Volume Analysis | Flash Market Update 12.12.22

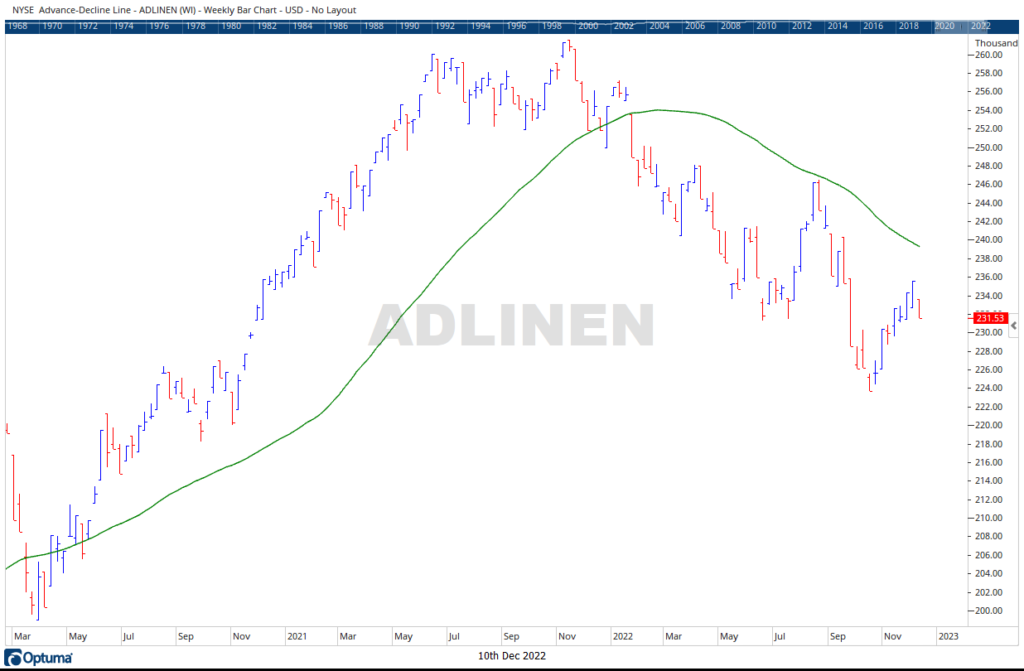

The S&P 500 is caught between a trading range with support at 3900 and resistance 4100. Next week’s long anticipated Federal Reserve meeting coincides with the coming conclusion of a rising wedge formation.

These conditions are ideal for a potential breakout/breakdown of our forementioned training range. A rising wedge, aka a bear flag, occurs during a short-term bull counter trend within a longer/intermediate-term downtrend. The inflection point between these opposing trends is the apex. When price reaches the point of the apex, it naturally forms an end to a steadily tightening trading range (see attached chart SPX Ascending Wedge/ Bear Flag).

Often the tipoff in identifying a bear flag is weakening volume. In our weekly analysis, we have consistently pointed out that the S&P 500’s Capital Weighted Volume is relatively weak given the strength of the uptrend. Last week was no exception, the S&P 500 saw $2.7 Billion in capital inflows versus $12.9 Billion in capital outflows. Although the rising wedge / bear flag pattern is typically bearish, the conservative approach is to await the directional break of the apex then follow the direction of the prevailing trend. Whether you are a bull looking forward to Federal Reserve accommodation or a bear, next week seems set up for fireworks.

Grace and peace to you my friends,

BUFF DORMEIER, CMT®

Chief Technical Analyst | Kingsview Partners

Updated: 12/12/2022

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.