Volume Analysis | Flash Market Update 2.21.23

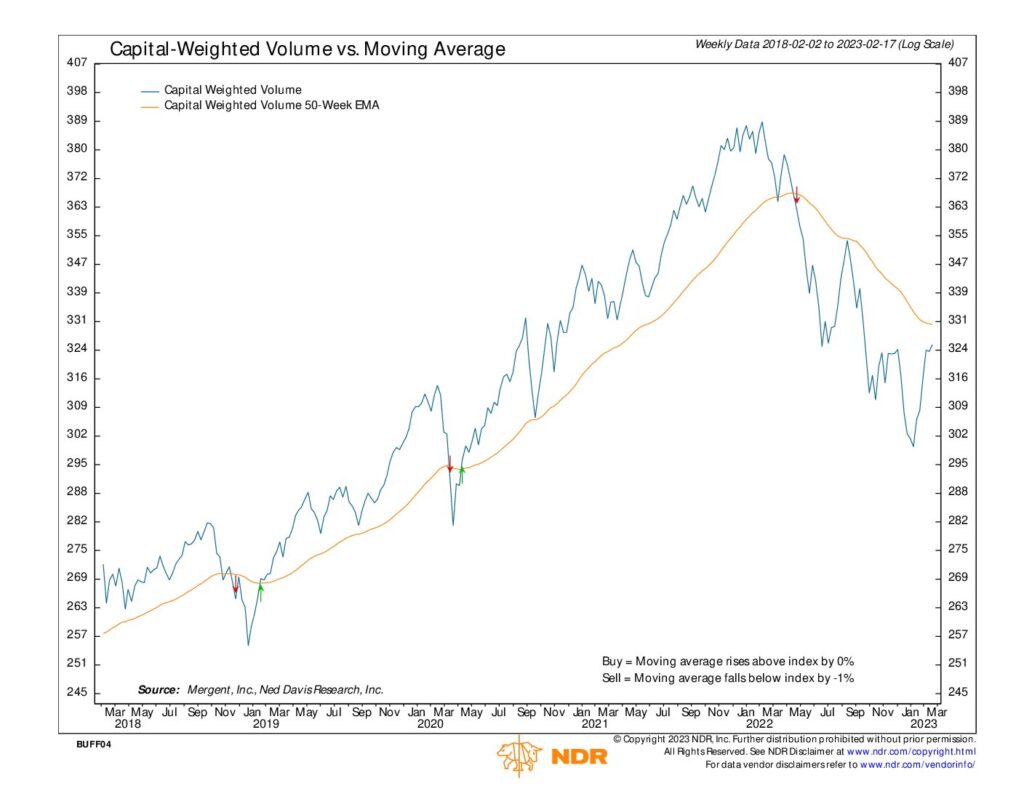

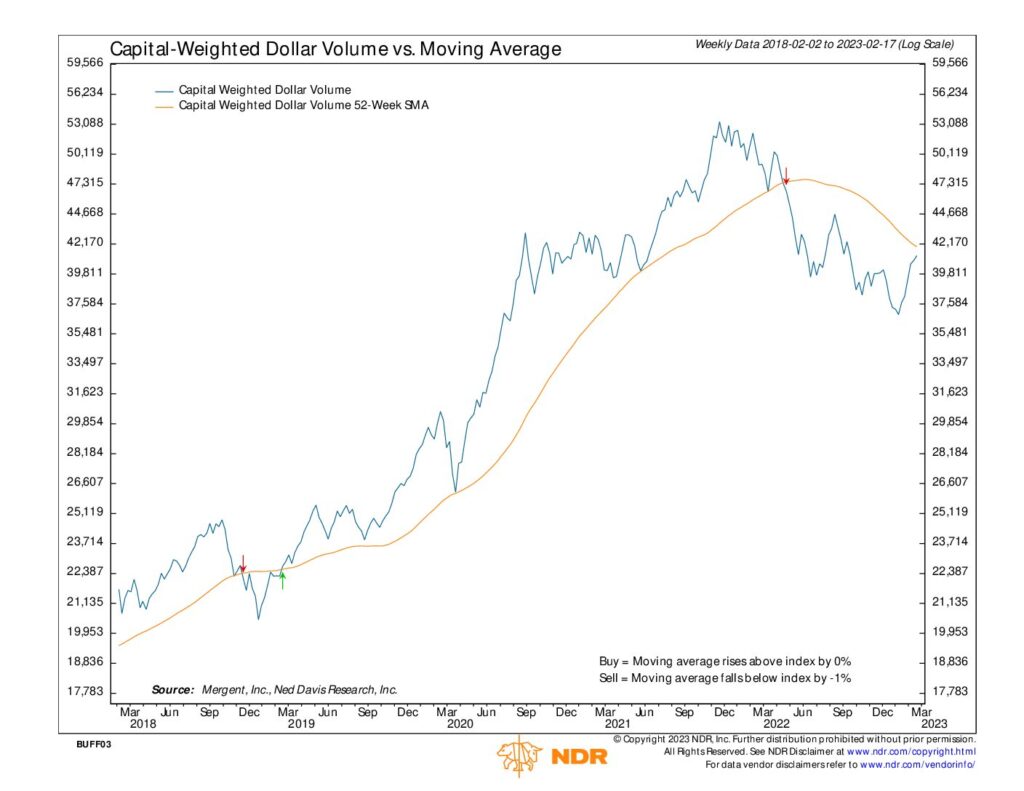

The stock market has fallen for the second straight week while capital inflows continue to increase. At the current pace, if capital flows were to just hold (not go down) for another few weeks or so, the S&P 500 may enter a Volume Analysis Bull market.

