Volume Analysis | Flash Market Update 5.22.23

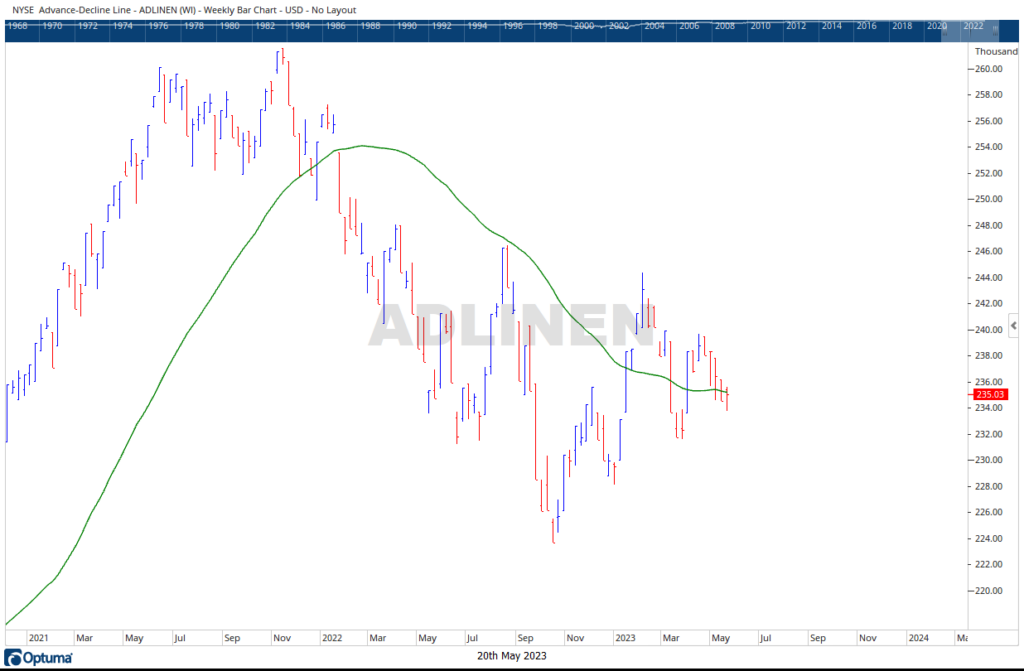

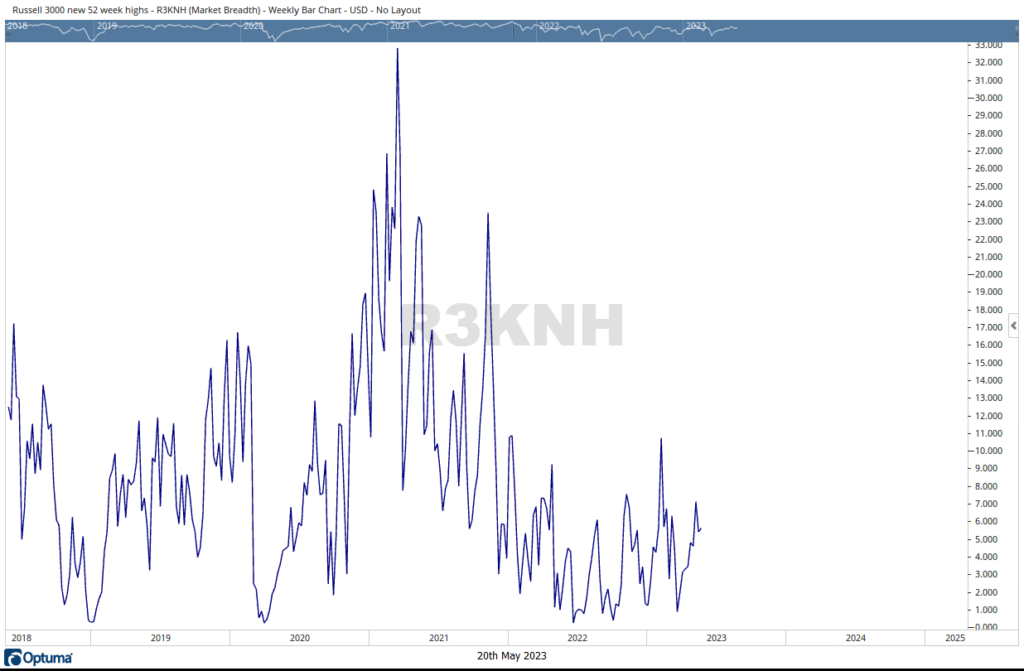

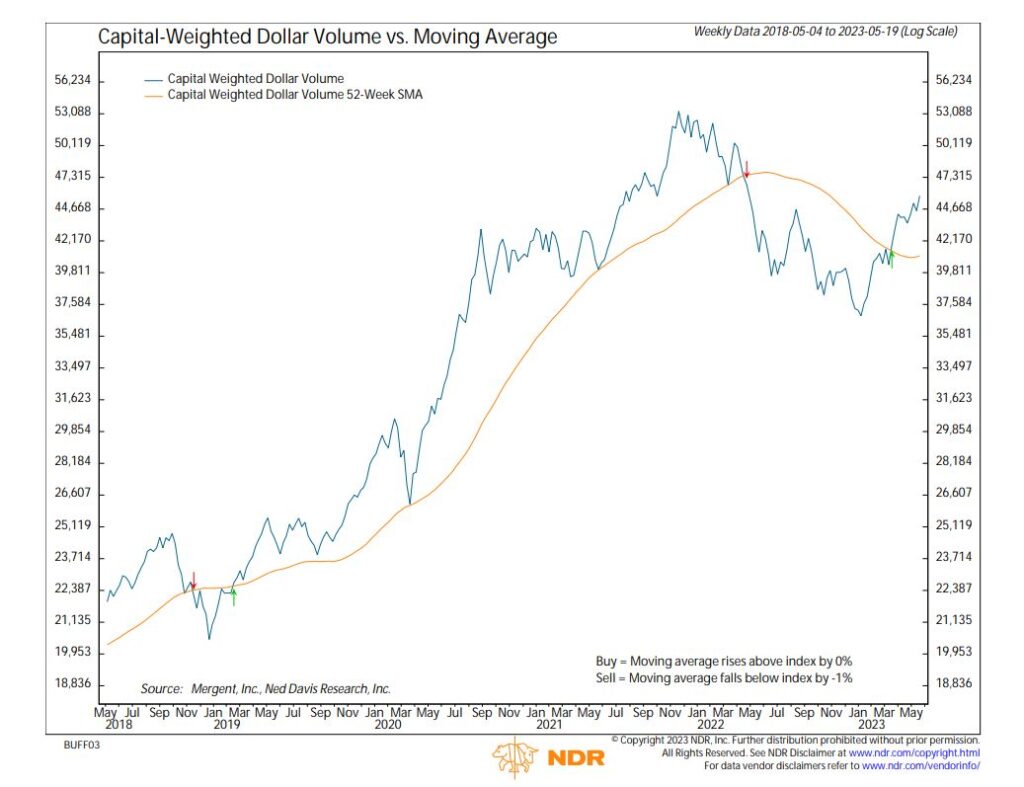

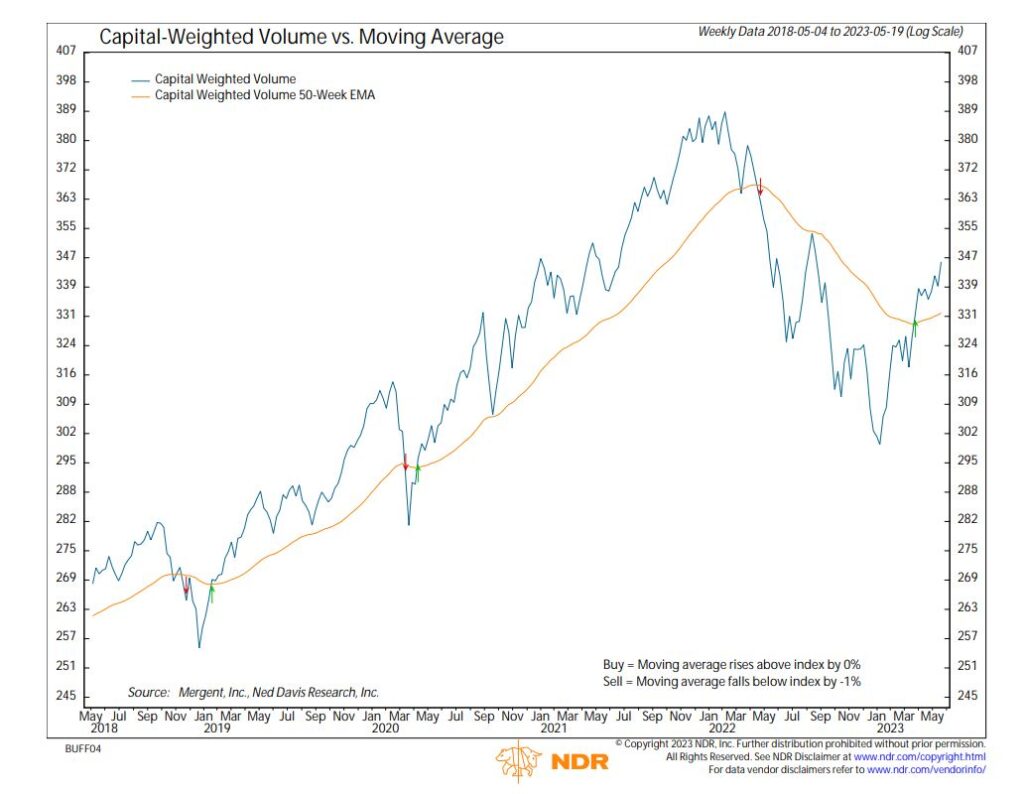

Capital Flows continued their positive trend last week as capital continued to pour into the S&P 500. The generals (NASDAQ 100) again led the charge. But this week, they were able to pull up some of their troops (Russell 2000) with them, as evidenced by a 1.89% weekly gain in the Russell 2000. The Advance-Decline Line also showed marginal improvement while teetering between support and resistance. A healthy $56 billion flowed into the S&P 500, whereas only $23.5 billion flowed out. S&P 500 Capital Weighted Volume also continued its advance higher. The S&P 500 briefly broke above 4200 intraday Thursday and Friday, only to close below the critical resistance level.

With capital flows backing them, the generals are trying to pull the rest of the market higher. However, all investor eyes are on the circus clowns walking the tightrope without a net in Washington. A misstep could be disastrous, a resolution may be the pop needed to break through resistance.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 5/22/2023

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.