Volume Analysis | Flash Update – 1.26.26

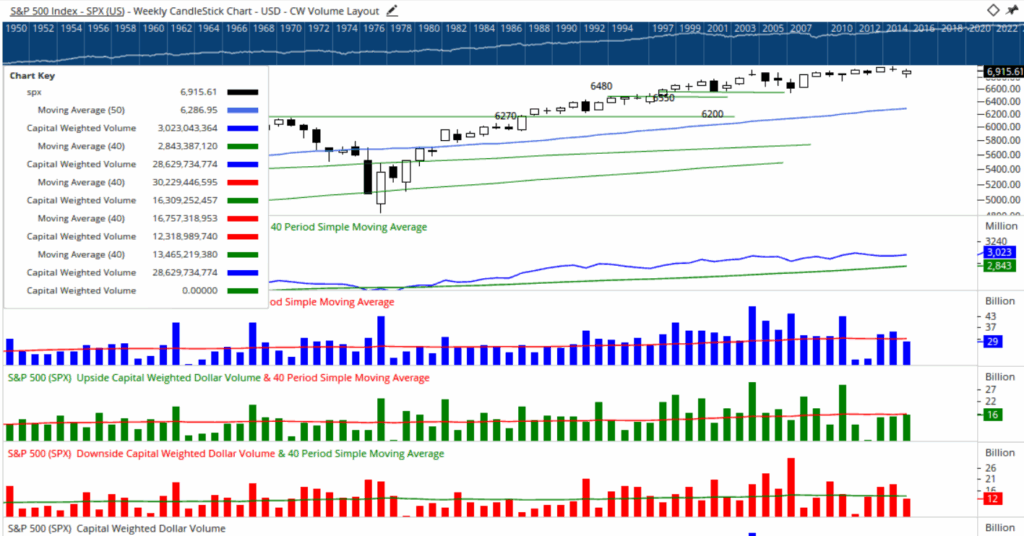

The shortened four-day week opened with a sharp test of conviction. Tuesday began with a decisive 95% downside Capital Weighted Volume day, marked by heavy downside activity on average total volume. That early pressure was met swiftly. Wednesday the 21st delivered an 80% capital inflow day alongside 85% upside capital weighted volume day, though participation remained below average. The sequence captured the tone of the week, abrupt moves in both directions, but without sustained force.

Across the week, capital flows came in slightly below average, while downside volume also finished modestly below average. Capital Weighted Volume remained consistently light across all categories. Despite the S&P 500 Index slipping -0.4% on the week, internal participation leaned constructive. Weekly S&P 500 Capital Weighted upside volume accounted for 58% of total activity, while capital inflows represented 57% of flows.

