Volume Analysis | Flash Update – 1.5.26

Volume Analysis Flash Update

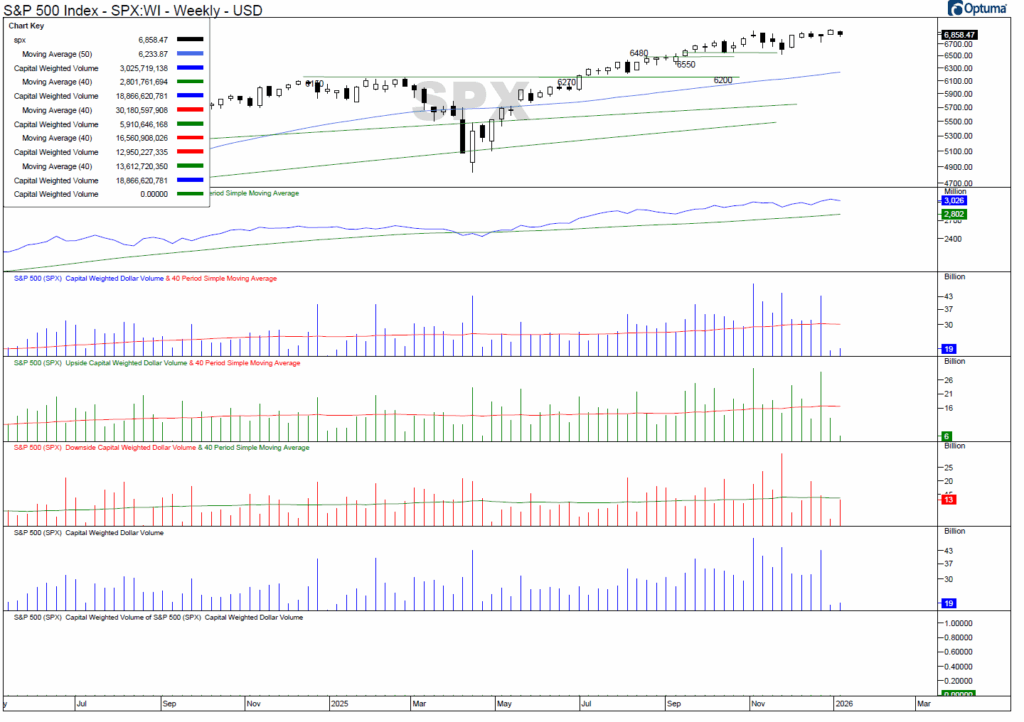

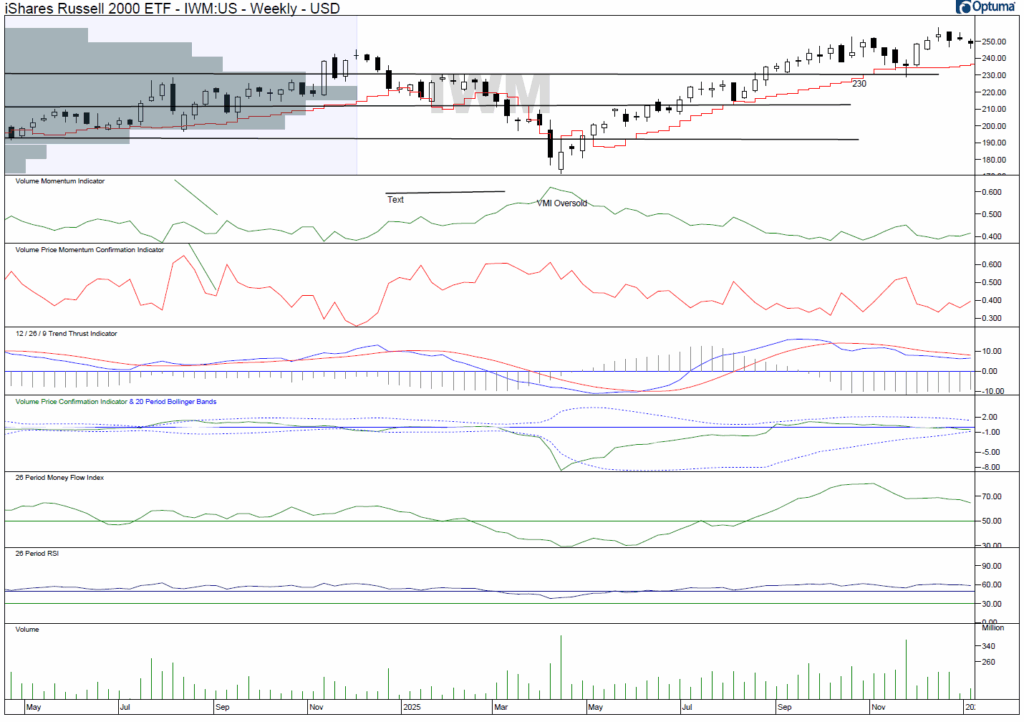

As the market closed the final chapter of 2025 and opened the first page of 2026, conditions softened with a broadening tone that favored relative defense over leadership. The S&P 500, represented by the SPDR S&P 500 ETF Trust, declined roughly 1% on the week. Leadership retreated more sharply, with the Invesco QQQ Trust, our generals, pulling back 1.7%. The troops, represented by the iShares Russell 2000 ETF, followed closely behind, falling 1.57%.

In contrast, the broader formation showed relative resilience. The Invesco S&P 500 Equal Weight ETF declined a more modest 0.48%, while the dividend-oriented brass commanders, represented by the Schwab US Dividend Equity ETF, managed a small gain of approximately 0.3%. This dispersion suggests that investors favored balance and income as the calendar turned, rather than concentrated leadership exposure.

