Portfolio Manager Insights | Why the U.S. Dollar Is Still the Leading Global Currency — 4.19.23

The U.S. dollar has been in the headlines due to an anticipated pause in Fed policy and concerns over the currency’s place in the global financial system. However, to borrow Mark Twain’s famous line, reports of the dollar’s death are greatly exaggerated. While the role of the dollar has declined by some measures over the past two decades, fears of the dollar’s demise are not new among investors and economists. What does the dollar’s role mean for investors going forward?

For many, the value of the U.S. dollar is viewed as a barometer of the country’s importance on the global stage. It’s been a century since the U.S. dollar overtook the British pound as the leading global currency. Many worry that the dollar could lose this status through poor U.S. policies or from competing currencies such as the renminbi. However, these concerns are not new and evolve with every economic cycle.

In the 1980s, it was feared that the yen would overtake the dollar as the Japanese economy boomed. Since the 2000s, it has been feared that the euro or the Chinese renminbi would become a new global reserve currency. More recently, some expected cryptocurrencies such as Bitcoin to quickly upend the dollar-based system. Despite numerous challenges to the dollar and concerns over U.S. fiscal and monetary policies, none of these scenarios have yet occurred.

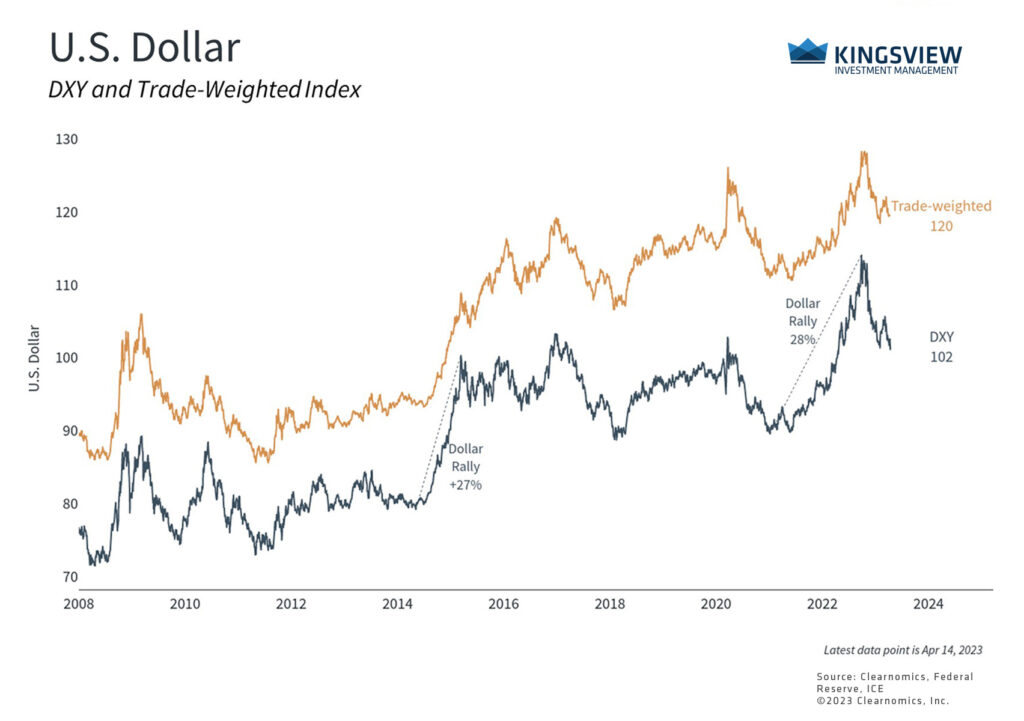

The dollar remains strong but has weakened over the past six months

While the dollar’s importance should not be taken for granted, it’s important to have a broader perspective on why it remains the world’s reserve currency. The value of any major currency reflects a wide array of global economic trends and, as a medium of exchange, permeates every part of the global economy. The dollar plays a central role in this dynamic.

According to the IMF, the dollar made up 58% of the world’s currency reserves held by central banks at the end of 2022. The next largest share was held by the euro at 20%, followed by the yen and British pound at 6% and 5%, respectively. The Chinese renminbi’s trails far behind at only 2.7%.