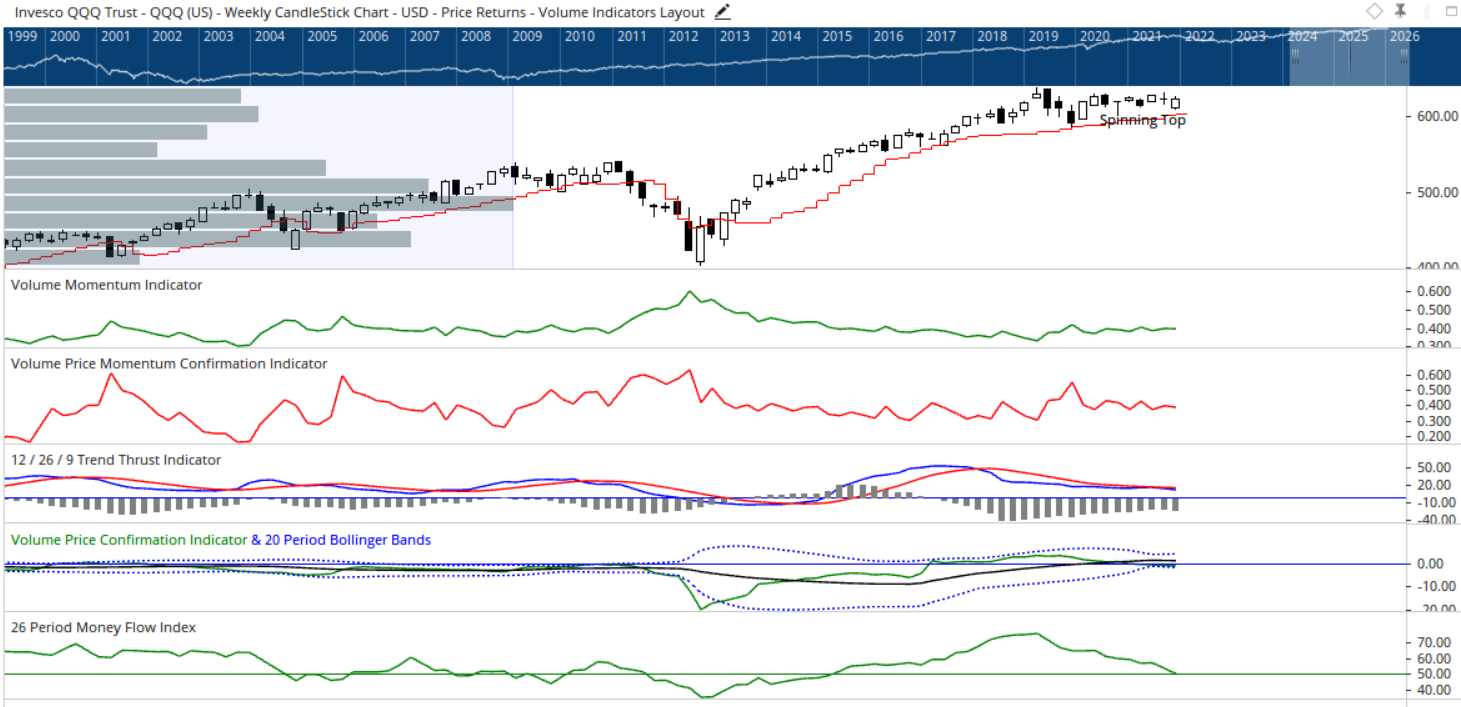

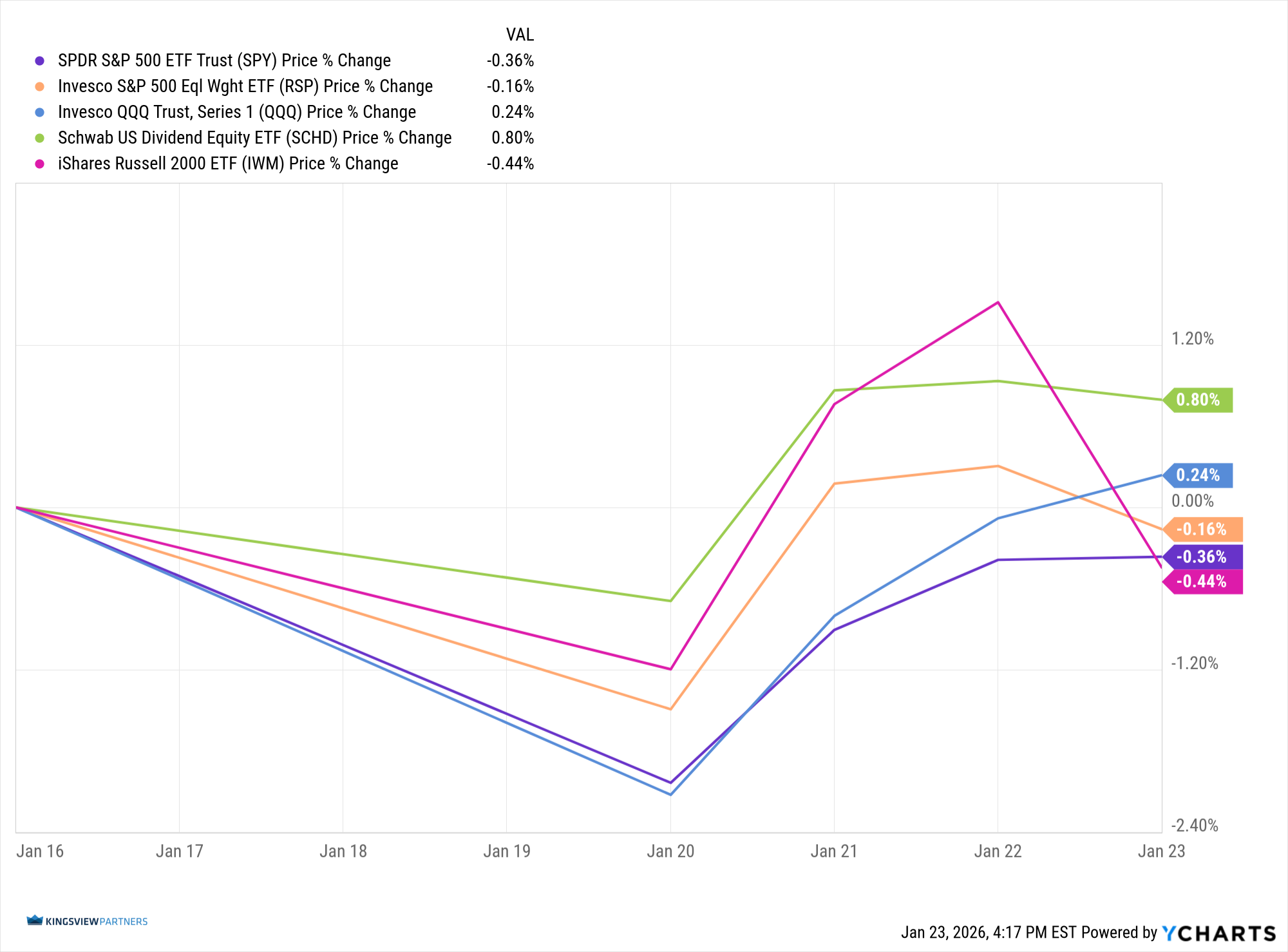

As earnings season approaches, leadership rotated once again. The brass commanders, represented by the Schwab US Dividend Equity ETF, assumed control, advancing 0.80% on the week. Their equal-weight counterparts, represented by the Invesco S&P 500 Equal Weight ETF, finished slightly lower, down -0.16%. Last week we noted that the troops, represented by the iShares Russell 2000 ETF, may require a pause after closing on a daily doji print. This week delivered that reprieve, with the troops easing -0.44%. The generals, represented by the Invesco QQQ Trust, finally gained a little ground after being confined within a spinning-top formation since mid-December, advancing 0.24% and narrowing the gap with the surging troops.

