Portfolio Manager Insights | What a Housing Recession Means to Investors 11.30.22

Perhaps no sector of the economy has been impacted by rising interest rates as much as housing. The declines in both housing activity and prices have wide-ranging effects on households and the economy, as well as across financial markets. Like many other sectors, the housing market surged during the pandemic and is now experiencing a hangover. Some investors may even worry about echoes of the 2008 housing bubble and the resulting global financial crisis. How might the current slowdown in housing impact portfolios in the months and years to come?

The housing market affects the economy and financial markets in important ways. As individuals, primary residences are usually the most important assets on household balance sheets, and monthly mortgage payments are the largest expenses. As diversified investors, the housing market can represent an income-generating asset class as well as a macro-economic indicator. Rising home prices can bolster financial confidence and spur consumer spending, and vice versa, a fact often referred to as a “wealth effect.”

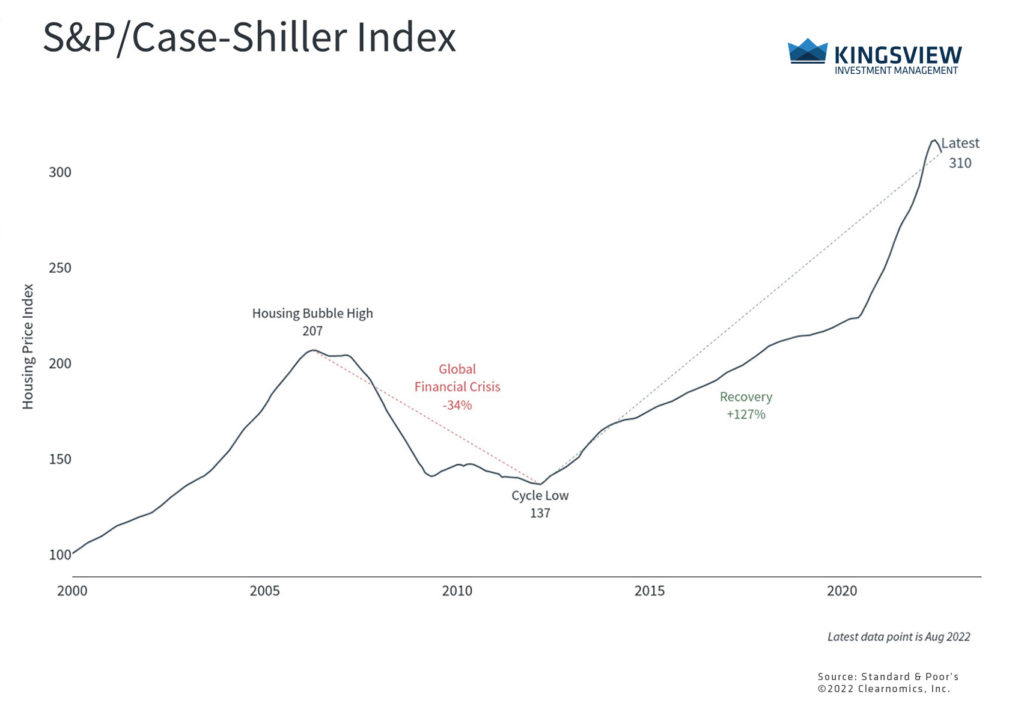

The housing market has made strong gains since 2012 but is slowing

Housing prices accelerated during and after the pandemic as many sought to purchase new homes because they left cities, needed more space, or were working from home. In addition, robust consumer balance sheets and limited spending on other goods and services meant that consumers had the excess savings to consider major purchases. The chart above shows an index of housing prices across 20 major U.S. metropolitan areas and highlights the steep rise since 2020. This added to the gains since the housing market bottomed in 2012. Over this full period, the average home price in these areas rose 127%.

One measure of the economic impact of housing is what’s referred to as “residential fixed investment” in the quarterly GDP report. According to the Bureau of Economic Analysis, residential fixed investment increased by 7.2% and 10.7% on an annual basis in 2020 and 2021, respectively, contributing 0.28 and 0.47 percentage points to annual growth in those years. This has also added to inflationary pressures. In October, the shelter component of the Consumer Price Index, which has a weight of 42% within core CPI, rose 6.9% compared to the previous year. A red hot housing market added to economic growth but also to the price pressures felt by many households.

