Volume Analysis | Flash Update – 1.20.26

Volume Analysis Flash Update – Ranks Widen

The S&P 500 finished slightly lower on the week as headline price paused, while the broader market continued to display underlying strength. On balance, activity reflected a market in transition rather than retreat, with leadership rotating and participation widening beneath the surface.

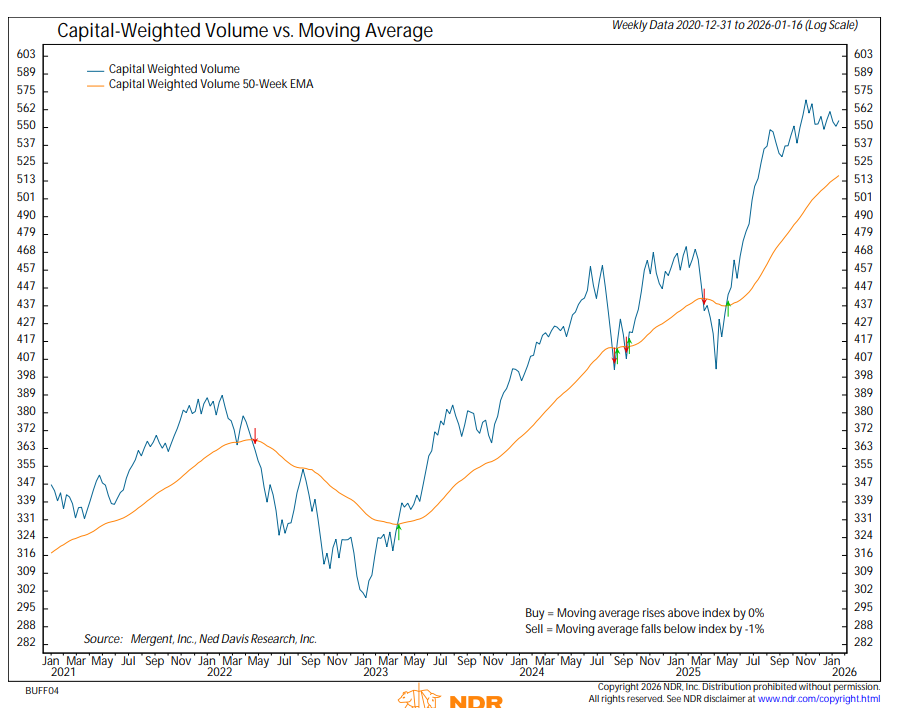

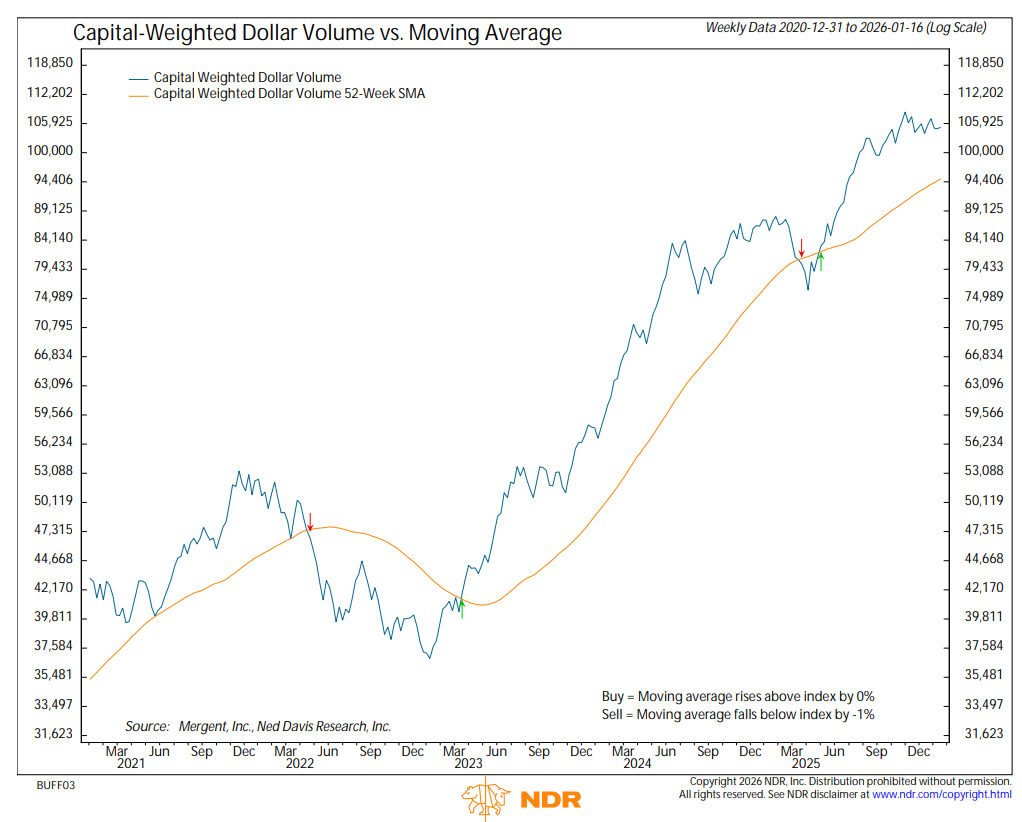

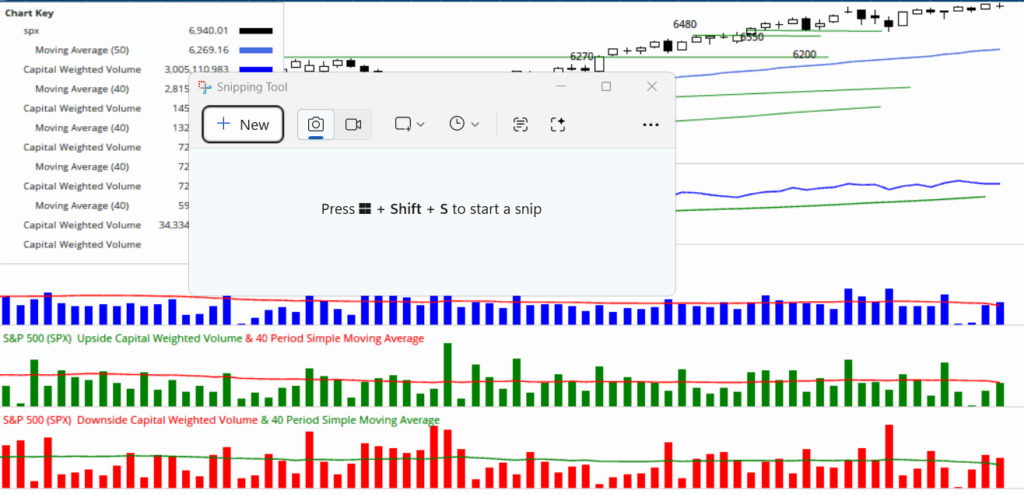

For the week, S&P 500 Capital Weighted upside and downside volume finished essentially even on average volume, signaling near parity between buying and selling pressure. Capital Weighted dollar flows, however, leaned defensive, with 62% of flows to the downside. Much of this imbalance occurred on Wednesday the 14th, when downside volume reached 89% of total activity on a modest volume day. Importantly, downside volume was only slightly above average, suggesting the move was driven more by an absence of demand than by aggressive supply.

