Volume Analysis | Flash Update 1.9.23

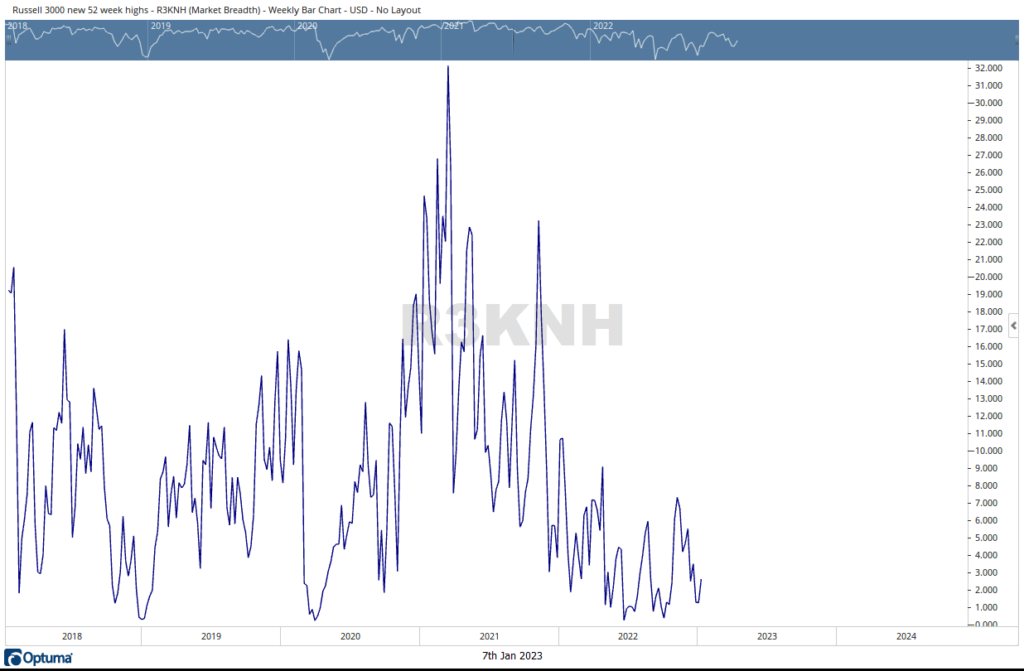

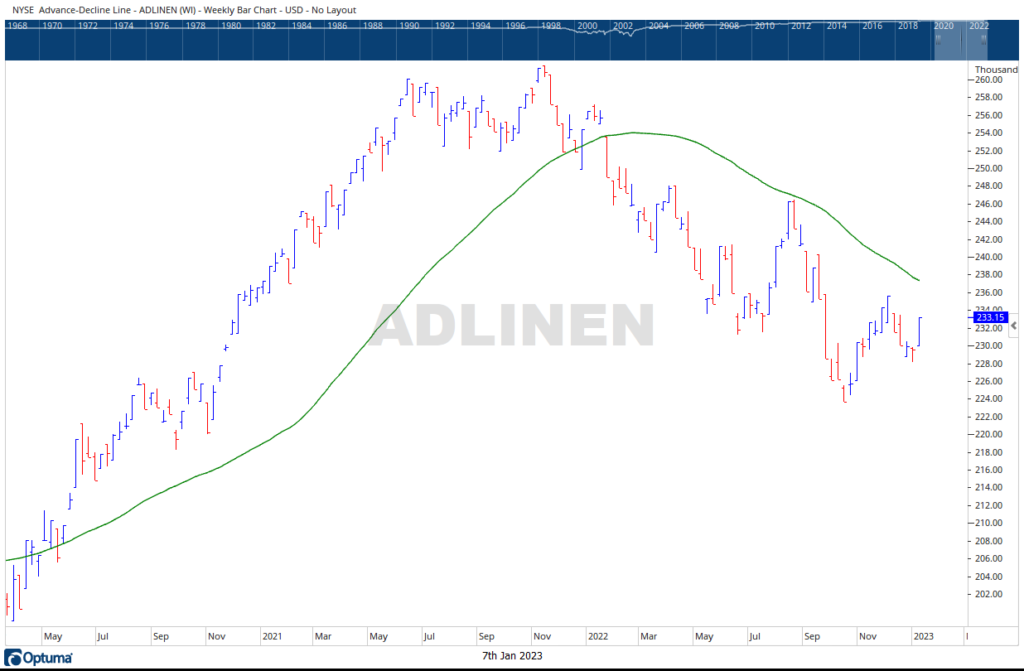

The S&P 500’s Ascending Triangle pointed out in last week’s commentary, broke out to the upside this past week creating a near-term S&P 500 target of 3950. Additionally, the numbers of stocks making New Highs closed off their recent lows for the first time in a long while. The strongest mover was the Advance-Decline line which also broke connective weekly losses, closing significantly higher for the week.