The global payments numbers tell a similar story. According to SWIFT, a major global payments network, the dollar was used in 41% of transactions. This compares to the euro, pound, and yen with 36%, 7% and 3%, respectively. Only 2.2% of SWIFT transactions used the renminbi. The fact that the dollar is central to global trade, the price of oil is denominated in dollars, and many foreign currencies are pegged to the dollar, have helped to preserve its status.

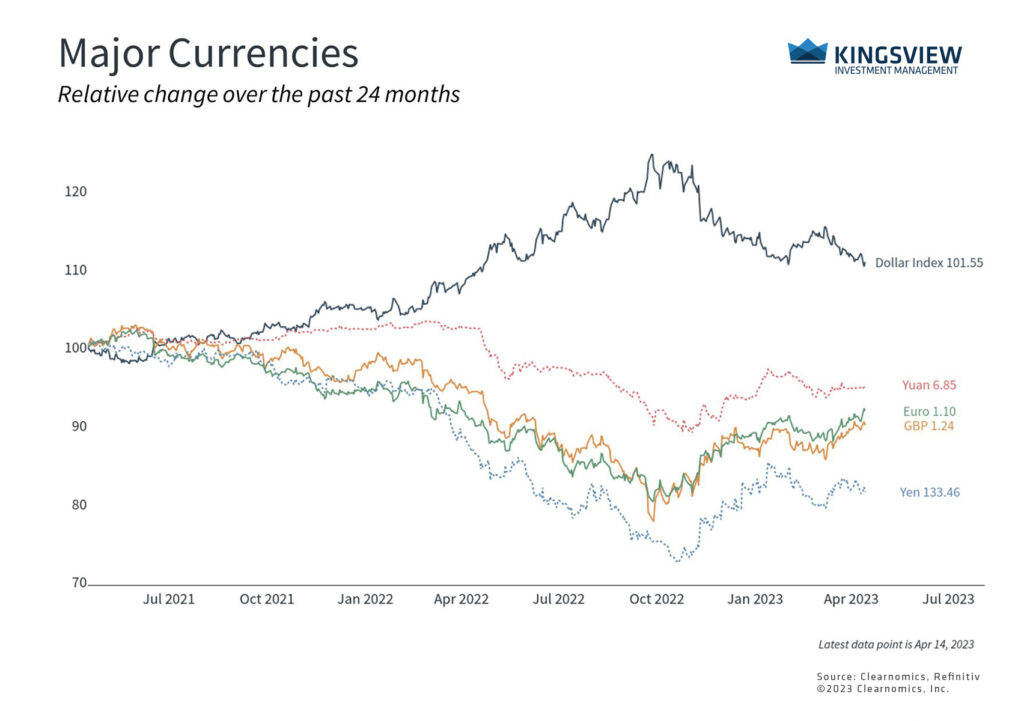

The dollar reached parity with the Euro last year

These numbers put into perspective the latest headlines around several emerging market countries, known collectively as the BRICS nations, that plan to increase competition with the dollar. These countries, of which China is the largest, established the Shanghai-based New Development Bank in 2014 as an alternative to the World Bank and the IMF. While this may help reduce these countries’ reliance on the dollar in some areas of trade and in foreign debt, it does not solve the underlying need for a currency that is stable and trusted globally.

A case in point is that during times of stress, investors often flock to the dollar as a safe haven asset. Even as inflation began to rise in 2021, which would normally weaken a currency, the dollar rallied due to the robust U.S. economic recovery compared to the rest of the world and the prudent tightening of monetary policy by the Fed. The dollar even reached parity with the euro last year for the first time since 2002. So, while the rise of China in the geopolitical and economic spheres should not be underestimated, this does not mean that the dollar will be supplanted overnight.

While Americans do benefit from a trusted dollar, what’s important is that the dollar is trusted globally because of the vibrancy and strength of the U.S. economy. After all, the dollar is not backed by gold but by the “full faith and credit” of the U.S. government. Thus, the dollar reflects expectations around the prudent management of the economy, geopolitical issues, inflation concerns, and many other factors.

When it comes to investing, there are three key ways in which the value of the dollar will continue to impact portfolios, regardless of the role of the dollar. First, the importance of the dollar doesn’t tell the whole story since having a currency that is too strong can be problematic if it makes U.S. goods and services more expensive to the rest of the world. In other words, a stronger dollar can make it more difficult for U.S. companies to compete abroad, reducing profitability.

