Volume Analysis | Flash Market Update – 8.22.22

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

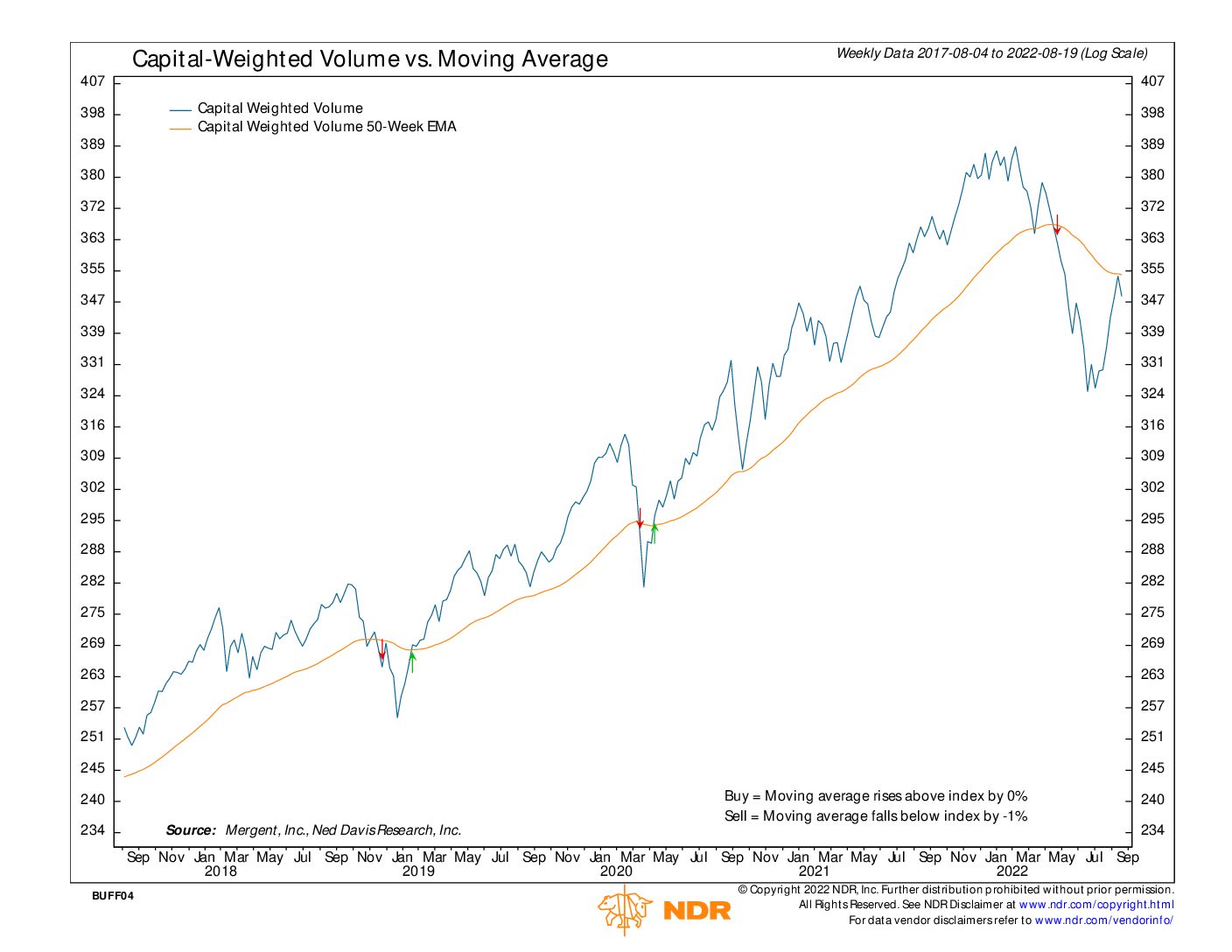

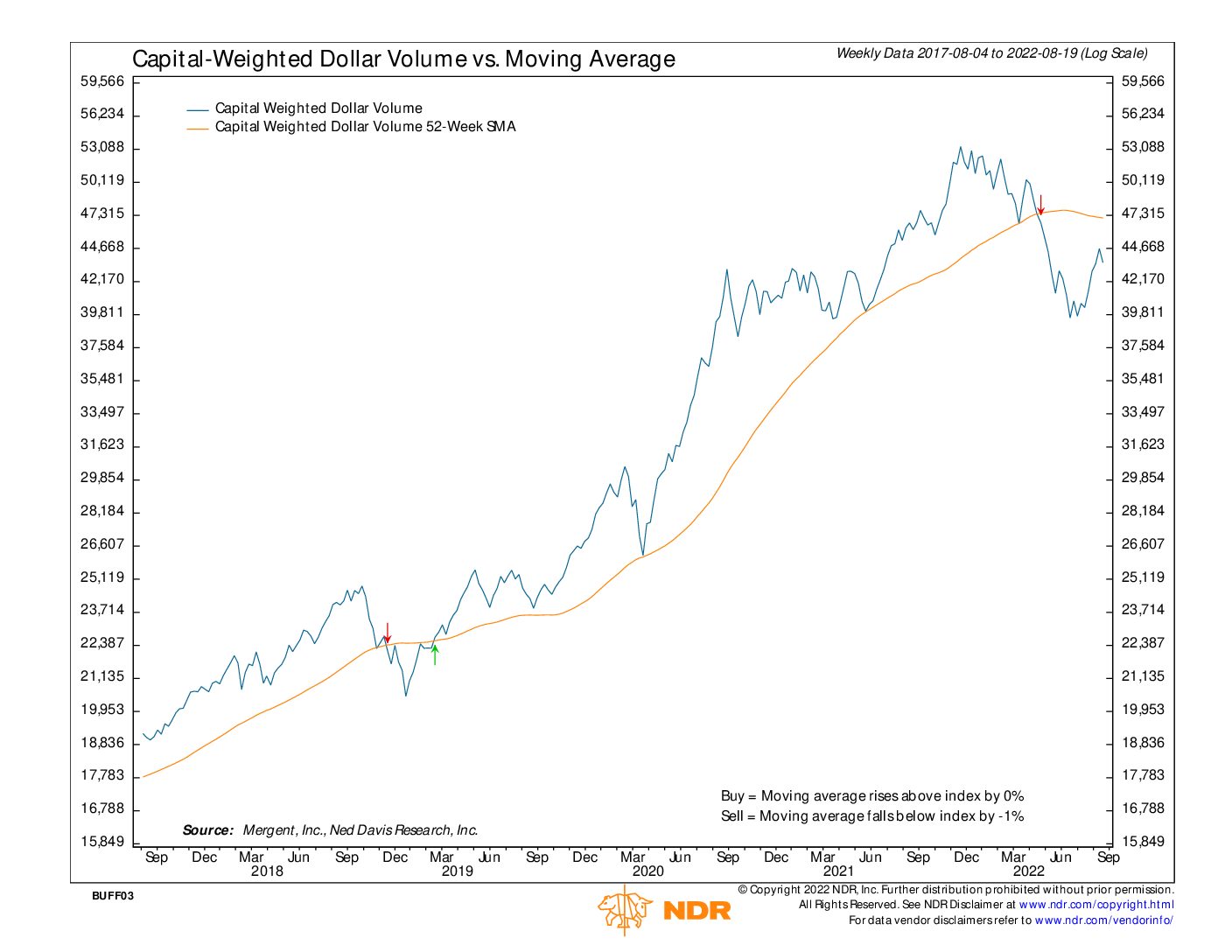

In previous commentary, we discussed this overbought market may be closing in on heavy resistance. This past week the market and our leading indicators all turned lower. Most noteworthy, Capital Weighted Volume, which was on the cusp of breaking into bullish territory, hit resistance and sold-off.

Our thesis view since the June 21st VPCI V bottom has been that this current rally is most likely not a new bull market but rather a counter trend rally within a bear market. Having now reiterated our prior outlook, let’s examine the bullish perspective as it is now building merit.

We believe the recent rally was overbought and overextended. Bear markets rarely become overbought. Additionally, the recent rally broke through several resistance points eventually threatening to break through the major resistance level formerly described as a tight “lid”. Don’t forget, market strength is in and of itself a bullish condition. Additionally, anytime the market breaks through or tests resistance, this indicates that the bulls are gaining control, overwhelming the bears. Momentum begats momentum. This strength could be a harbinger of good things to come. Most importantly, as we move closer towards 2023, we are approaching what has been historically the most bullish point of the presidential cycle.

Near term, we are entering the weakest and most volatile seasonal time of year. September has historically been the poorest performing month and October notorious for fall crashes. And the backdrop to all of this is our VPCI V bottom capitulation signal is aging while our leading indicators are all at or nearing major resistance levels. Until resistance is broken, fading the strength could be a defensive short-term strategy.

Buff Dormeier, CMT®

Updated: 8/22/2022

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.