Volume Analysis | Flash Market Update – 2.5.24

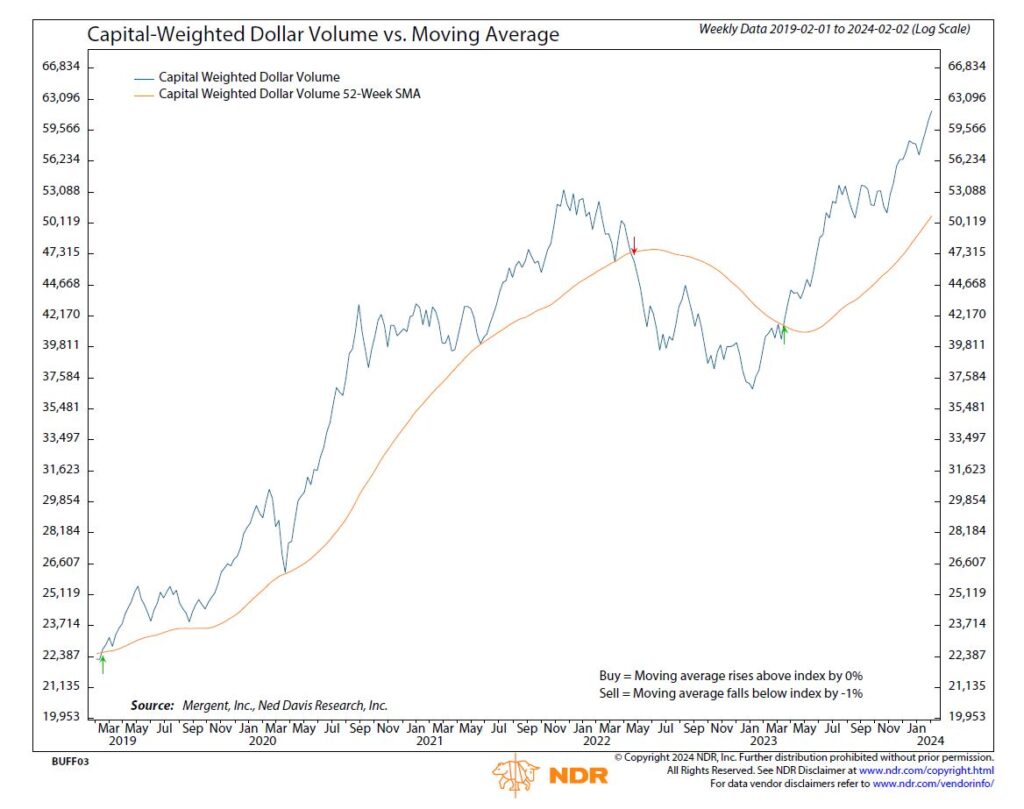

Although the S&P 500 price index reached all-time highs, capital flows were not as decisive. Capital inflows ended slightly above average at just under $52 billion. However, capital outflows also exceeded average levels, with over $48 billion exiting S&P 500 index members. Overall, S&P 500 Capital Weighted Volume and Dollar Volume both continue to set new highs, albeit at a slower pace compared to price, in contrast to the earlier phase of the rally.

