Our Mission

Our mission is to provide our clients "sleep equity", the ability to lay their heads on the pillow at night and not worry.

Comfort in knowing their finances are being properly managed.

A Proven Approach

Our team will create a Financial Plan, manage the investments and continually monitor your progress.

We are Fee-Based Advisors Only.

Our emphasis is on keeping fees as reasonable as possible and completely transparent.

Why Us?

Our founding partners have been working together and advising clients since 1997. We have managed through many different Market Cycles and are prepared to adapt to anything.

Our clients choose where their assets are held:

Raymond James

TD Ameritrade

Charles Schwab

No cost, no obligation introductory meeting to assess your current situation and learn about your goals and what's important to you and your family. We will build a Financial Plan based on your wants, needs, wishes and risk tolerance, then analyze your current investments and detail what should be adjusted and why.

- Understand your financial goals, obstacles and preferences

- Identifying your interests beyond investing

- Formalize your personalized financial plan

We help you reposition your assets according to your Financial Plan so that you can feel confidence about your investments and a comfortable retirement.

- Consolidate assets to one of our three custodians

- Initiate the financial plan

- Phase in the investment recommendations

- Review the forthcoming client statements

We monitor your assets, keep you informed with regular communication, and work with you to make changes as needed to your Financial Plan and investments as circumstances change.

- Monitor progress according to the plan

- Adjust the plan and investments when needed

- Inform you, your accountant and your attorney of anything necessary

- Help you navigate your options

Being a fiduciary entails always acting in your best interest. For a financial advisor, this may mean recommending a product that results in reduced or no compensation because it's the best option for the client.

Fiduciaries have a duty to care. A fiduciary will continually monitor a client's investments and financial situation and adhere to the highest standard of conduct.

We Are Available

You can always call and talk to or meet with one of your experienced Financial Advisors who will answer all of your questions.

We Are Transparent

All fees, charges and expenses are spelled out clearly before we do business.

We Are Teachers

You will always know exactly what you own, and understand precisely why you own it.

We Are Fiduciaries

Everything we do for you is always in your best interest.

Fiduciary Standard vs. Suitable Standard

For advice to be considered merely "suitable," the financial professional must only have an adequate reason to believe a recommendation fits the client's financial situation, needs and other investments. For that to be the case, an advisor must obtain adequate information about the investment as well as the customer's financial situation before making the recommendation.

How to Spot a Breach of Fiduciary Duty?

A breach generally occurs when your investment advisor does something that goes against the guidelines established under the fiduciary standard. See below for examples of what to look for regarding a breach of fiduciary duty in an investment advisor relationship:

What to Look For:

Steering towards investments that may not fit your strategy to earn a larger commission

Encouraging you to invest in a security by providing inaccurate or incorrect statements

Consciously misleading you about investment services, products, or fees

Trading investments without your authorization

Making excessive trades from your account to earn commissions

Failing to disclose any conflicts of interest associated with an investment

Act in a negligent or reckless manner when making investment decisions

Fiduciaries Must:

Put their clients best interest above their own at all times

Act with undivided loyalty and utmost good faith

Provide full and fair disclosure of all material facts

Never mislead clients

Avoid and disclose any potential conflicts of interest

Never use a client's assets for the advisor's own benefit or the benefit of other clients

The Benefits of Choosing an AIF® Designee

Only Accredited Investment Fiduciary® Designees have been certified specifically for their ability to follow a fiduciary process with their clients' best interest at heart.

Here are some attributes that make AIF® Designees different from other advisors or financial professionals:

Experience -- Designees are required to provide documented industry and educational experiences to qualify for the designation

Education -- Designees must complete the Accredited Investment Fiduciary® training, which covers the Prudent Practices® for managing fiduciary assets for wealth, nonprofit and retirement clients

Examination -- Designees must pass an examination to prove comprehension of the Prudent Practices® and the ability to act in the best interest of clients.

Ethics -- Designees adhere to a Code of Ethics and Conduct Standards that show a commitment to a higher degree of industry professionalism.

Continuing Education -- Designees commit to keeping their knowledge and skills sharp by completing annual continuing education requirements.

Our clients range in size from sole proprietors with SEP IRA’s all the way up to 401(k) clients that have hundreds of employees all over the United States.

