Volume Analysis ‘Flash Market Update’ – 9.18.23

During the late stages of July and early August, as the markets showed an upward trend, our 7/31 Volume Analysis Flash update conveyed the following message:

“While we remain optimistic, it’s essential to exercise caution during this unique time of seasonal trends. Historically, August is known for reversals, and September tends to be the worst month, the only month with a negative historical return. Research suggests that after a positive quarter, August has a 60% probability of reversing. However, a bullish outlook could involve the generals (NDX 100 or the magnificent 7) taking a pause to refresh while the troops gather strength for a potential assault on all-time highs. So, a light-volume pause over the coming months may not be the worst condition, as it could possibly facilitate a bullish outcome.”

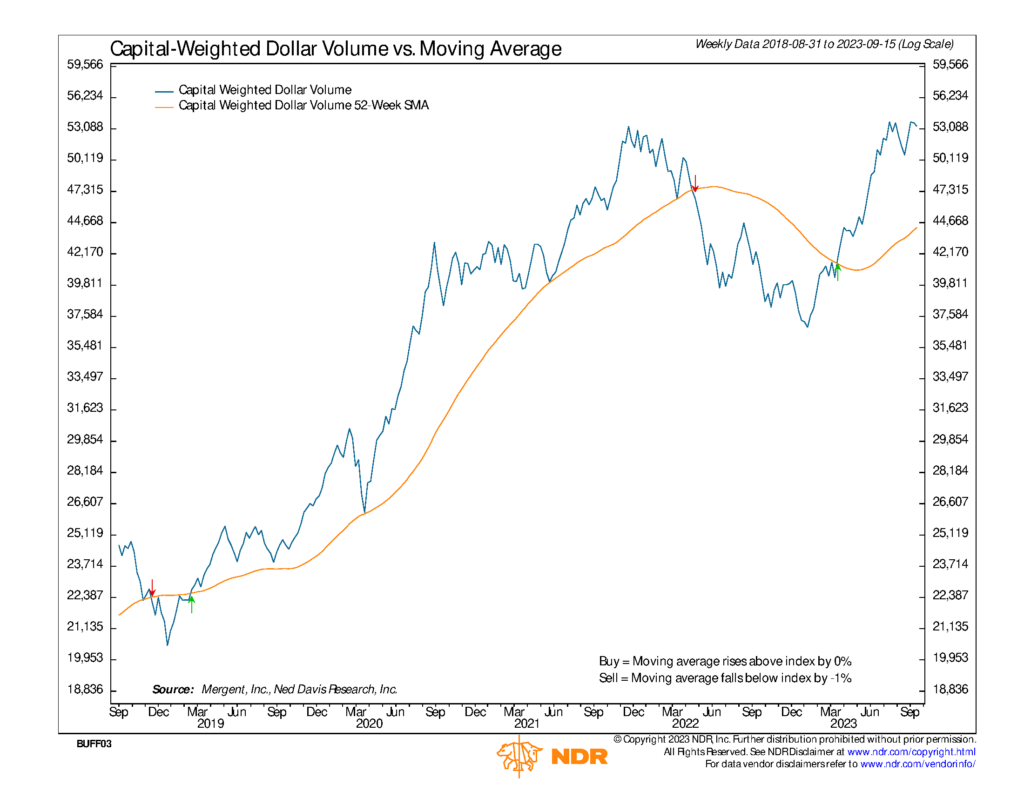

Now, as we look ahead to October, investors are contemplating what lies on the horizon. October has a reputation as the month of market crashes, but my experience suggests that these corrections are more likely to occur following stronger preceding months rather than weaker ones. Despite the troops (Russell 2000) experiencing a significant decline of over 8% over the past couple of months, Capital-Weighted Volume and Capital-Weighted Dollar Volume have only shown marginal retreats. Thus, the aforementioned phase of light-volume consolidation may have transformed into a healthy bullish condition as we enter the fourth quarter.

