Volume Analysis | Flash Update – 2.17.26

Broadening Divergence Remains in Vogue

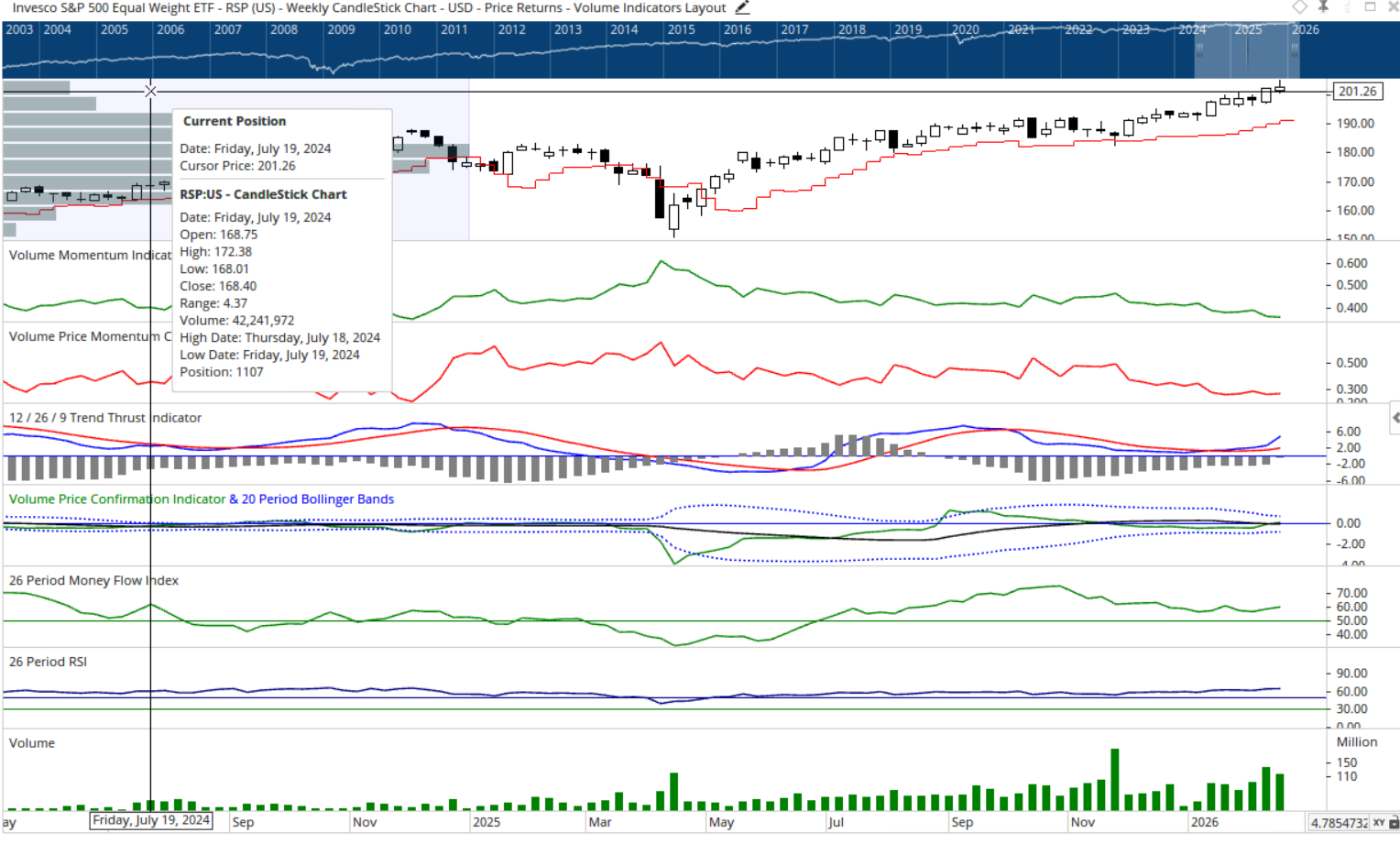

The campaign continues to fragment along familiar lines. Broadening divergence remains the dominant theme, consistent with the broadening wider and deeper narrative, rotating away from narrow leadership and into broader ranks.

