Volume Analysis | Flash Update – 5.27.25

Tactical Pullback – Bears Counterattack After Bullish Blitz

Following a five-week surge that saw the bulls in full control of the field, the S&P 500 paused to regroup last week, retreating on below-average volume. All units experienced a pullback, though the generals (Invesco QQQ Trust – QQQ) held their ground best, falling -2.35%. In contrast, the troops (iShares Russell 2000 ETF – IWM) suffered the heaviest casualties, retreating -3.47% under heavy fire.

The bears launched a successful mid-week ambush on Wednesday, May 21st, delivering an 86% downside day, followed by a decisive strike to end the week with a 93% downside capital-weighted volume day. These high-intensity downside sessions left a mark: for the week, 60% of S&P 500 flows were outflows, and the index broke its prior weekly range, though it held the key 5,800 support zone into Friday’s close.

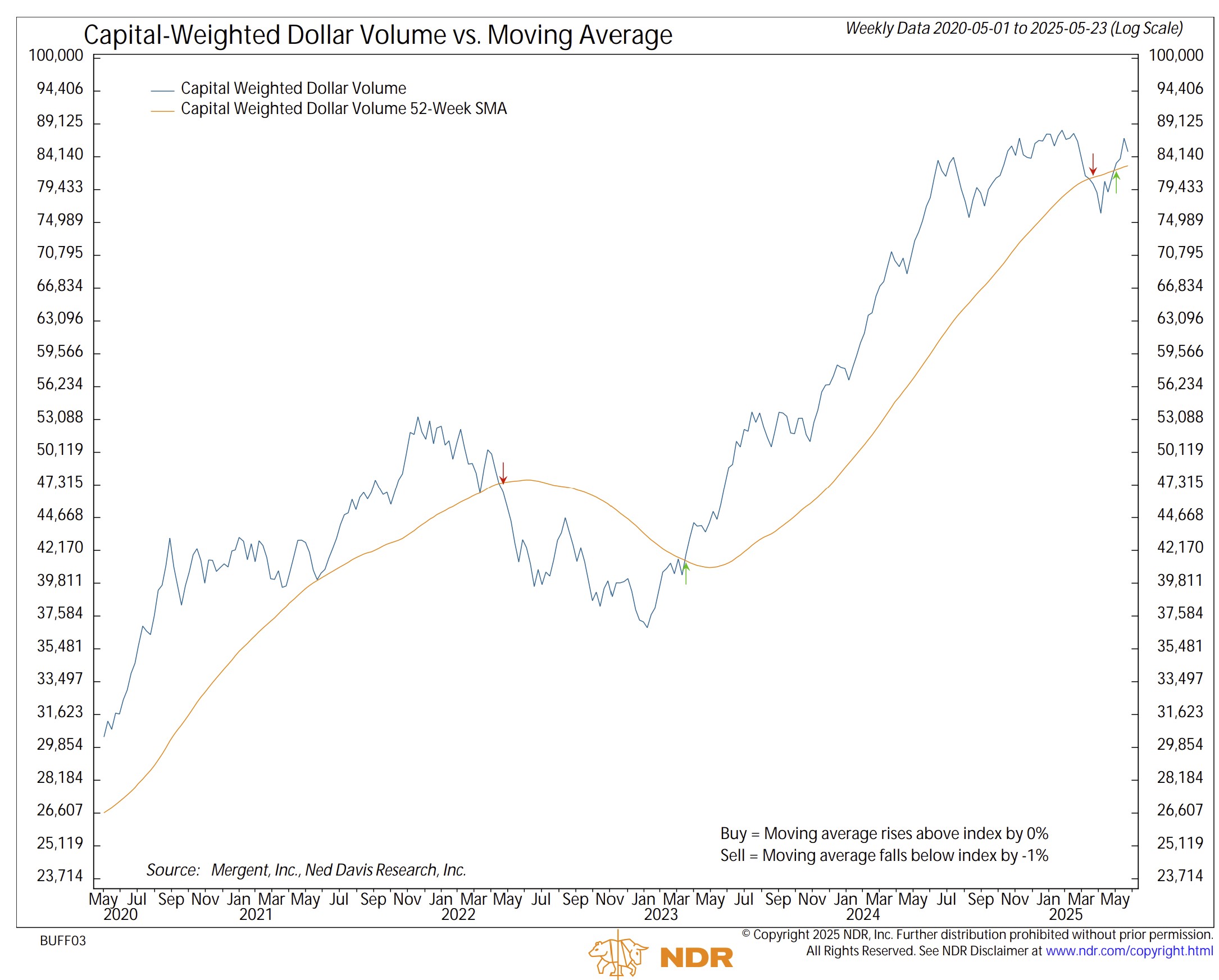

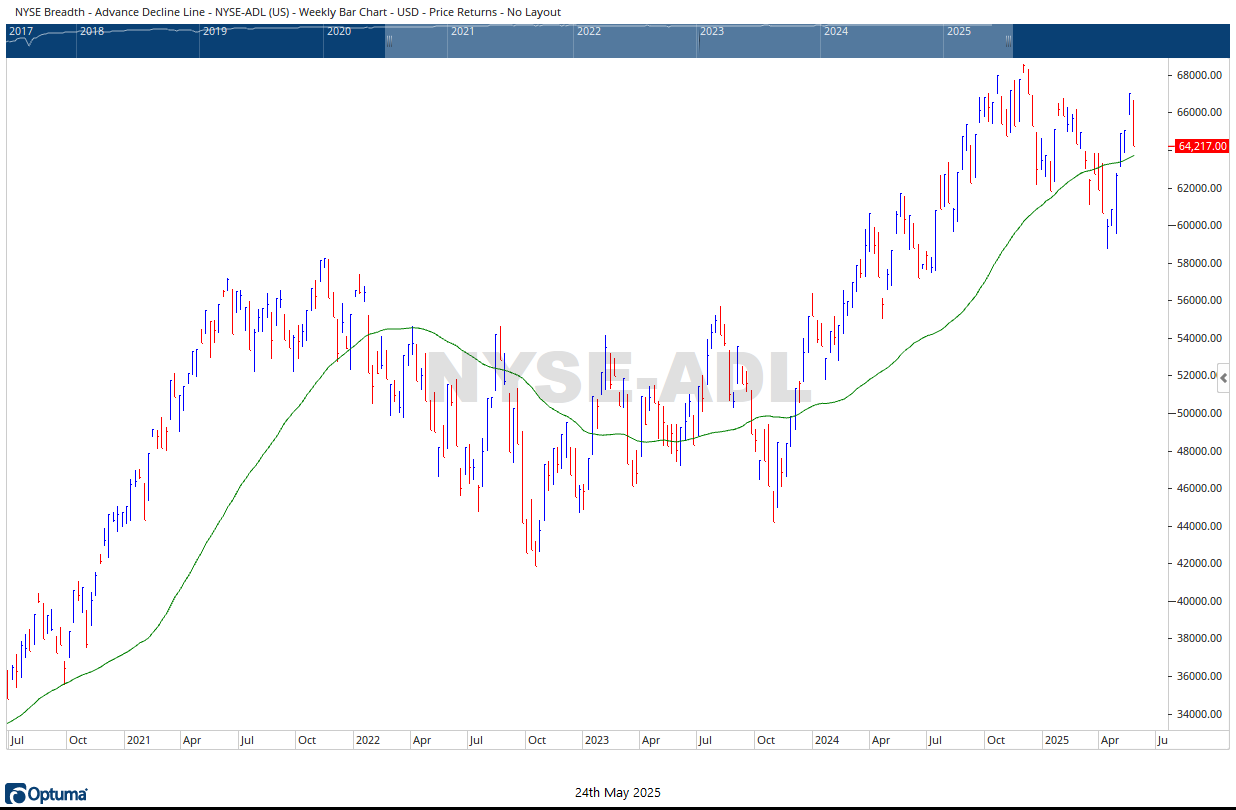

Market internals confirmed the retreat, with Capital Weighted Volume, Dollar Volume, and the NYSE

Advance–Decline Line all closing lower on the week. That said, all three measures continue to uphold their recently reestablished uptrends, suggesting the pullback may be more of a tactical retreat than a full-scale rout.

Technically, the troops (IWM) failed in their mission to breach overhead resistance, now retreating back into the 180–212 trading range. The generals (QQQ), while pulling back, remained resilient—closing within the prior week’s range of 500–525.

After the recent blitz, the S&P 500 now appears to be consolidating gains, pulling back to assess its position. Intraweek, the index briefly violated its breakout gap low at 5,786, though it managed to recover above that line by week’s end. A full fill of the ascending triangle’s breakout gap would require a drop to 5,720, though, not all gaps fill.

Looking ahead, a trading range may be forming, with 6,000 as the upper boundary and intermediate support between 5,500 – 5,700. Below that, trendline support currently rises through the 5,375–5,400 zone, providing the next line of defense should the bears press their advantage.

Tactical Takeaway:

After a relentless rally, even elite forces need to regroup. The recent pullback appears to be part of a broader consolidation—normal within a strong campaign. That said, the emergence of intense downside days reminds us that risk management remains mission-critical. Maintain discipline, monitor the trendlines, and stay alert—because in the markets, even during peacetime, the next skirmish is always just around the corner.

Grace and peace my friends,

BUFF DORMEIER, CMT

Updated: 5/19/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.