Around 2015, a surging U.S. dollar resulted in an “earnings recession,” driven also by the fact that the share of international revenue for U.S. companies has increased over time. Thus, having the dollar at a sensible level is often better than a dollar that is too strong. Fortunately, the dollar has backed away from its recent peaks with the dollar index (DXY) declining from around 114 to 102 in recent months.

A weaker dollar is a tailwind for international investments

Second, just as a dollar that is too strong may not be ideal for global corporations, it can also act as a drag on foreign investment returns by U.S. investors. In general, currencies can add an additional layer of complexity to international investing that doesn’t exist when buying and selling domestic stocks. When the dollar strengthens, international investments lose value for dollar-based investors since they are made in foreign currencies which become weaker.

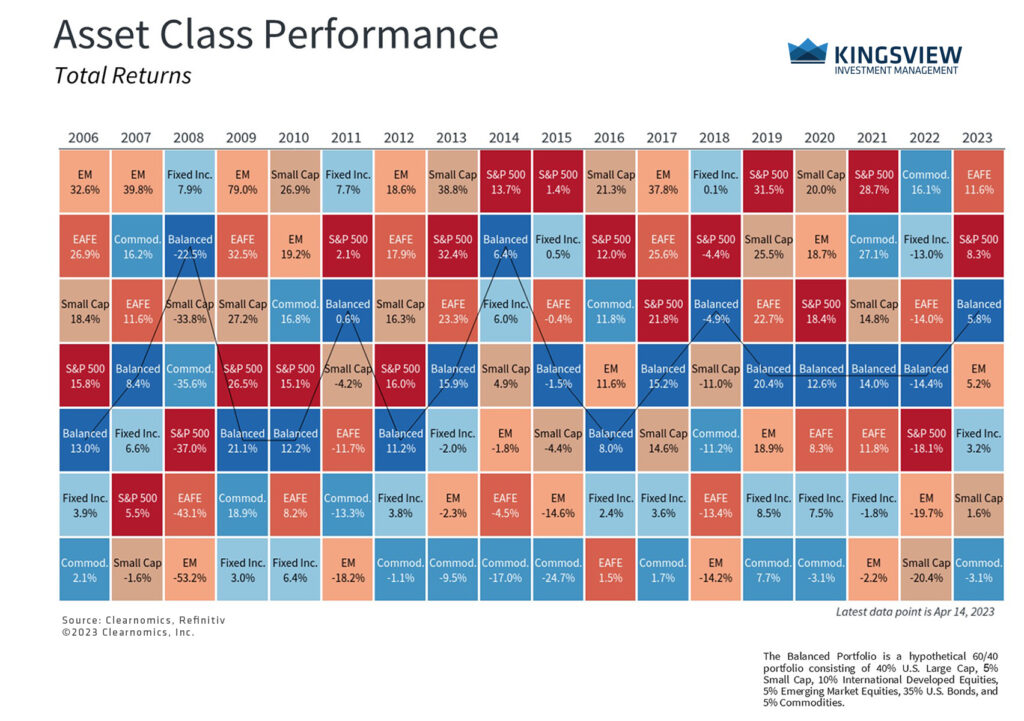

This dynamic hurt foreign returns last year alongside many other challenges. Fortunately, it’s the direction and not the level that matters, and the weakening dollar has helped to push international returns higher this year. The MSCI EAFE index of developed market stocks, for instance, has generated a total return of 11.6% in dollar terms so far this year while the MSCI EM index of emerging market stocks has returned 5.2%. A falling dollar is a tailwind for these international indices.

Third, fiat currencies – i.e., currencies not backed by gold – are only trusted to the extent that their countries maintain appropriate fiscal and monetary policies. Thus, an important driver of the dollar rally last year was the Fed’s rate hikes in response to inflation alongside the shrinking money supply. Conversely, the expected pause in Fed rate hikes later this year is one important reason the dollar may be weaker in the coming months. This could help support corporate profitability as well as investor returns.

The bottom line? There will always be concerns around the dollar’s place in the global economy. Investors should maintain a broader perspective on why the dollar plays such an important role and focus instead on how the dollar impacts the economy and returns.

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser. (2023)