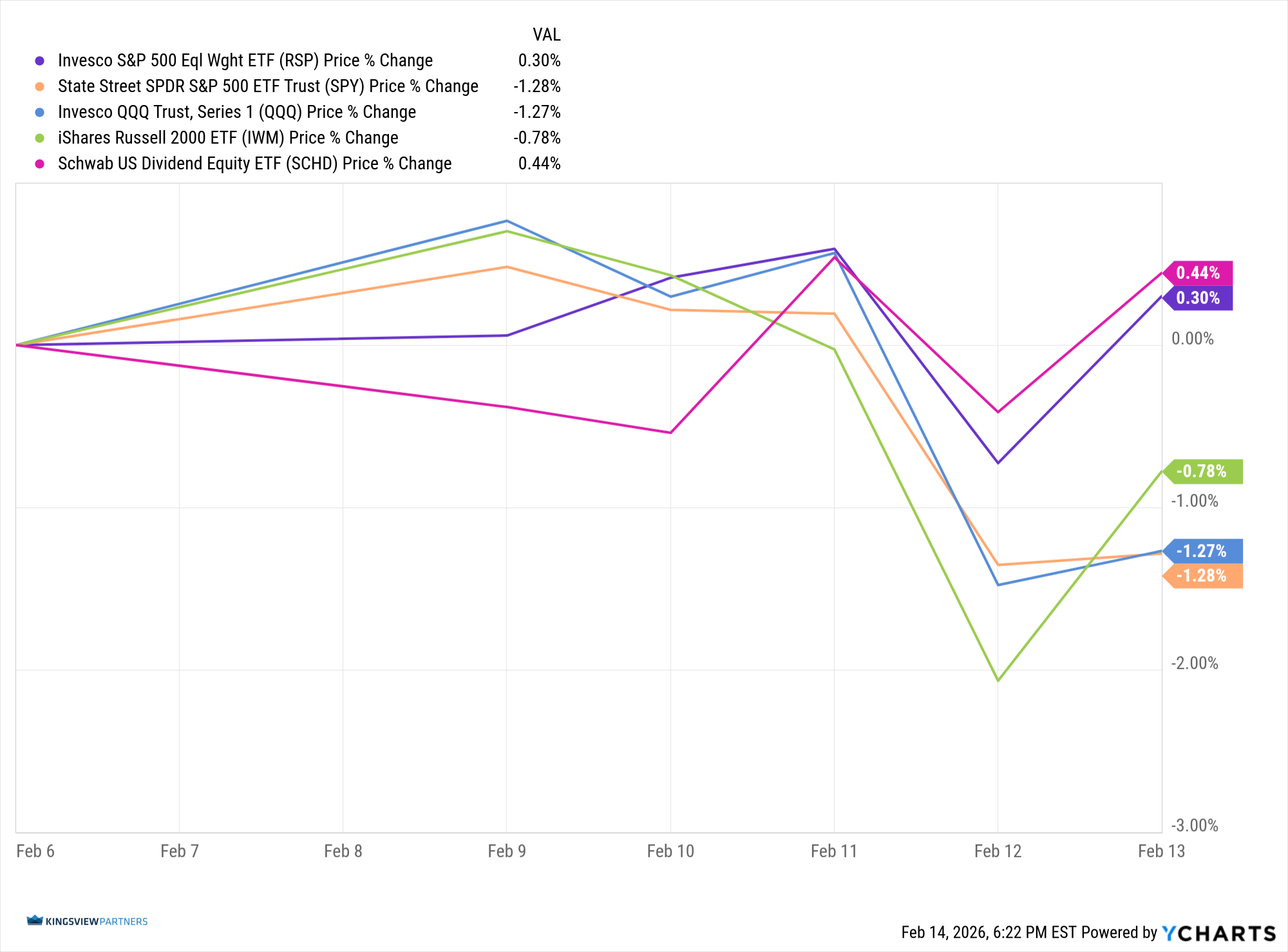

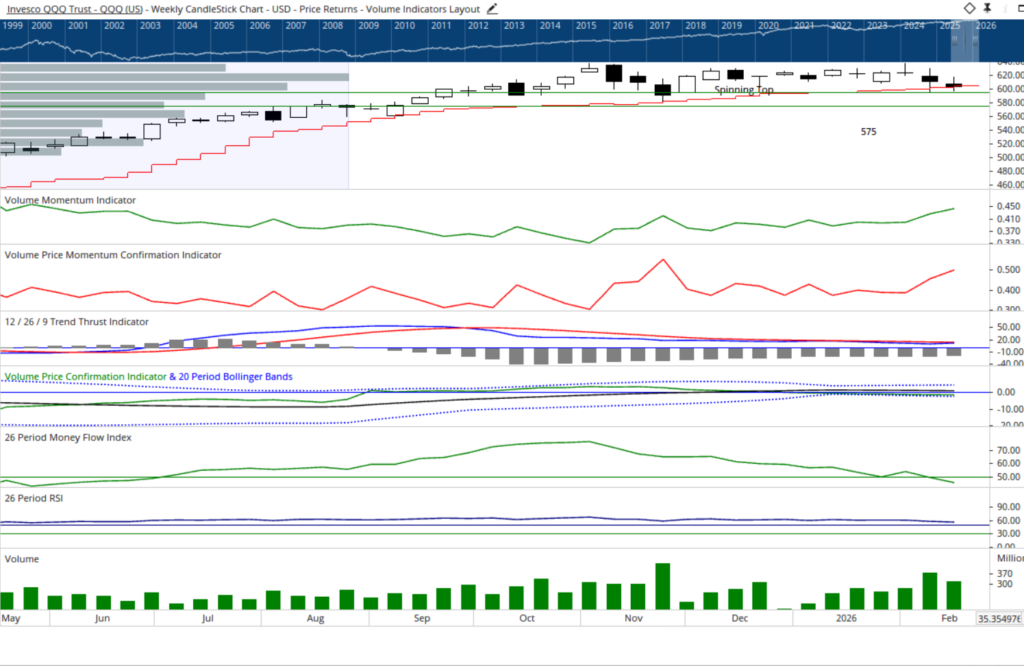

The capital weighted S&P 500, represented by the SPDR S&P 500 ETF Trust, declined -1.28% on the week. The generals, represented by the Invesco QQQ Trust, followed closely, down -1.27%. The troops, represented by the iShares Russell 2000 ETF, continued their recent doji pause and fell a more moderate -0.78%. In contrast, the broader equal weight formation, represented by the Invesco S&P 500 Equal Weight ETF, advanced 0.30%, while the brass commanders, represented by the Schwab US Dividend Equity ETF, added another 0.44% as their valuation charge continues.

