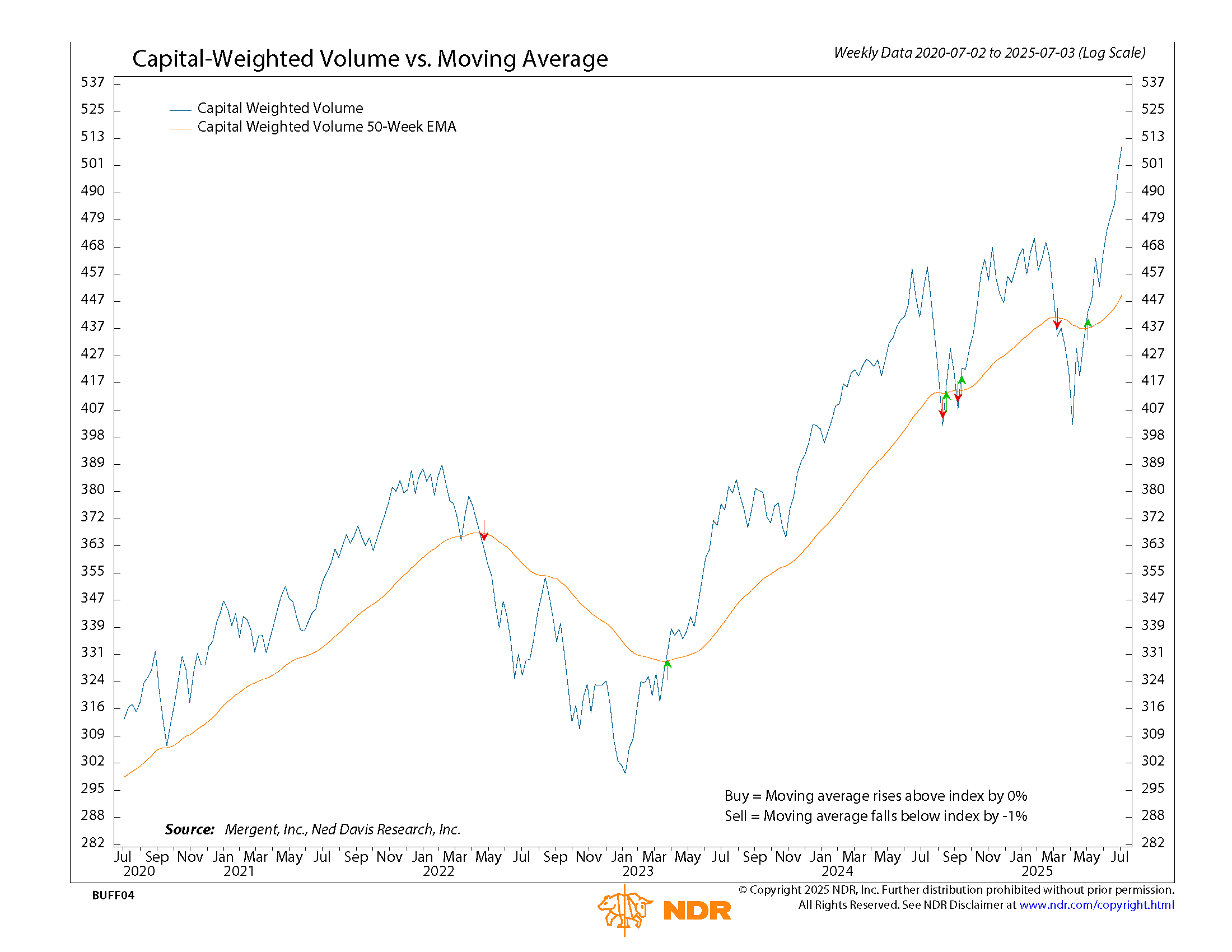

Meanwhile, S&P 500 Capital Weighted Volume and Capital Flows pushed ever higher into record territory, extending their lead over price indexes. This volume-based conviction reinforces the bullish structure and affirms the momentum we first noted when volume broke out ahead of price several weeks ago.

The S&P 500 now marches with clear skies above and fortified support at 6050 below. The troops have decisively reclaimed 212 continuing their climb toward next resistance at 230, with secondary support at 210. This week’s broad-based advance matches the conditions we outlined last week as a constructive and necessary development for sustained progress.

Summary:

The campaign has broadened. Volume and capital flows continue to lead from the front, with the brass commanders now reinforcing the advance. Breadth has joined the party, price has followed volume, and leadership has rotated in a healthy formation. While the terrain ahead appears favorable, forward units should remain vigilant. No campaign is without risk. Tactical repositioning or pullbacks near resistance are common and can offer fresh opportunities, but they also demand discipline. Stay alert, follow the volume, and be prepared to regroup if needed. And then there were none left unsupported.

Grace and peace my friends,

BUFF DORMEIER, CMT

Updated: 7/7/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.