Volume Analysis | Flash Update – 10.6.25

A New Hope or a Gathering Storm?

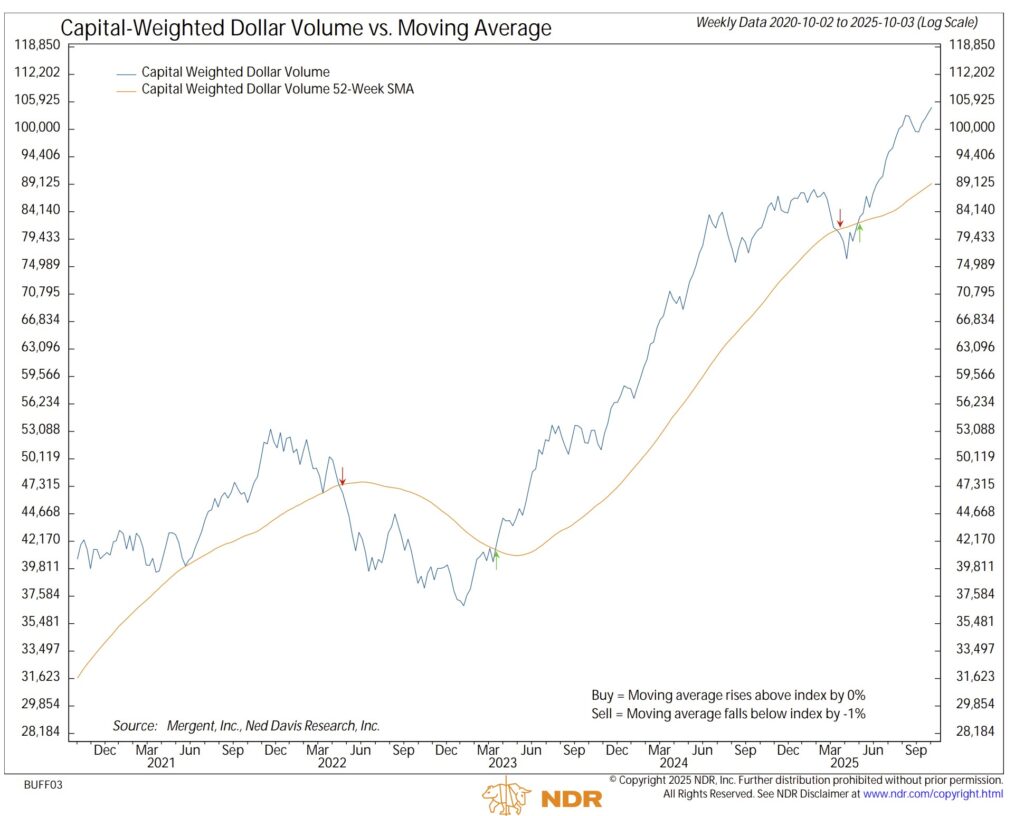

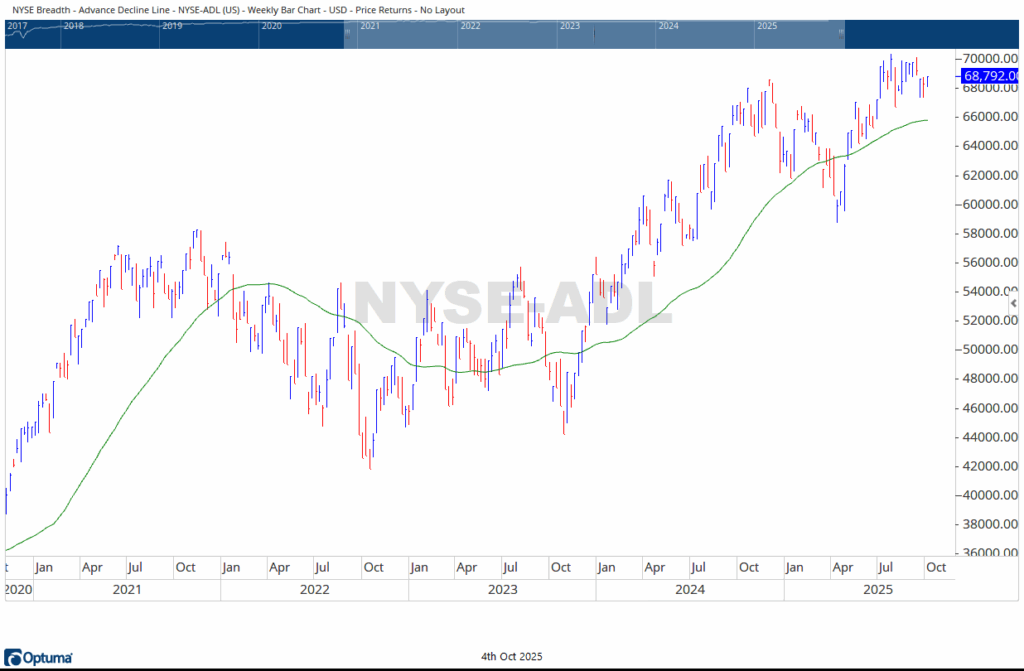

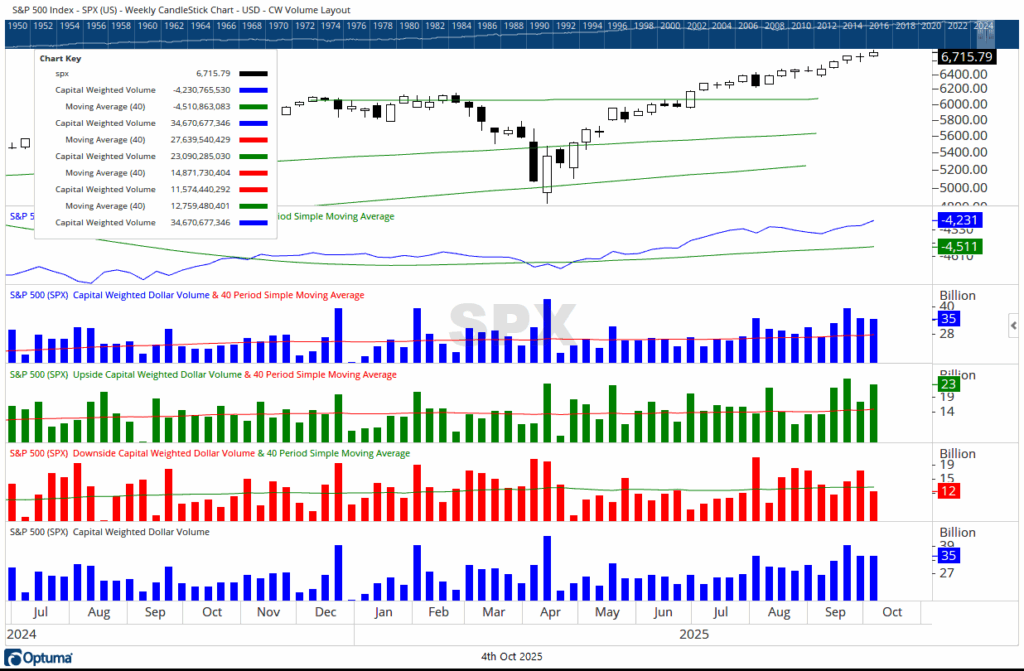

The tide of capital continued to rise this week, pushing the market toward new milestones. Both Capital-Weighted Volume and Capital Flows pressed higher, with Capital-Weighted Dollar Volume (Capital Flows) breaking out to fresh all-time highs, and accumulated volume matching prior highs at resistance. While price confirmed the advance, the action beneath the surface revealed a deeper story of strength, leadership rotation, and renewal across the battlefield.