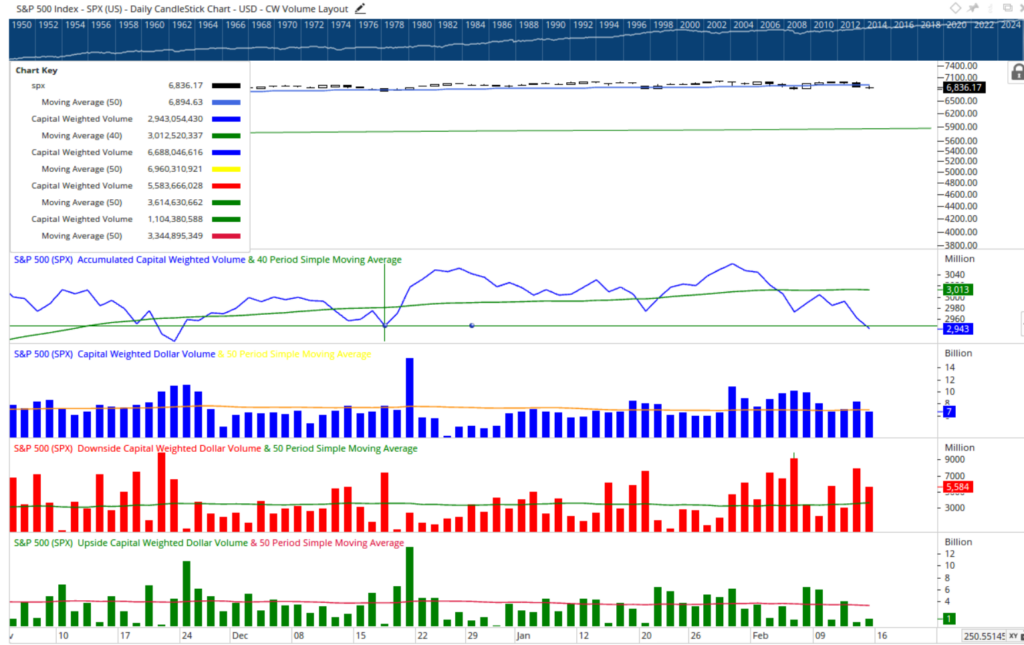

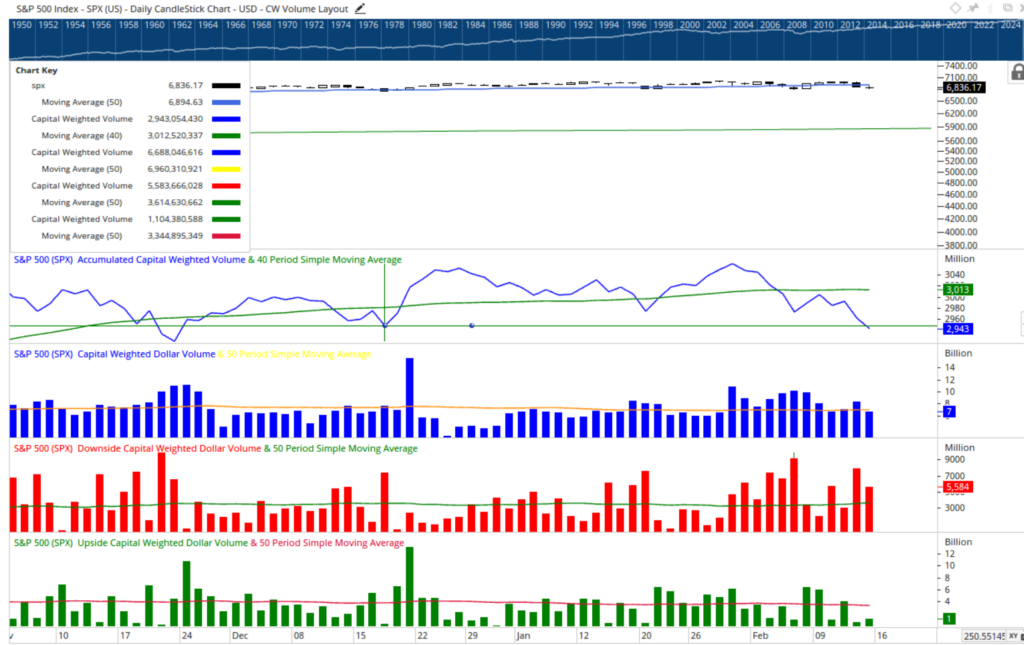

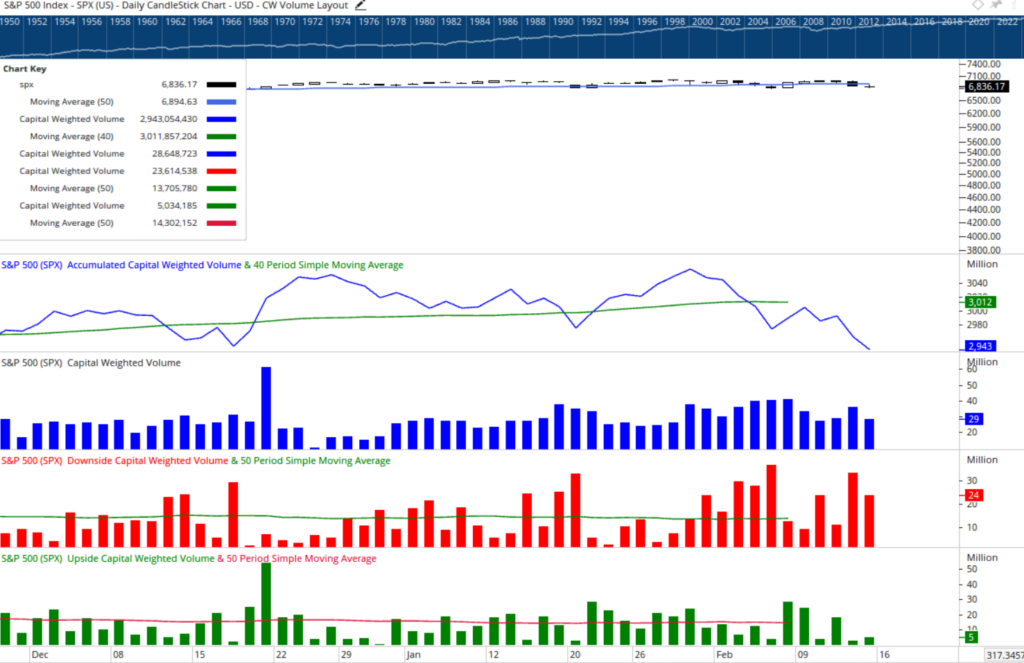

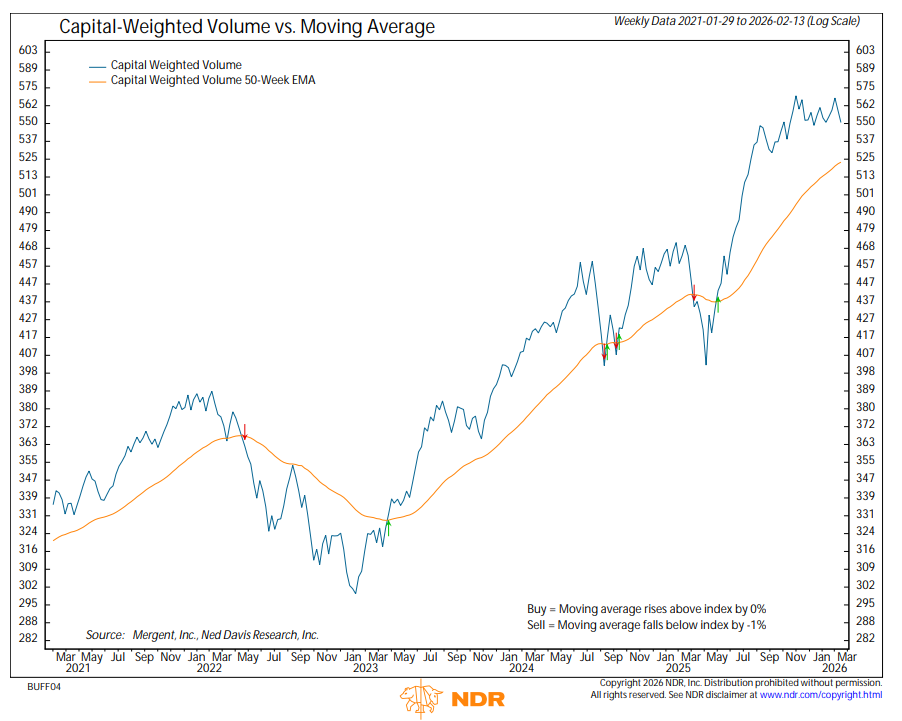

Thursday, February 12th delivered a decisive blow, registering a 96% downside Capital Weighted Volume day, scoring yet another 90% downside session again this week. Selling pressure intensified, and the tone shifted from rotation to outright distribution. The following day, February 13th, SPX printed a doji candle with 82% of Capital Weighted Volume still to the downside. The doji may represent a temporary halt in selling pressure, particularly as the S&P 500 approaches short term support. However, it could also signal confirmation of the intermediate term pause suggested by the persistent rise in downside volume.

On a weekly basis, both Capital Weighted Volume and Capital Weighted Dollar Volume leaned decisively defensive, with approximately 65% of activity weighted to the downside. The accumulated trend peaks in both measures continue to curl lower, reinforcing the view that while price weakness has been orderly, supply has been gaining incremental control. Support still holds and this zone is a trench the bulls need to hold to maintain shorter term control of the battlefield.