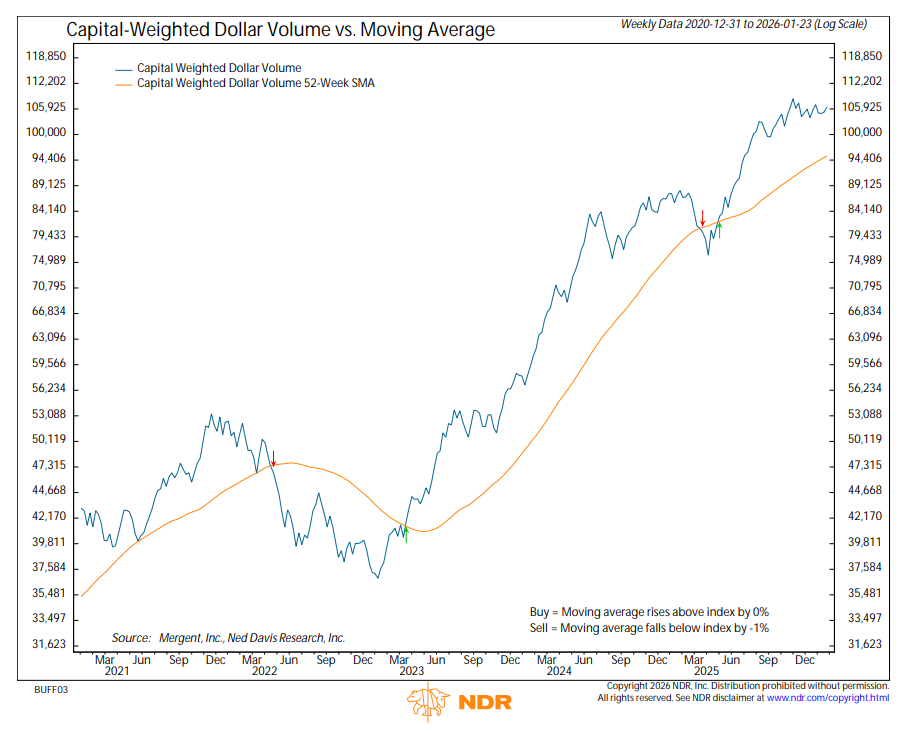

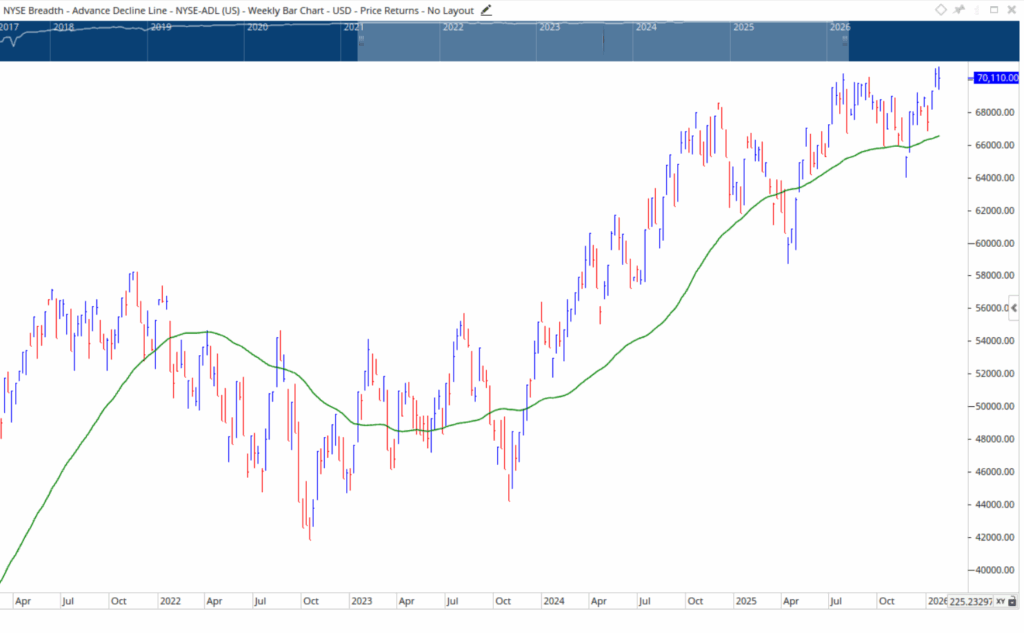

The accumulated trends of Capital Weighted Volume and Capital Weighted Dollar Volume curled modestly higher during the week but remain locked inside a consolidation zone. These supply lines are coiling rather than expanding, and the direction of their eventual break may provide an early signal on the next major phase of the campaign. Market participation reflected similar ambiguity. The NYSE Advance–Decline Line finished slightly lower for the week, printing an outside bar with both a higher high and a lower low, a classic sign of uncertainty rather than resolution.

Among the fighting units, the generals remain confined within the mid-December spinning-top range. After gapping lower at the start of the week, they recovered to finish near the weekly high. Resistance remains firm near 630, while support sits closer to 585. Until 630 is decisively cleared, the generals appear to be operating under limited orders. The troops briefly pressed to new weekly all-time highs early in the period, even after last Friday’s doji pause, but those gains proved fleeting. They ultimately retreated to close lower on the week while successfully defending last week’s low near 258, which now stands as an important intermediate support level.

Summary and Risk Management Perspective

Overall, this past week reinforced the theme of rotation without resolution. Leadership continues to shift, participation remains active, and capital flows show neither panic nor full commitment. These conditions align closely with the narrative of recalibration rather than retreat, as capital searches for balance and diversification ahead of renewed conviction.

For investors, discipline remains paramount. Consolidation in volume and flows often precedes expansion, but direction matters. Respecting support levels, maintaining diversification across leadership tiers, and avoiding overextension ahead of confirmation remain prudent. In campaigns defined by pauses and repositioning, patience and preparedness often determine success. And then there were none left exposed without a plan.

Grace and peace,

BUFF DORMEIER, CMT

Updated: 1/26/2026. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.