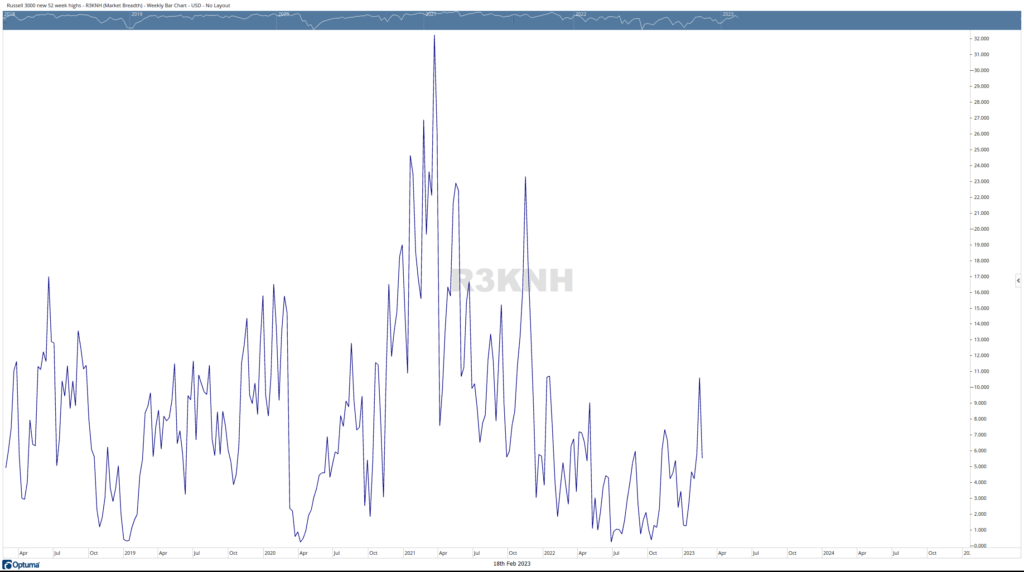

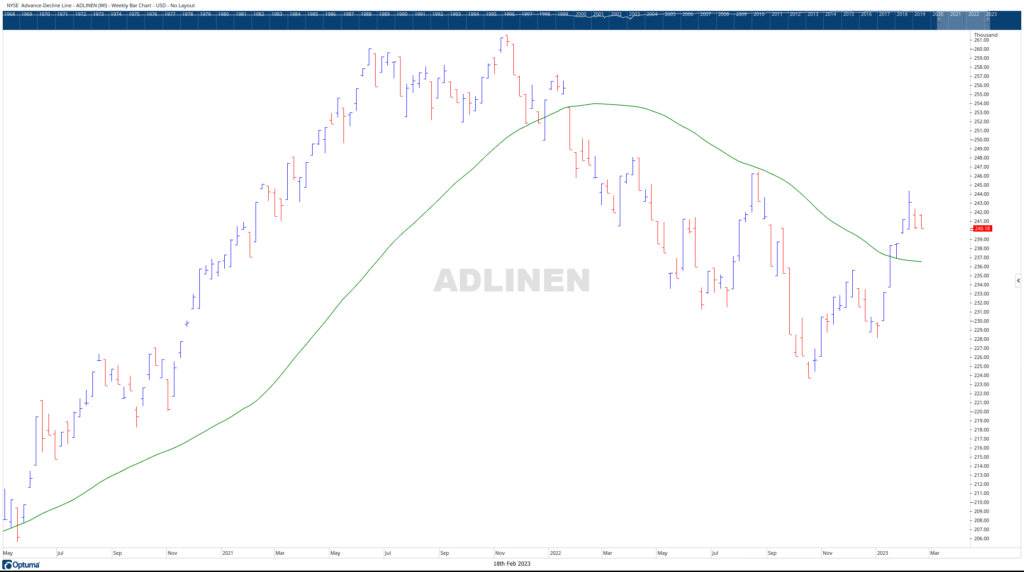

Although the S&P 500 is not advancing, it still holds above 4000 support, represented by the apex of the former Wedge. Meanwhile, the Advance-Decline is also holding above recent lows. Although fewer stocks are making New Highs, the rate of decline does not appear to be too concerning considering the recent surge.

Formerly, the stock market seemed to be craving the sugar high of easy money. Yet, recent economic data is damaging those hopes. It is impressive how well the market is shaking off this data. These recent reactions provide some optimism there may be more to this rally than the expectation of easy monetary policy.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 2/21/23

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.