Our experienced 401(k) advisors are ready to help take your organization’s retirement plan to the next level. We are dedicated to providing customized retirement plan solutions that mitigate fiduciary risk, reduce costs and minimize the administrative burden. Above all, we strive to provide great value and guidance to your employees and improve their retirement readiness.

- NQDC - Non Qualified Deferred Comp Plans

- Defined Benefit

- Cash Balance Plans

- Business Cash & Asset Management

Our 401(K) solution is built upon 5 principles:

- Competitive Fees

- Headache-Free Administration

- Participant Level Advice

- Flexible Investment Menu

- Pro-Active Plan Design

We will provide you with a side by side comparison of your current 401(K) plan compared to one or two other 401(K) platforms. All fees associated with the plan will be analyzed and we will show you where you can save more and the best possible investment options.

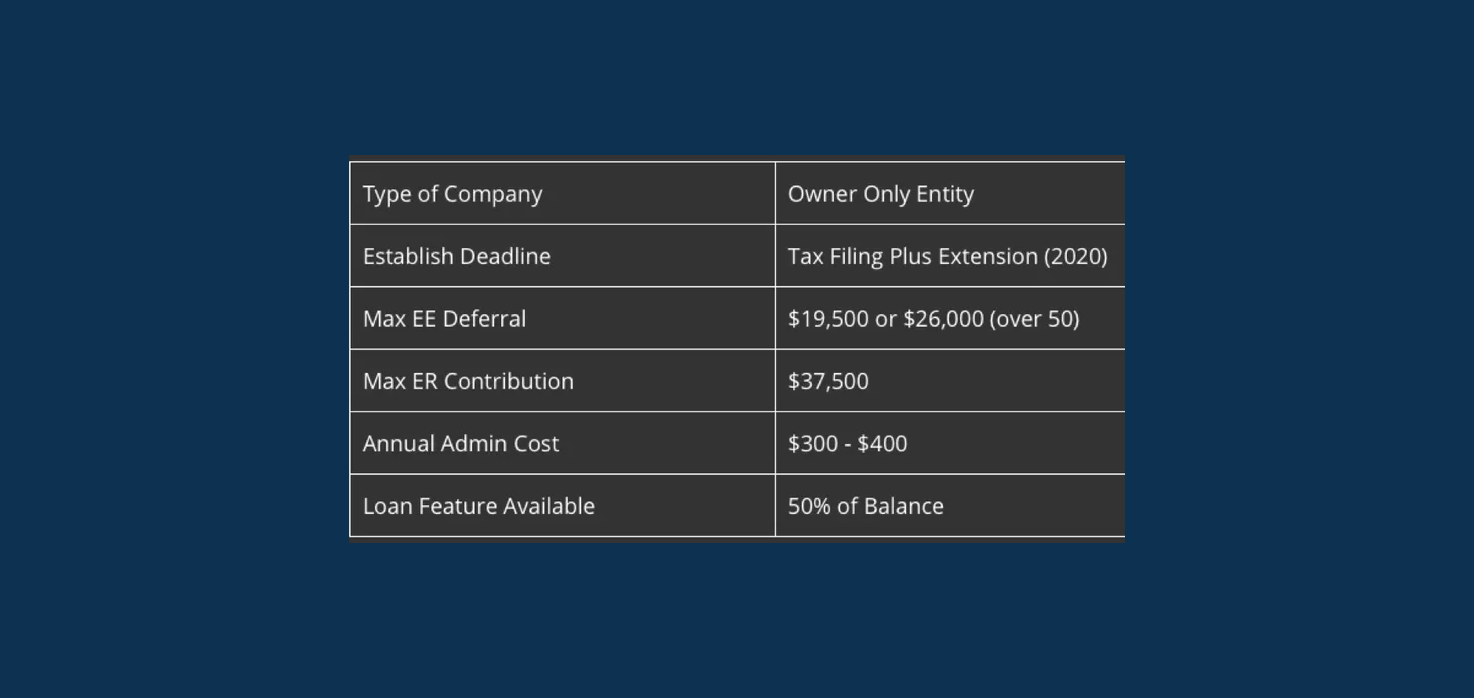

Single(K) plans are one of the most popular types of retirement plans for owner-only entities. These plans provide and contribute limits of a traditional 401(K) at the fraction of the normal administrative cost.

