Volume Analysis | Flash Market Update 12.5.22

Last week the S&P 500 brought in $42.5 billion of inflows versus $40.4 billion in capital outflows. The volume and other internal data may be suggesting this is a short-term rally with still more downside to go. Traders seem to be speculating that inflation is on the down swing and the Fed will soon move to be accommodative. Late September through early October witnessed several positive technical signals with bullish indications. Most importantly, the VPCI V bottom just barely missed on a capitulation signal the last day of September. Given these short-term positives, I still expect the SPX could move higher to 4100 / 4200 by mid-December coinciding with the federal reserve meeting pivot point.

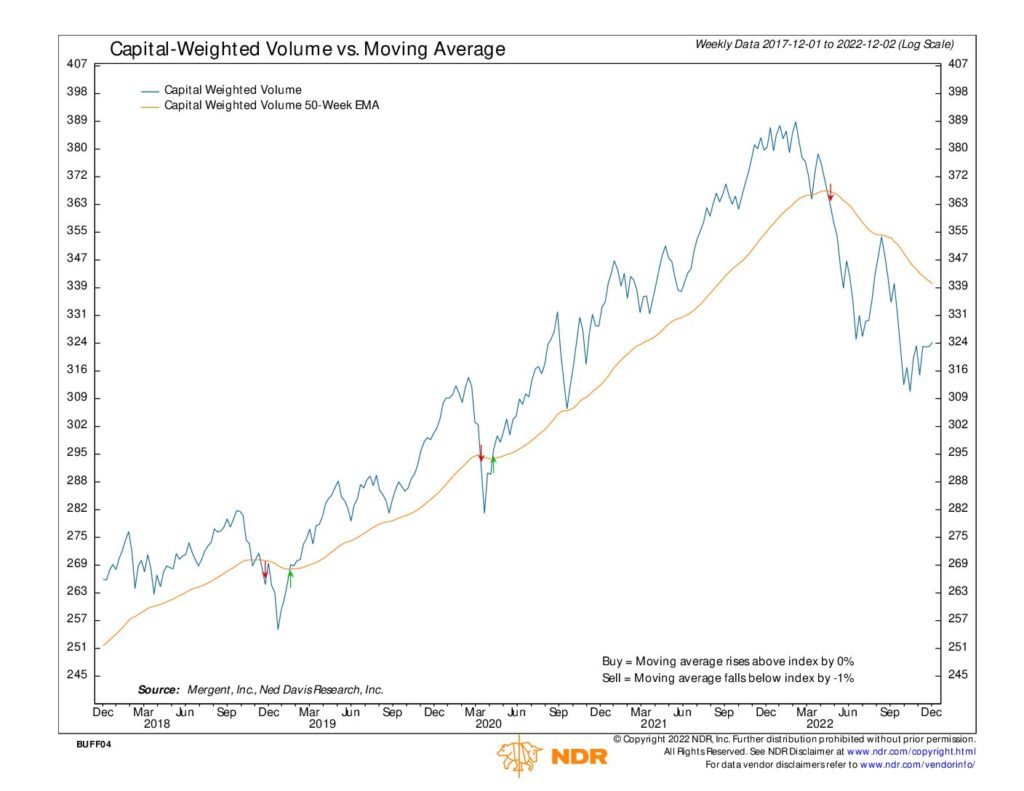

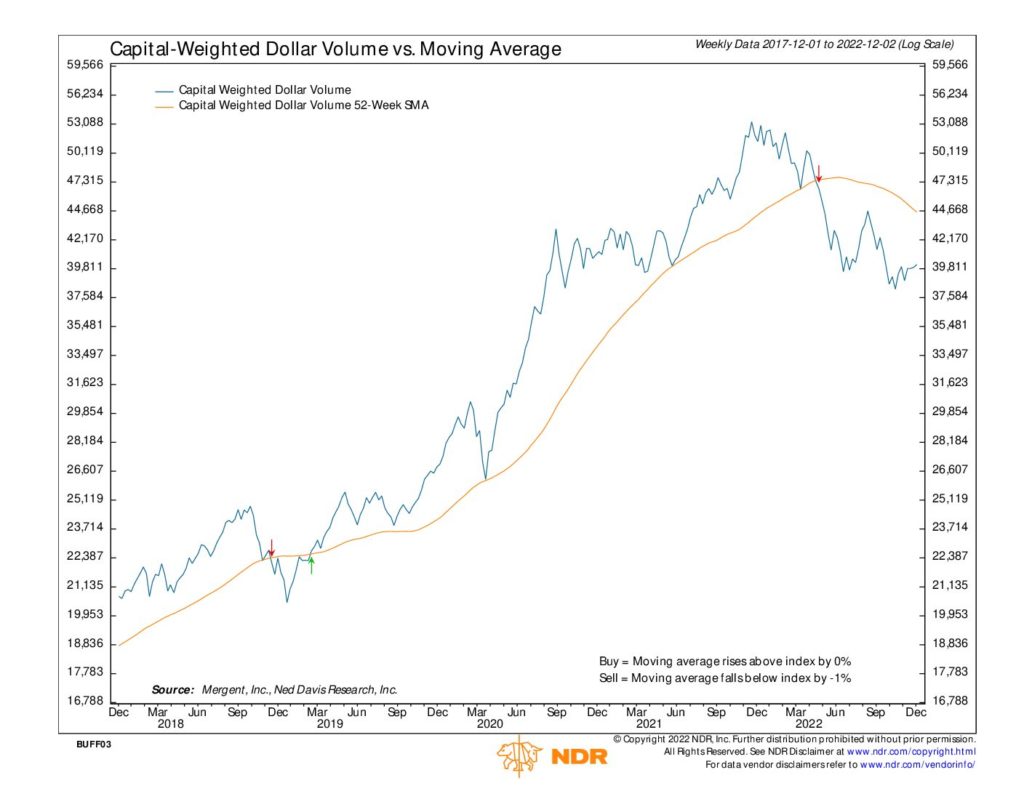

Nonetheless, short term trends against the primary are often temporary and fickle. Much of this rally thus far shows the classic signs of a bear market rebound similar to late June and July. In many ways, the market is currently behaving almost identically to June and July’s actions. The major difference is in June our capitulation signal barely triggered as opposed to just missing in September. Like June and July, this rally is led by the oversold growth stocks much like the former summer rally. Most importantly, the volume and capital flows are significantly lagging price, just like June and July. The S&P 500 is threatening to break it’s 200 day moving average while volume and capital flows are not even close to challenging corresponding levels. This action illustrates that the big money is not participating in the buying spree. Thus, the recent rally echoes the former summer rally in this and most other ways.

Additionally, our other leading indicators are still lagging long term. This suggests the smart money is not buying the narrative that the Fed / inflation is done but rather they may believe the Fed has more to go. That stated, the price surge suggests the big $’s (commercials) are not yet selling into strength either, at least not yet. Those perspectives assumingly held by the big $’s could change but the evidence of that is not there yet. I believe most likely we are nearer to the end of the bear than the beginning, however I do not believe the evidence suggests that the Fed is done yet. The December meeting is weeks away. It seems to me that the market is set to price in a letdown between now and then similar to the disappointment at the end of July. That stated, should the big money and liquidity shift and suddenly move alongside the actions of the traders, our risk overlay indicators should follow.

Grace and peace to you my friends,

BUFF DORMEIER, CMT®

Chief Technical Analyst | Kingsview Partners

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.