Volume Analysis | Flash Market Update – 7.18.22

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

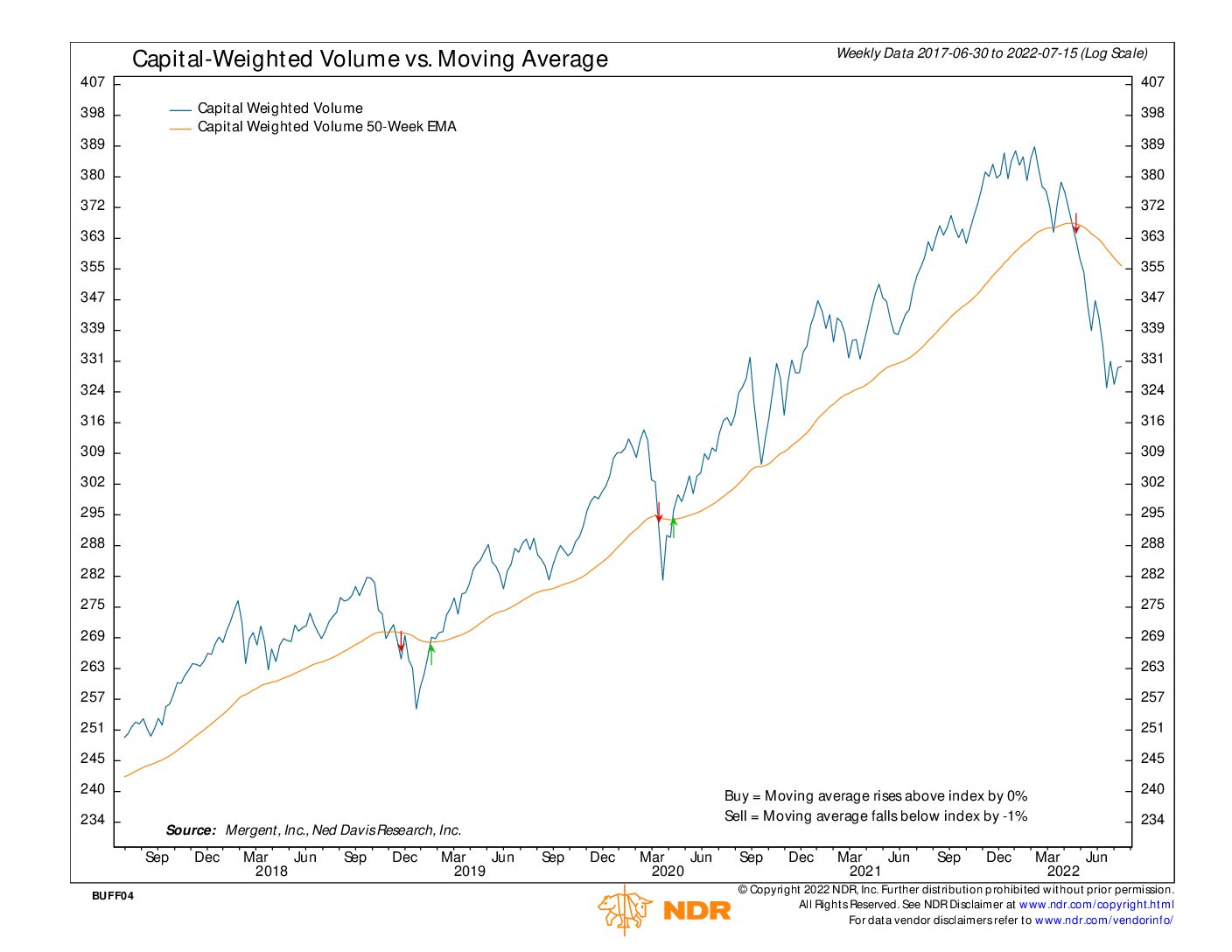

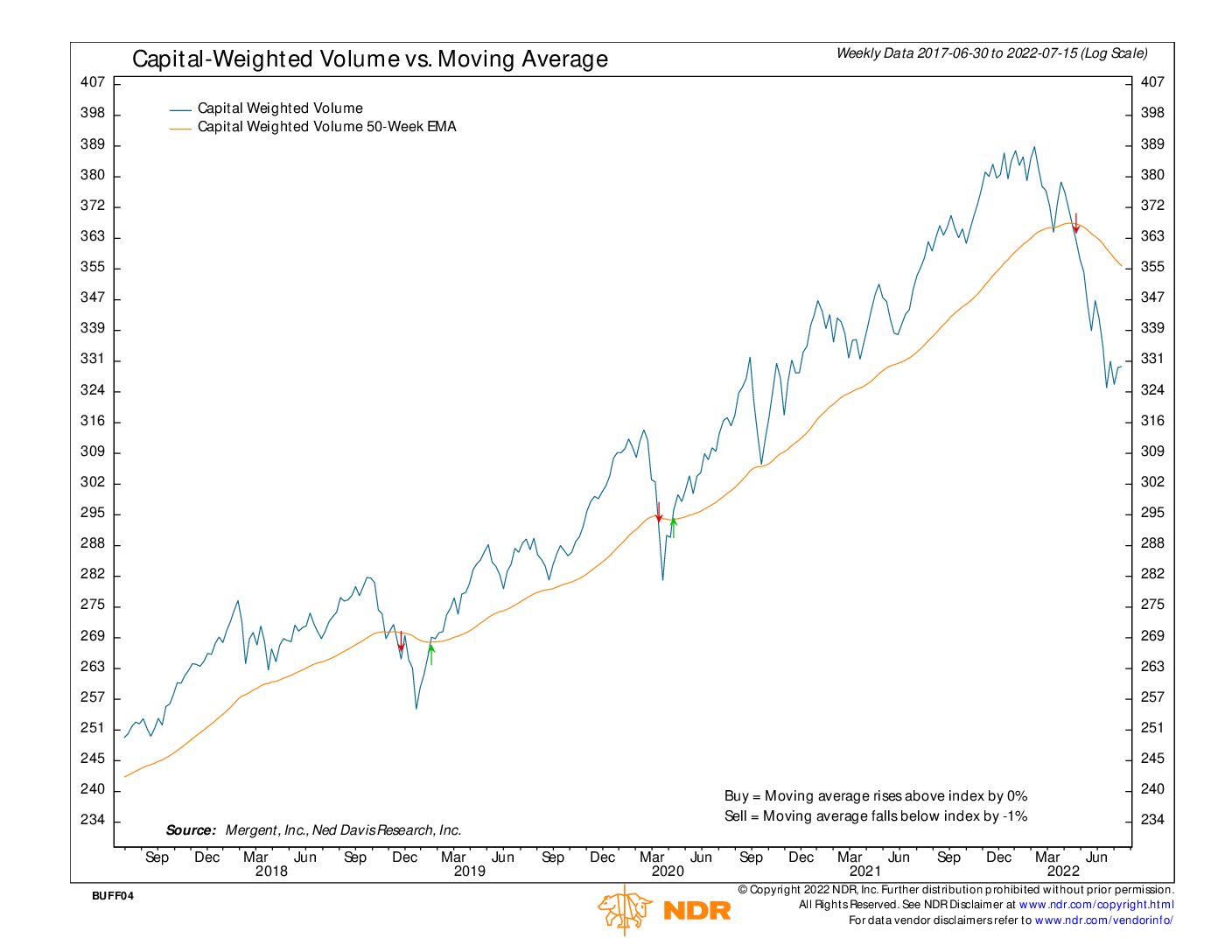

Although the market was down for the week, capital inflows slightly outpaced outflows this past week. That is a bullish divergence sign of hope for the bulls.

Yet overall capital flows remain well below trend. The VPCI capitulation V bottom signal is running its course and is now slowly rolling off as time mends many wounds. Strong support resides @ 3600 for the S&P 500 while a rising ceiling just above 4200 represents significant resistance. It appears the market maybe presently stuck in a range between these two points, 3600 on the bottom end and 4200 (and rising) on the top end.

Updated: 7/18/2022

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.