Volume Analysis | Flash Market Update 2.6.23

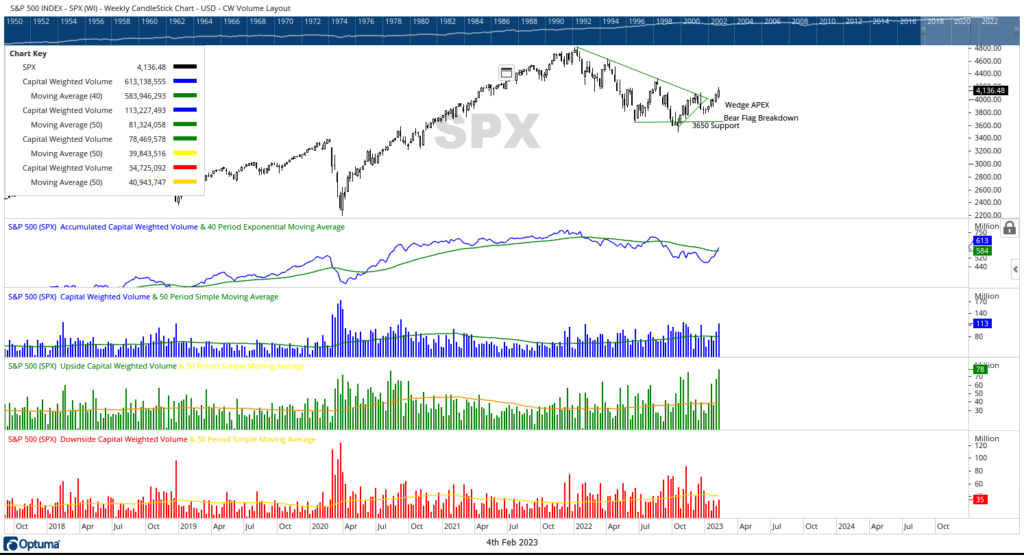

Our last Volume Analysis Flash Update began with “This past week, the Bulls pushed through resistance, the apex of the Bearish Wedge. It is common for bearish wedges to be mildly retested, just like last week demonstrated. The key to identifying if the breakout is indeed legitimate is the break’s volume. Unfortunately for the Bulls, the overall volume was weak for the week.” And our commentary ended with “Major SPX 500 resistance resides at 4100. If the Bulls close above this 4100 level, all Bear bets are off. Next week’s Federal Reverse (pun unintended) meeting may be the final catalyst to determine the direction of the intermediate trend. Get your popcorn ready!”