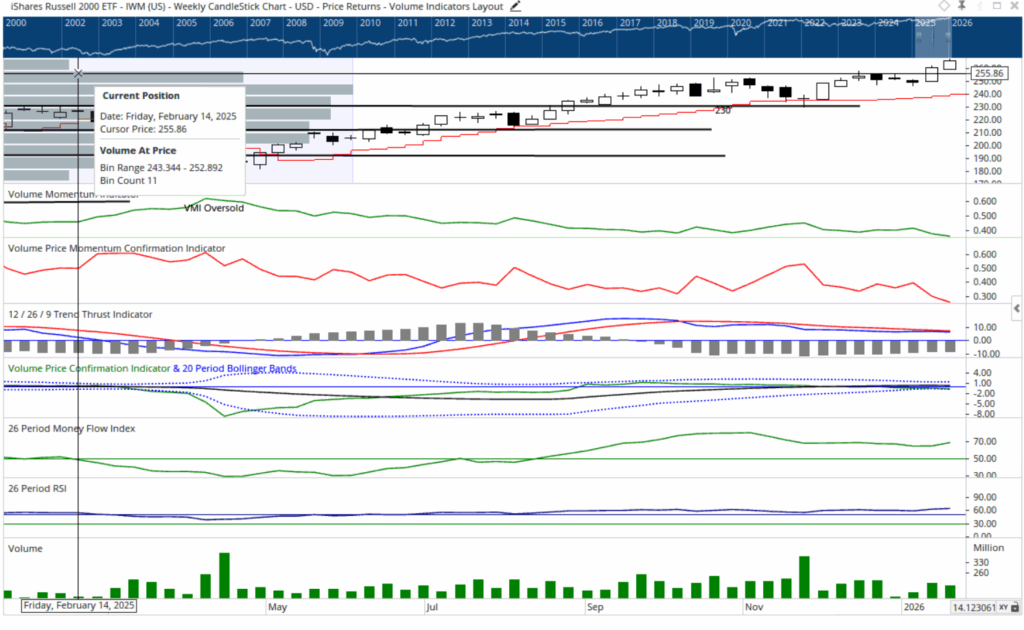

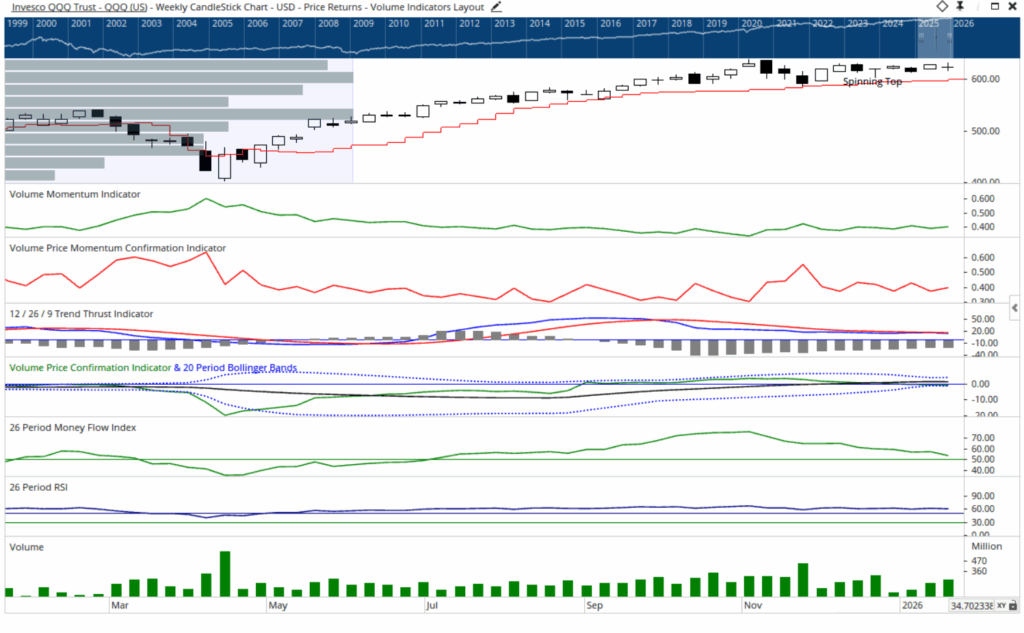

Leadership reflected this shift. The generals, represented by the Invesco QQQ Trust, led the decline within the narrow leadership cohort, finishing down -0.89% on the week. Their lieutenants, represented by the SPDR S&P 500 ETF Trust, followed lower by -0.38%. In contrast, their equal weight brethren, represented by the Invesco S&P 500 Equal Weight ETF, finished higher by 0.64%. The brass commanders, represented by the Schwab US Dividend Equity ETF, extended their advance with a 1.26% gain. Meanwhile, the troops, represented by the iShares Russell 2000 ETF, continued to lead all brigades, advancing another 2.16% on the week. Collectively, this rotation exemplifies the broadening theme we have highlighted both in recent Flash Updates and in the VFGU Q1 quarterly commentary.