Unlike SEP IRA's, these plans have an employee deferral feature which provides the owner with the option to make employee deferrals up to the lesser of the max hard dollar limit for the year or 100% of net earning income or W2 wages from the entity. Since these plans are qualified plans, they provide the same ERISA protection as traditional 401(k) plans. These plans offer a lot of flexibility both from a plan design standpoint and an investment standpoint.

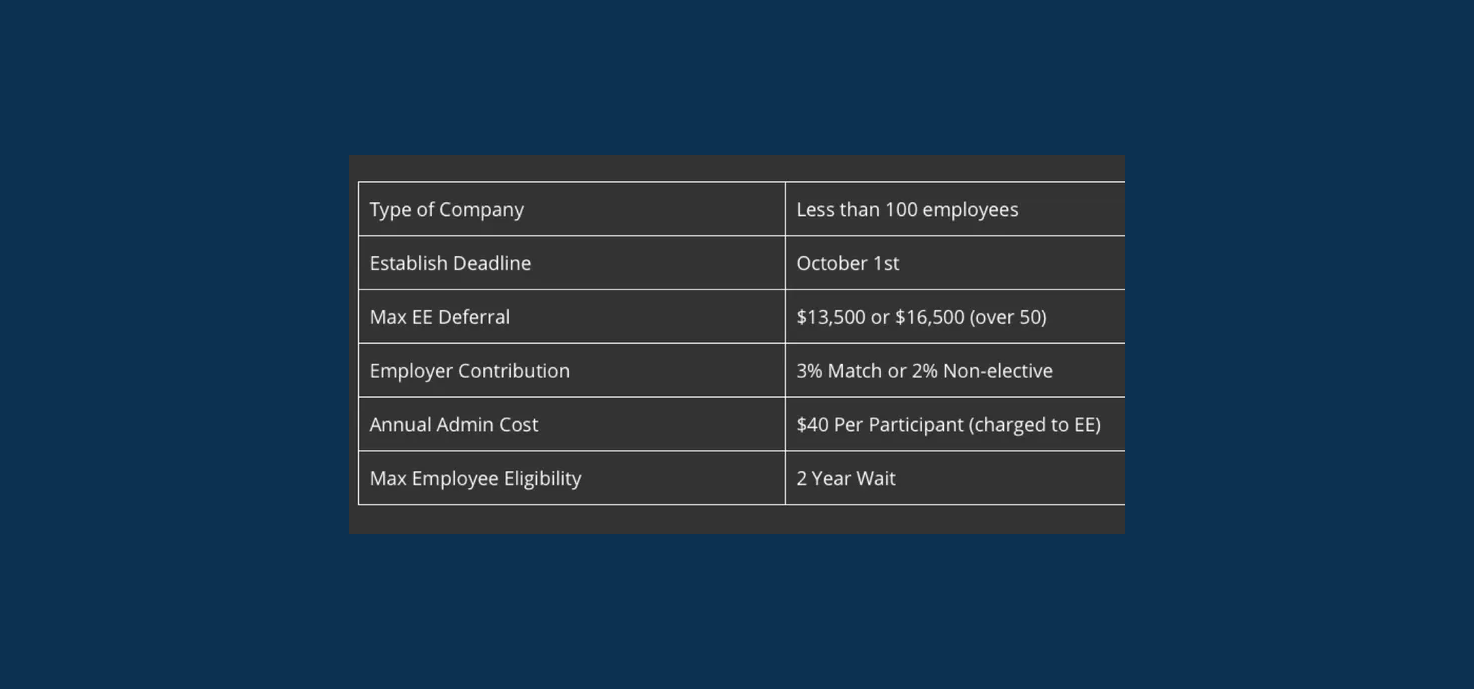

Simple IRA’s are often times the best fit for small companies that are not ready for full 401(K) plan but want to put a retirement plan in place that is low cost, easy to administer, and provides participant directed investment accounts.

The contribution limits are lower than 401(K) plans but unlike 401(K) plans there is no discrimination testing at the end of the year. So the owner does not have to worry about money getting kick back to them at the end of the year due to failed testing. These plans have a mandatory employer contribution. Most employers elect the 3% matching contribution which is a dollar for dollar match up to 3% of comp for each eligible employee. However, that 3% match can be reduced to 1% in 2 out of any 5 consecutive years.

