Volume Analysis | Flash Update – 1.12.26

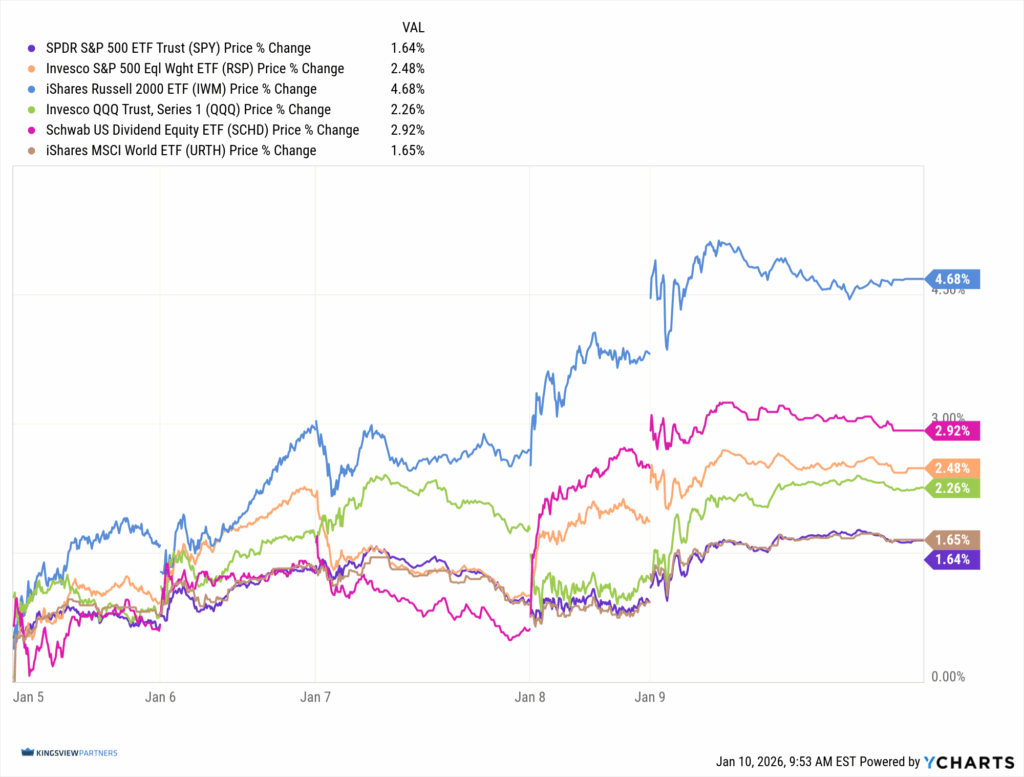

This past week marked a clear shift in leadership as the troops took control of the advance. The iShares Russell 2000 ETF led the charge, surging 4.68% and breaking decisively above prior resistance. The broader ranks followed with conviction. The Schwab US Dividend Equity ETF advanced 2.92%, while the Invesco S&P 500 Equal Weight ETF gained 2.48%. This broad participation reflects a market willing and eager to rotate internally rather than retreat.

The generals, represented by the Invesco QQQ Trust, advanced 2.26% but lagged the broader formation. The lieutenants, represented by the SPDR S&P 500 ETF Trust, rose 1.64%. The S&P 500 Index finished up on the week, breaking to new all-time highs but underperforming the broader market. This divergence between broad based price strength and headline leadership continues to define the current campaign.