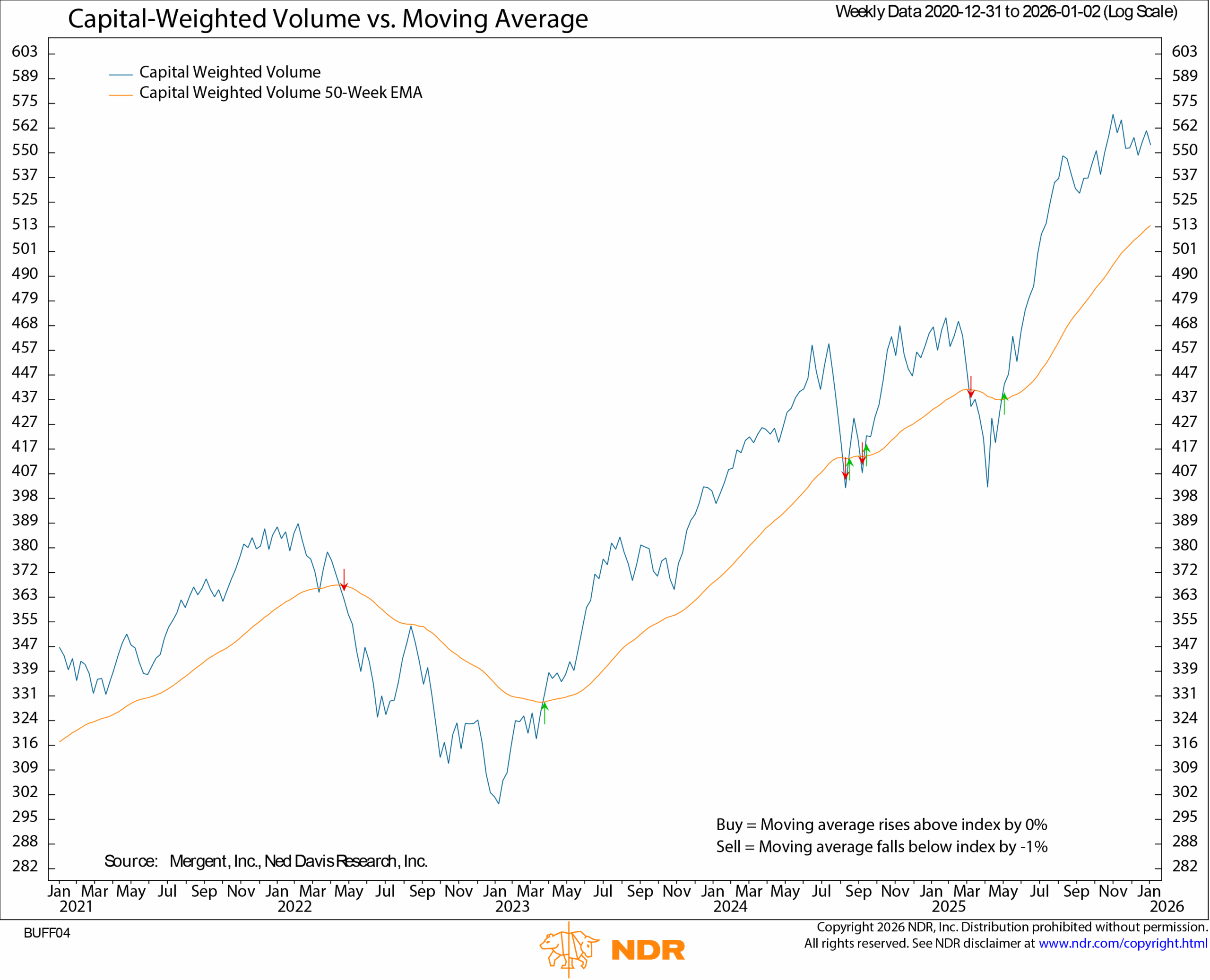

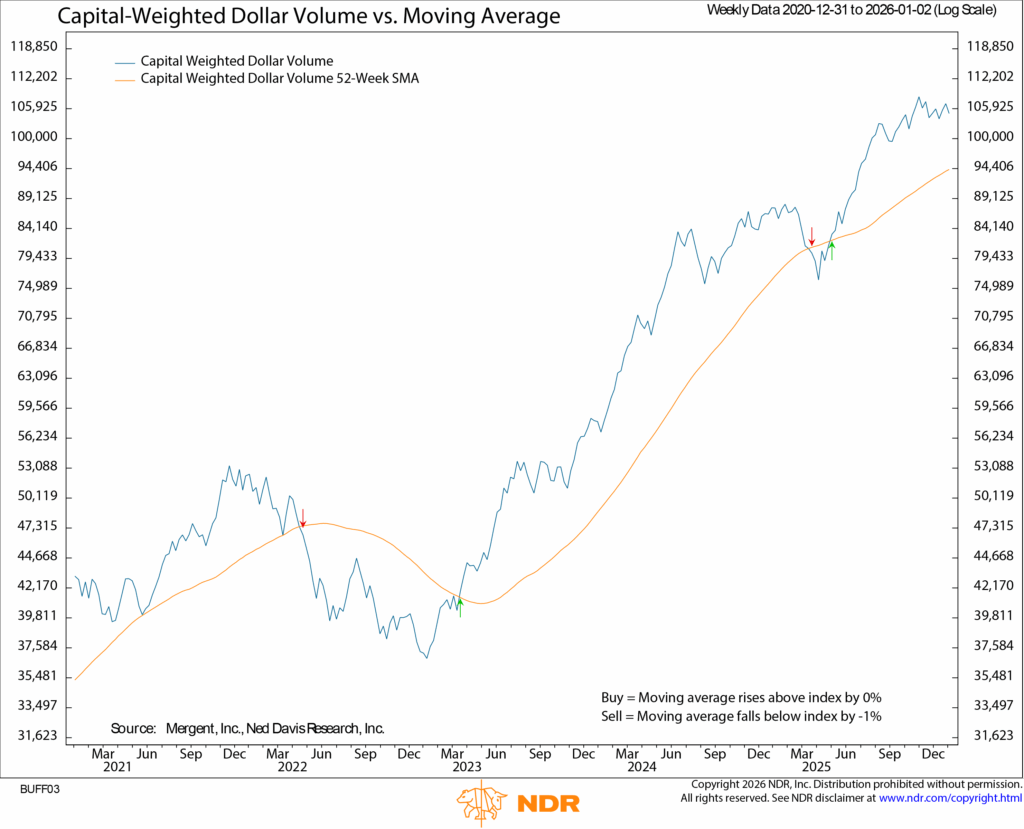

Volume conditions were notably subdued, even by short-week standards. Upside volume and capital inflows were particularly light, while Capital Weighted downside volume registered near average levels. The weakness occurred primarily within the year’s strongest performing units, consistent with late-year profit taking rather than broad-based liquidation. Overall, roughly 68% of total volume was weighted to the downside.