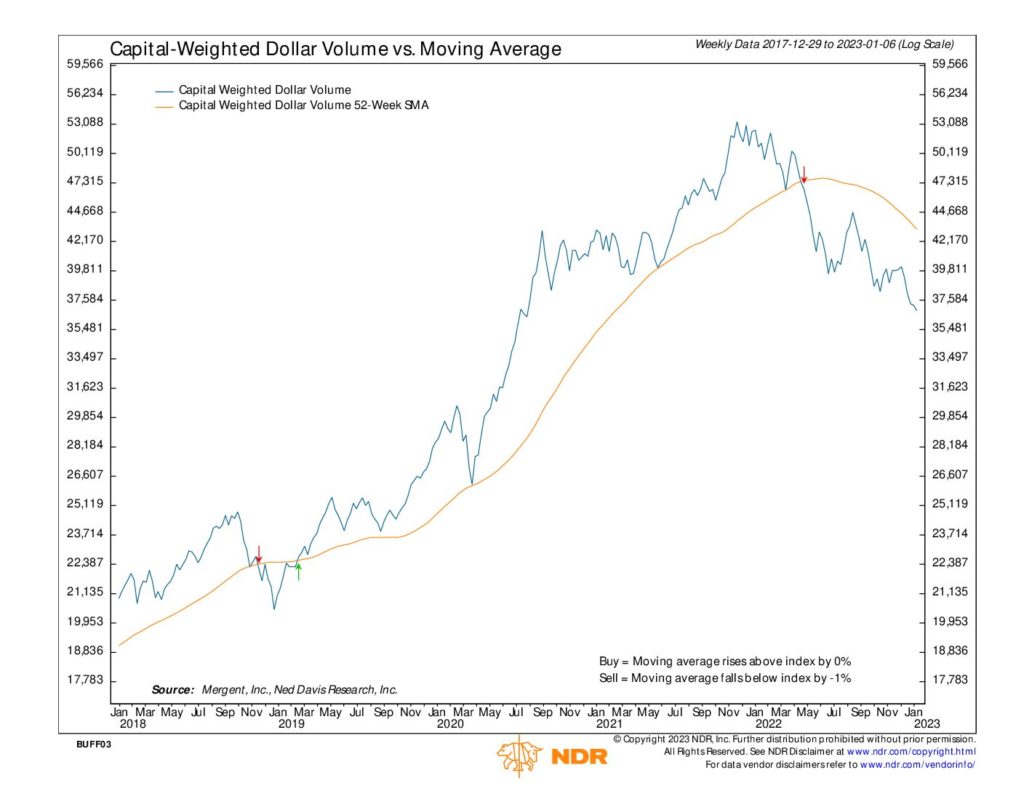

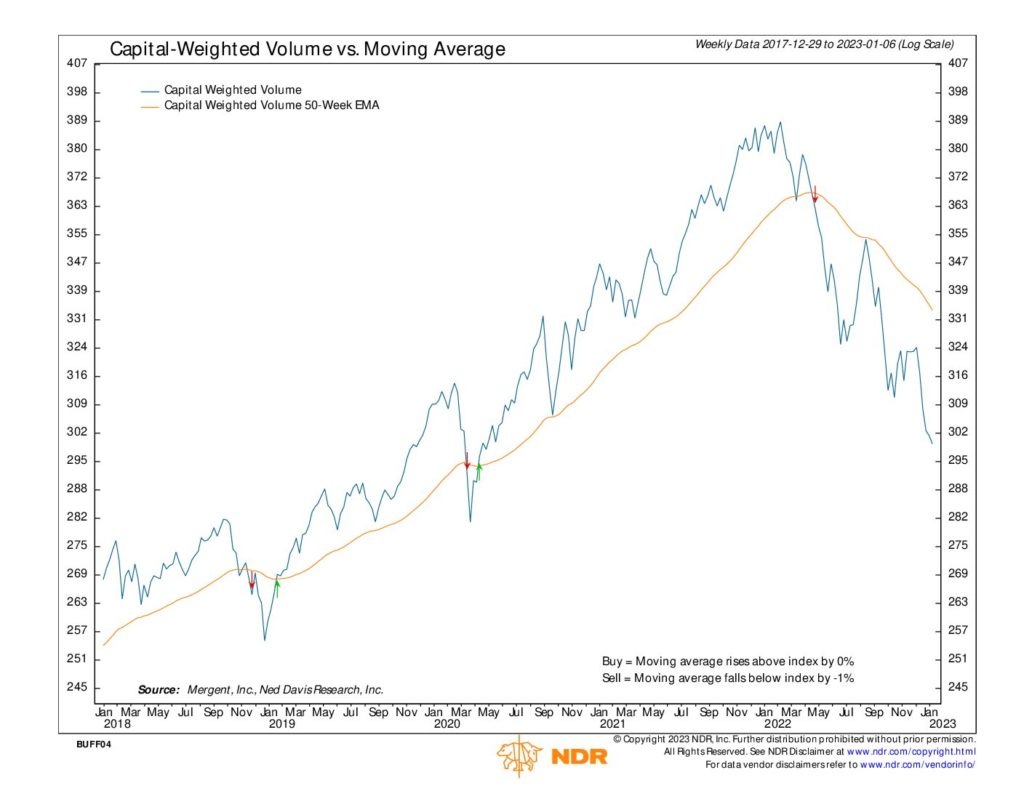

Although the S&P 500 price index closed at 2023 highs, volume, the fuel of the market, continues to lag. Capital inflows just barely outpaced outflows, $38 Billion to $34 Billion. And despite Friday’s rally, Capital Weighted Volume closed the week again at 52-week plus lows. The Santa Clause Rally effect should start to dissipate next week but the bullish Presidential Cycle influence remains prominent. Intermediate term, the S&P 500 remains below the apex of the broken bare flag @ 4000, which also represents major resistance.