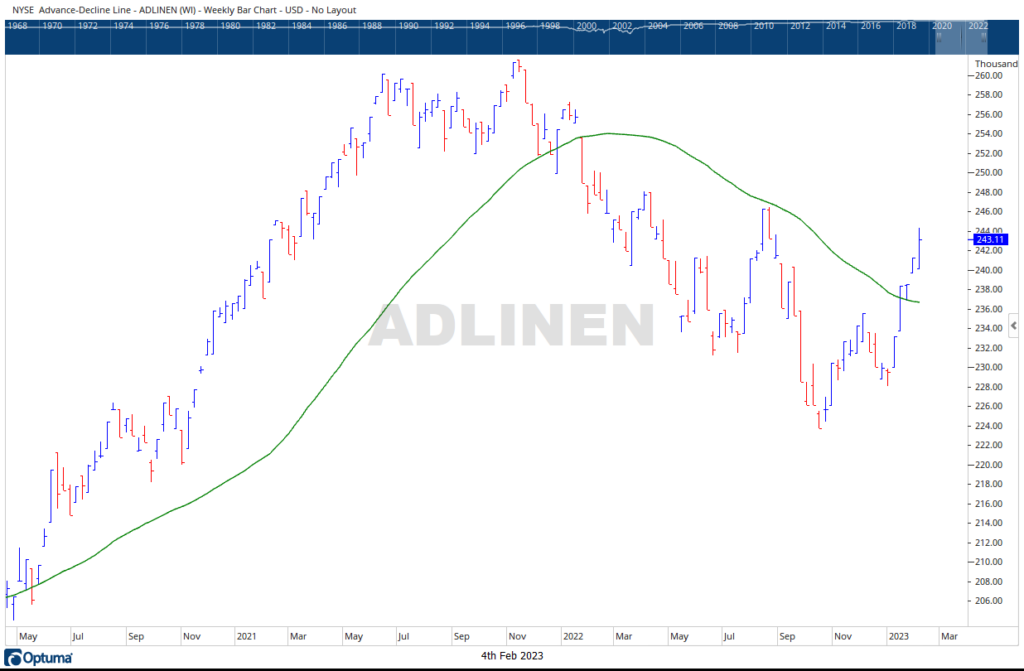

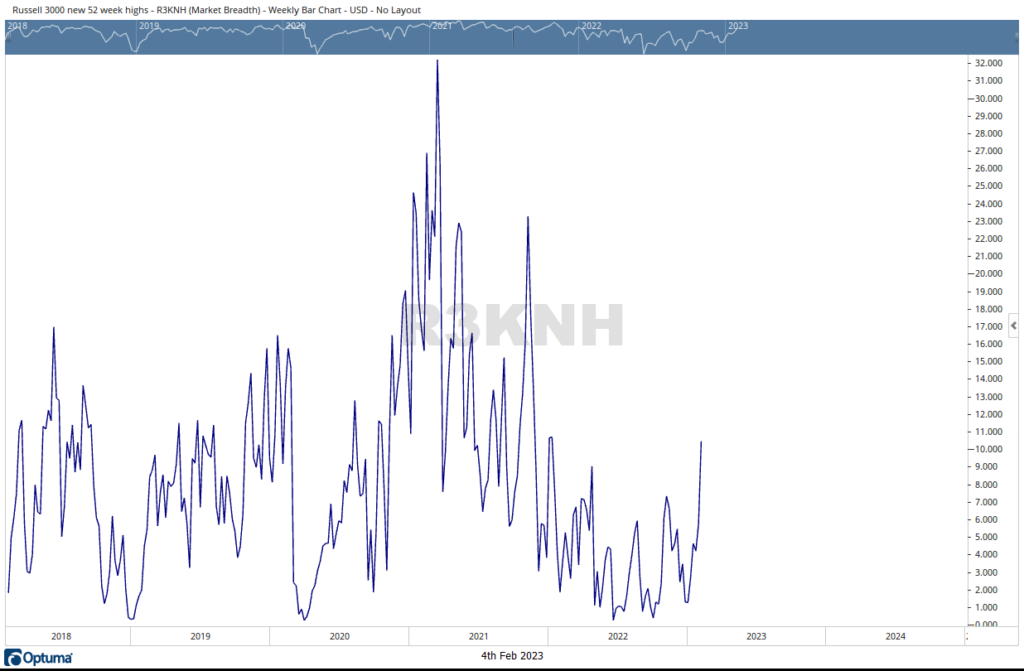

Spurred on by dovish interpretations of Federal Reserve comments, the market popped through 4100 resistance. At the break of this critical level, bears were forced to cover their short bets. And they did so in a massive way with Capital Inflows surging to $78.5 Billion, significantly above average, more than doubling $34.725 capital outflows. Overall, S&P 500’s 4100 breakout occurred on high volume, confirming the intermediate-term breakout. Liquidity continues to flow into the market, with the Advance-Decline making solidly bullish strides. And this past week, the % of stocks making New Highs joined the party in a big way as well. This action bodes very favorably for the bull camp.

Despite the S&P 500 breaking out above resistance, the Advance-Decline surging above trend, volume, and capital flows remain below trend. However, after starting the year at multiyear lows, both have been moving higher in 2023. Nonetheless, in a healthy market, volume should be leading price, not the other way around. Overall, the bulls presently control the short-term and intermediate momentum while the shape of the underlying foundation remains vulnerable long term.

Grace and peace my friends,

BUFF DORMEIER, CMT®