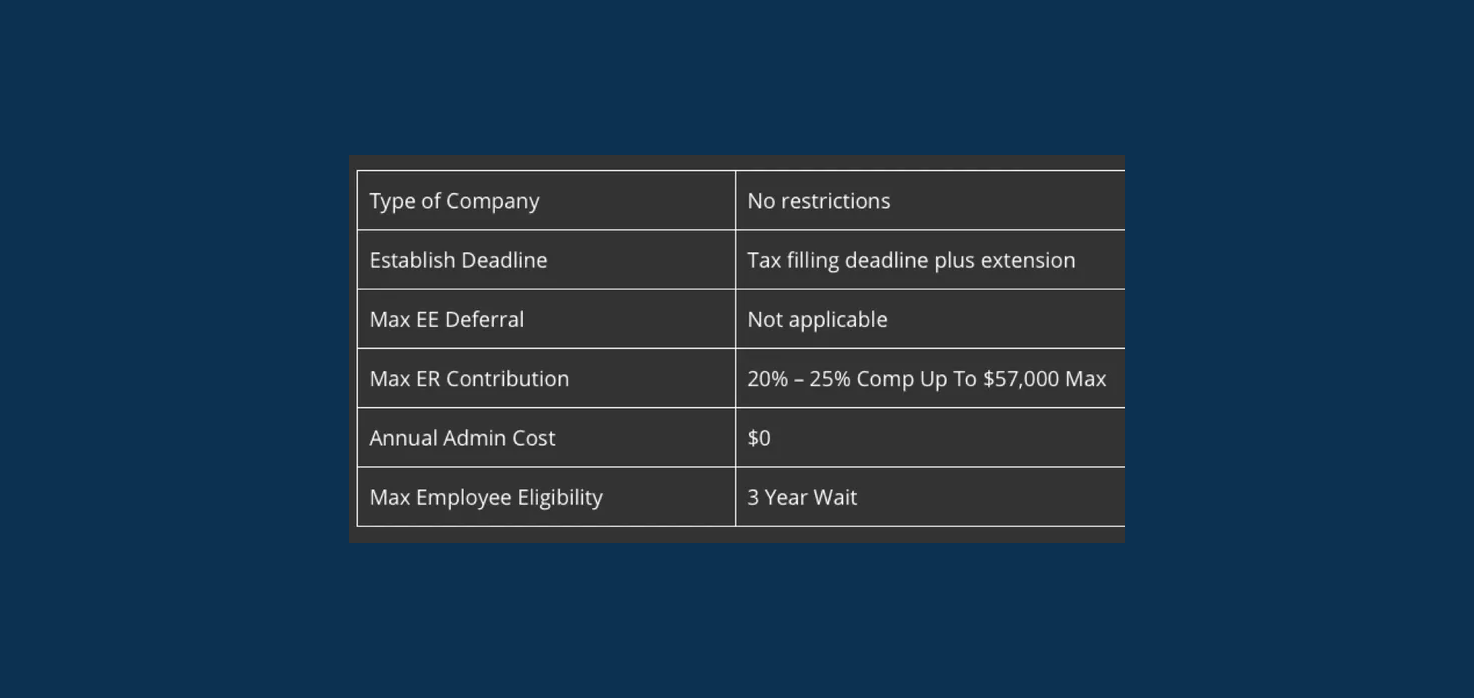

SEP stands for “Simplified Employee Pension”. One of the unique features of the SEP IRA plan is this is the only type of retirement plan that can be established after December 31st. In addition, the plan does not have to be funded until tax filing deadline plus extension.

SEP IRA’s usually work best for owner only entities or companies with less than 5 employees. Why? SEP IRA’s are 100% employer funded and the contribution is expressed as a percentage of comp. If the owner contributes 20% of comp for themselves they have to contribution 20% of comp for all eligible employees. The good news, the company can keep new employees out of the plan for 3 years, if the plan is designed correctly. It’s often the case that small companies will start with a SEP IRA Plan but as soon as employees start becoming eligible for the plan, they terminate the SEP IRA and replace it with a Simple IRA or 401(K) plan.

