Volume Analysis | Flash Market Update 1.30.23

This past week, the Bulls pushed through resistance, the apex of the Bearish Wedge. It is common for bearish wedges to be mildly retested, just like last week demonstrated. The key to identifying if the breakout is indeed legitimate is the break’s volume. Unfortunately for the Bulls, the overall volume was weak for the week. But diving deeper into the numbers, Capital Weighted Upside Dollar Volume totaled 49.7 Billion inflows, which is above average. That is a bullish sign. And there were only $22 Billion Outflows, well below average, another promising indication for the Bulls. Overall, the breaking of the Bearish Wedge on weak volume should be questioned. Ideally, such breakouts should occur on high volume, not low.

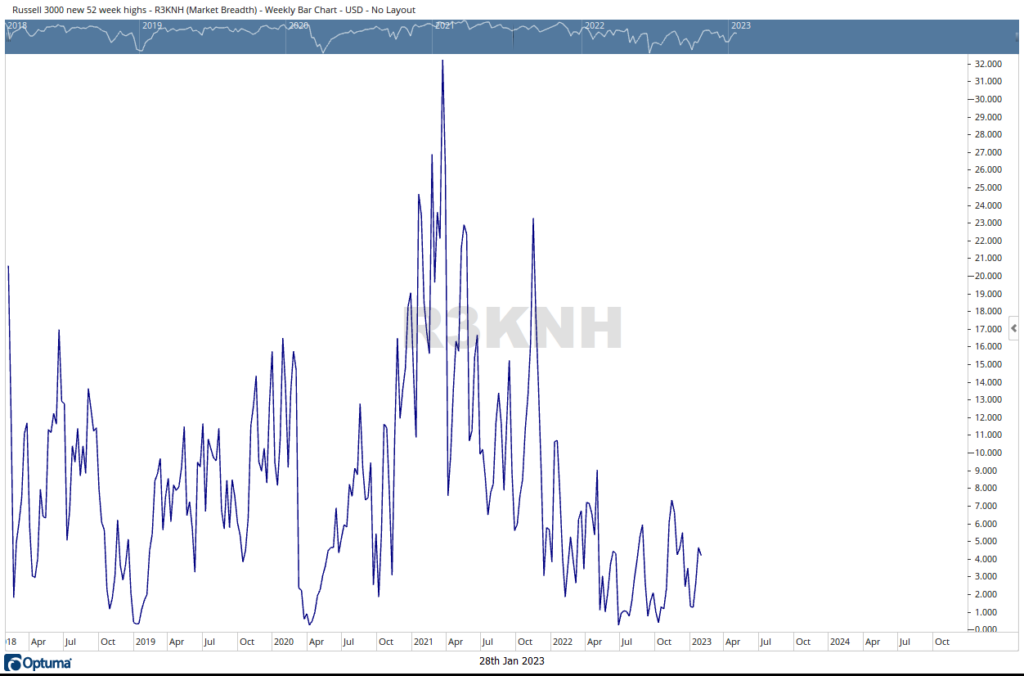

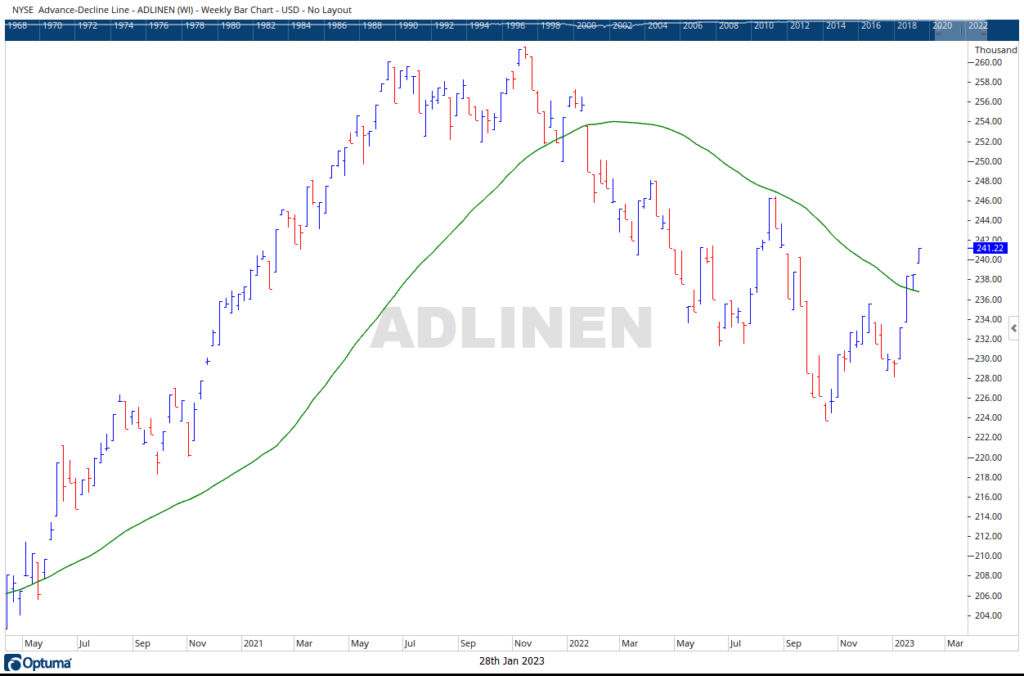

Although the Bulls did not have conviction in terms of volume, they did score a big win in terms of market breadth as the Advance-Decline had another surge last week, breaking 1% above trend. However, the % of Stocks making New Highs should have followed suit. Yet, New Highs declined slightly for the week.

Major SPX 500 resistance resides at 4100. If the Bulls close above this 4100 level, all Bear bets are off. Next week’s Federal Reverse meeting may be the final catalyst to determine the direction of the intermediate trend. Get your popcorn ready!

Grace and peace,

BUFF DORMEIER, CMT®