Volume Analysis | Flash Market Update – 8.1.22

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

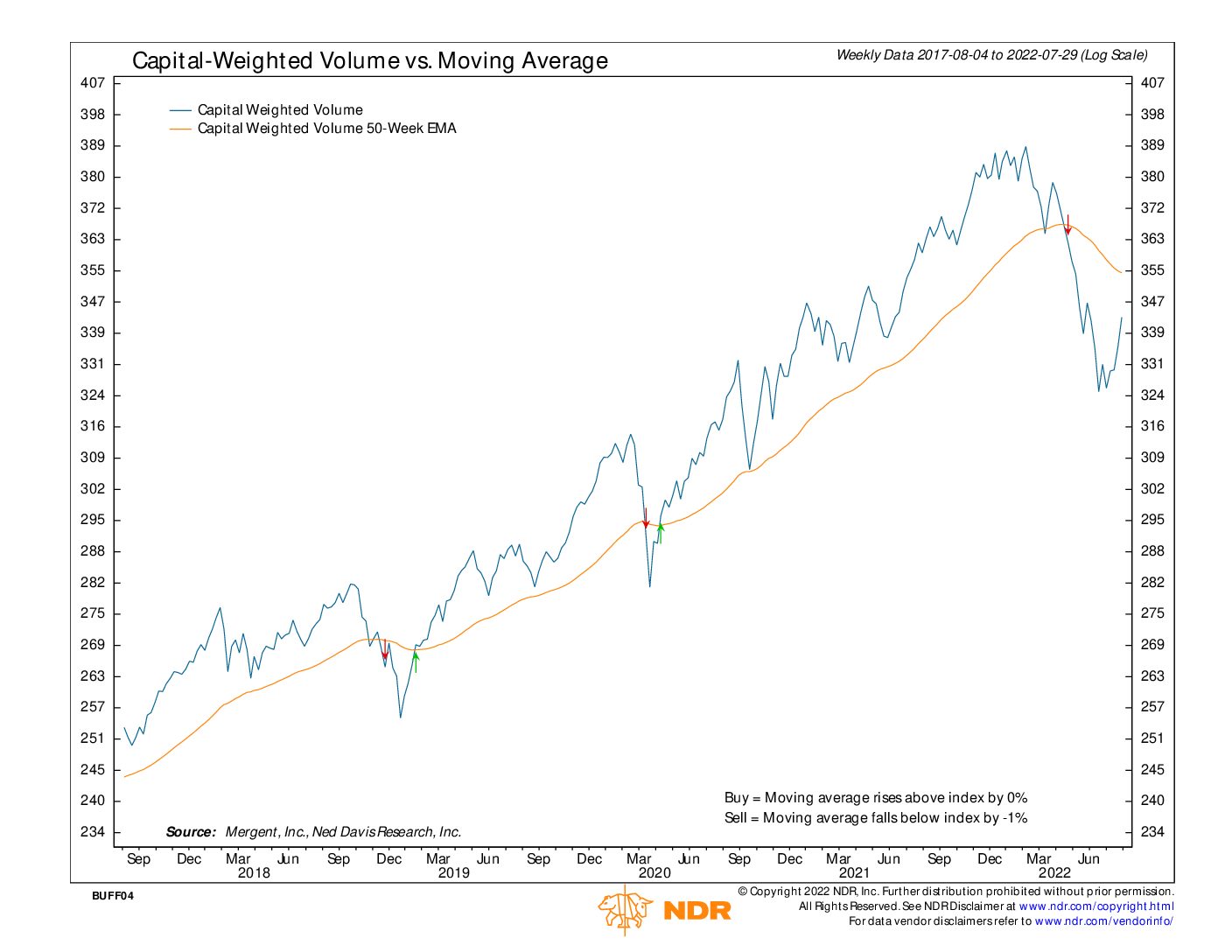

This week, economic and market news was projected to be bad, and the results came in even worse than projections. With the bad news is presumably in, capital flows continued to improve along with price. Price strength in bad news is a positive sign for the market and this successful bounce tells investors that perhaps the pullbacks may once again be boughten successfully.

Despite the positive move, I believe this action is a countertrend move not the development of a new emerging bull market trend. Leadership has changed from the quality cash cows back to stocks formerly associated with growth. Leadership retracements are common during extremes especially during the summer months. If this retracement plays out in line similar to other reversion cycles, I expect the countertrend to fade sometime in September. A break in the major capital flow trends from down to up would nullify this countertrend hypothesis and signal a new bull market has already begun.

The S&P 500 has now broken through minor resistance @ 4100. Look for support @ 4100 and again @ 4000. Next resistance is 4200. There is a major resistance or ceiling at approximately 4300 steadily rising about 7 points a week.

Updated: 8/1/2022

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.