Volume Analysis | Flash Update 3.13.23

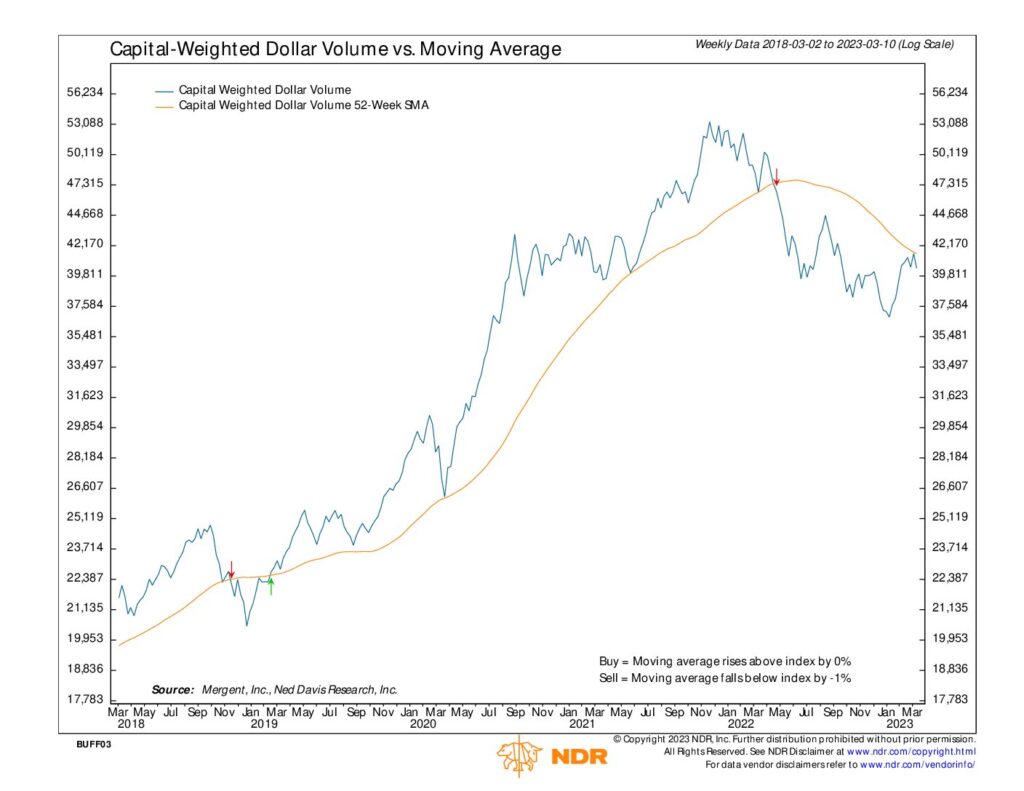

Last week, we analyzed the potential implications of nearing capital-weighted dollar volume resistance. Such events often act as pivot points, with the market either breaking out from the resistance ceiling or breaking down due to overwhelming supply. This past week provided a clear message as the market dropped when testing capital-weighted dollar volume resistance.

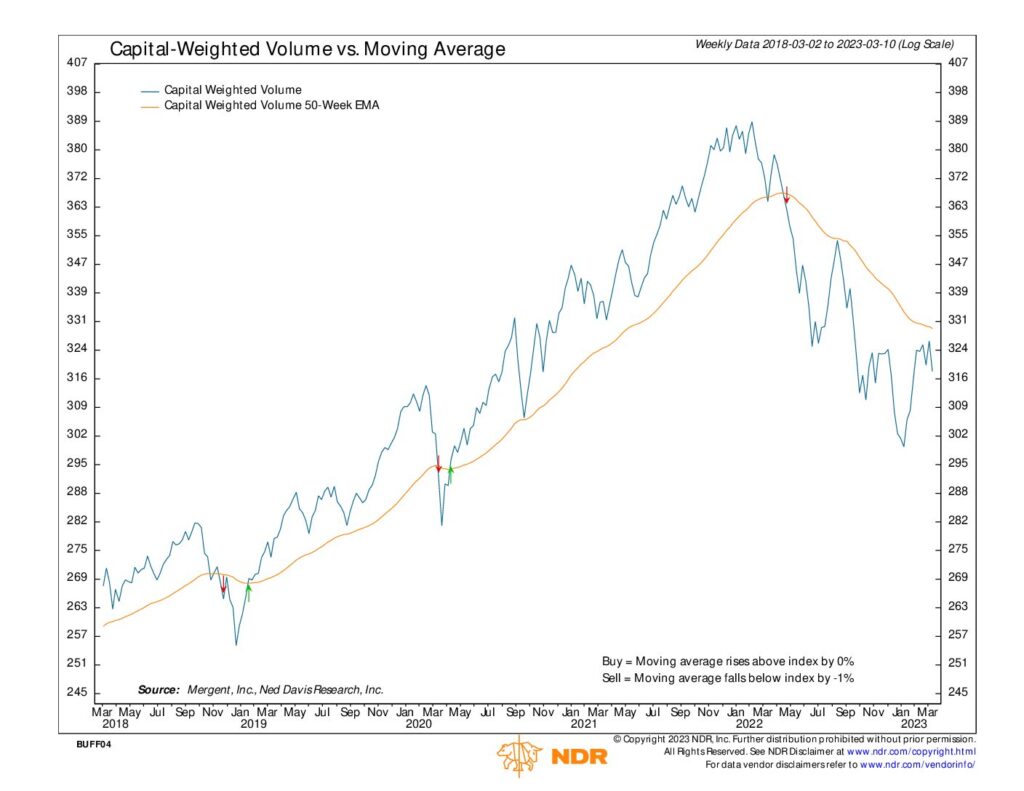

Although there was a significant price decline, the capital-weighted dollar volume was only average for the week. While this is not a positive sign, it is one of the few indications that were not outright bearish during this week’s heavy price decline. The market selloff was broad-based, with large, mid and small market caps declining by several percent for the week. Furthermore, the NYSE Advance-Decline Line experienced a major drop, breaking below the trend, suggesting that the market may be losing liquidity. This indication was seemingly validated by the significant retreat in the S&P 500 capital-weighted volume last week, indicating a high number of issues declining on strong volume. For the week, there were $60 billion of capital outflows from the S&P 500 compared to only $25 billion in capital inflows.

While the capital-weighted dollar volume on the S&P 500 was only average, the same cannot be said for the SPY ETF. The SPY experienced strong outflows, which is evident from the surging downside volume causing the SPY VPCI to fall more than two standard deviations below its Bollinger Band. This strong downward movement could indicate a blowoff by fickle retail investors. If the VPCI continues to drop lower, it could possibly drop deep enough to setup our VPCI V-bottom conditions once again. Currently, major resistance resides at the apex of the former bearish wedge, which is at the 4000 level. S&P 500 support may be found at 3800, 3750, and major support at 3650.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 3/13/2023

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.