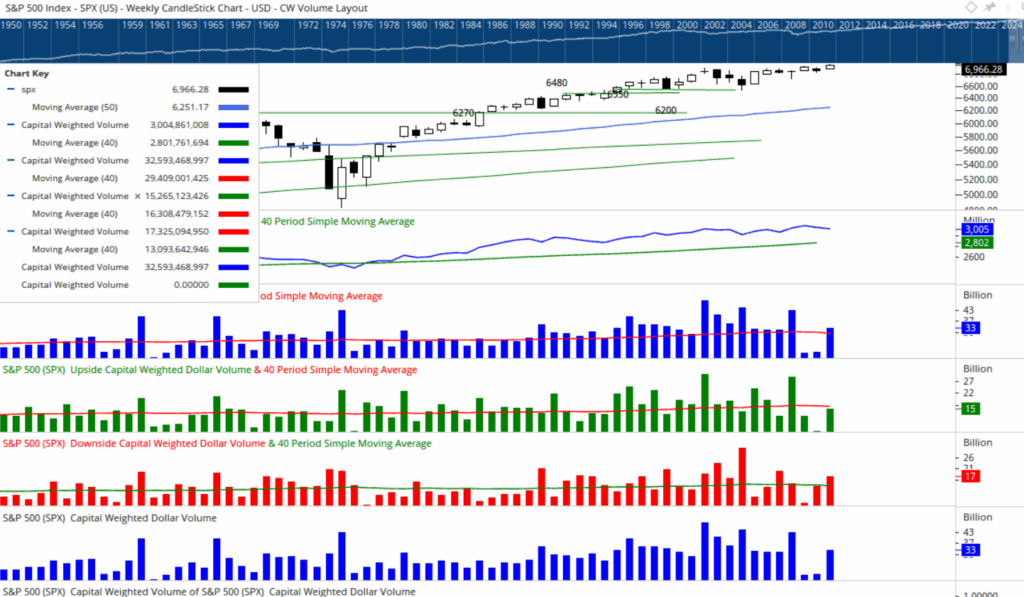

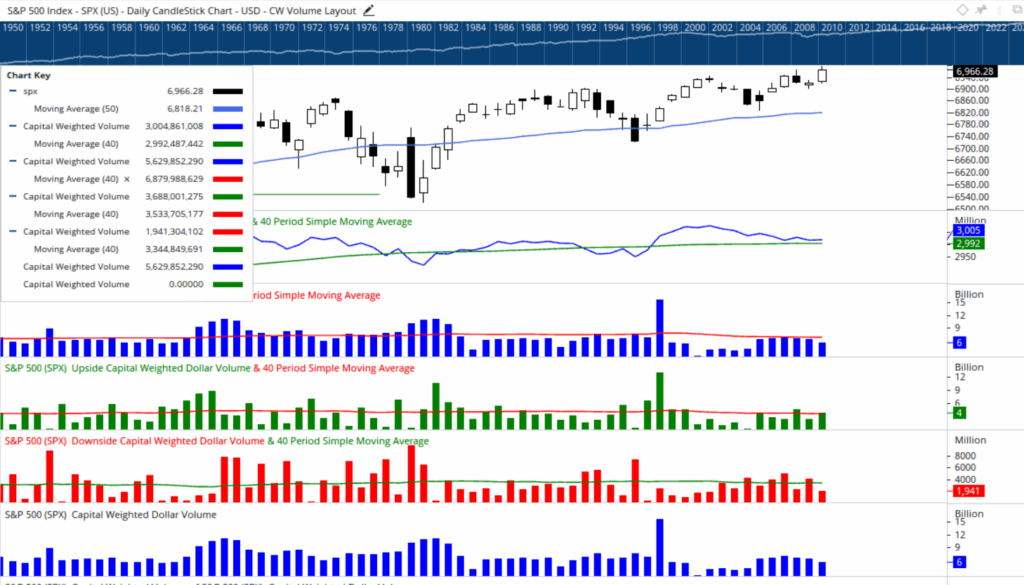

Despite higher prices, volume and capital flows revealed signs of distribution beneath the surface. On Tuesday, January 6th, the S&P 500 surged to close at a new all-time high, yet S&P 500 upside capital weighted volume was roughly half its daily average. Downside volume was well above average, with approximately three shares trading lower for every one advancing. Over the full week, S&P 500 downside volume remained above average while upside volume was well below average, resulting in 58% of capital weighted volume falling to the downside. Capital flows echoed this same message, with 53% of flows registering as outflows.