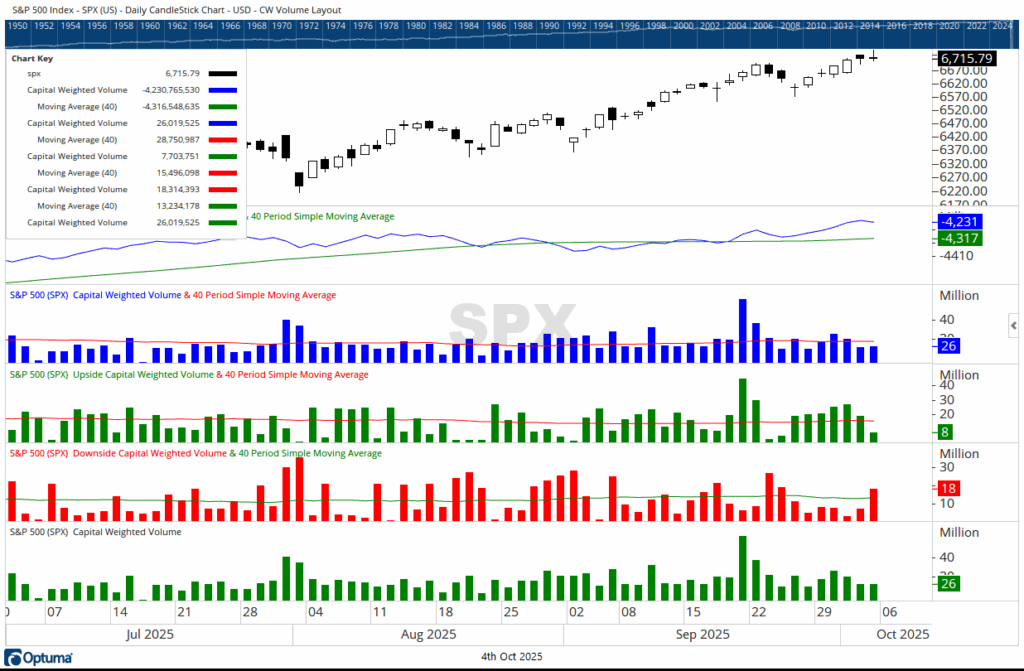

Capital Flows and Volume

Capital flows were well above average, with 66% of weekly movement to the upside. Inflows surged solidly above trend while outflows slipped modestly below average. Capital-Weighted Volume registered at average levels, but within that balance, upside volume ran a bit above average and downside volume fell well below. In total, 71% of the week’s trading volume was to the upside, underscoring that buying conviction remains firmly in command.