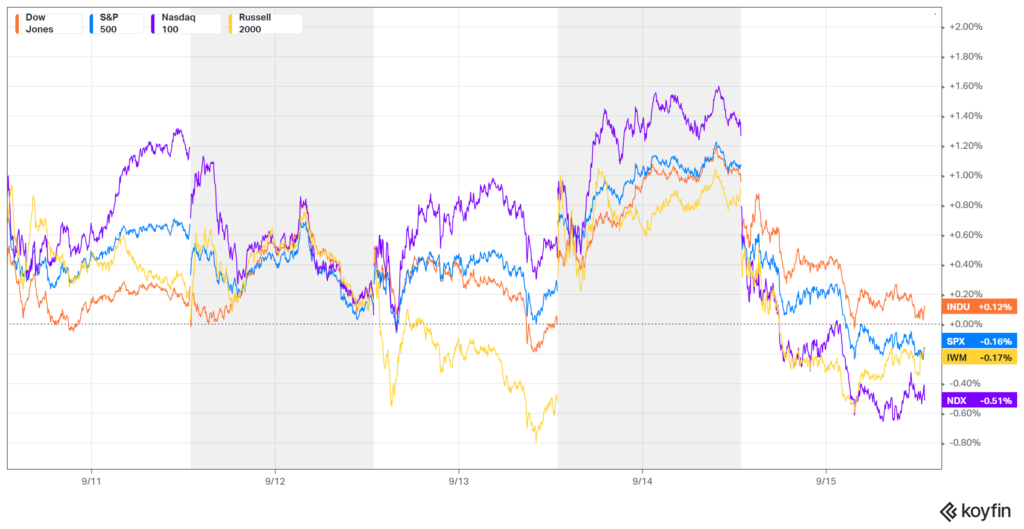

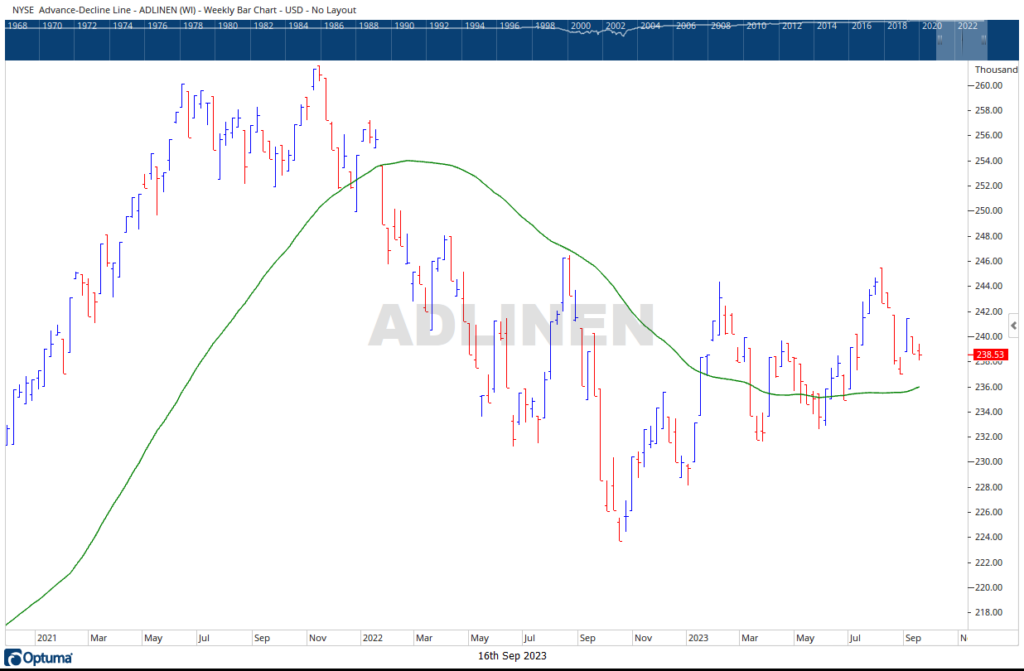

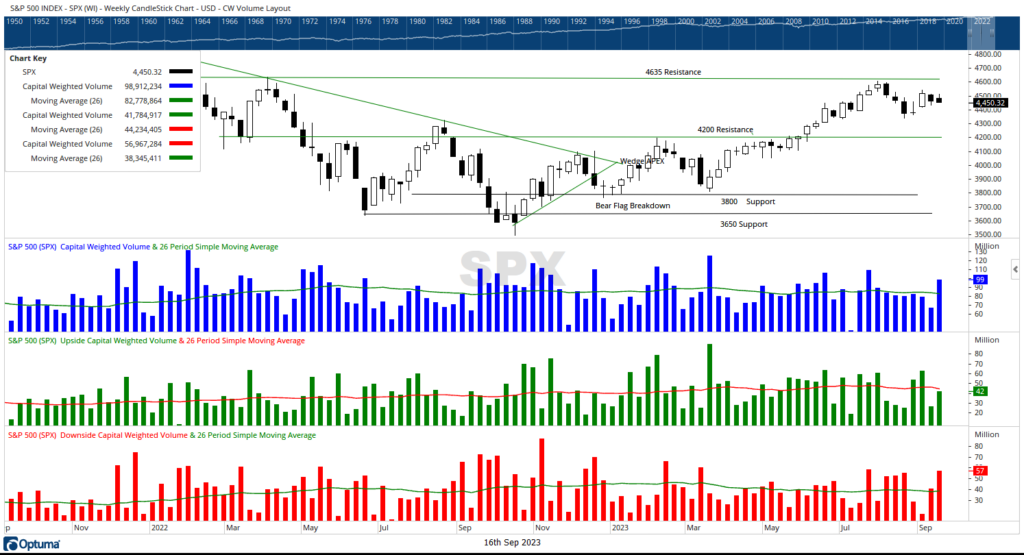

Last week, the generals represented by the NDX 100 led the broader markets lower, with a decline of -0.51%. In contrast, the troops, exemplified by the iShares Russell 2000 ETF, held up relatively better, falling only -0.17%. The NYSE Advance-Decline, while down, remains above its trend line and critical support levels. Downside capital flows saw an above-average exodus from the S&P 500 of nearly $57 Billion, while upside capital flows finished the week below average with only a modest influx into the S&P 500 of just under $42 Billion.

To sum it up, in recent times, the markets have experienced moderate declines during August and September. However, the strength exhibited by Capital-Weighted Volume and Dollar Volume seemingly contradicts this price decline, providing reason for optimism among the bulls as we head into the fourth quarter.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 9/18/2023

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.