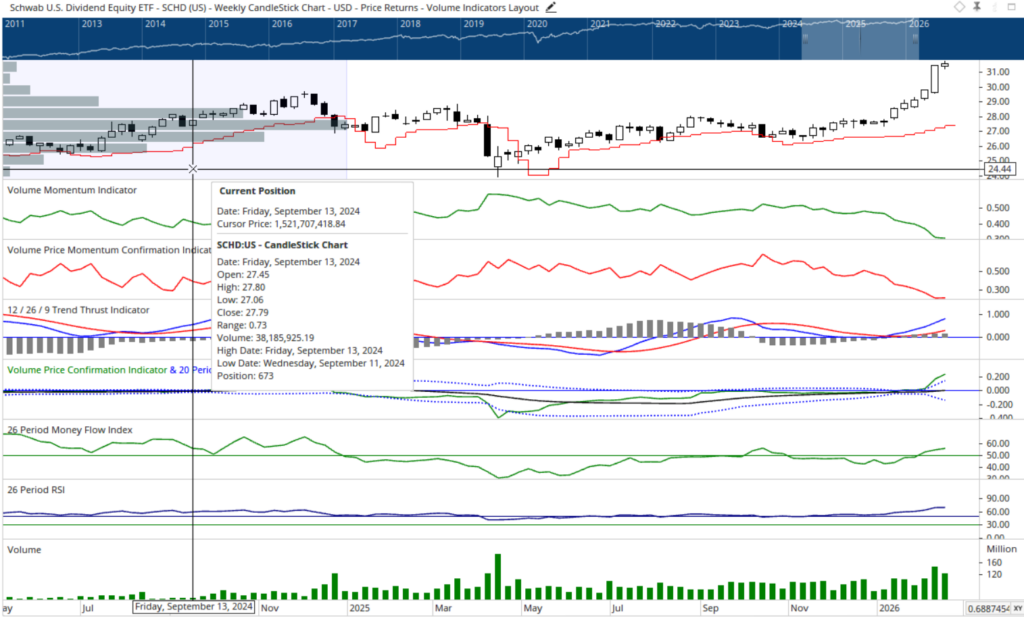

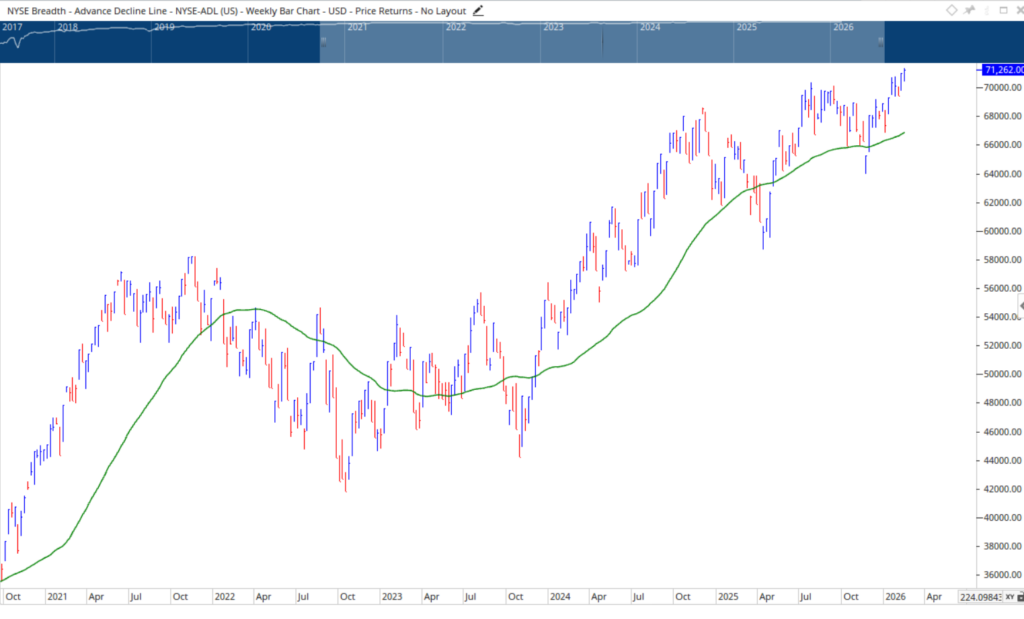

Yet beneath the surface, the broadening theme persists. The accumulated NYSE Advance–Decline Line continues to press to new all-time weekly highs. The troops maintain relative strength versus the generals, and the brass commanders continue to build momentum. The Schwab US Dividend Equity ETF has completed a substantial base and has now broken out, marking a meaningful shift in internal leadership. Earnings quality that was once forgotten has now stepped forward.

This environment echoes the And Then There Were None dynamic, where former giants lose dominance and participation redistributes across the formation. Leadership is no longer concentrated. Capital is not exiting the field, but it is clearly reallocating.

S&P 500 short-term support now resides near recent consolidation levels between 6800 – 6720. The response at those levels will be critical. Should support hold and downside volume contract, rotation may continue constructively. A decisive break accompanied by expanding downside volume would argue for a more defensive posture.

Risk Command

Rotation can be healthy, but sustained downside volume demands respect. Investors should consider remaining aligned with relative strength, particularly among equal weight and dividend exposure, while avoiding overexposure to stalled leadership. Position sizing, diversification, and disciplined adherence to support levels remain essential. In markets defined by divergence, conviction is revealed not by headlines but by volume. When supply begins to outpace demand, patience becomes a strategic asset. And then there were none left unprepared.

Grace and peace,

BUFF DORMEIER, CMT

Updated: 2/17/2026. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.