Volume Analysis | Flash Market Update – 8.15.22

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

We are closing in on ground zero in meeting critical resistance of the broad market. Closing last week @ 4280, S&P 500 resistance presently resides @ approximately 4300, rising approximately 7 points per week.

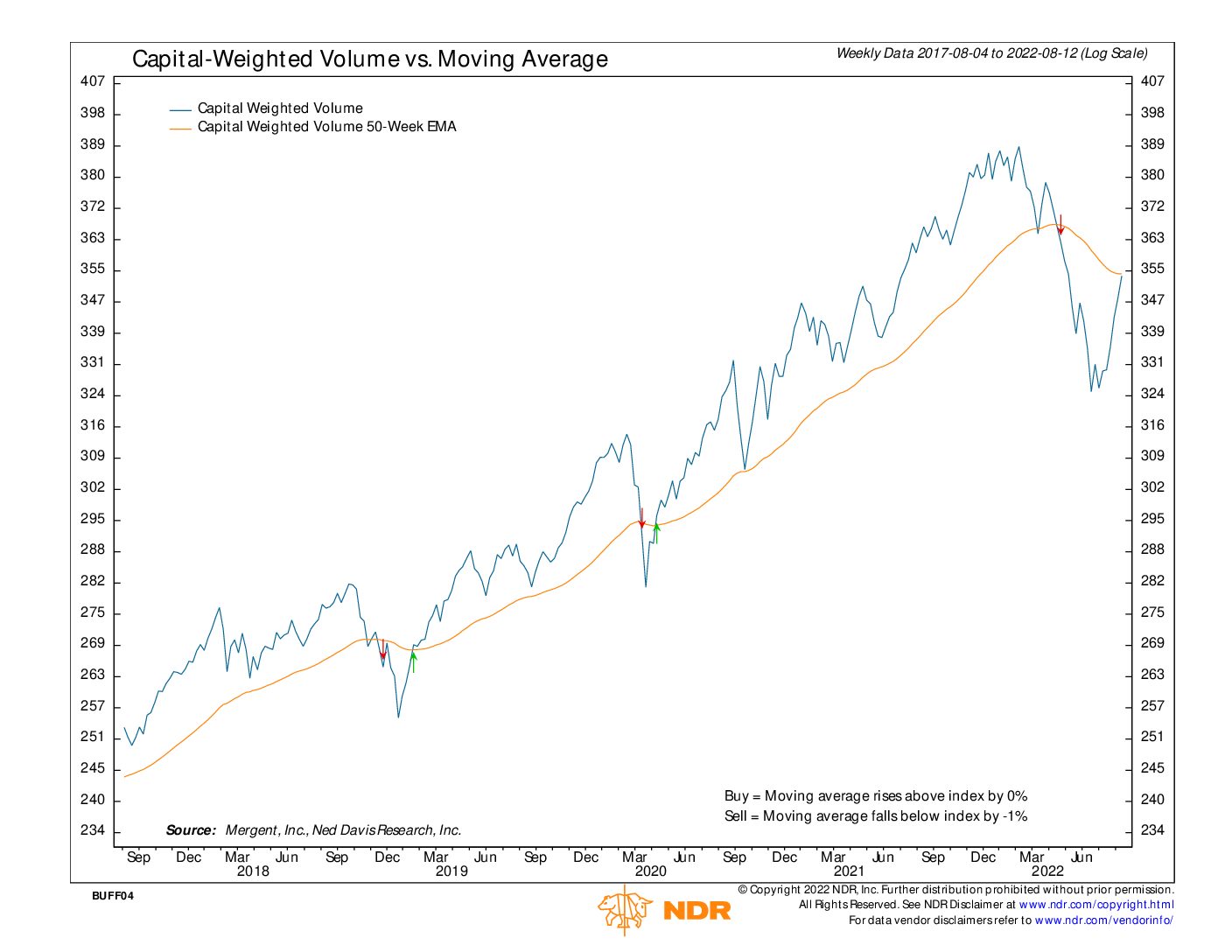

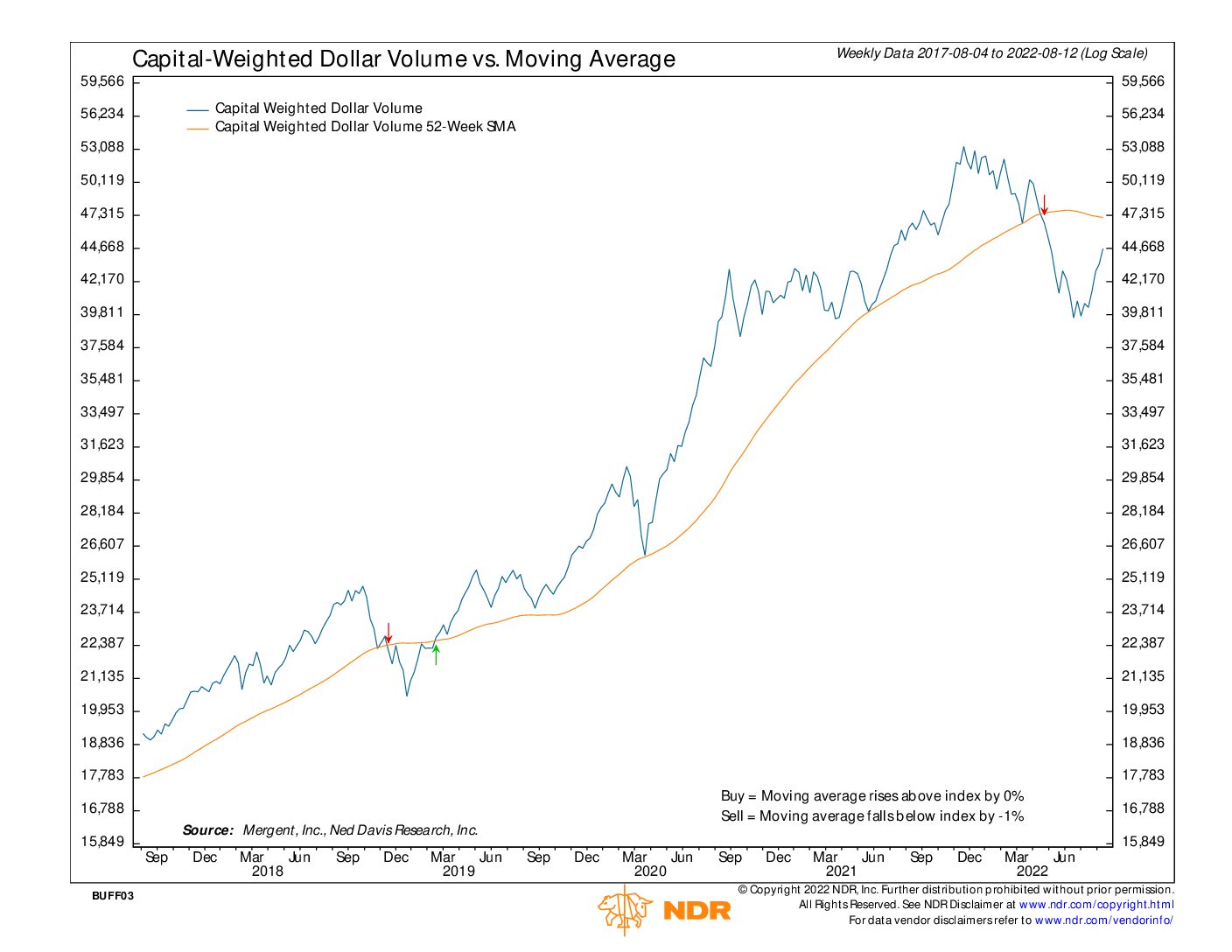

Additionally, Capital Weighted Volume is also on the cusp of breaking resistance. Should capital weighted volume turn positive, it would be a positive sign that the bull market is indeed for real.

Although price and volume are significantly improving, capital flows as well as market breadth are both lagging the price advance. These leading indicators still suggest that the summer rally is just that, a counter trend rally within a bear market.

Overall, price and volume are at crucial inflection points. Their outcomes, whether to breakthrough or retrace, could be viewed as telling for the current health and future direction of the markets both near and intermediate term.

Grace and peace be to you my friends,

Buff Dormeier, CMT®

Updated: 8/15/2022

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.