The Forces in Motion

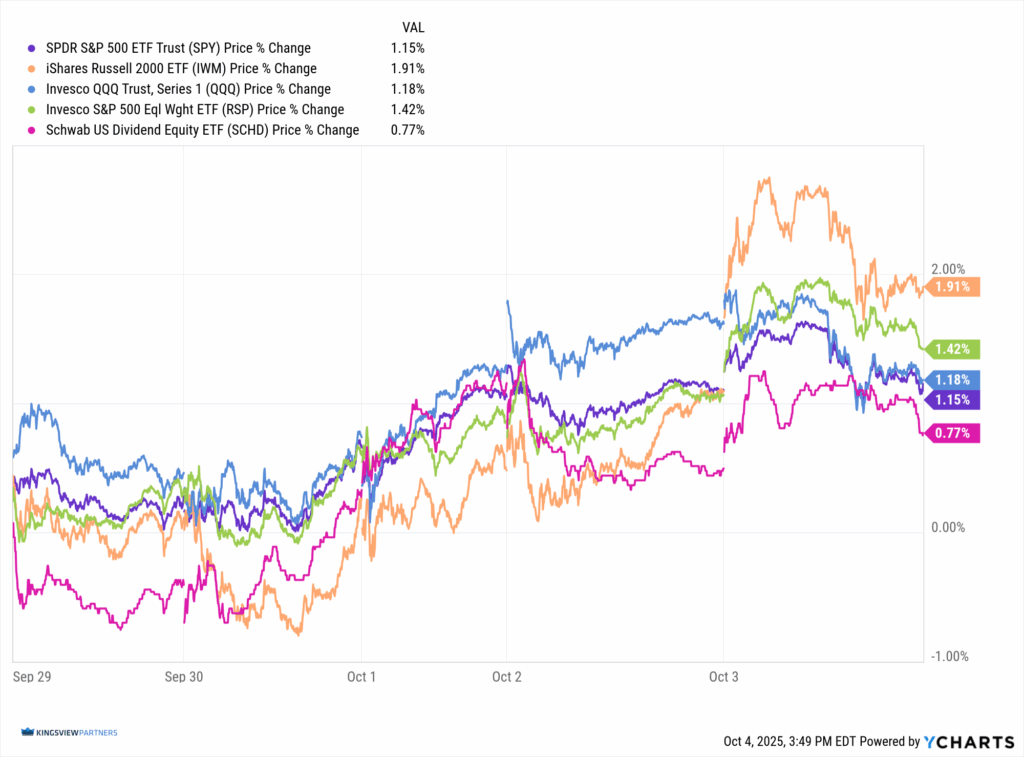

Both the generals, Invesco QQQ Trust (QQQ), and the troops, iShares Russell 2000 ETF (IWM), made higher highs and lower lows before closing at new all-time weekly highs, a classic mark of strength following brief consolidation.

Leading the charge, the troops (IWM) surged +1.91%, reclaiming the field after weeks of hesitation. The generals (QQQ) followed, advancing +1.18%, regaining leadership momentum even as they ceded relative strength to the smaller ranks. The lieutenants—Invesco S&P 500 Equal Weight ETF (RSP)—rose +1.42%, outpacing their capital-weighted counterpart, the SPDR S&P 500 ETF Trust (SPY), which climbed +1.15%. Bringing up the rear, the brass commanders—Schwab U.S. Dividend Equity ETF (SCHD) added a respectable but lagging +0.77%.

This synchronized advance across nearly all ranks reflects a broadening offensive, where even the previously lagging divisions are beginning to rejoin the campaign.

Market Interpretation

In recent weeks, the “fishhook” patterns in both capital flows and volume hinted that underlying support was quietly turning higher. Now, that inflection has confirmed itself—capital flows have broken to new highs, suggesting re-energized participation and healthy liquidity expansion.

Yet history reminds us that even the strongest advances carry the seeds of potential exhaustion. Volume, while improving, has not yet exceeded prior peaks. When price breaks to new highs ahead of volume, the message can be two-fold: enthusiasm remains, but conviction has not yet caught up.

A New Hope or Gathering Storm

The troops have regained stride, the generals are marching in step, and the lieutenants and commanders are following behind. This alignment across ranks rekindles the sense of new hope—a rally that is broadening rather than narrowing. But even as the field looks favorable, volume confirmation remains key. Without sustained capital support, rallies can lose footing as quickly as they ascend.

Conclusion:

The market presently stands beneath clear skies but with storm clouds still visible on the horizon. The new hope is the breakout in capital flows and all-time highs across major indices. The gathering storm is the question of whether volume will continue to confirm or fade at resistance.

For disciplined investors, the course remains the same—advance tactically, protect your flanks, and keep your risk armor in place. A well-managed defense allows participation in the advance without exposure should the winds shift.

Grace and peace my friends,

BUFF DORMEIER, CMT

Updated: 10/6/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.