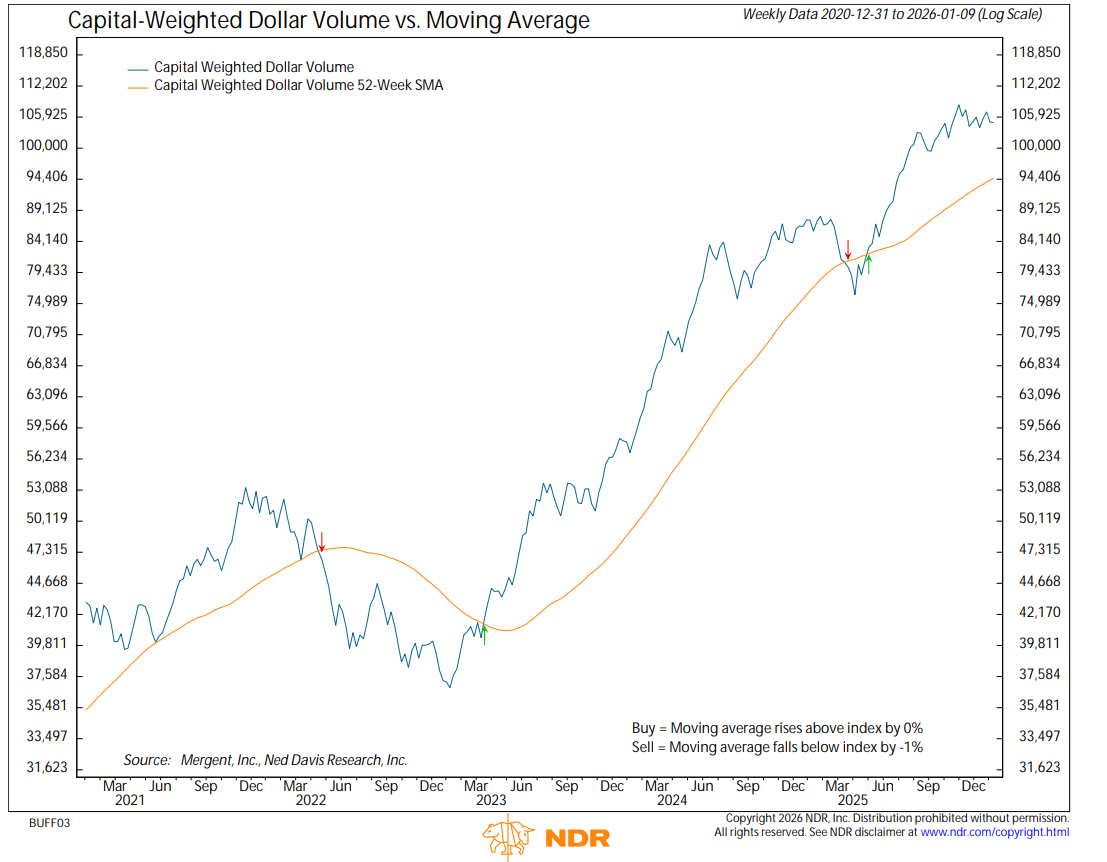

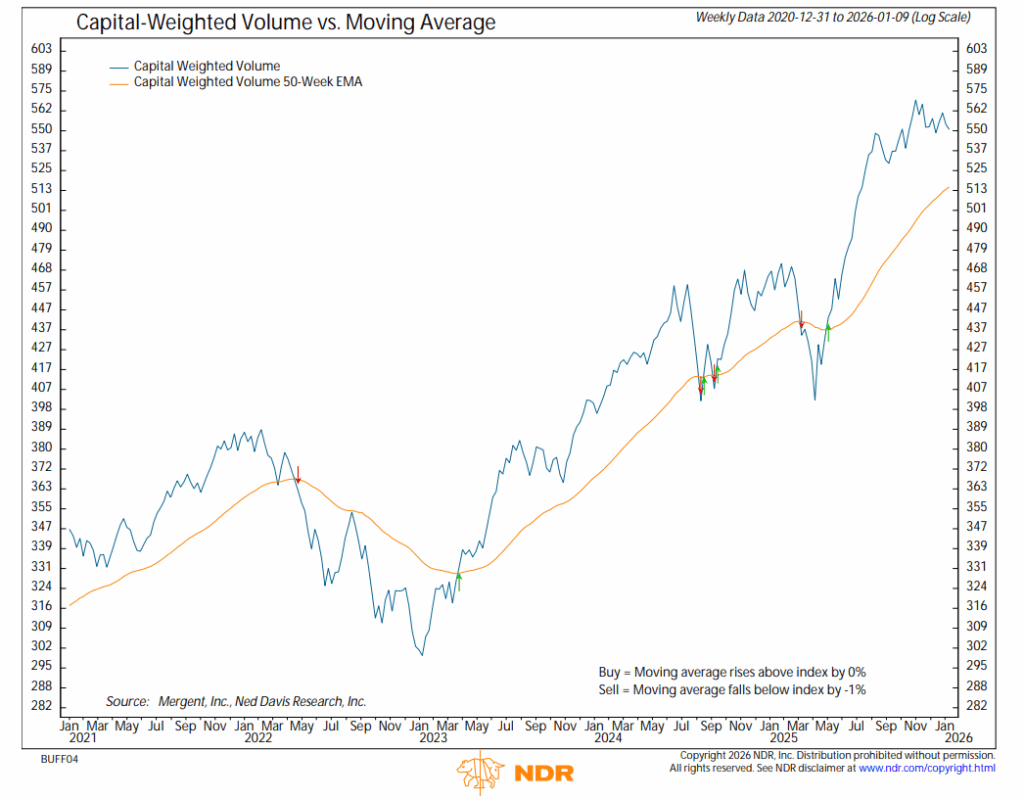

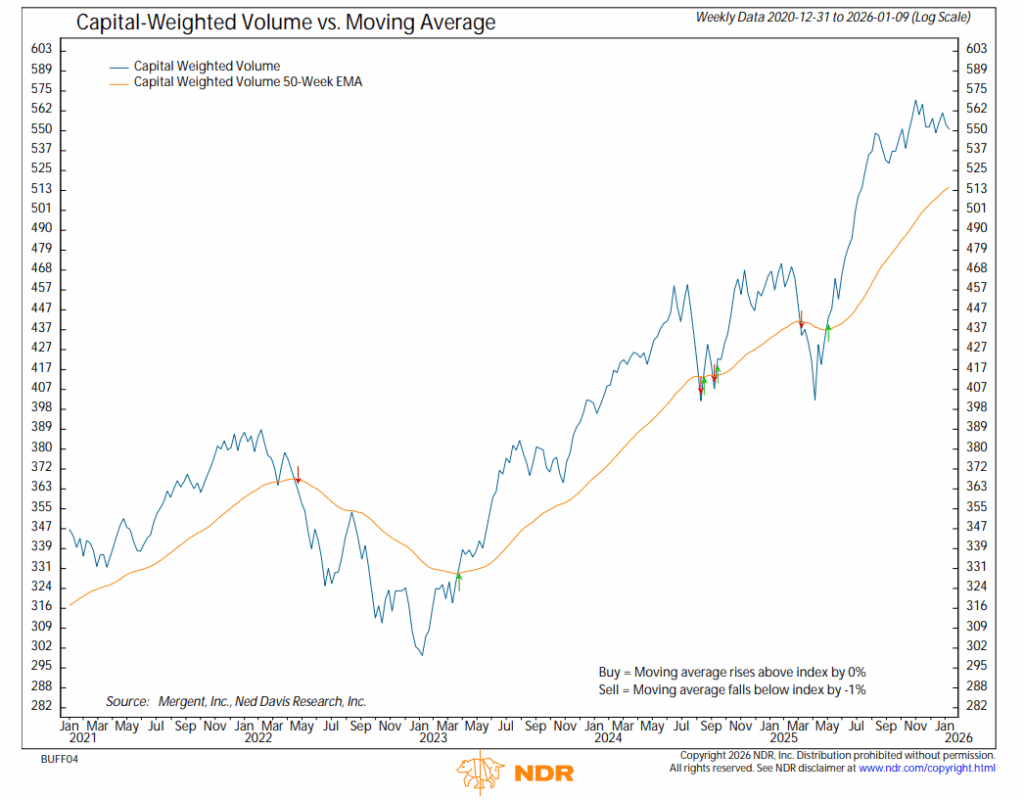

Although the S&P 500 continues to trend higher in price, the accumulated trends of Capital Weighted Volume and Capital Weighted Dollar Volume have both turned lower, forming downward hooks and drifting toward December’s support lows. While both measures remain positively above intermediate trends, a violation of the December levels could suggest growing caution beneath the advance.