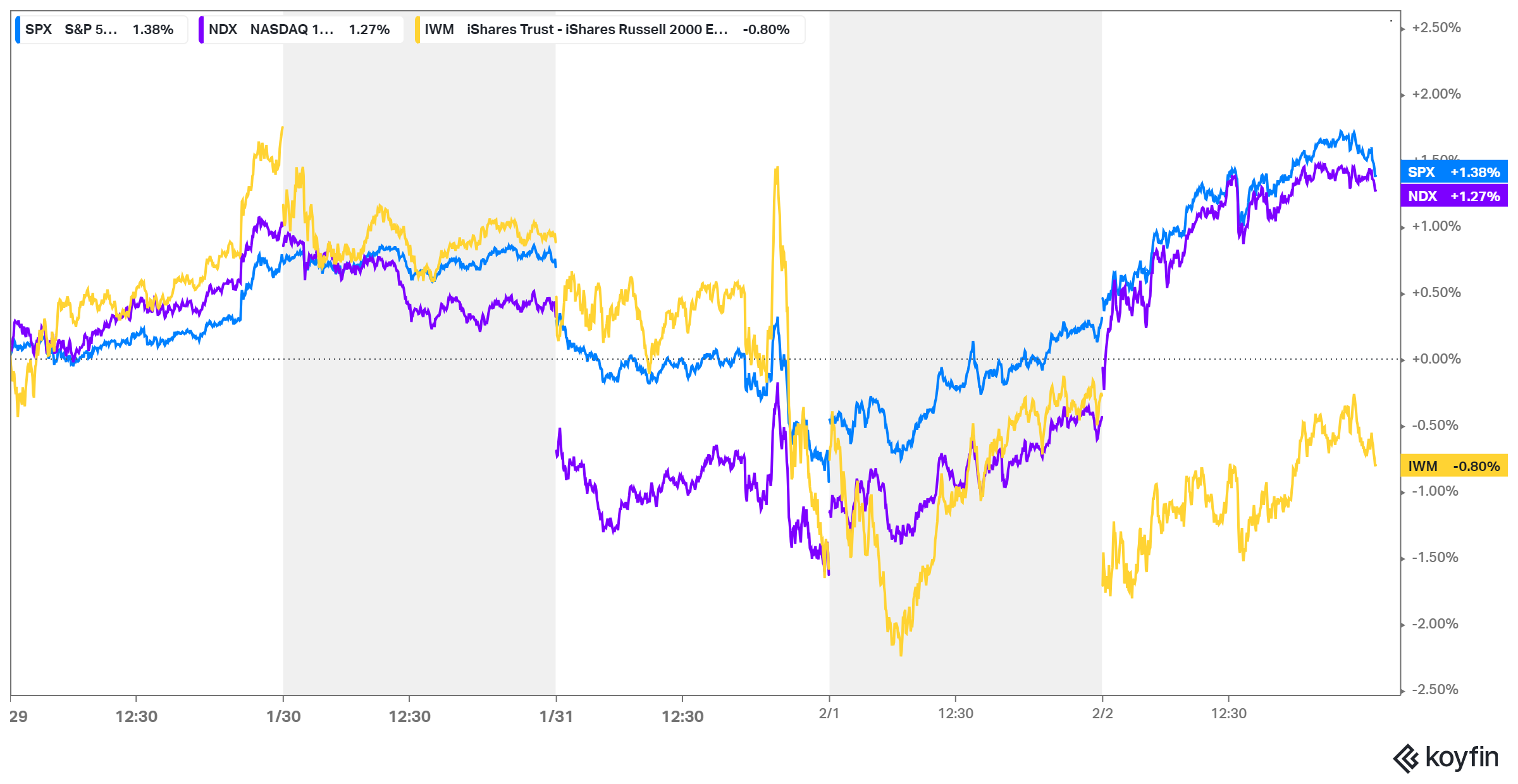

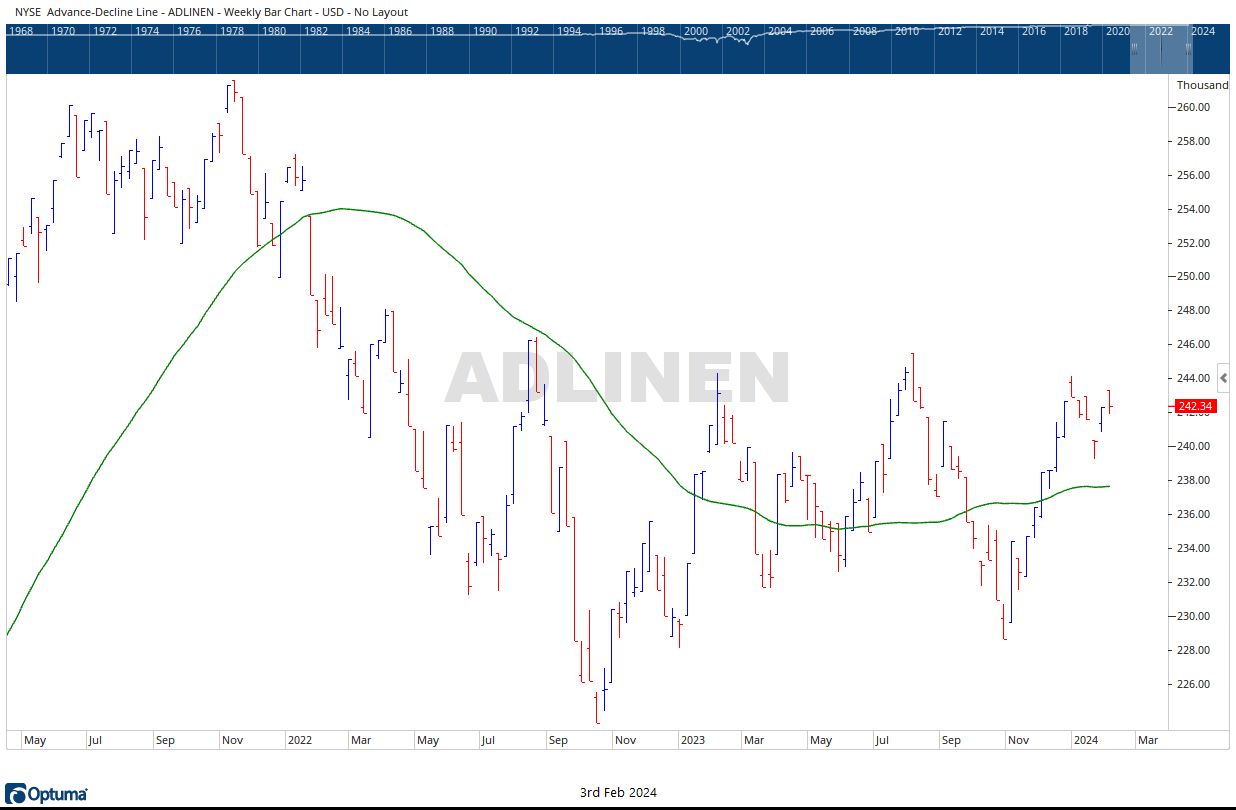

For the week, the S&P 500 led the way with a 1.38% increase, closely followed by the generals (NDX 100), up 1.27%, while the troops (iShares Russell 2000 ETF, IWM) experienced a retreat of -0.80%. Market breadth also displayed less robustness; the NYSE AD Line began the week strongly only to finish at the same level it started. Although the AD Line remains above trend, it is broadening, indicating both higher highs and lower lows. Similarly, the troops, as represented by IWM, broke last week’s highs only to conclude the week lower, establishing a new weekly range. S&P 500 support levels are situated at 4800, 4700, with major support resting at 4600.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 2/5/2024. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.