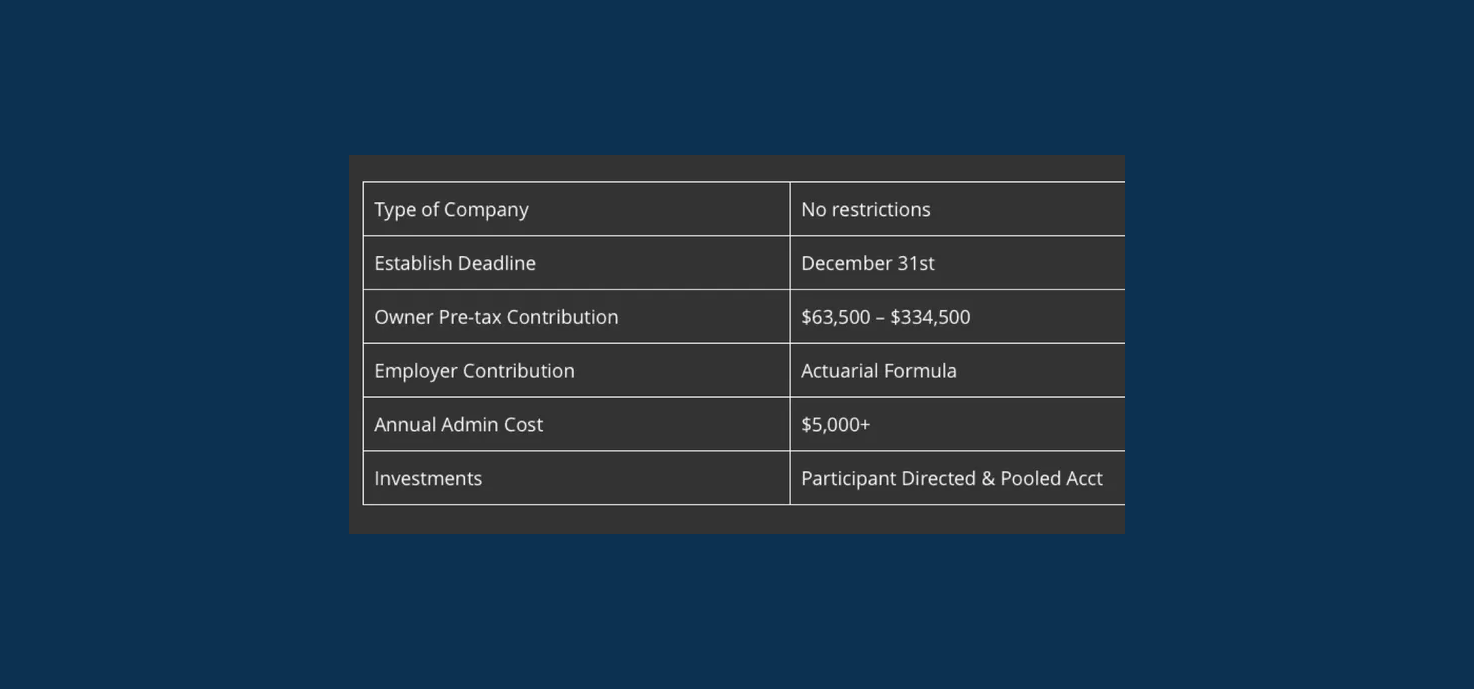

A DB/DC Combo Plan is an advanced plan design strategy that runs a traditional 401(K) plan side by side with a Cash Balance Plan. DB/DC Combo plans can be designed that will allow each owner to contribute over $300,000 per year, pre-tax.

The employees are able to benefit from the features associated with a 401(K) plan: employee deferrals, loans, participant directed investment accounts, and rollover options. While the owners are able to access higher levels of pre‐tax savings through the use of the Cash Balance Plan which is a defined benefit plan. This plan design works best for companies that have predicable cash flow, the owners have high levels of compensation, and there are less than 20 eligible employees.