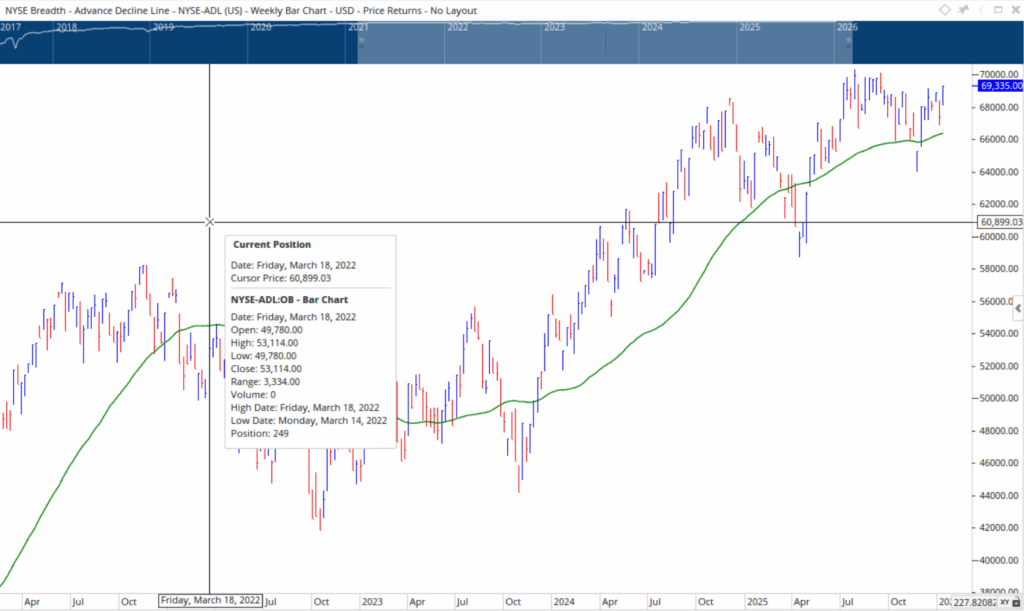

Market participation improved meaningfully. The NYSE Advance–Decline Line surged on the week, closing just above the upper boundary of the December 12th wide-range resistance. Similar to volume, the accumulated Advance–Decline Line remains in an upward trend but has yet to confirm price by reaching new highs.

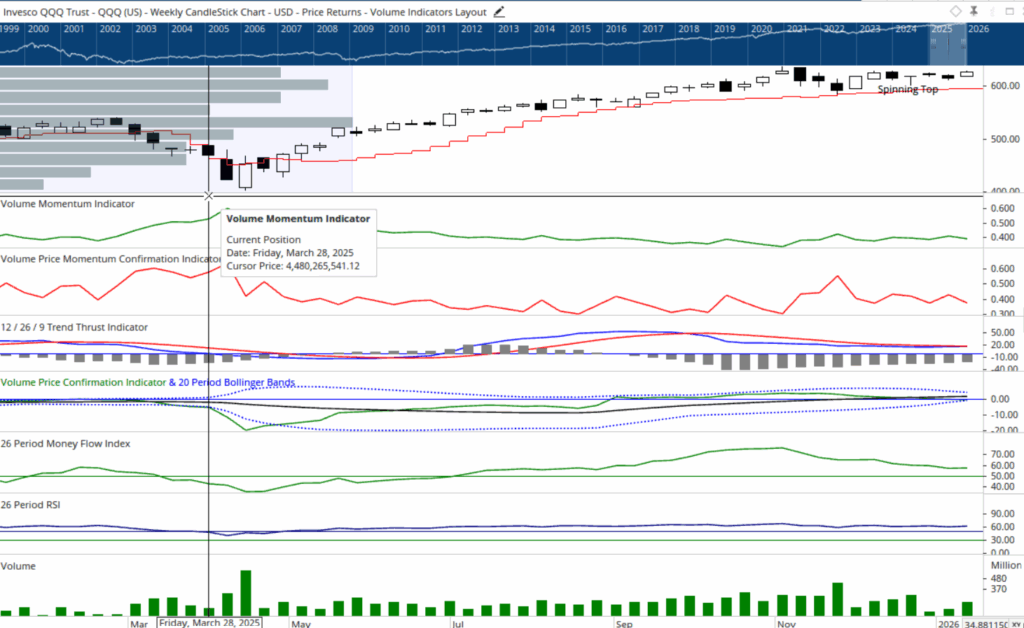

Leadership dynamics remain mixed. The Invesco QQQ Trust remains confined within the upper boundary of its spinning-top formation established on December 5th and 12th. This week it advanced above the midpoint of that range but failed to mount a successful assault on resistance near 630, closing the week near 628. In contrast, the troops have assumed leadership, breaking above December 12th resistance and recording new all-time highs. With both equal-weight and dividend-focused brass commanders strongly advancing, our broadening in prior commentaries appears firmly in play.

Summary and Risk Management Perspective

This market continues to advance, but not uniformly. Leadership is rotating, participation is expanding, and capital is reallocating rather than outright exiting. These are hallmarks of an evolving campaign, not an exhausted one. However, the divergence between price and capital conviction warrants discipline. Investors should remain aligned with the trend while respecting the message from volume and capital flows. Position sizing, diversification, and attention to key support levels remain essential. In markets where leadership broadens before volume confirms, patience often proves more valuable than aggression. And then there were none left without a plan.

Grace and peace,

BUFF DORMEIER, CMT

Updated: 1/12/2026. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.