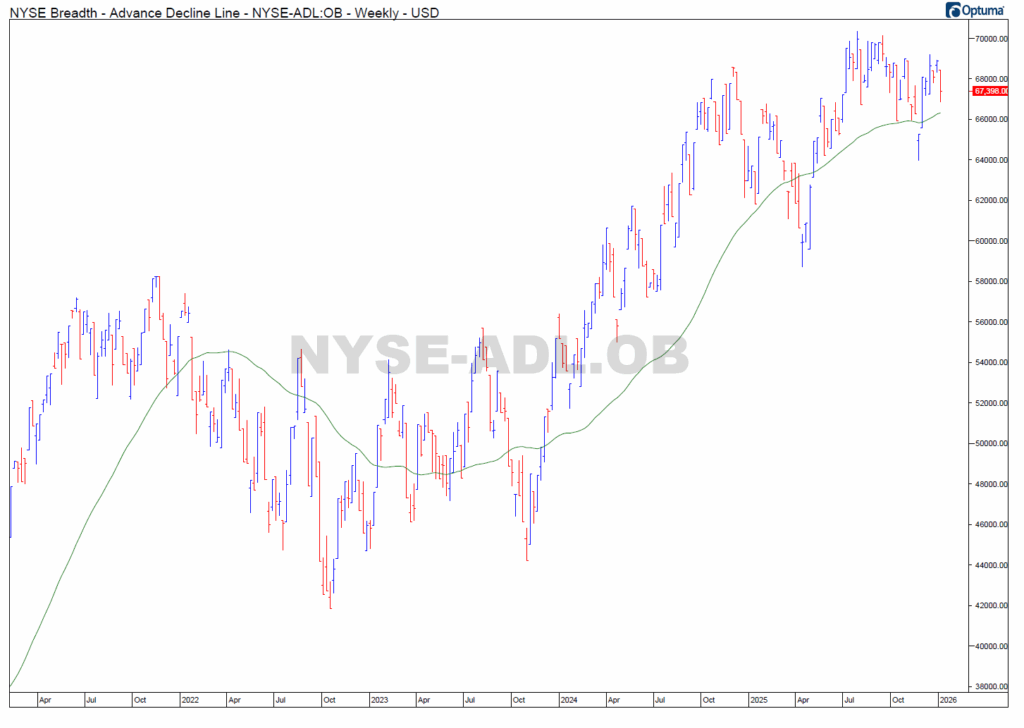

Market participation weakened meaningfully. After testing resistance the prior week, the accumulated NYSE Advance–Decline Line broke below the December 12th wide range bar, though it continues to hold an upward intermediate trend. Leadership reflected similar behavior. The Invesco QQQ Trust failed to sustain progress after probing resistance near the upper end of its spinning-top range, closing the week just above 212 support after briefly violating that level earlier in the week. The iShares Russell 2000 ETF mirrored this action, retreating to test support near 245 and finishing the week slightly below the midpoint of its recent range around 250.

Taken together, the final two weeks of the year appear less like an orchestrated retreat but more like selective units being called back for year-end holiday leave. Participation has thinned, leadership has paused, and capital has grown cautious. The true marching orders for 2026 are likely still forming behind the scenes and may not reveal themselves until liquidity and conviction return in the weeks ahead.

Periods of transition often blur the line between signal and noise. While price weakness has emerged, the absence of aggressive volume and the resilience of defensive and equal-weight exposure suggest recalibration rather than new marching orders. Investors should remain disciplined, emphasizing risk controls, respecting key support levels, and avoiding overinterpretation of thin-volume moves. Conviction in capital flows will be the ultimate litmus test separating genuine trend shifts from deceptive smokescreens. Until that conviction returns, preparation and patience remain the most reliable strategy. And then there were none left without a risk management plan.

Grace and peace,

BUFF DORMEIER, CMT

Updated: 1/5/2026. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.