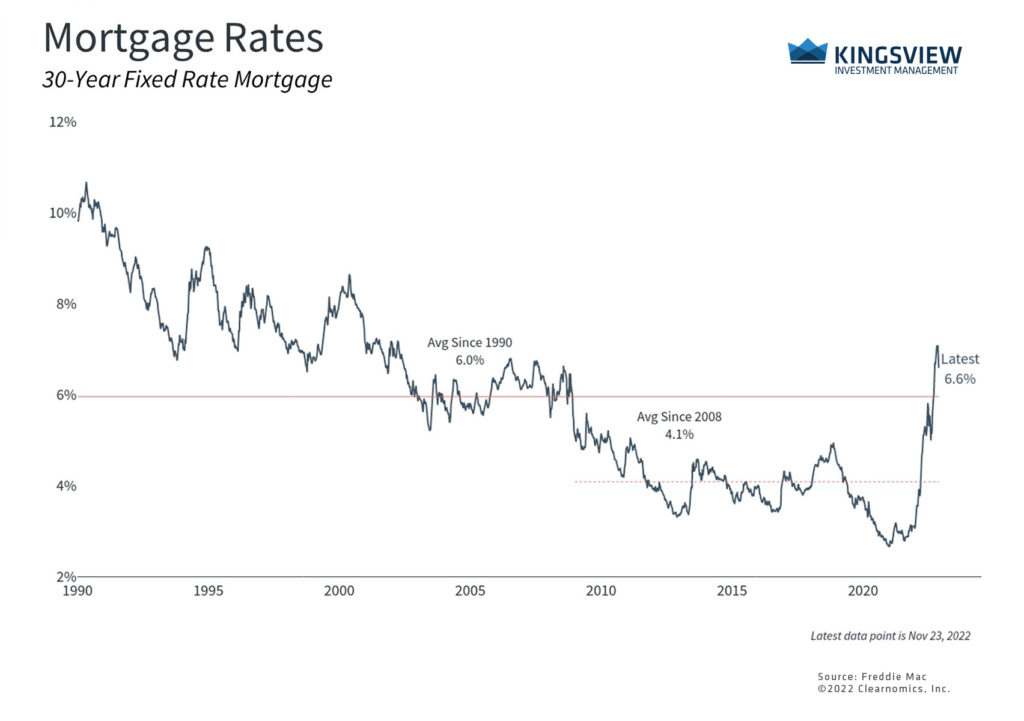

Mortgage rates are at their highest since the mid-2000s housing bubble

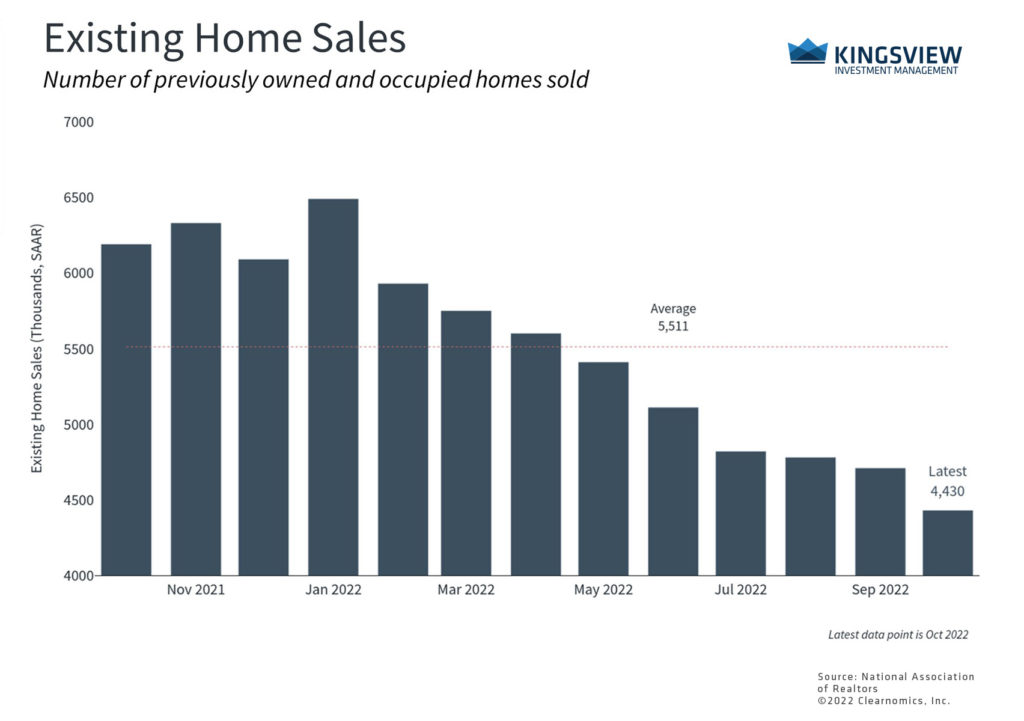

More recently, the Case-Shiller index experienced its largest deceleration in its history. This is due to rapidly rising mortgage rates, the slowing economy, and the general reversal of pandemic trends that has impacted many economic and stock market sectors. The average rate on a 30-year fixed mortgage currently sits at 6.6% after briefly rising above 7% for the first time since 2002. This exceeds the 30-year average of 6% and is well above the average of 4.1% since 2008. Homebuyers and investors alike are experiencing sticker shock as rising rates make housing less affordable by pushing up mortgage payments, even as home prices decline. Many measures of housing activity have slowed as a result, from building permits and housing starts to existing home sales and mortgage refinancing.

Similarly, the S&P 500 real estate sector has fallen 25% this year, worse than the overall index decline of 16%. While privately held real estate may be holding up in value on paper, this is likely due to delayed mark-to-market adjustments. For those holding private real estate, this may not matter if there is steady rental income, especially if it can offset rising costs in this inflationary environment.

Existing home sales have slowed

Where does the dramatic rise and now decline in the housing market leave us? While the future is uncertain, market expectations are for rates to remain elevated alongside inflation. Even if the Fed does slow its pace of rate hikes, fed funds futures suggest that policy rates will hit 5% by mid-2023. Of course, it’s also unlikely that rates will surge as much as they have already. So, unless there is another surge in housing demand, the short-term path of home prices is likely to be sideways at best. Regardless, these factors could continue to affect the entire housing sector and detract from residential real estate activity.

The good news for investors is that a repeat of 2008 is also unlikely. Household balance sheets strengthened during the pandemic and many focused on paying off debts and shoring up savings. Additionally, the housing bubble was not just due to sky-high home prices – it was due to historic levels of financial leverage that led to systemic risks within and across banks. Fortunately, there are few signs that this is the case today. Collapses in areas such as cryptocurrencies, and declines in tech stocks, appear to be having few spillover effects into the real economy so far.

The bottom line? While the housing market may face headwinds, many other parts of the economy are steady. Investors ought to remain diversified across sectors and construct their portfolios and financial plans with a broad view of their assets, including their real estate holdings.