Volume Analysis | Flash Market Update 11.28.22

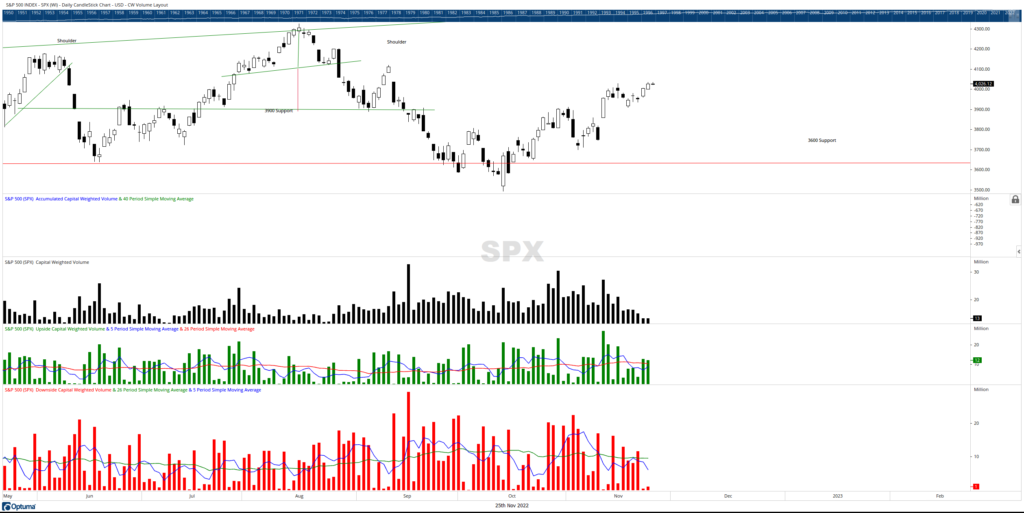

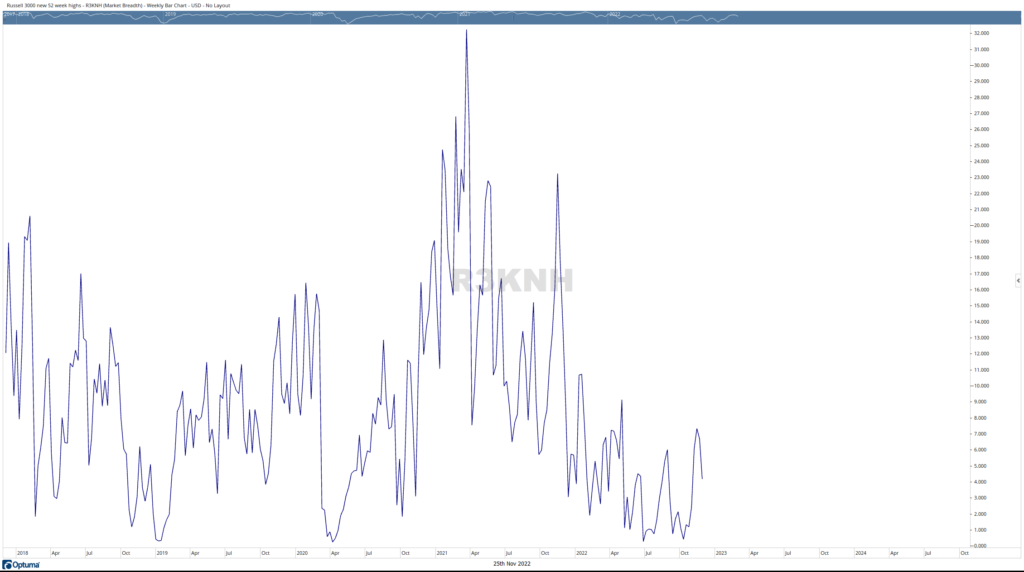

Last week was a quiet week for the markets. The S&P 500 traded mostly inside its range, closing near the weekly highs. For the week, the bulls received $28 billion in inflows versus the bears only $6 billion in outflows. Being a shortened week, this money flow action had little impact on the longer-term trend. Although the Advance-Decline line moved higher this week, the number of stocks making new 52-week highs began dropping for the first time since the October low. New Highs are the fastest of the indicators we follow, meaning changes in New Highs generally not only lead price but the other leading indicators as well. One weekly divergence hardly constitutes a trend, nevertheless, we will be keeping a closer eye on this New Highs indicator as we move to the new year and, more importantly, towards the pivotal Federal Reserve meeting Dec 13-14th.

Grace and peace to you my friends,

Buff Dormeier

Updated: 11/28/2022

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.