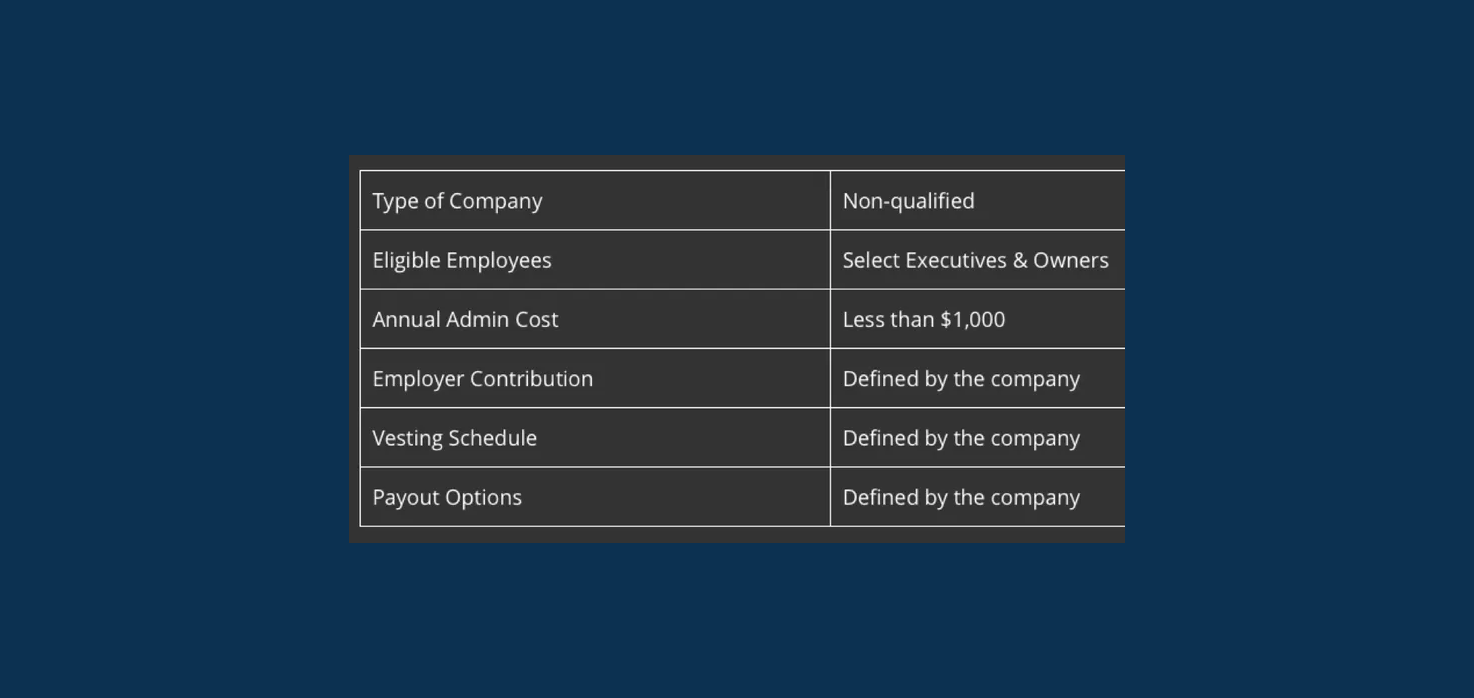

Executive Deferred Compensation Plans or Top Hat Plans are retention tools that are frequently used by companies and organization to entice key executive to stay with their current employer for a specified period of time.

Since these plans are non-qualified plans, the company can hand pick who to cover and not cover with these plans. These plans also vary greatly om design. An agreement is drafted between the company and the key employee specifying the vesting schedule, dollar amount of the benefits, and payout structure. There must be "substantial risk of forfeiture" associated with the benefit for these plans to operate correctly. Companies also have a liability associated with executive deferred compensation plans.

We are aware of how difficult it can be to navigate wealth in ways that give you freedom and not more obligation. That’s why for the team at Kingsview Melville, personalized service has taken on a whole new meaning.

Kingsview Partners is a boutique advisory firm with sizable partners, which allows us to adapt our strategies as appropriate. Our clients receive the “small firm” benefits of a custom financial plan, paired with the security provided by large custodial partners.

Kingsview Wealth Managers are never obligated to push certain products and services. They are free to present all available options to investors and do not restrict offerings simply because they may be inconvenient, complex or difficult.

Kingsview Partners offers a truly independent platform for its advisors. As fiduciaries, our Wealth Managers can effectively mitigate conflicts of interest and provide investors with a clear understanding of the motivations behind their recommendations.

Kingsview Partners attaches great importance to the responsibility borne from our fiduciary duty. Kingsview Wealth Managers may serve up to 40% fewer clients than their peers, allowing them a greater opportunity to listen, plan and execute for the investor.