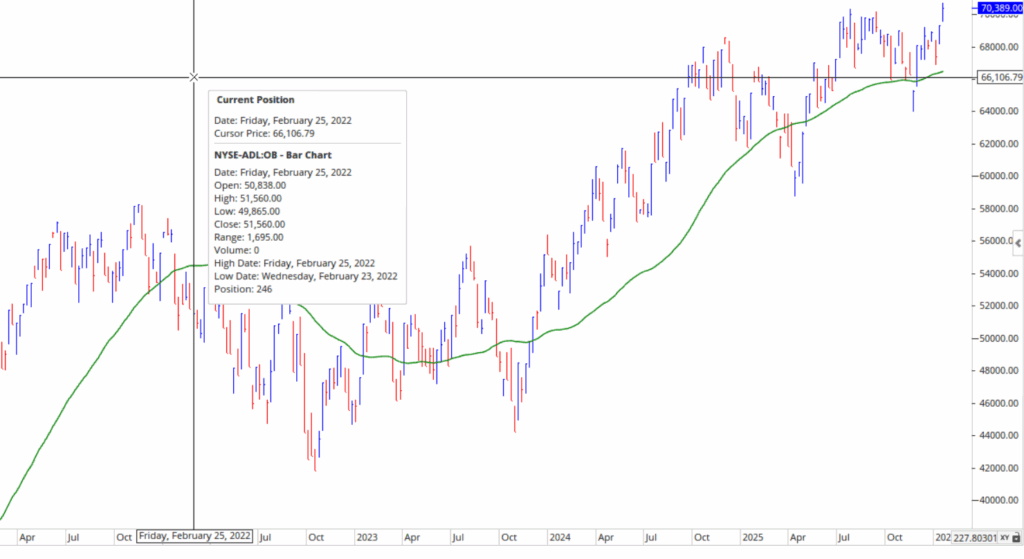

Market participation confirmed this internal expansion. The accumulated NYSE Advance–Decline Line broke through resistance to register new all-time highs, following last week’s all-time highs in the Advance–Decline Line of NYSE operating companies only. These developments reinforce the view that participation is expanding even as headline indices consolidate.

Among the fighting units, the generals remained locked inside the upper portion of their prior consolidation. After testing both the upper and lower bounds of last week’s range, they finished slightly below their starting point, forming a doji candlestick that reflects indecision rather than breakdown. The troops showed no such hesitation. Building on last week’s new all-time highs, they advanced again to fresh daily and weekly records. That said, the daily candlestick also formed a doji, hinting that even the leading battalion may be due for a brief furlough after an extended march.

Summary and Risk Management Perspective

This week’s action underscores a market that is rotating rather than rolling over. Leadership is dispersing, participation is expanding, and capital is reallocating across the formation, consistent with the VFGU Q1 theme of broadening exposure without excess. At the same time, capital flows into the S&P 500 remain cautious, and volume confirmation has not yet followed price to the same degree.

In this environment, discipline remains essential. Investors should respect the signals of rotation, maintain diversification, and remain attentive to support levels as leadership continues to evolve. Broadening participation often strengthens a campaign, but advances unsupported by capital conviction can stall. Risk management through position sizing, balance across styles and market caps, and patience during pauses remains the most reliable defense. In markets where leadership shifts quietly, those prepared tend to endure. And then there were none left unguarded.

Grace and peace,

BUFF DORMEIER, CMT

Updated: 1/20/2026. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.